The Emerging Markets (EM) MSCI stock price index may outperform both the US MSCI stock price index and the Developed Countries ex-US MSCI stock price index in 2026. It outperformed the former in 2025 but underperformed the latter and many of its constituents. The broader EM outperformance we expect in 2026 might last for a few years.

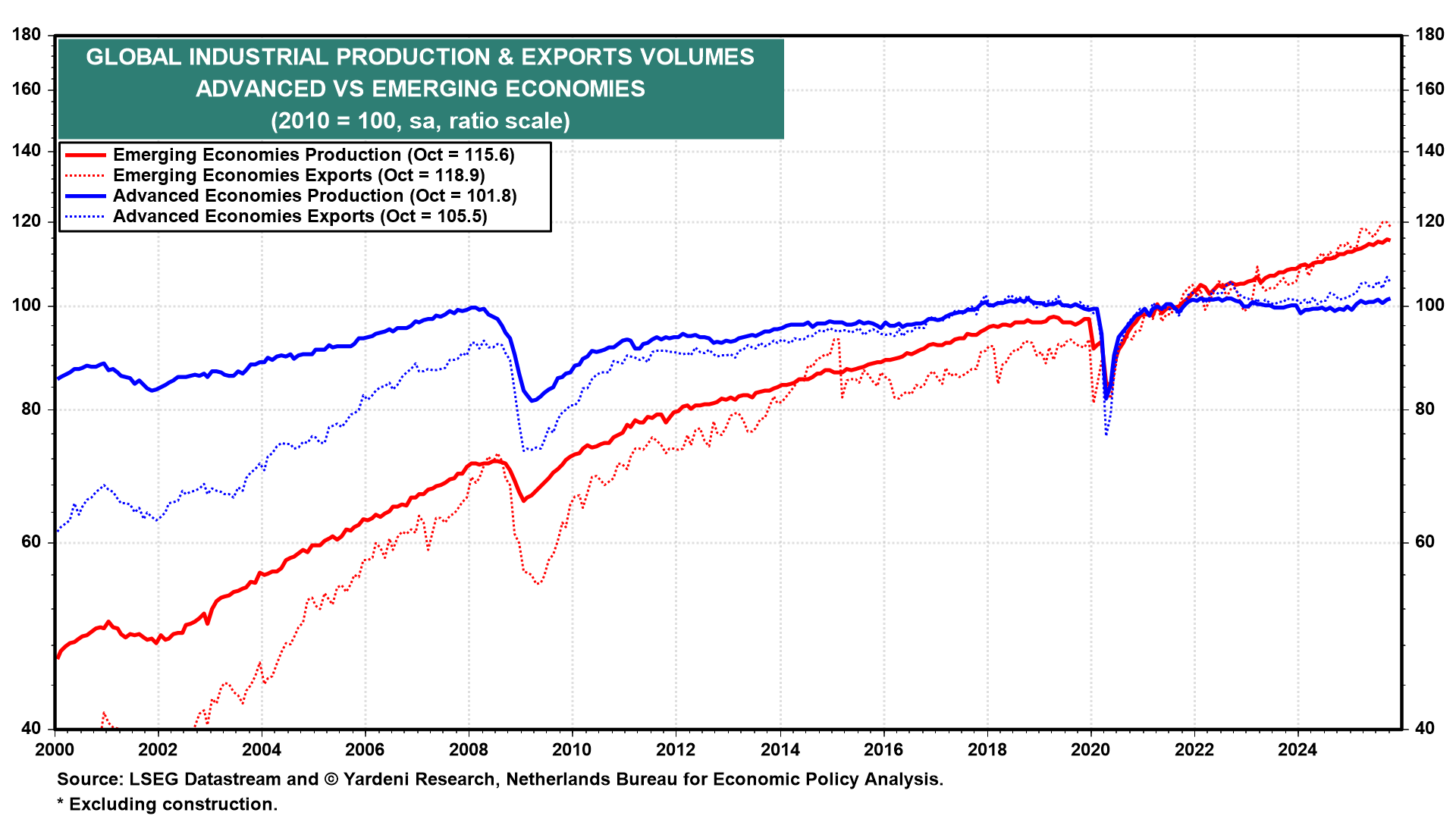

That's because advanced economies have, on average, stagnated in both production and exports for many years, whereas emerging economies continue to see both measures rise to record highs (chart). On average, developed countries have populations that are growing slowly and aging rapidly, while developing economies have mostly young and growing populations, with the notable exception of China. In any event, they have many more people who aspire to a middle-class standard of living than do already prosperous developed countries.

Yet the EM MSCI currently accounts for just 10.8% of the market capitalization of the All Country World (ACW) MSCI (chart). The US, Europe, and Japan collectively account for 89.8% of the ACW MSCI. The US alone has a staggering 64.4% market-cap share of global stock markets; we doubt that share has more upside. We don't doubt that the market-cap share of emerging markets has more upside.