What does the bond market know that the equity market doesn't? The yield on the 10-year Treasury is down from 4.25% on October 24, 2022 to 3.29% today. The S&P 500 is up 8.0% over the same period. Bond investors must believe that the banking crisis will soon morph into a credit crunch and a recession, so inflation will continue to fall perhaps even more rapidly than widely expected.

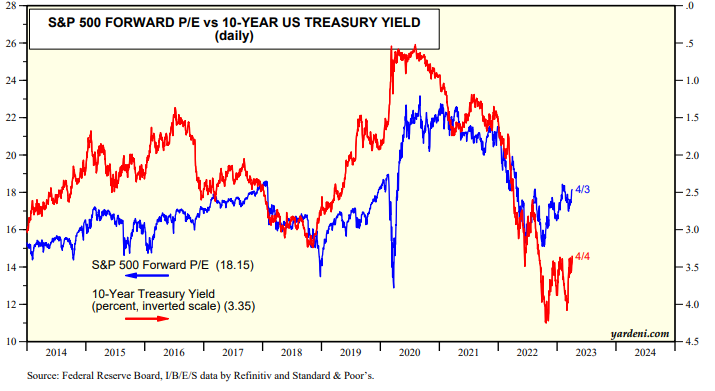

If so, then the Fed should be done. If the Fed persists with more rate hikes that would surely cause a credit crunch and a recession. Deflation might be the outcome of that dire scenario. Lower bond yields may be giving some support to the valuation multiples of various technology stocks for now, but a recession would surely revive last year's bear market in stocks (chart).

Nevertheless, we remain in the soft-landing camp. We continue to see a rolling recession that may be about to roll over commercial real estate. Of course, we are concerned about the potential for a worsening banking crisis and credit crunch, but we think the Fed and FDIC have stabilized the situation for now.

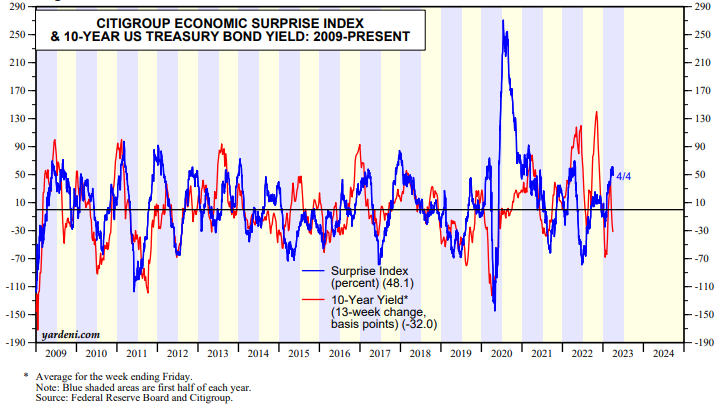

The latest batch of economic indicators have been weaker than expected. Today, we learned, according to ADP, that private sector hiring rose by just 145,000 in March, down from 261,000 in February and below the estimate for 210,000. Annual pay rose at a 6.9% rate in March, down from 7.2% in February. The bond market seems to be anticipating that the Citigroup Economic Surprise Index has peaked recently and is about to fall sharply (chart).

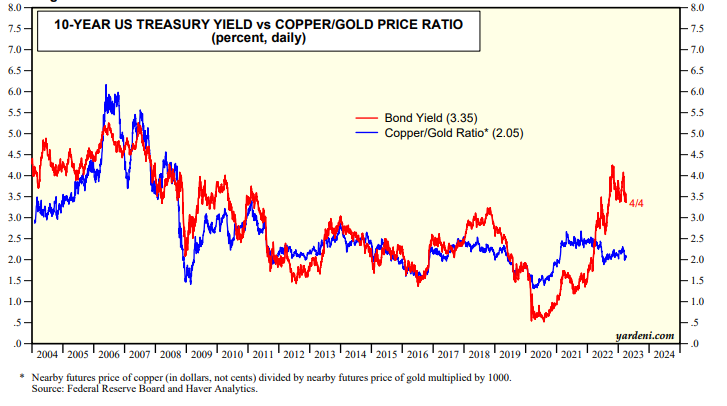

Meanwhile, the relationship between the bond yield and the copper/gold price ratio suggests that the yield could drop to 2.0% (chart). We think that could only happen if the economy falls into a recession caused by a credit crunch. That's not our most likely scenario. We are still assigning a 60% subjective probability to a soft landing and 40% to a hard one.