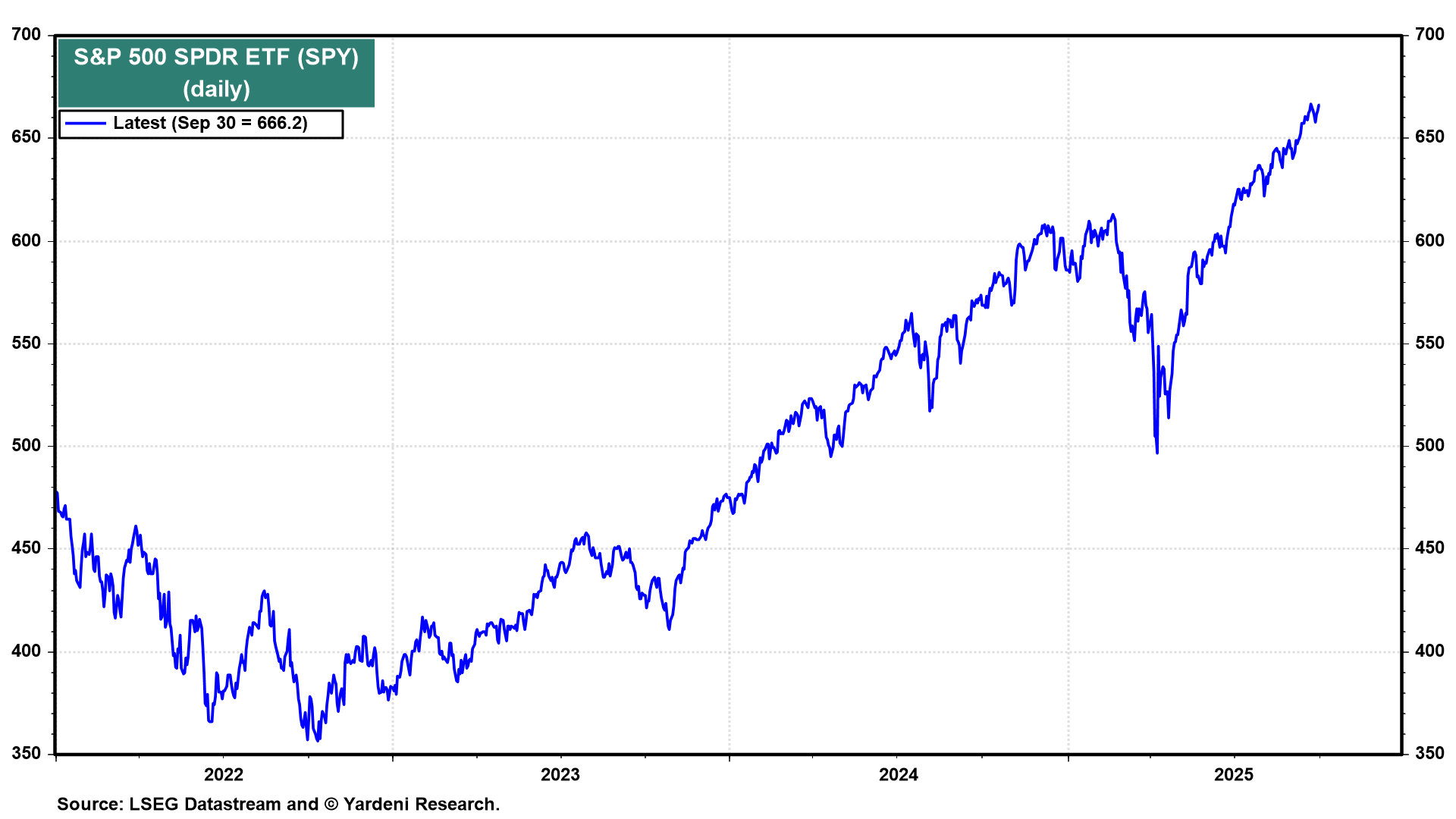

The S&P 500 SPDR ETF (SPY) closed today at 666 (chart). I have fond memories of that number. I wrote on March 16, 2009: "We’ve been to Hades and back. The S&P 500 bottomed last week on March 6 at an intraday low of 666. This is a number commonly associated with the Devil. . . . The latest relief rally was sparked by lots of good news for a refreshing change, which I believe may have some staying power. . . . I'm rooting for more good news, and hoping that 666 was THE low." The same day, the Fed's first round of quantitative easing was expanded to $1.25 trillion in mortgage-related securities and $300 billion in Treasury bonds.

On July 27, 2009, I wrote: "I prefer meltups to meltdowns. The S&P 500 has been on a tear ever since it bottomed at the intraday low of 666 on Friday, March 6. I should have known immediately that this devilish number was the bear market low. It took me a few days to conclude that it probably was the low. . . . I felt like Tom Hanks in 'The Da Vinci Code.' Subsequently, when I told this story to our accounts, I said that I called the bottom in stocks more as a symbolist than as an investment strategist."

So what does the latest 666 mean? Might it be signaling a market top this time? If so, then we can see that happening for the Magnificent-7, as investors struggle to fathom whether all their spending on AI infrastructure will ever be profitable. Meanwhile, the S&P 493 should continue rising on solid earnings. On balance, the S&P 500 should end the year at a new high of around 6800.

Now for some more devilish news out of the labor market today. Among the most real-time indicators of this market are the three jobs availability series included in the Consumer Confidence Index (CCI) survey (chart). In September, the "jobs-plentiful" series fell to 26.9%, while the "jobs-hard-to-get" series rose to 19.1%.