Oil prices fell more than 1% today after President Donald Trump signaled he might not attack Iran. Late in the day, Trump told reporters in the Oval Office that "we've been told that the killing in Iran is stopping. It's stopped. It's stopping, and there's no plan for executions." The price of a barrel of Brent crude oil was down 93 cents to $64.50. The price of gold also fell on the news.

In the stock market, traders chose to sell Financials for the third day in a row. On Monday, they were hit by Trump's proposal to cap credit-card interest rates at 10%. He reportedly is working with liberal Senator Elizabeth Warren (D., MA) on the idea! On Tuesday and Wednesday, the Financials fell despite relatively good earnings reports from the big banks, as we anticipated in Monday's QT titled "Banking On The Banks." So we view the three-day selloff as a buying opportunity. Goldman and Morgan Stanley will likely report gangbuster earnings tomorrow. (And we expect the banks will succeed at killing the credit-card cap idea.)

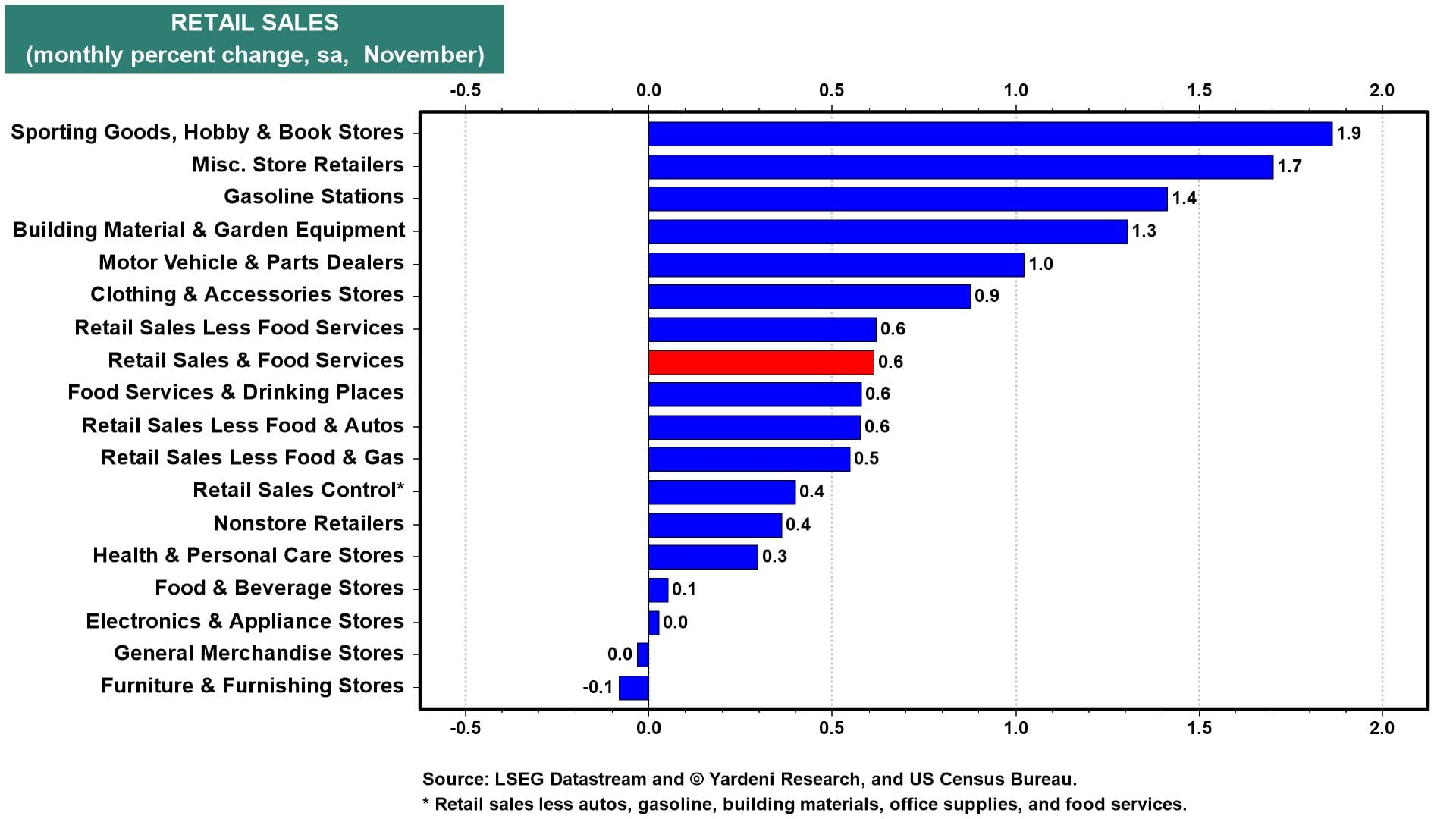

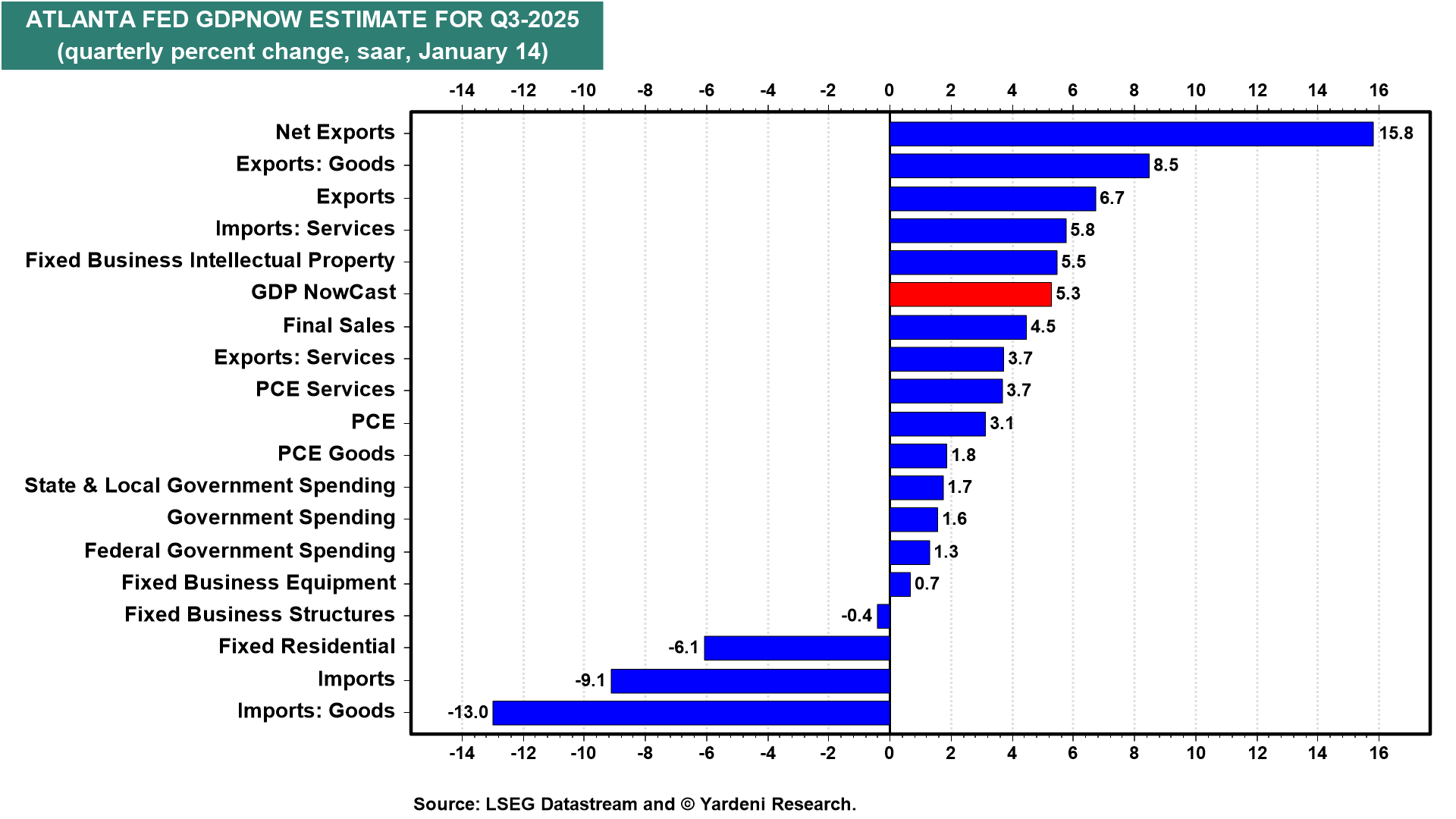

Speaking of “gangbusters,” that adjective describes last year's real GDP performance in Q2 (3.8%), Q3 (4.3%), and probably Q4. The Atlanta Fed's GDPNow estimated growth rate for the final quarter of 2025 was raised from 5.1% yesterday to 5.3% today after the release of November's solid retail sales report (charts).