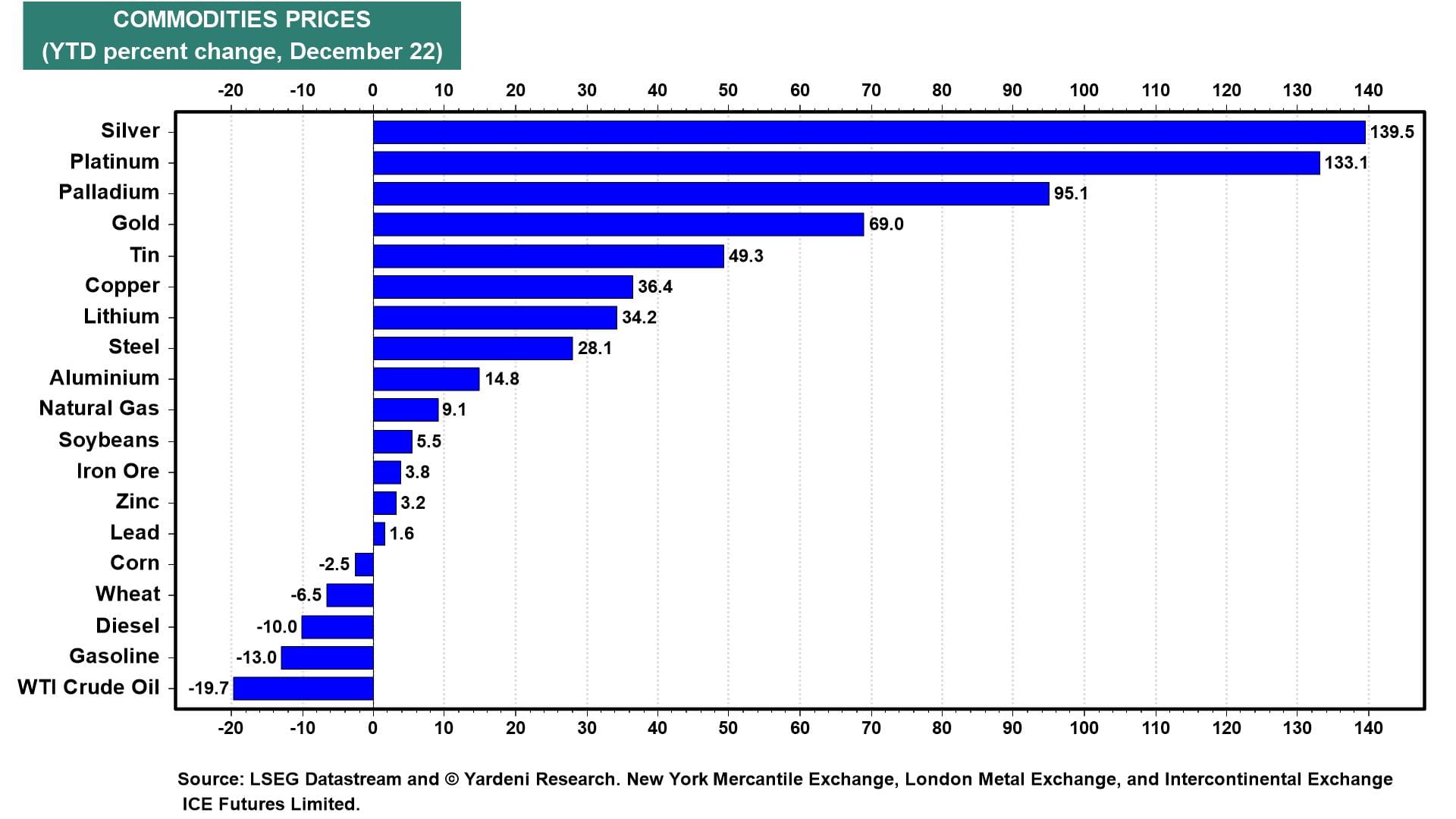

Are the soaring prices of precious metals a warning sign that the Roaring 2020s might end in 2026? We don't think so. However, we have been considering what might be driving the recent spike in precious metals prices. On a y/y basis, gold is up 69.0%. It is lagging silver (139.5%), platinum (133.1%), and palladium (95.1%). We doubt this reflects a rebound in global economic activity, as prices of basic metals, which are more closely linked to industrial production, have increased by much less (chart).

The price of gold has led the rally in precious metals since it first rose to a new record high above $2,000 per ounce in early 2024 (chart). We turned bullish on gold at the time, believing that central banks were increasing their purchases of gold in response to the freezing of Russia's international reserves by the US and EU after Russia invaded Ukraine in early 2022. Central banks don't buy silver, which recently soared to a new record high. The same can be said for platinum and palladium, which have also soared in recent days.

We suspect that the precious metals prices might be signaling recent concerns about an excessively stimulative combination of monetary and fiscal policies in the US next year. Even if the Fed stops cutting the federal funds rate during the first four months of 2026, the Fed is committed to buying about $40 billion per month in Treasury bills through April, according to a December 10 FRBNY press release.