Stock prices fell after Fed Chair Jerome Powell's press conference today, which was actually relatively dovish. He said that inflation remains too high, but the banking crisis might force the Fed to pause tightening soon. Of greater concern to the stock market was that US Treasury Secretary Janet Yellen said at a congressional hearing this afternoon: “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.” The day before at a conference sponsored by the American Bankers Association, she said "Let me be clear: the government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe." She added, "The situation is stabilizing. And the US banking system remains sound." Yet her speech today was destabilizing.

Yellen and Powell need to get their acts together. They both claim that the banking system remains sound. They both want to protect depositors during the current banking crisis. Neither is in a position to provide insurance coverage to all depositors. So they are trying to convince the public that they can keep their banks safe by providing access to additional sources of liquidity, which perversely raises doubts about the soundness of the banking system.

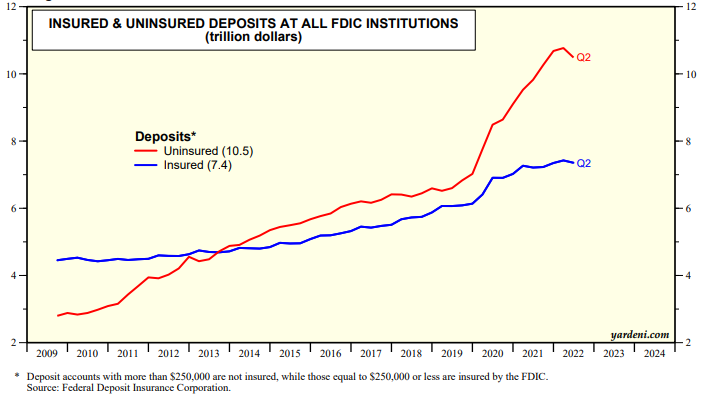

According to the FDIC $7.4 trillion of deposits are insured up to $250,000, while $10.5 trillion are uninsured (chart).

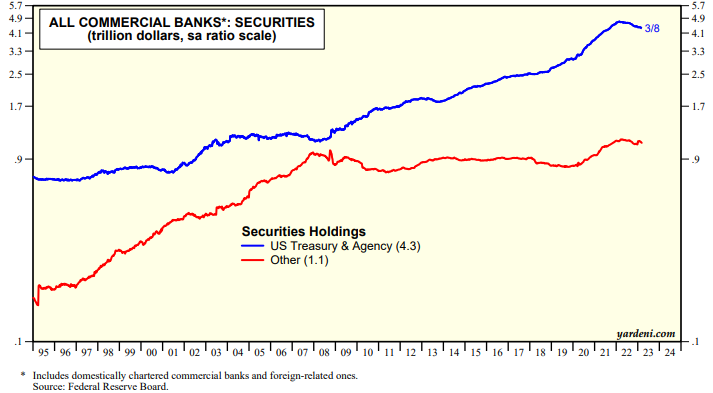

The FDIC also estimated that at the end of last year, banks had unrealized losses of $600 billion in their securities portfolios, which totaled $5.4 trillion with $4.3 trillion in US Treasuries and Agencies and $1.1 trillion other securities at the end of Q2-2022 (chart). The banks purchased most of their Treasuries and Agencies after the Great Financial Crisis at record low yields when the Fed was pegging the federal funds rate close to zero. The securities are deemed to be safe because they are backed by the US government. However, no one anticipated that inflation would make a big comeback in 2022, forcing the Fed to raise the federal funds rare from zero to 5.00% in a year.

Interest rate risk has turned out to be a much bigger problem than credit risk for the banks during the current monetary policy tightening cycle. Then again, as long as the securities are held to maturity, unrealized losses don't have to be realized unless the banks have to sell them if they are faced with bank runs. In any case, they are forced to raise their deposit rates to be competitive with money market rates to halt disintermediation. Doing so hits their profitability since they can't raise interest rates on all their current loans.

With the benefit of hindsight, the era of free money under Fed Chairs Ben Bernanke, Janet Yellen, and Jerome Powell created a big bubble in the banks' bond portfolios. The Treasury contributed to the bubble by issuing lots of bonds that the banks purchased at much higher prices.

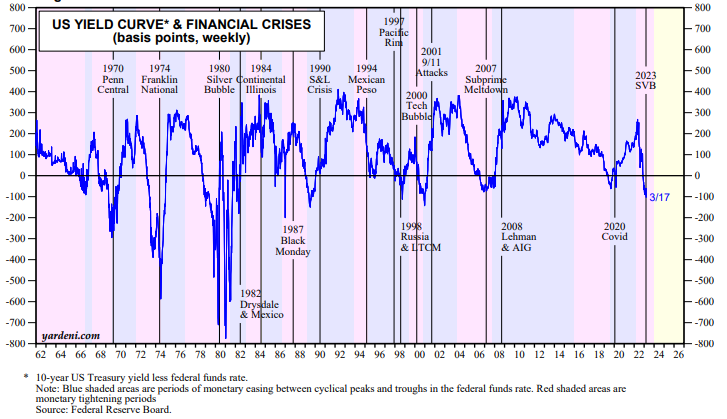

The inverted yield curve has been predicting since last summer that something will break in the financial system as a result of the Fed's abrupt pivoting away from free money. Silicon Valley Bank is that broken something that has raised concern about small community and regional banks (chart).

In his presser, Powell said, "Our banking system is sound and resilient, with strong capital and liquidity. We will continue to closely monitor conditions in the banking system and are prepared to use all of our tools as needed to keep it safe and sound."

Yellen needs to sing from the same hymn book. When she was Fed Chair, I often referred to her as the Fairy Godmother of the bull market. She didn't play that role today.

Finally, we would feel better if both Yellen and Powell wouldn't feel the need to assure us that the banking system is sound.