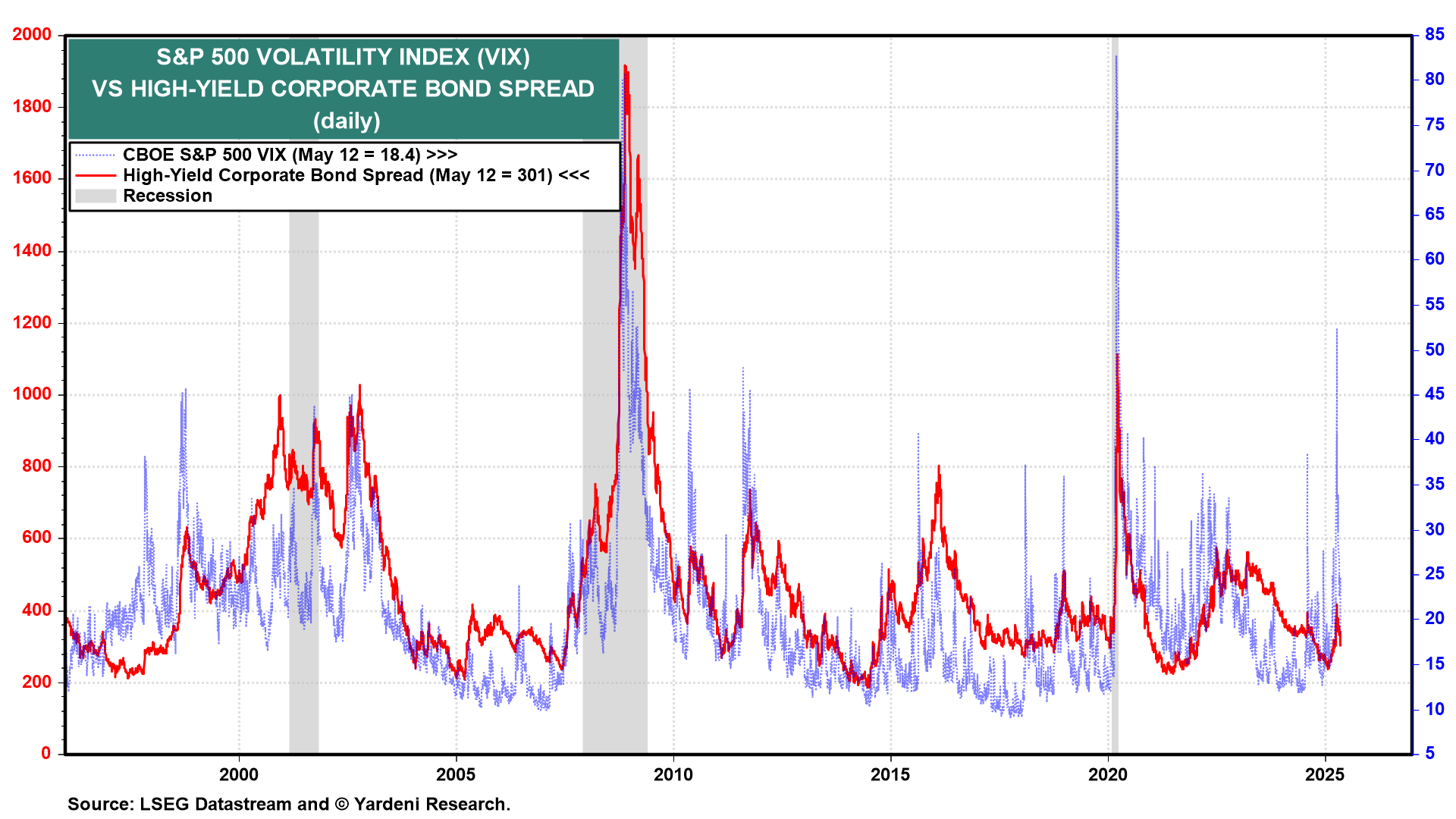

The Dow Jones Industrial Average wasn't up or down by 1,000 points today. The S&P 500's VIX was back down below 20 on Monday and again today (chart). The yield spread between corporate junk bonds and the 10-year Treasury bond has narrowed recently. The latter seems to be settling down around 4.50%, in the middle of our 2025 range of 4.25%-4.75%. President Donald Trump is in the Middle East and focusing his remarks on relationships with Saudi Arabia today.

Following the surprising de-escalation of the China-US trade war over the weekend, Wall Street's economists are scrambling to lower their odds of a recession this year. The economists and strategists at Goldman Sachs reduced their US recession probability for the next 12 months from 45% to 35% and raised their S&P 500 year-end target to 6100. JP Morgan's chief economist lowered his recession odds to "now below 50%." The odds of a recession according to Polymarket.com dropped from 51% on Friday to 41% on Monday (chart). We lowered our recession odds on Monday from 35% to 25% and raised our year-end S&P 500 target from 6000 to 6500.