A few weeks ago, we observed a bubble in fears of a bubble. The fearmongers see an "everything bubble" that will soon burst. The expression "the bubble in everything" began gaining traction during the tenure of Federal Reserve Chair Janet Yellen (2014–2018), but it became widely associated with Jerome Powell's leadership and the monetary stimulus of the 2020–2021 pandemic era.

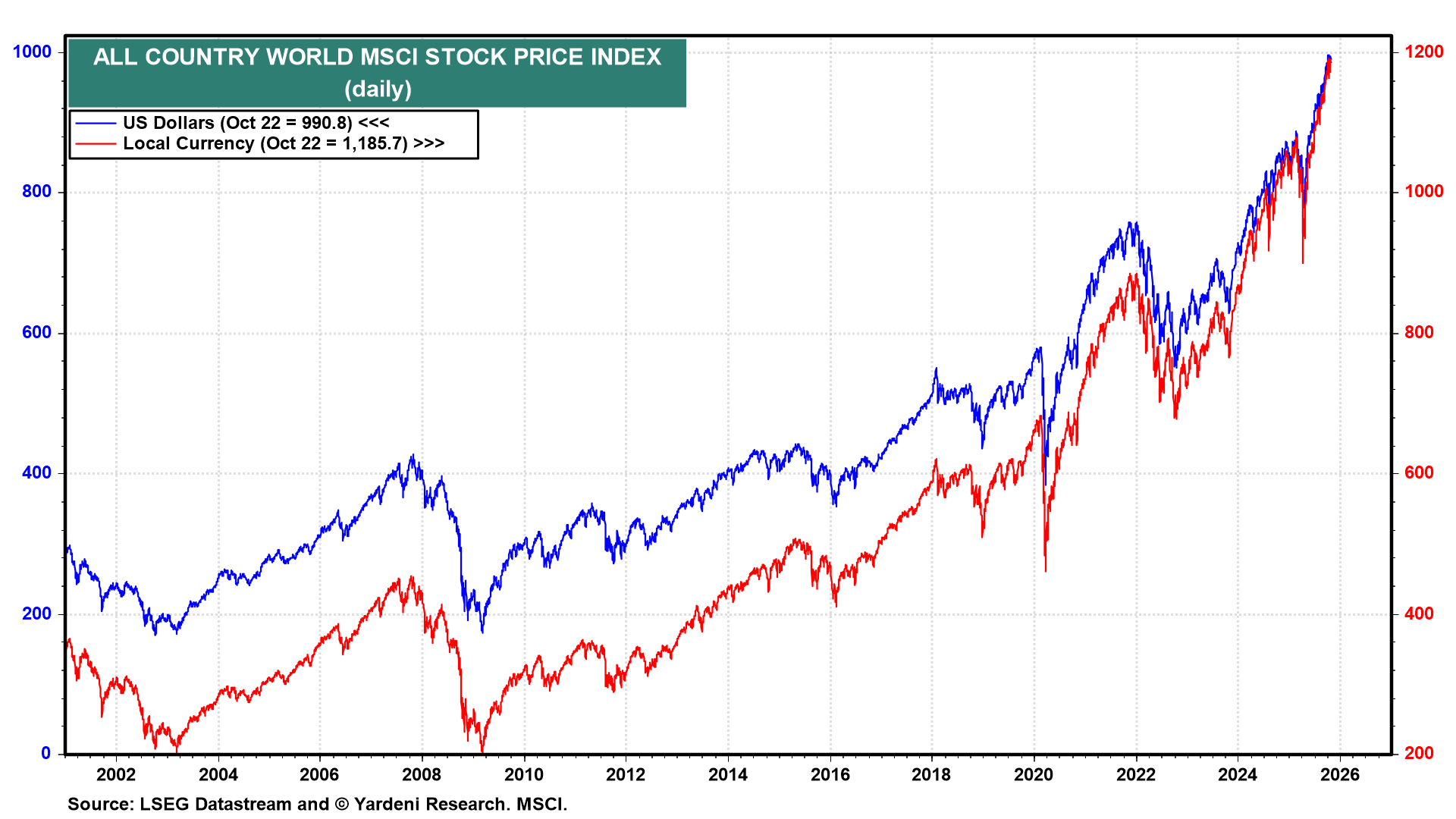

In other words, we've seen this movie play out only a few years ago. Numerous bubbles burst, but they didn't cause a financial calamity or a recession. And here we are today, with the US MSCI and many other stock markets around the world at record highs (chart). Here we are today, with US real GDP at a record high. Except for the two-month pandemic lockdown recession in early 2020, the last US recession occurred 16 years ago!

There are bubbles out there. They will burst because that's what bubbles do. However, they are unlikely to follow the script of the Great Financial Crisis. They are more likely to create buying opportunities in various asset markets, which is what happened when the previous everything bubble burst.

Consider the following:

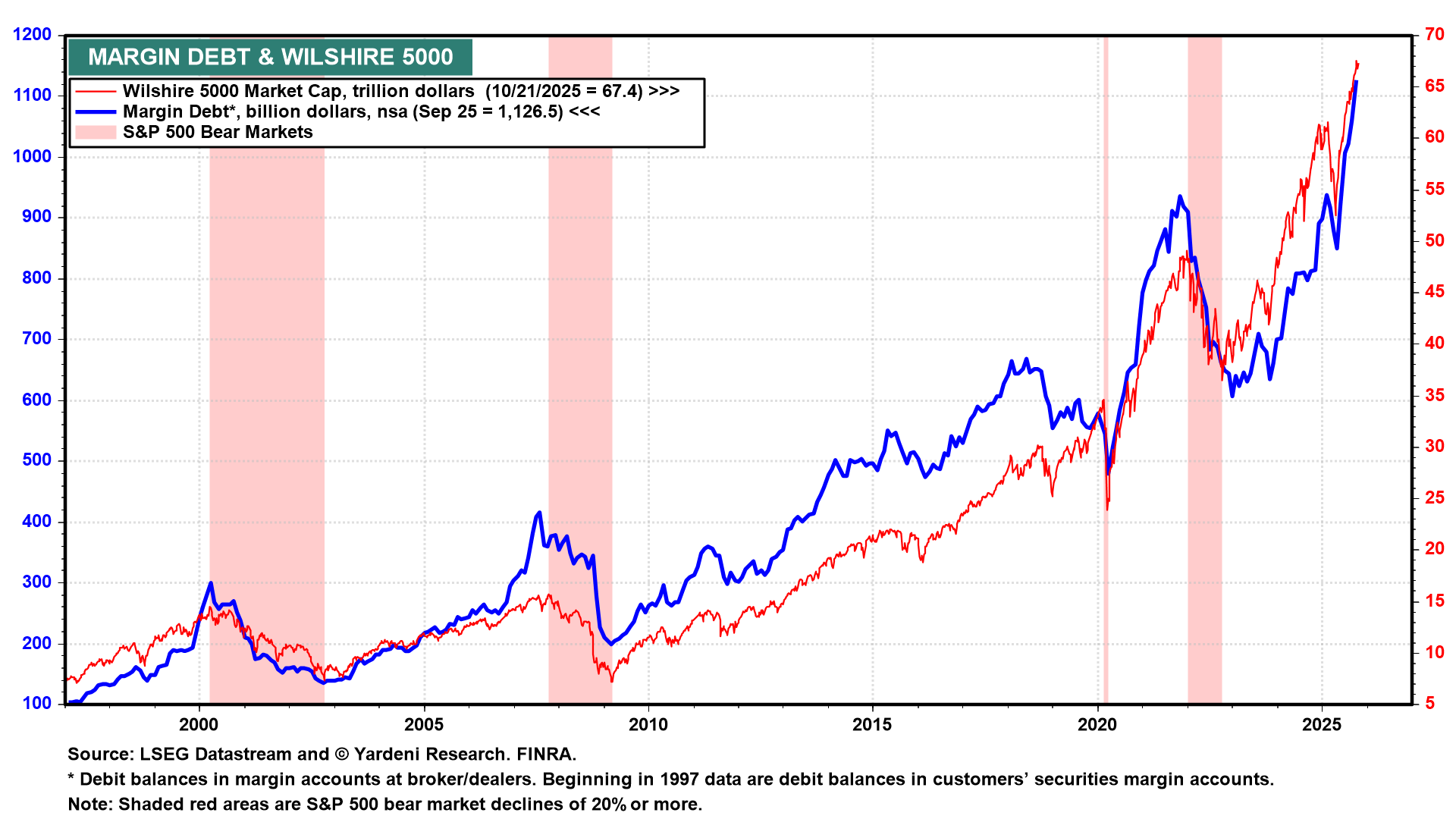

(1) Margin debt rose over $1.0 trillion for the first time during the summer (chart). In the event of a severe pullback, the stock market becomes more vulnerable to margin calls and a bear market. That's what happened during the previous bear market in 2022. However, it didn't last long, despite a sharp decline in margin debt.

(2) Everyone agrees that valuation multiples are stretched. The S&P 500 forward P/E of the S&P 500 was 22.6 in September (chart). But that's where it was a few months after the end of the lockdown recession. Along the way, it fell to around 15.0 during the 2020 bear market and to 18.0 during the correction this past spring. Again, these selloffs provided great buying opportunities.

Fears of a recession and actual recessions cause P/Es to drop. The economy has demonstrated its resilience since the pandemic. It is likely to remain resilient through the end of the Roaring 2020s, in our opinion.