The “soft” economic data releases have been weak, while the “hard” data have been strong in recent months. The former includes surveys of consumers, small business owners, and purchasing managers. We've been betting on the resilience of the economy, as confirmed by the hard data. Stock investors seem to agree with our view.

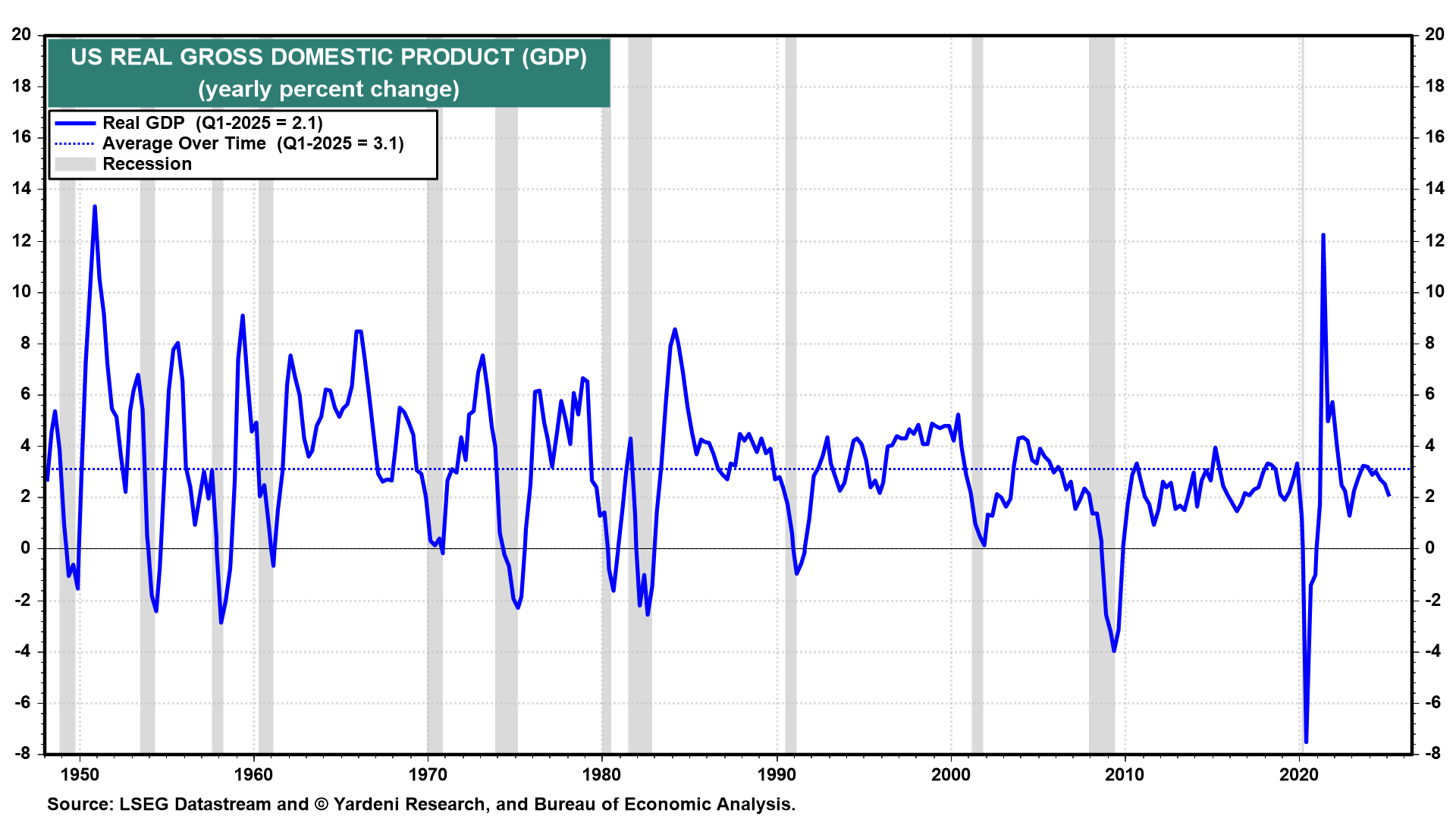

The purchasing managers indexes for both manufacturing (M-PMI) and non-manufacturing (NM-PMI) remained weak through May. However, the M-PMI doesn't track the growth in real goods GDP as it did prior to the pandemic. The same can be said for NM-PMI and the growth in real services GDP. The growth of real GDP on a y/y basis remains solid (chart).

Measures of consumer confidence have also been depressed so far this year, especially the Consumer Sentiment Index (CSI). It remained so in May, while the Consumer Confidence Index rebounded smartly during the month. Meanwhile, consumer spending, which was depressed by colder than usual winter weather in January and February, bounced back solidly in March and April because the labor market remained robust.