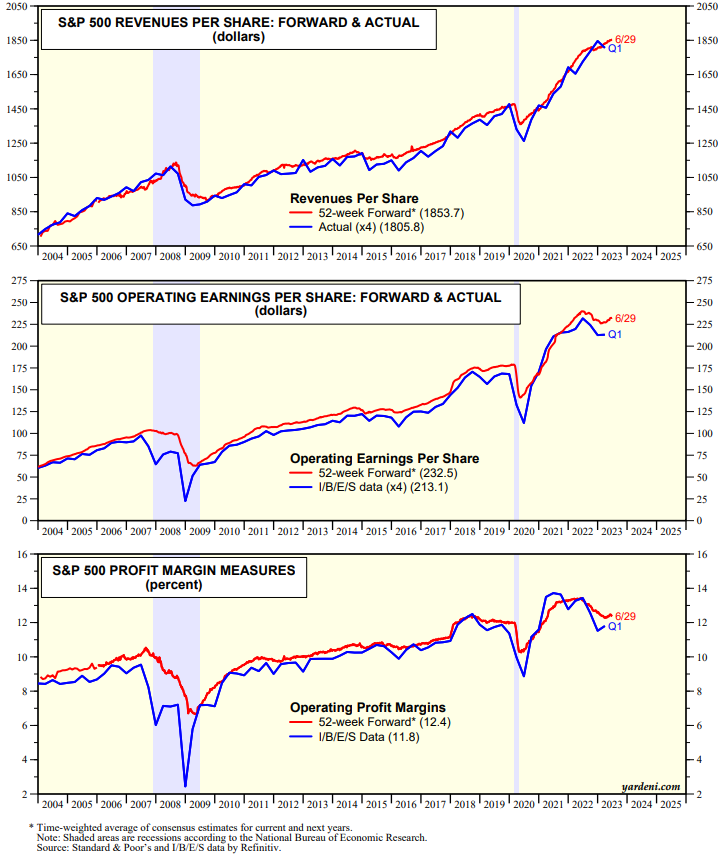

In the stock market equation P = P/E x E, the consensus expected forward earnings of industry analysts determines earnings (E), while investors determine the forward earnings multiple (P/E) that they are willing to pay for E. Industry analysts remain optimistic on S&P 500 forward revenues which rose to another record high during the June 29 week (chart). They've also stopped lowering their consensus expectations for the S&P 500's forward profit margin. As a result, S&P 500 forward earnings have been rising in recent weeks. The weekly data on forward revenues, forward earnings, and the forward profit margin are excellent coincident indicators of the comparable actual quarterly data collectively reported by the S&P 500 companies.

Investors apparently share the analysts' optimism as they are willing to pay a higher valuation multiple for the forward earnings expectations of the analysts. The forward P/E increased 400bps from 15.1 on October 12, 2022 to 19.1 today (chart).