Stock prices soared today on a better-than-expected April US employment report and news that China is evaluating US overtures to start trade negotiations. In the Chinese zodiac, 2025 is the Year of the Snake. It began on January 29, 2025. It is shaping up to be a bad year for China's economy.

We've been thinking that the Chinese are less likely to blink than President Donald Trump in his trade war with China. He has blinked, but he hasn't reduced the 145% tariff on Chinese imports. What he has done is to repeatedly state confidence in reaching a trade agreement with China. In April 2025, he told reporters that the US was in talks with China and expected a "very good" deal within three to four weeks, claiming that Chinese officials, including President Xi Jinping, had reached out multiple times. He described China as eager to negotiate due to the pressure of US tariffs, saying, "They have to make a deal—because otherwise, they’re not gonna be able to deal in the United States."

Trump has claimed to have gotten a call from Chinese President Xi Jinping and to be in active discussions with him. But Chinese officials have denied any such talks, dismissing these claims by President Trump and his administration as "groundless" or "fake news." This suggests that Trump's statements may be aimed at calming financial markets or projecting strength.

However, the Chinese may be changing their tune. That's probably because Trump's trade war is starting to hurt their economy. Consider the following indicators:

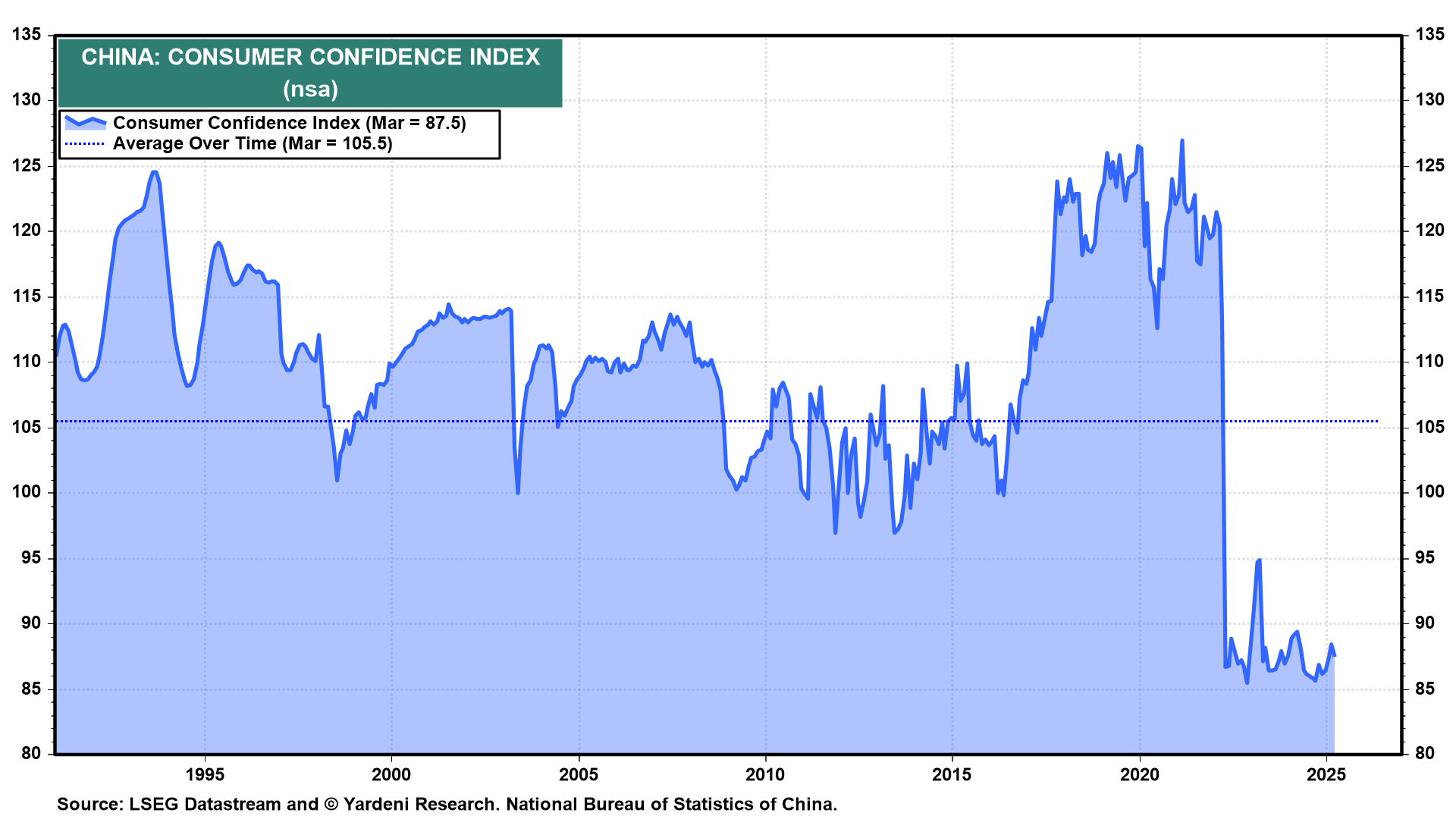

(1) The Chinese Consumer Confidence Index remained very depressed in March around the post-Covid lows (chart).

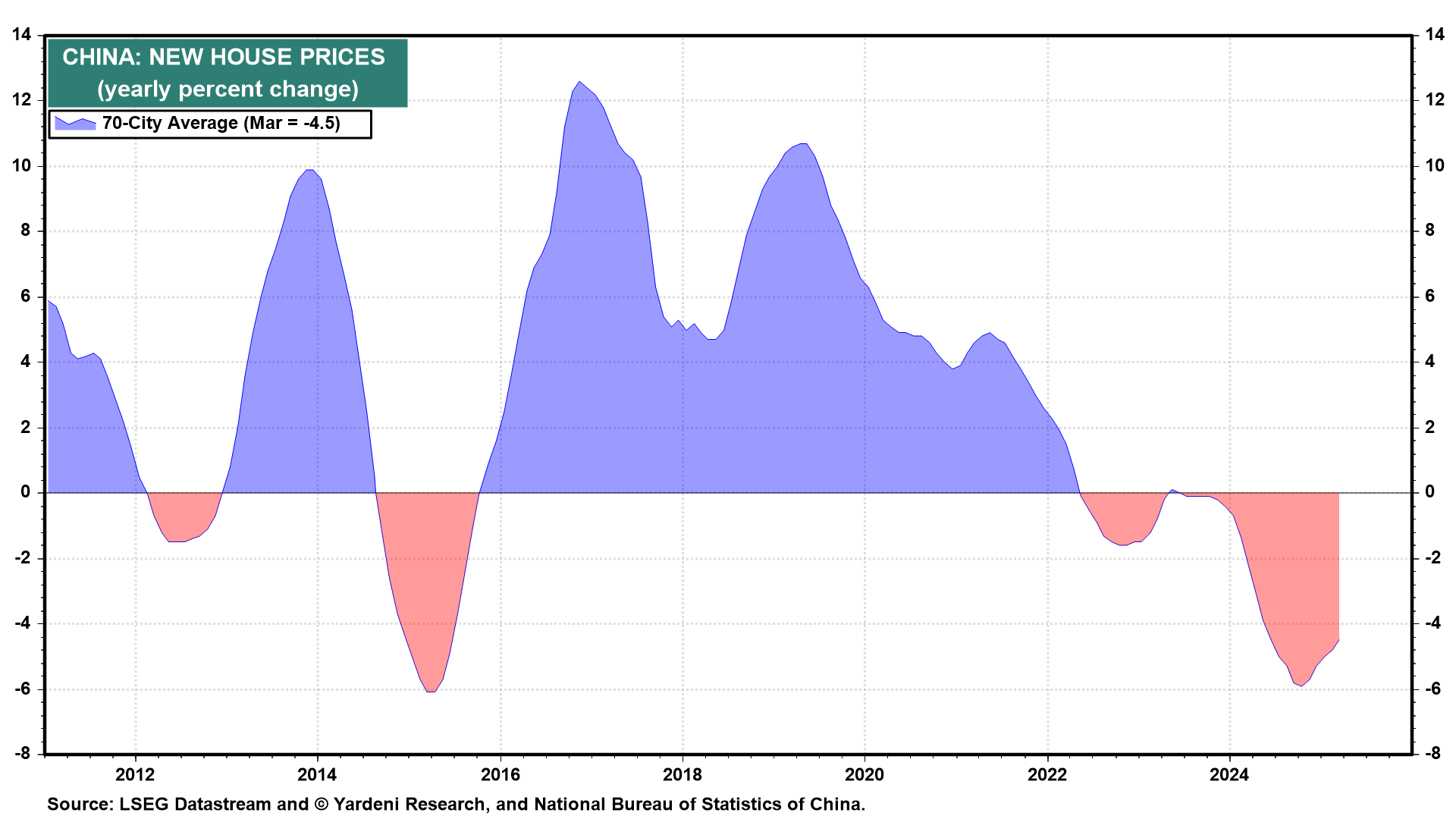

(2) Chinese households are depressed by the bursting of their property bubble, which has caused their finances to suffer and inflicted a significant negative wealth effect (chart).

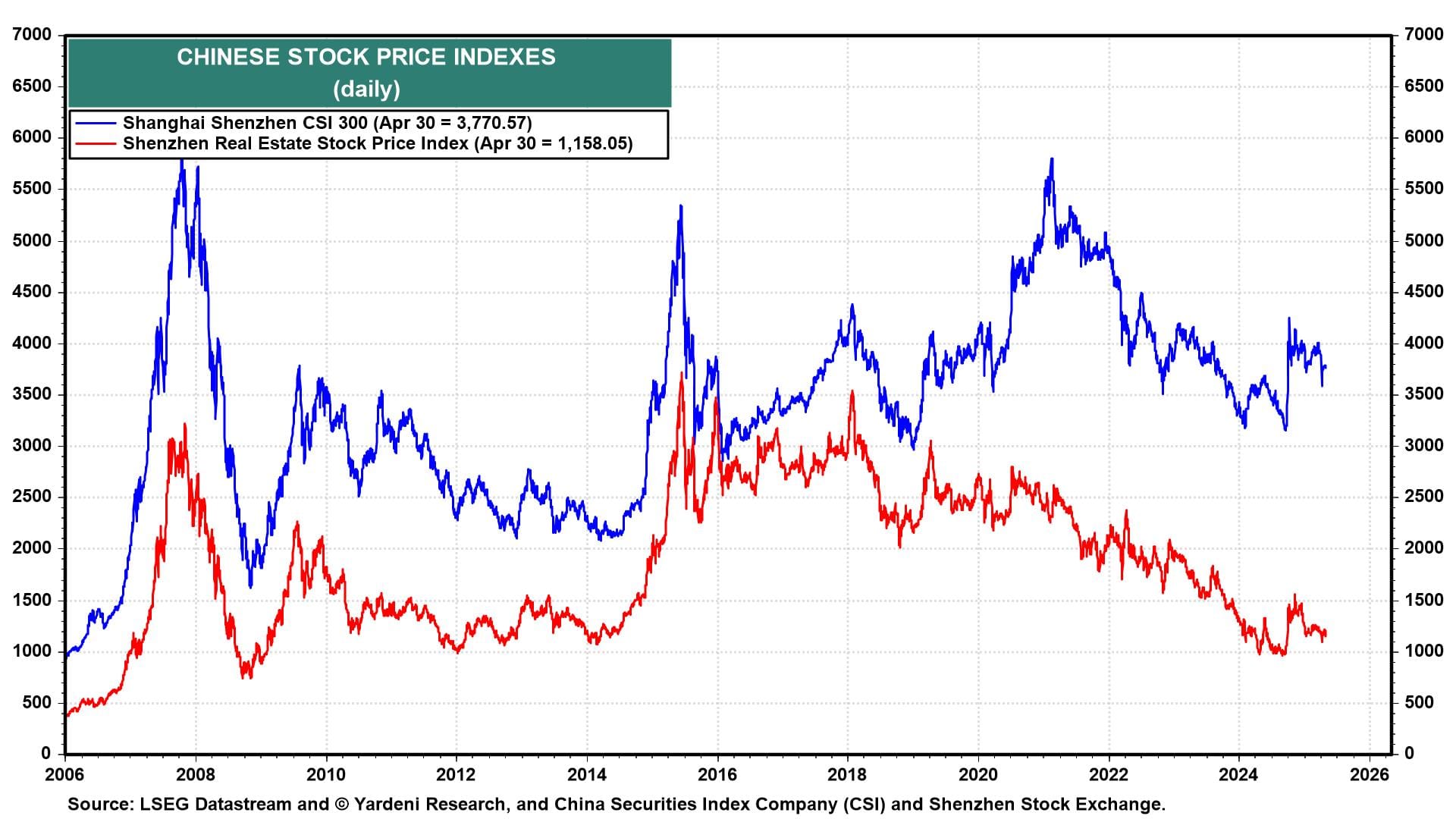

(3) Contributing to the negative wealth effect on Chinese consumers are still depressed Chinese stock prices notwithstanding the rally at the start of this year (chart).

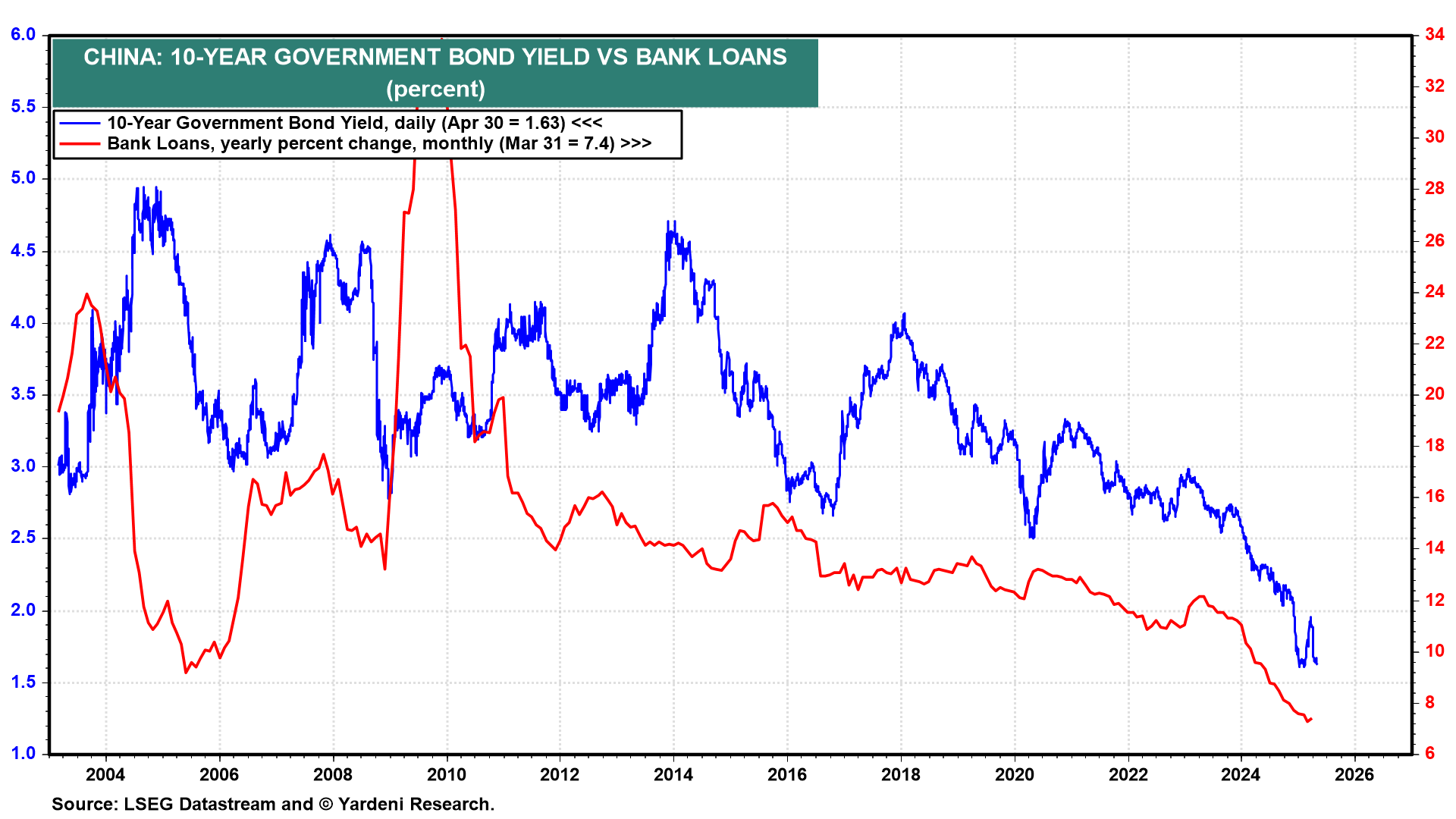

(4) The 10-year Chinese government bond yield rose earlier this year in response to the government's economic stimulus announcements (chart). But it has fallen back to record lows since early April.

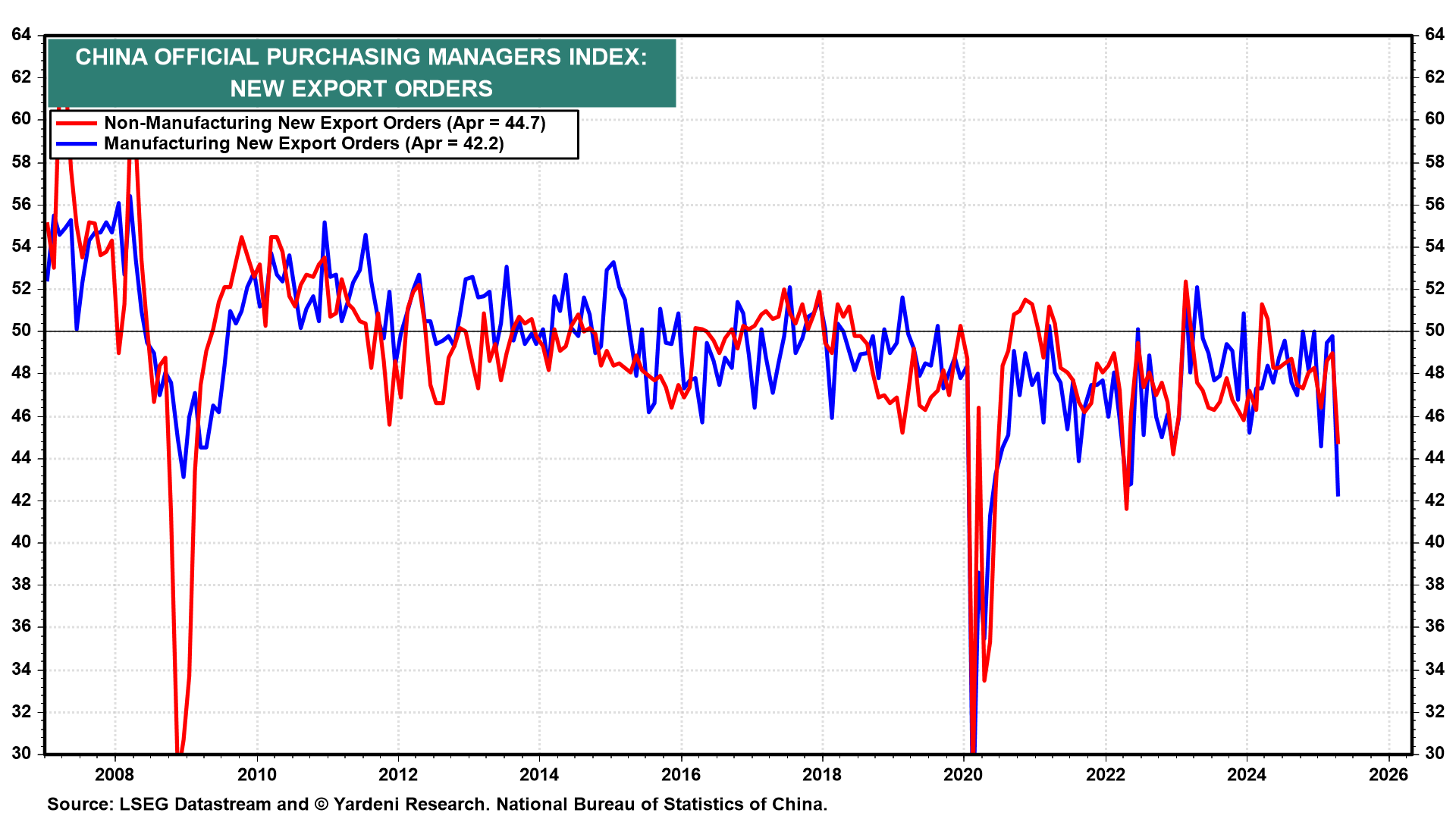

(5) China's official purchasing managers survey showed significant declines in the new export order indexes for both nonmanufacturing and manufacturing industries during April (chart).

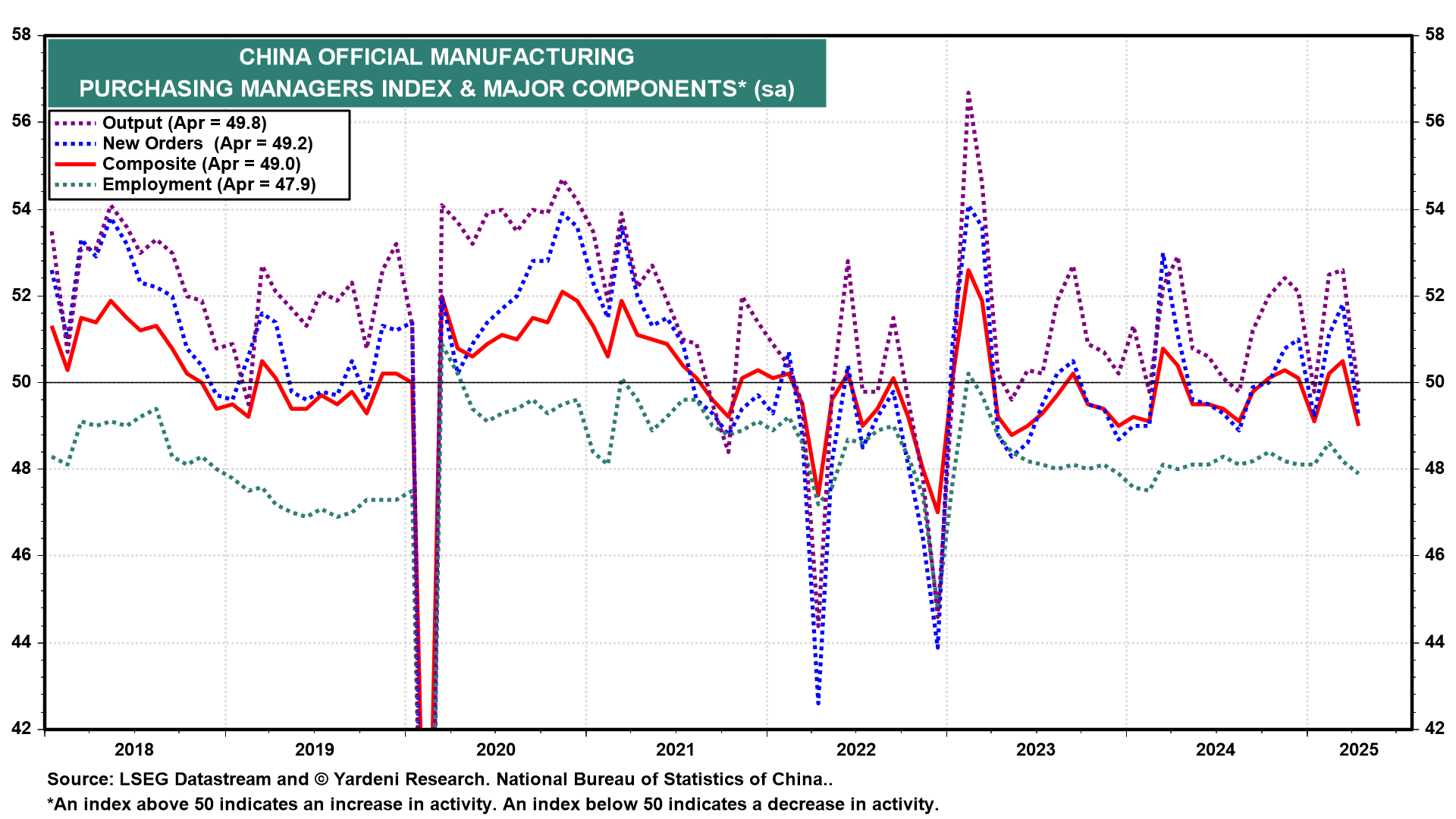

(6) China's official manufacturing purchasing managers index was back below 50.0 in April (chart). The same can be said for its output, new orders, and employment indexes. The latter has been mostly below 50.0 for many years.

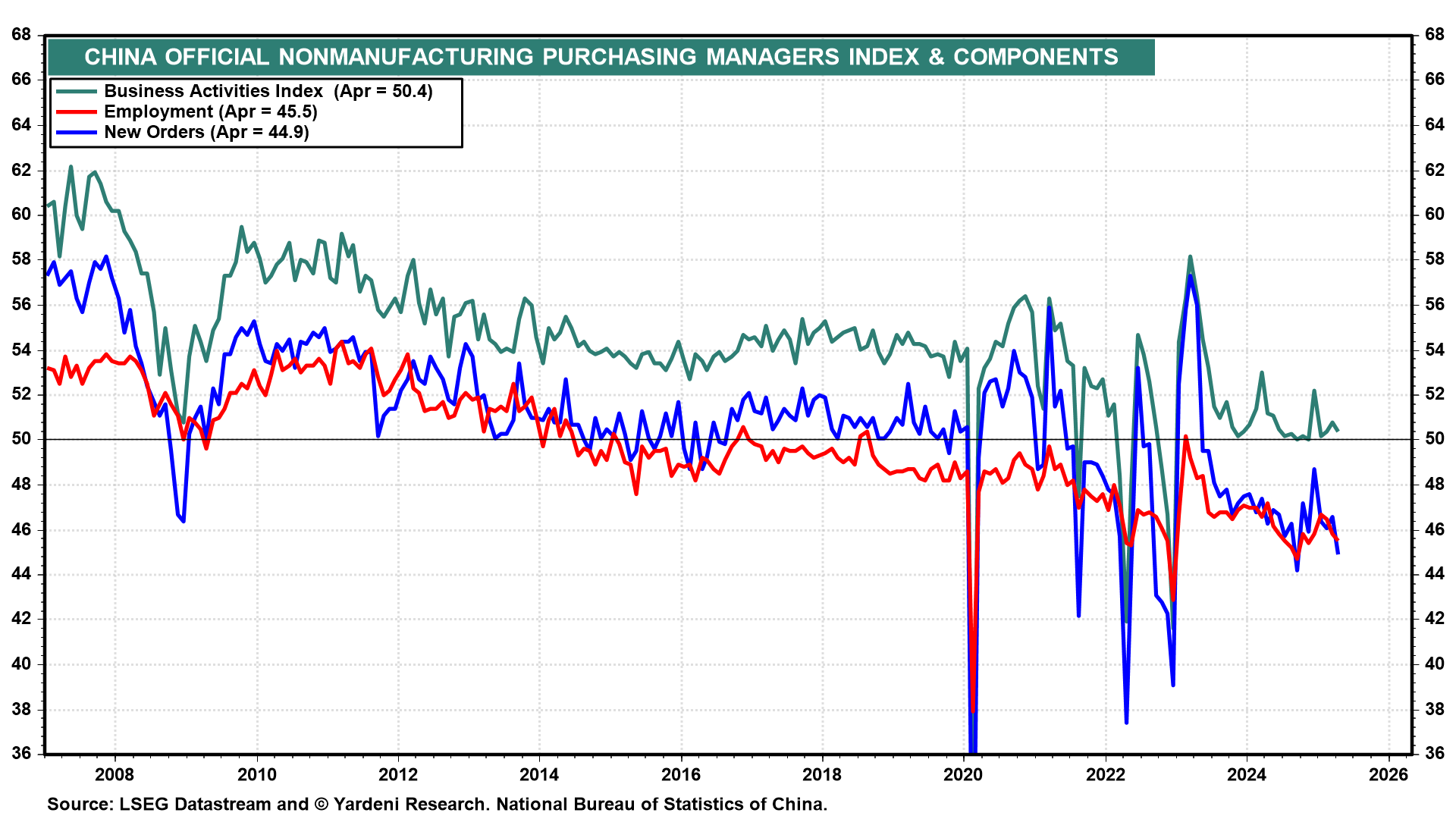

(7) China's official nonmanufacturing purchasing managers index remained slightly above 50.0 in April even though the new orders and employment indexes were well below that level (chart).

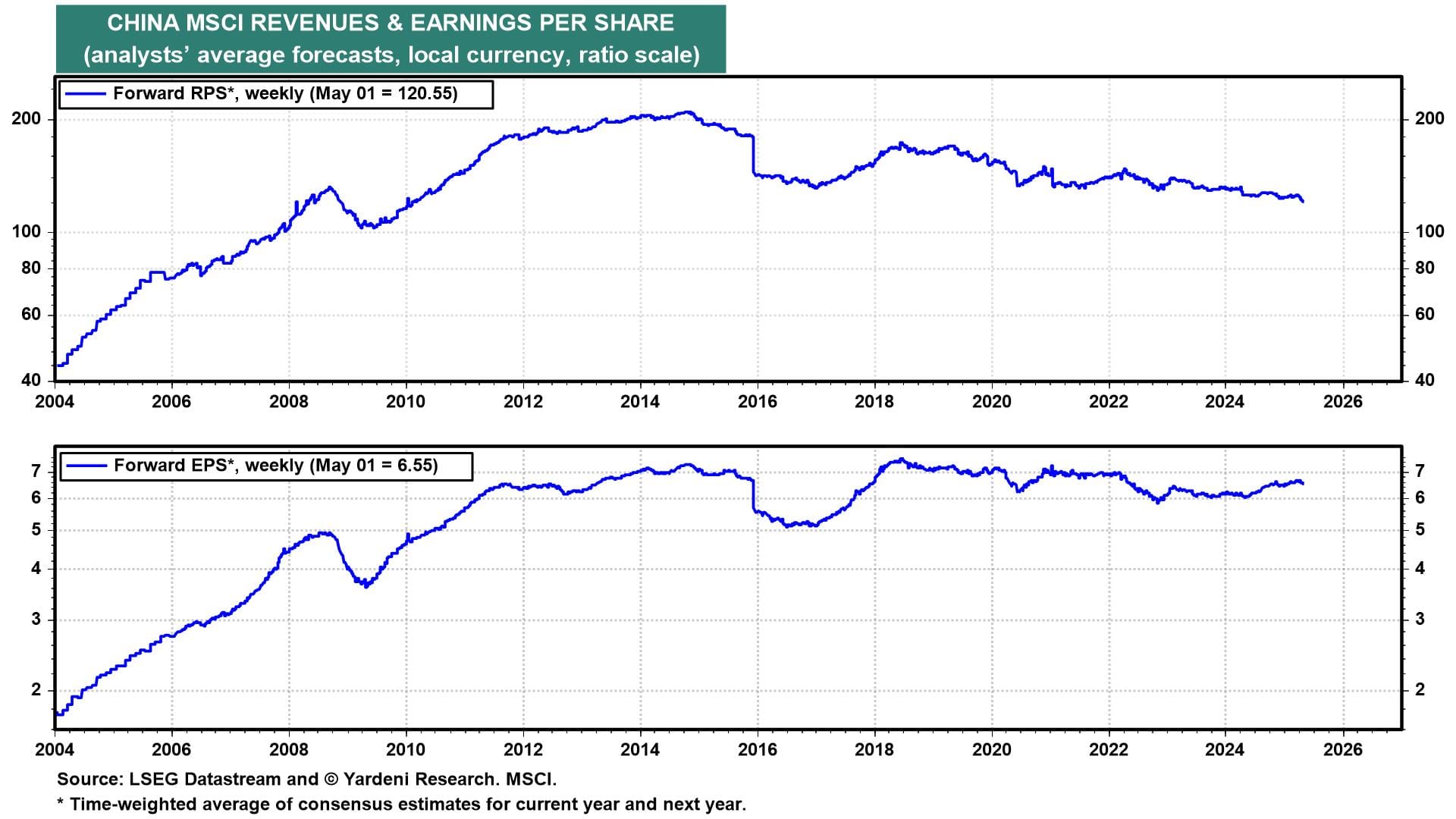

(8) The forward revenues per share of China's MSCI stock price index has been on a modest downward trend since 2014 (chart). Forward earnings per share has been flat over this period.