What do Tokyo and Nuuk have in common? They are the capital cities of Japan and Greenland. They are the two epicenters of the shocks that hit stock and bond markets worldwide today. In Tokyo, bond yields are soaring, suggesting that a debt crisis may be underway. In Nuuk, the locals are siding with Denmark in their opposition to President Donald Trump's plan to acquire Greenland "one way or another." This development just adds to the list of geopolitical tensions driving precious metals prices to record highs. The situation was exacerbated when eight NATO countries deployed troops to Greenland for joint military exercises, prompting Trump to threaten new tariffs on those countries. In other words, last year's Trump Tariff Turmoil is continuing in 2026.

Let's have a closer look at what is happening in and around Tokyo and Nuuk:

I. Will what happens in Tokyo stay in Tokyo?

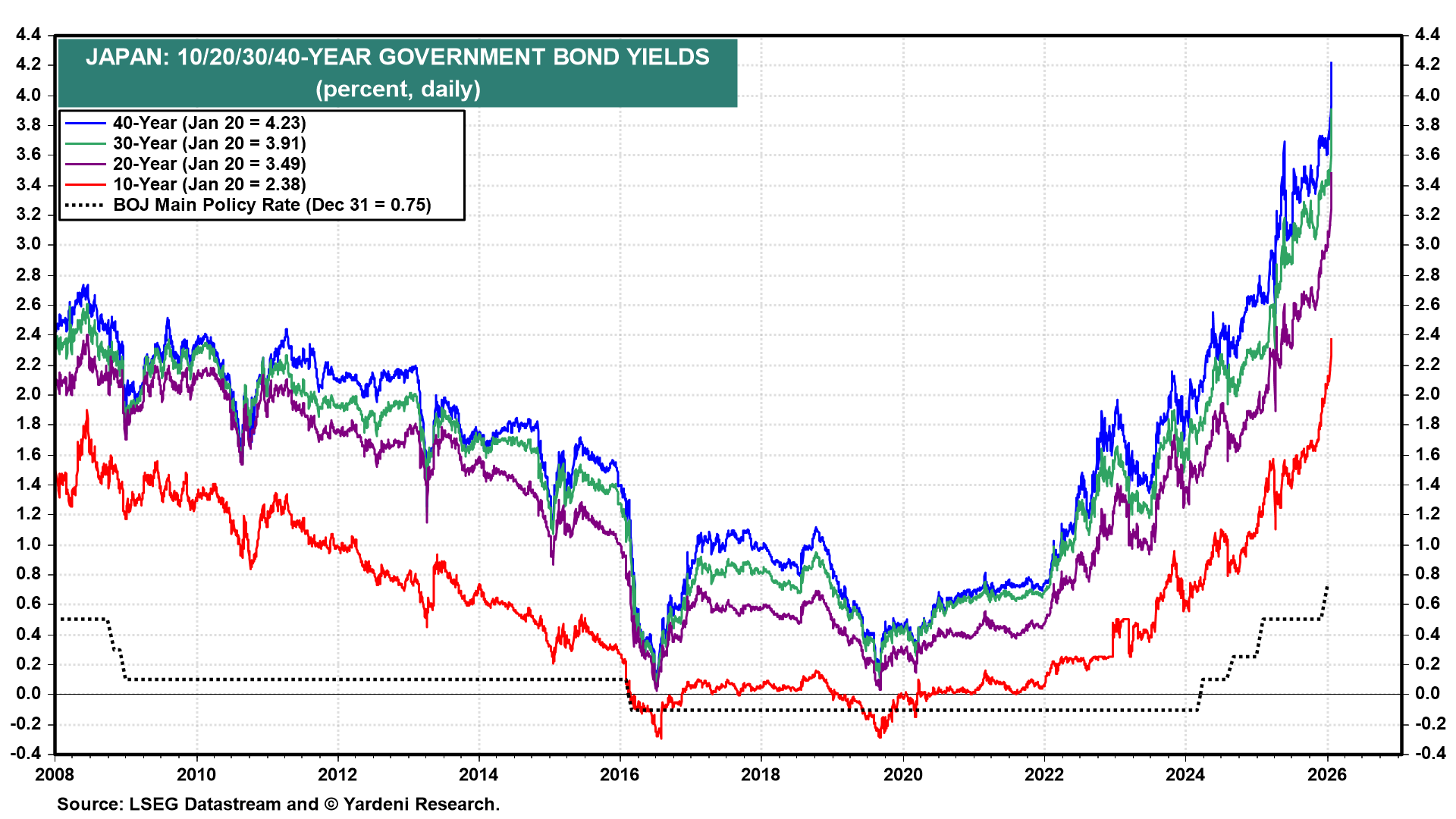

Japan's government debt crisis is certainly pushing bond yields higher (chart). However, we don't expect that it will cause a Lehman-like global financial crisis. Nevertheless, Japan's Bond Vigilantes are sending a clear message to governments worldwide about the need for fiscal discipline.

The problem in Japan is that the Bank of Japan has been trying to normalize monetary policy by raising its main policy rate since early 2024. However, inflation remains stuck around 3.0%, well above the BOJ's 2.0% inflation target and the current policy rate of 0.75% (chart). The BOJ is tightening too little, too late, because the economy is weak, prompting the new government to push for fiscal stimulus. That will widen Japan's government deficit, adding to the record public debt. The Bond Vigilantes are protesting by driving bond yields higher.