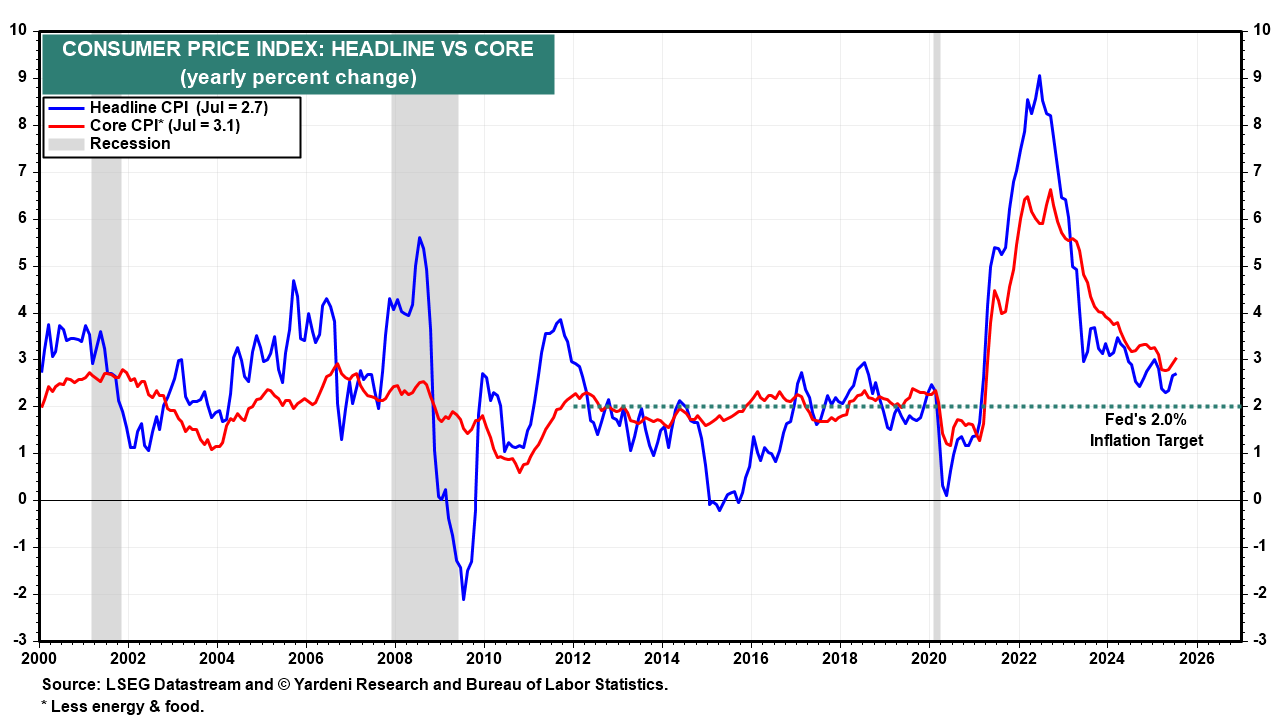

The S&P 500 and Nasdaq jumped to new record highs following the release of July's CPI report today. The headline inflation rate held steady at 2.7%, while the core rate warmed a bit to 3.1%. Stock investors concluded that the Fed is even more likely to ease in September. Indeed, the CME FedWatch tool now shows that the odds of that happening are 94.4%. The 10-year US Treasury bond yield, however, edged up to 4.30%.

Fed officials and stock investors should keep in mind what happened at the end of last year, when the Fed cut the federal funds rate three times by a total of 100 basis points from September 19 to December 19 (chart). The 10-year bond yield rose 100 basis points over the same period.