Happy Lunar New Year! Last year was the Year of the Wood Snake, according to the Chinese Zodiac. In Chinese culture, the Snake is often seen as a symbol of wisdom, intuition, and transformation. The Horse is one of the most beloved zodiac signs. It is a powerful symbol of energy, freedom, and rapid success. Because the Horse is a social and high-spirited animal, its year is usually expected to be fast-paced and full of movement.

While the Chinese year 4724 has just started, 2026 has already been a wild ride in the stock market, with a dramatic rotation of market leadership from the Magnificent-7 to the Impressive-493. Despite the weakness in the Mag-7, the S&P 500 has held up remarkably well. It is continuing to do so despite the increasingly likely prospect that the US will attack Iran in a matter of days, which has raised the price of a barrel of Brent crude oil from around $60 at the start of the year to over $70 (chart).

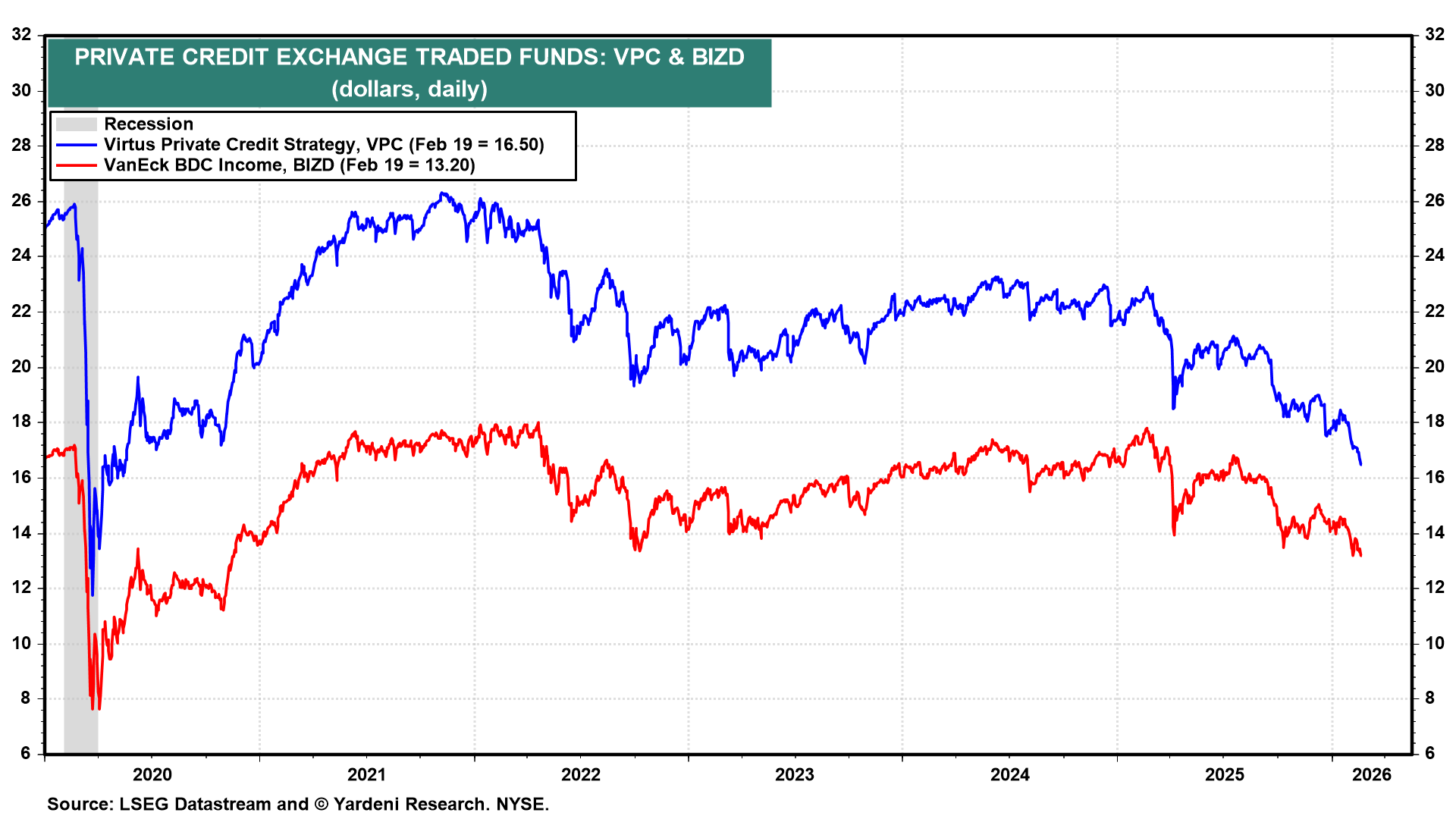

Concerns about private credit have also been increasing. Today, Blue Owl Capital shares tumbled after a decision to restrict withdrawals from one of its private credit funds raised fresh concern over the risks bubbling under the surface of the $1.8 trillion market. We've been monitoring the falling prices of ETFs that invest in the shares of private credit companies since late last year (chart). We don't expect a Lehman Moment in the private credit market, but it is included in our “what-could-go-wrong” scenario, to which we currently assign a 20% subjective probability. We include geopolitical risks in this bucket, too.