Fed Chair Jerome Powell was very reassuring during his congressional testimony today. He said the economy is fine, inflation is moderating, and interest rates have probably peaked. He also said the Fed is likely to lower interest rates, but won't rush to do so: "We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

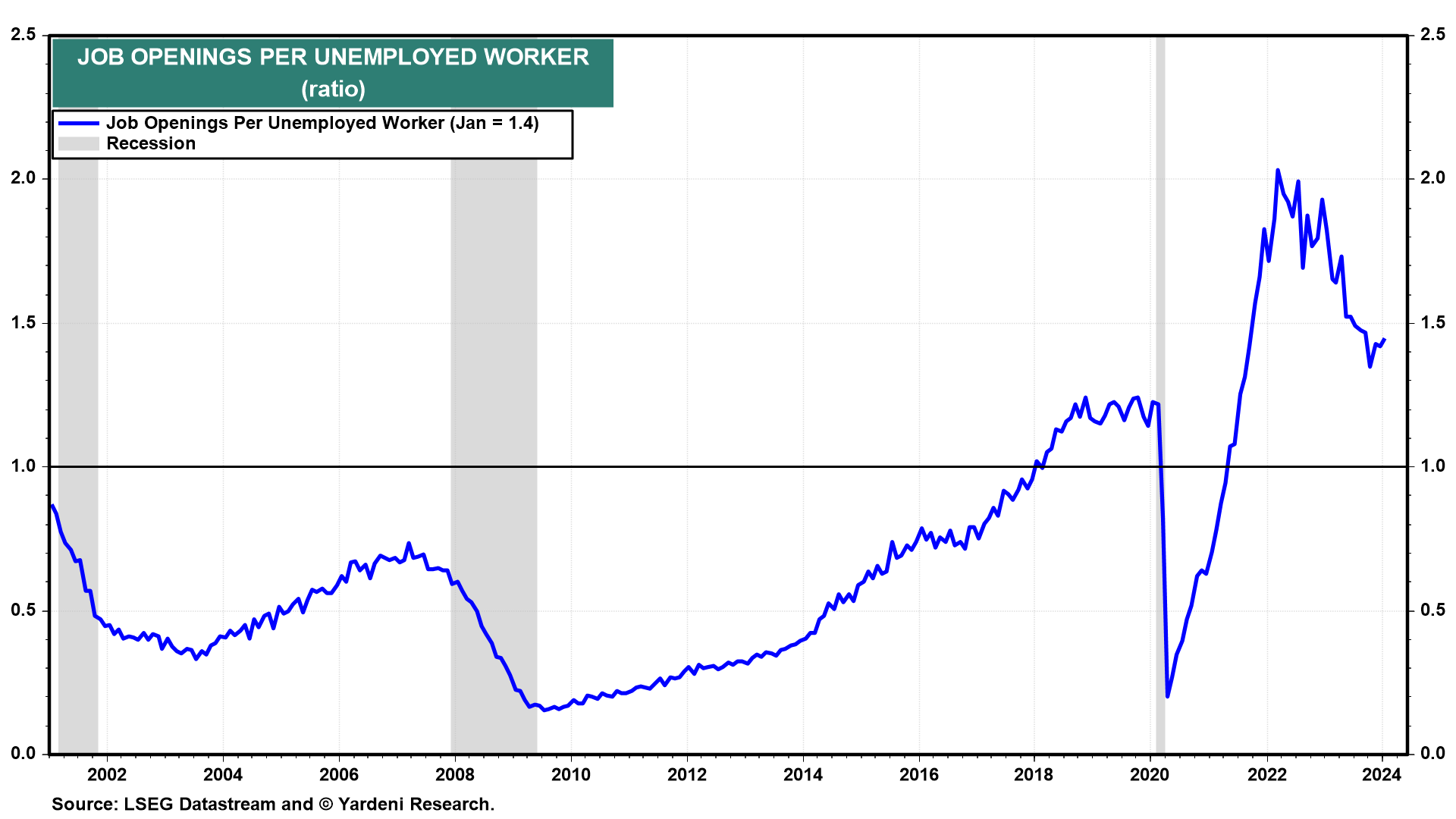

Today's JOLTS report for January was happy news. There were still plenty of job openings at 8.86 million , or 1.4 openings for every unemployed worker (chart).

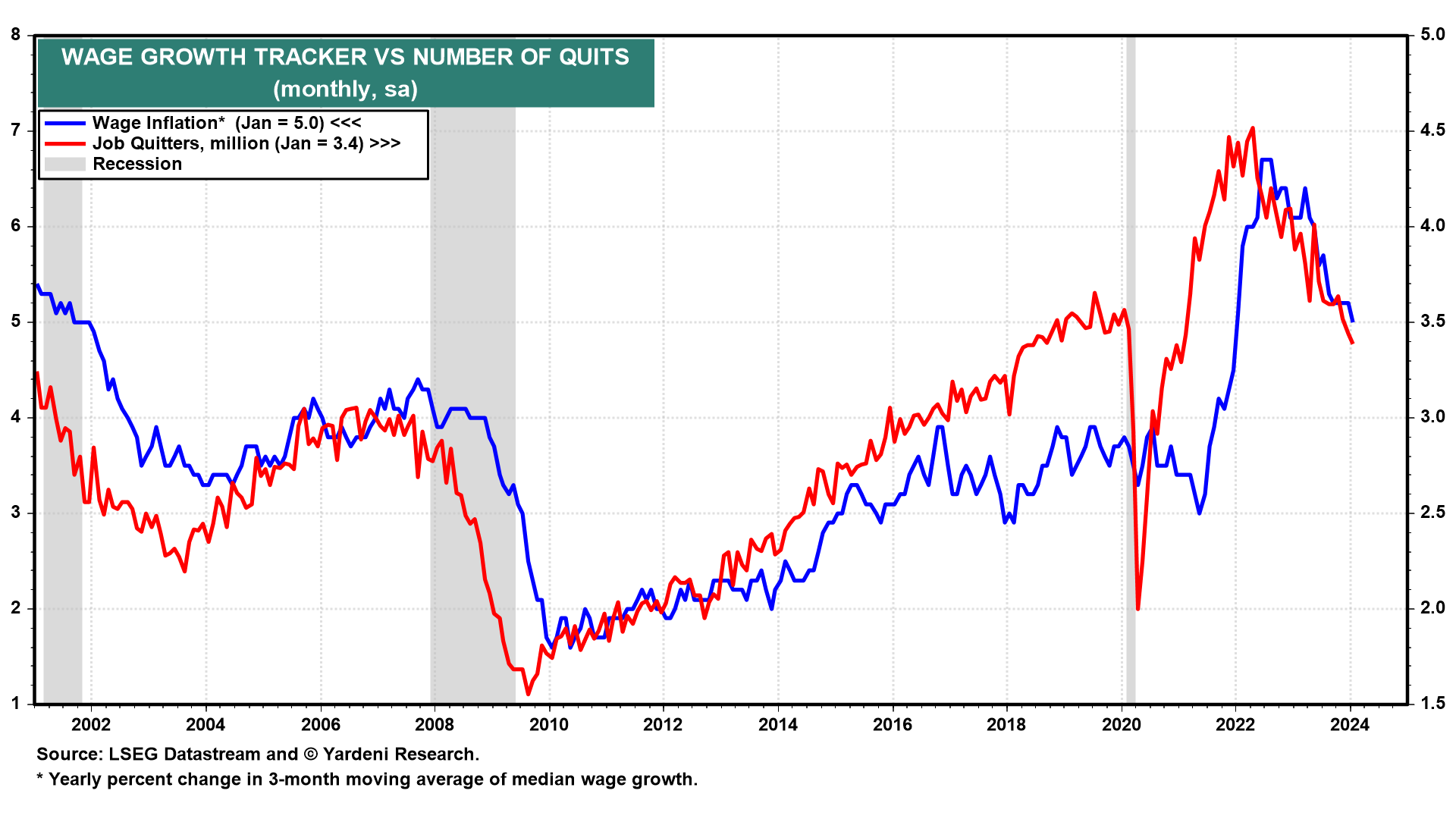

In addition, quits are falling, which should help to moderate wage inflation and boost productivity (chart). Wage inflation tends to be higher for job switchers than for job stayers.

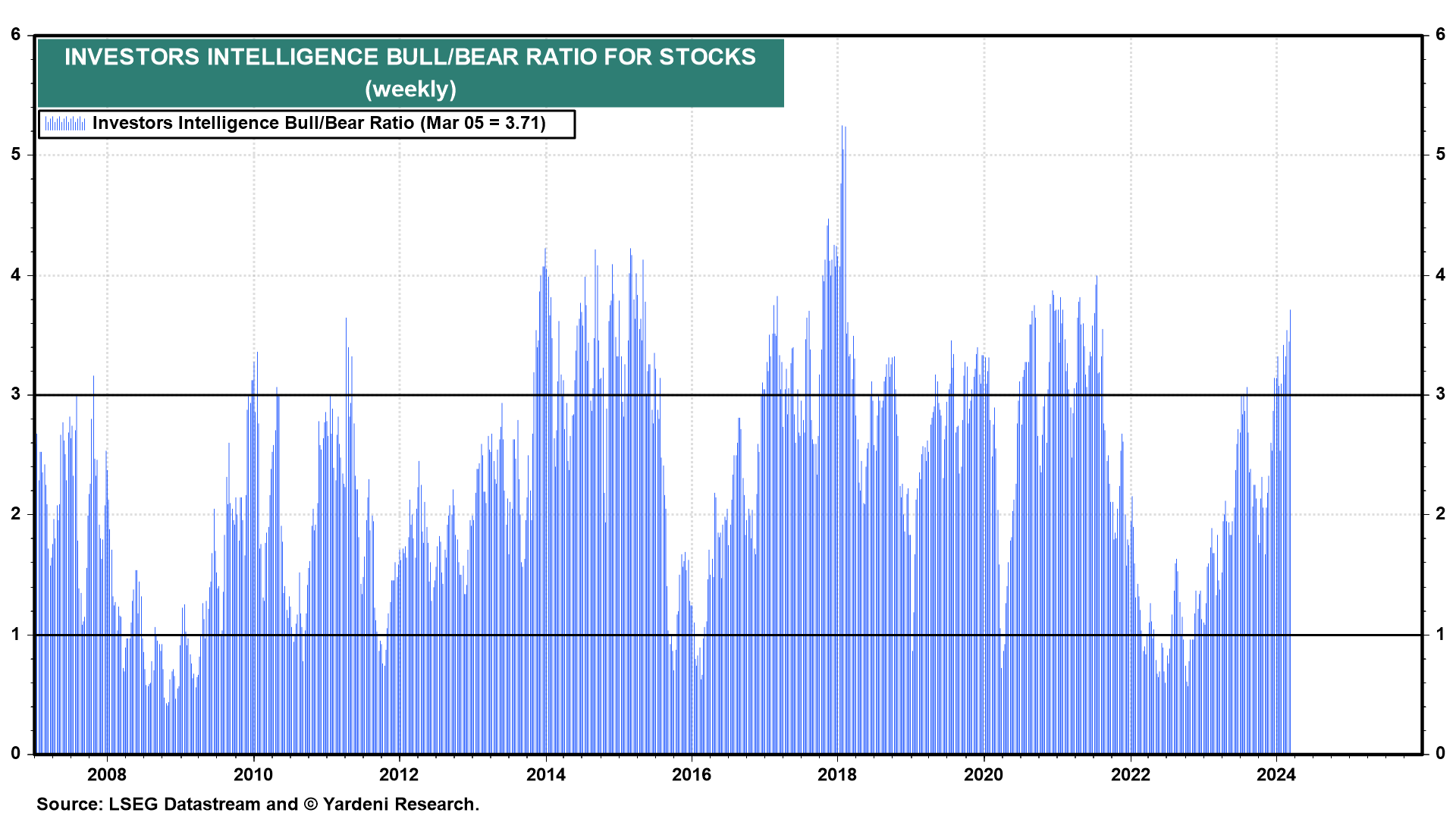

So there is nothing to fear but nothing to fear. Contrarians have to be concerned that everyone is so happy in the stock market. After all, "Is Everybody Happy?" was the title of a movie released in 1929, just before the Great Crash!

Well, Investors Intelligence Bull/Bear Ratio (BBR) rose to 3.71 this past week (chart). That's the highest since July 5, 2021. Back then, the bulls continued to stampede until January 3, 2022. Previously, our research has shown that BBR readings below 1.0 are better contrarian buy indicators than readings above 3.0 are sell contrarian signals.

So, is everybody happy?