We are raising our year-end S&P 500 target back to 7000. We started the year there, but lowered it earlier this year in response to Trump's Tariff Turmoil. We began raising our forecast again during the spring, when we concluded that the tariff issue would no longer impact the stock market by the end of the summer. We bet the resilience of the economy would boost S&P 500 earnings. So far, so good.

We think that the V-shaped stock market rebound since April 9 is discounting the economy's resilience, which reduces the odds of a recession. The market is now experiencing a slow-motion meltup. We attribute this to the Fed's rate cut on September 17 and expectations of one or more cuts before the end of the year.

As promised, we are increasing the odds of a meltup to 30% from 25% and reducing our base-case for a sustainable bull market (i.e., without a correction) to 50% from 55%. Our odds of a correction (or worse) remain at 20%.

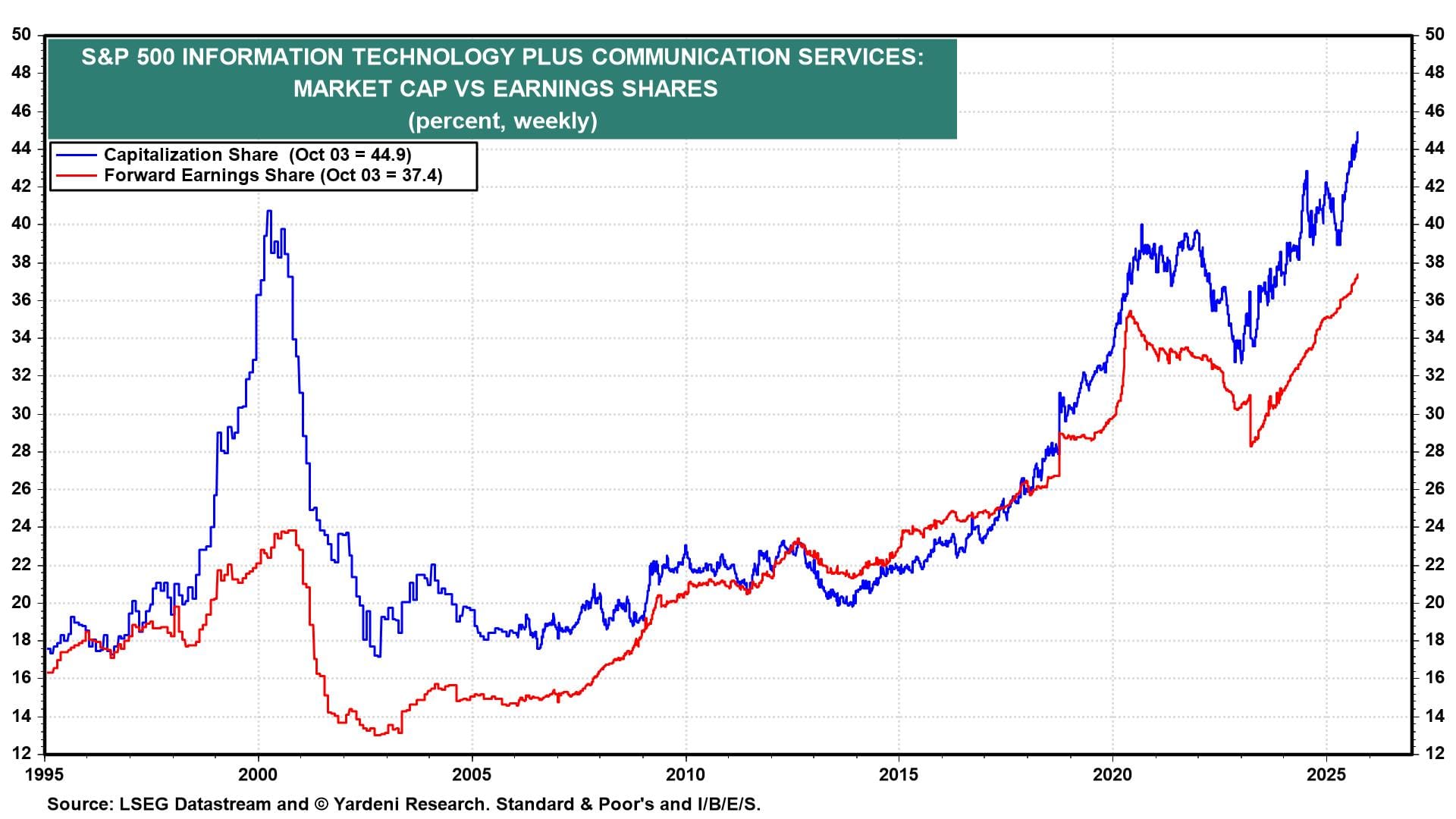

When the tech bubble in the stock market inflated during 1999, we don't recall as much chatter about a bubble as we are hearing today. From a contrarian perspective, it is comforting that there is a bubble in bubble fears. The Google Search index for "AI bubble" rose from zero in mid-September to 100 on October 2.

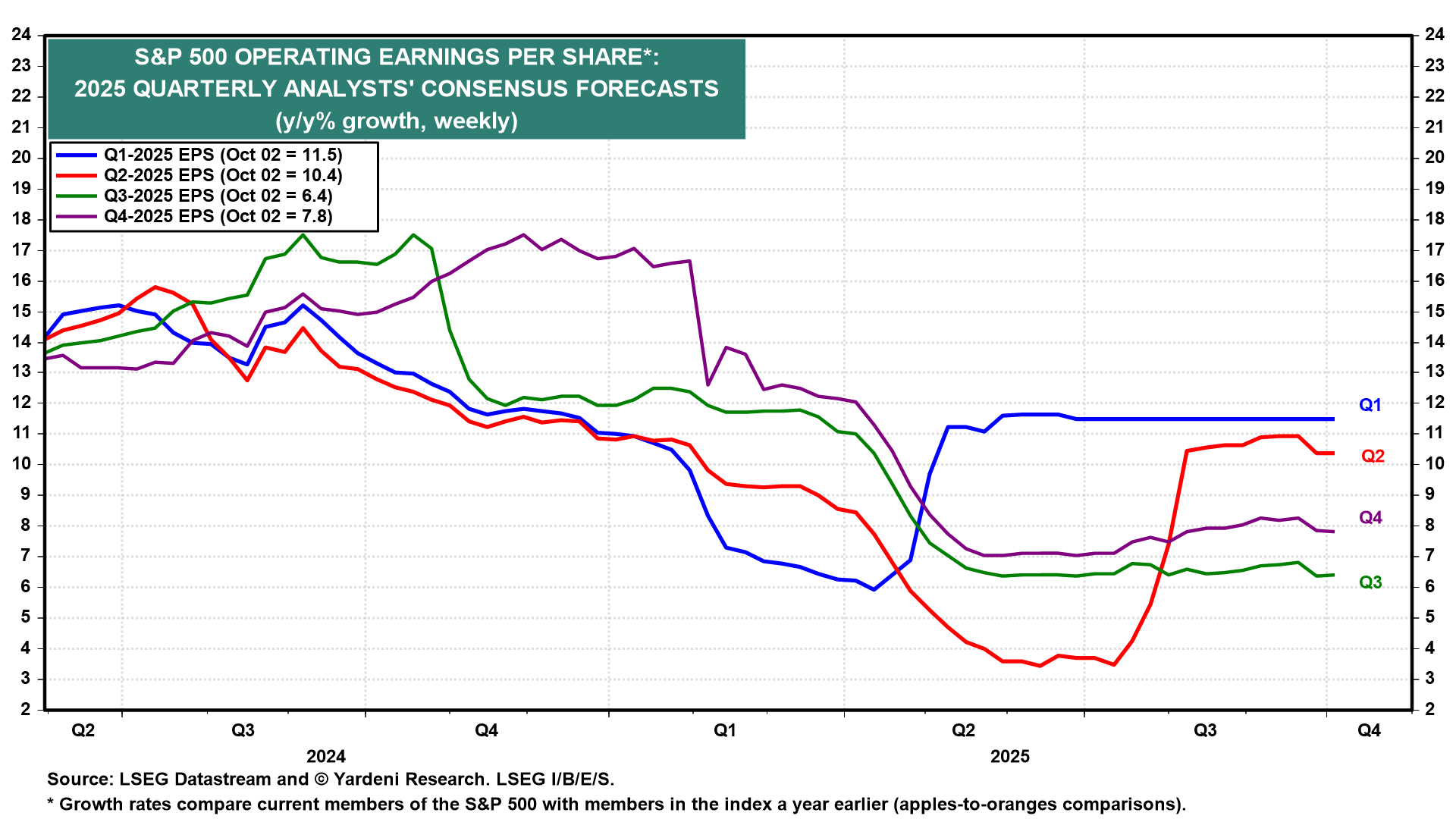

We are counting on another better-than-expected earnings reporting season for Q3 over the next few weeks to support the stock market's rally to record highs. Industry analysts are currently predicting that the quarter's earnings will increase by 6.4% y/y (chart). We are expecting a 10.7% increase. We expect the large banks to start the season around mid-October with upside earnings surprises. In addition, we expect that the AI and cloud companies won't disappoint either.

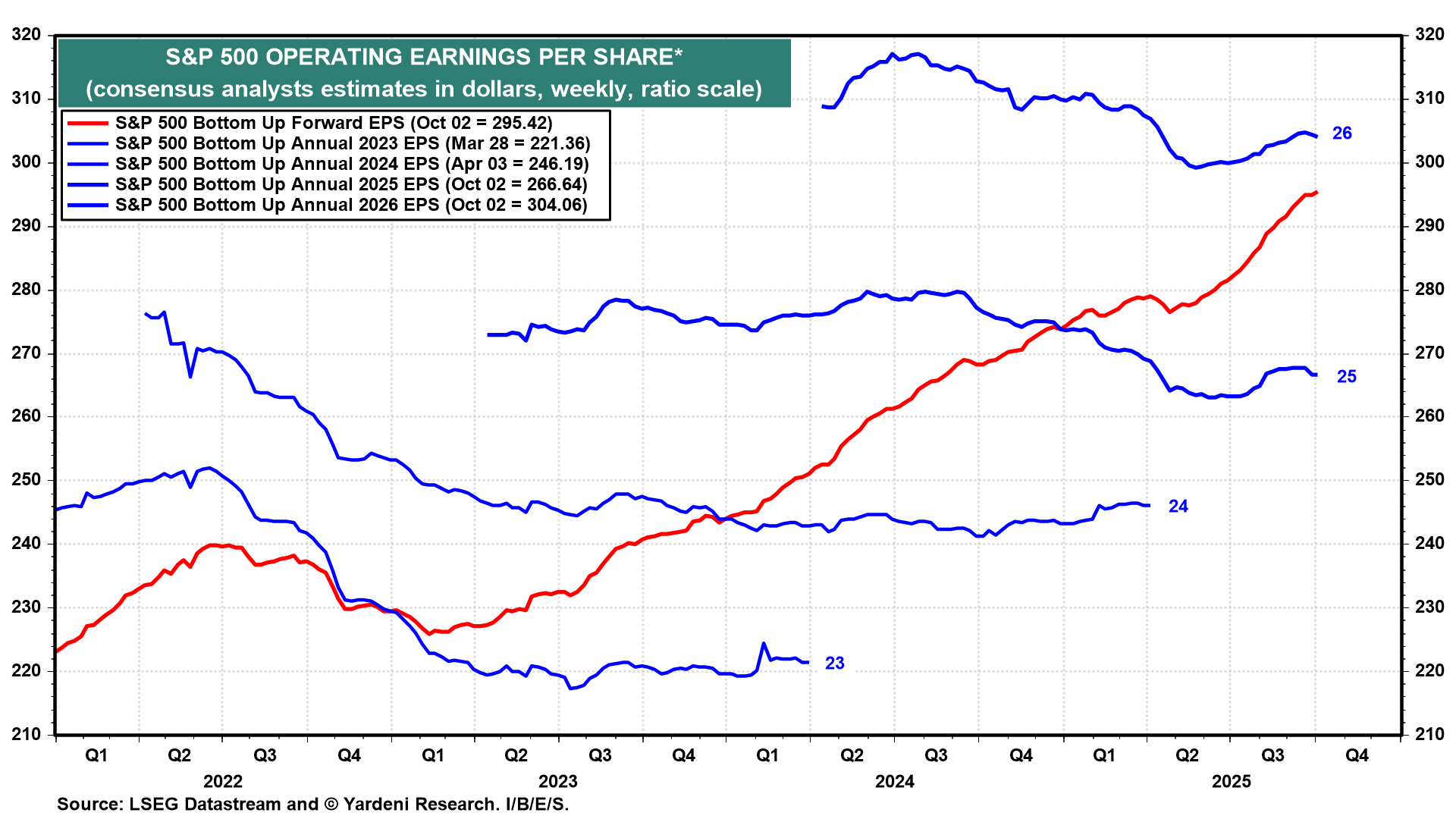

S&P 500 forward earnings per share for the S&P 500 rose to another new record high during the week of October 2 (chart). That puts the forward P/E at 22.7 based on Friday's close. (The recent downticks in the 2025 and 2026 earnings estimates reflect changes in the constituents of the S&P 500.)

The bubble in technology-related stocks today has less air than the one during 1999 (chart). Today, the S&P 500 Information Technology and Communication Services sectors account for a record 44.9% of the index's market capitalization and a record 37.4% of the index's forward earnings. During the Tech Bubble of 1999-2000, their combined market cap and forward earnings shares peaked at 40.7% and 23.8%.

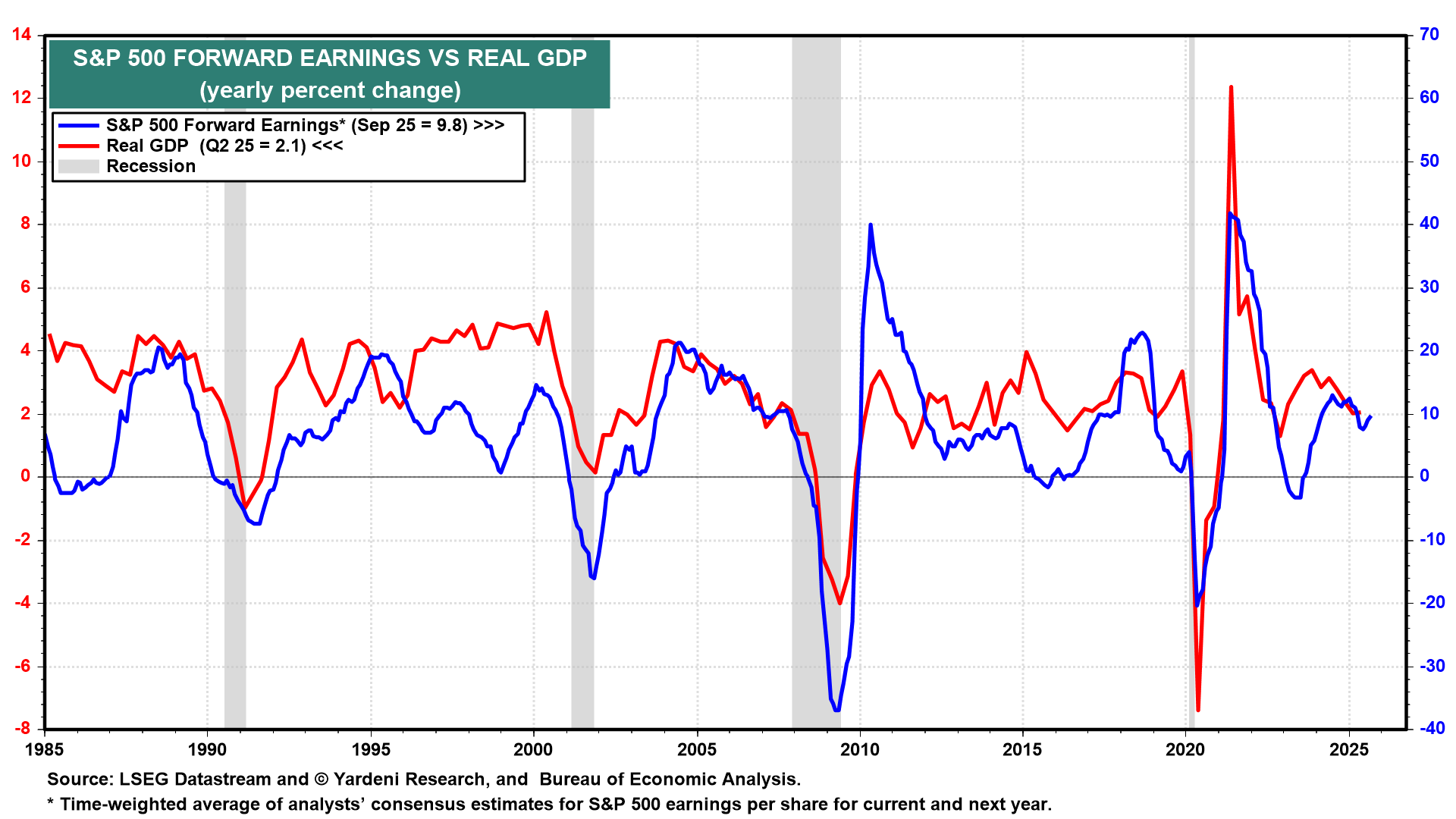

In the absence of government data on real economic activity, we will be giving even more weight to S&P 500 forward earnings as an economic indicator (chart). During September, it rose to a record high, showing a solid y/y increase of 9.8%.