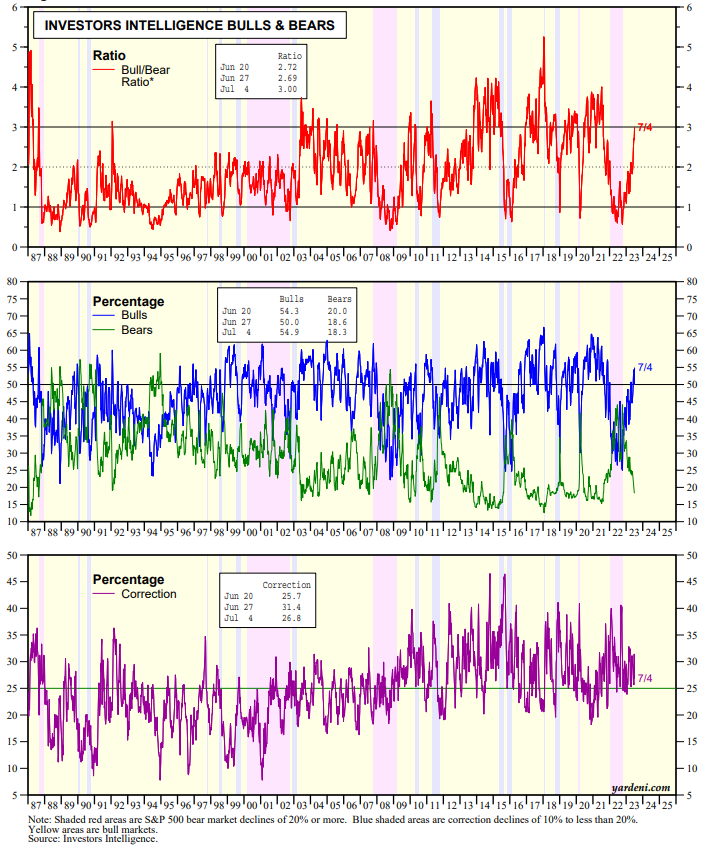

Are there too many bulls? The Bull/Bear Ratio (BBR) compiled by Investors Intelligence jumped to 3.00 during the July 4 week, up from 2.69 the previous week (chart). It is the highest reading since the bull run from March 23, 2020 through January 3, 2022. The bull then got gored during the bear market through October 12, 2022. During the latest week, the bullish percentage rose to 54.9%, while the bearish percentage fell to 18.3%.

We have found that from a contrarian perspective BBRs at 3.00 or higher are not as bearish as readings of 1.00 or lower are bullish (charts). Nevertheless, high bullish sentiment can be a caution flag. After all the S&P 500 is up 24.6% since October 24 led by a 50.6% advance in its Information Technology sector.