China's economy is struggling with excessive debt, deflation, excess capacity, and a rapidly aging population. China continues to rely on exports to support economic growth. China has been increasingly accused of dumping its excess production in world markets. This is exacerbating trade frictions, especially with the US.

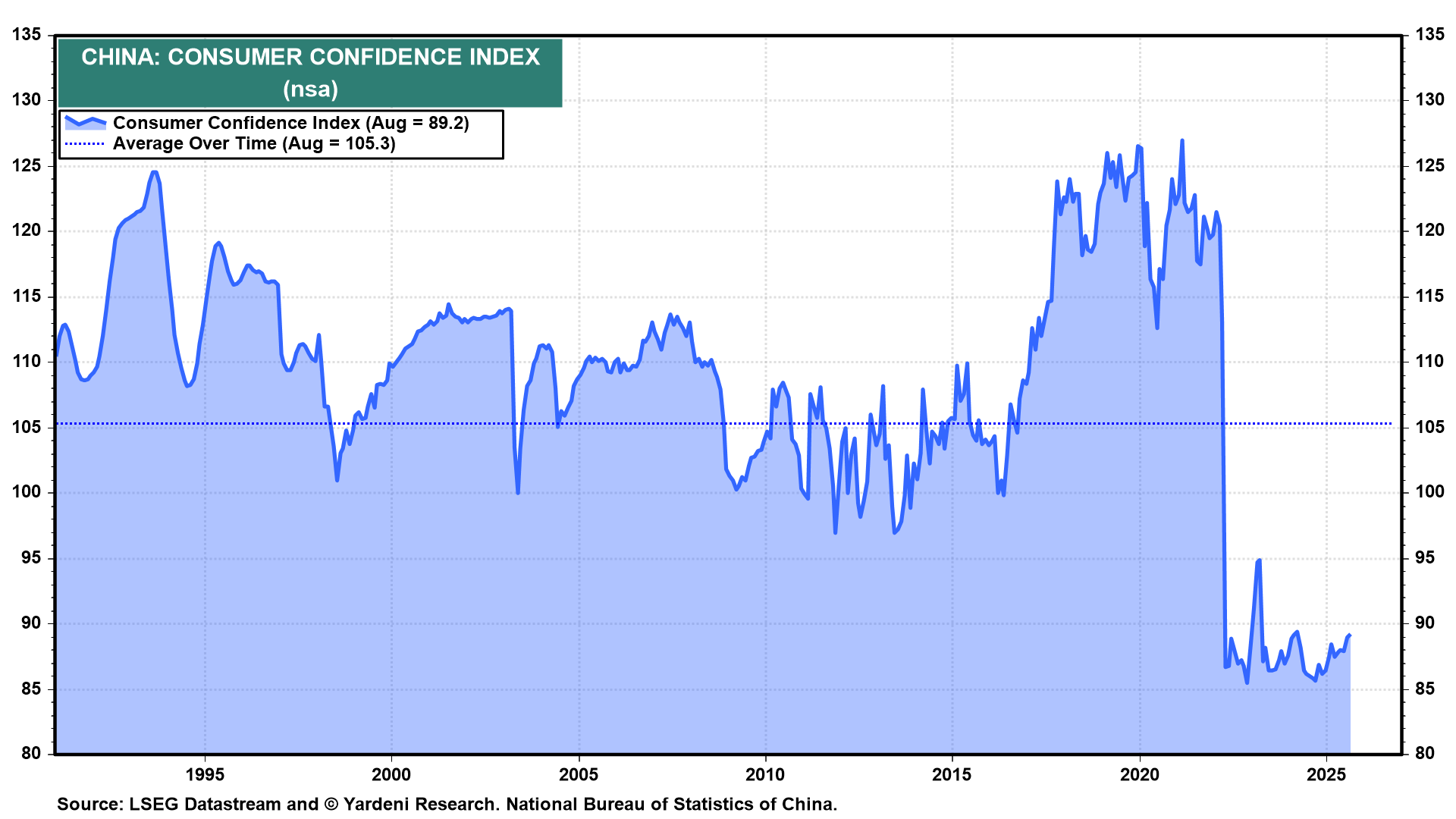

The Chinese government's efforts to stimulate domestic consumption have largely failed to achieve this goal. The problem is that Chinese consumers are depressed because many of them are experiencing a significant negative wealth effect from the losses they incurred when China's property bubble burst. The stock market has also whipsawed them. Consider the following:

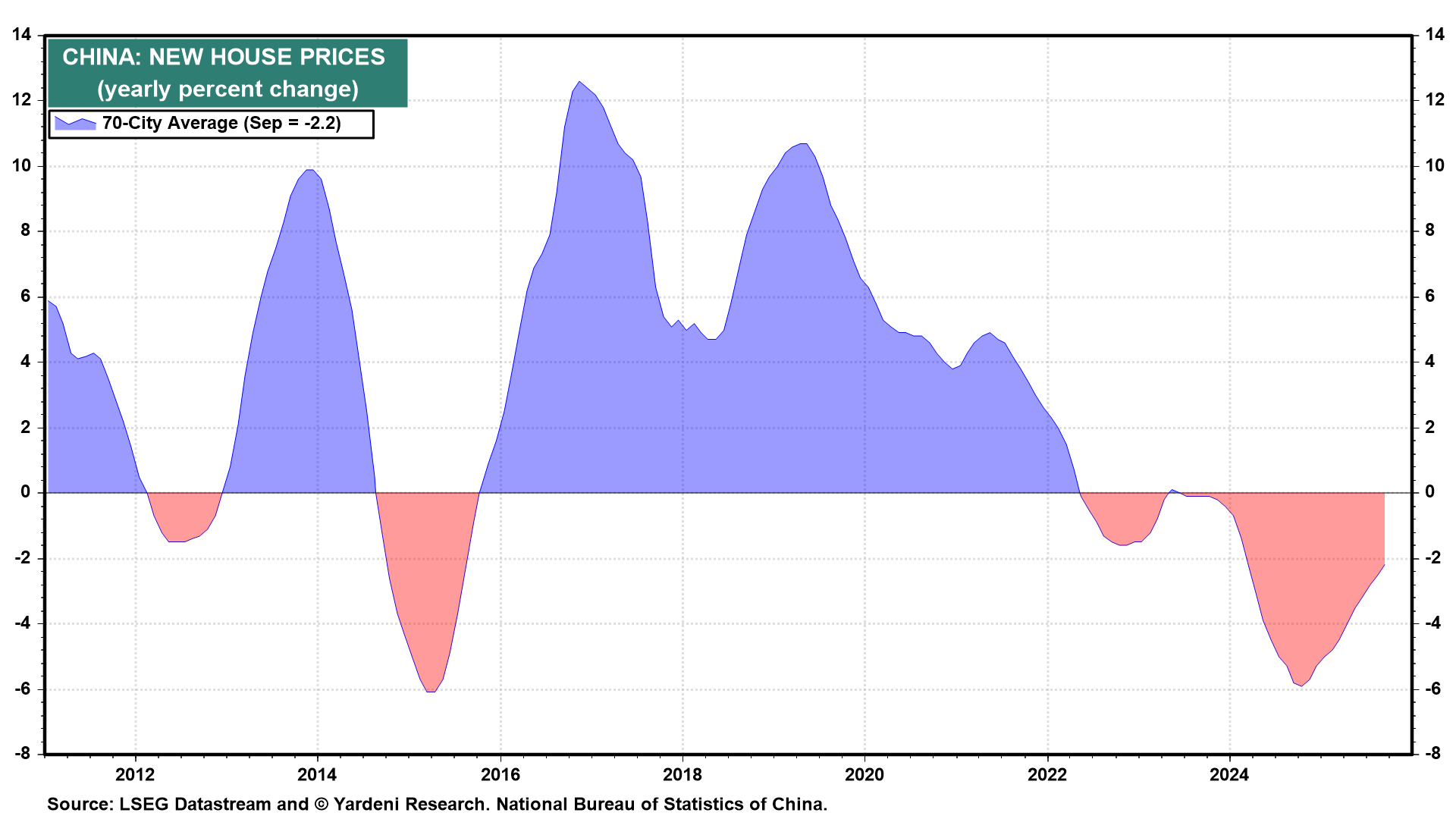

(1) New home prices have been falling since mid-2022 (chart). They fell 2.2% y/y during September. This marks the 26th consecutive month of decline, reflecting persistent weakness in demand.

(2) The housing slump is dragging down consumer confidence and household spending (chart).

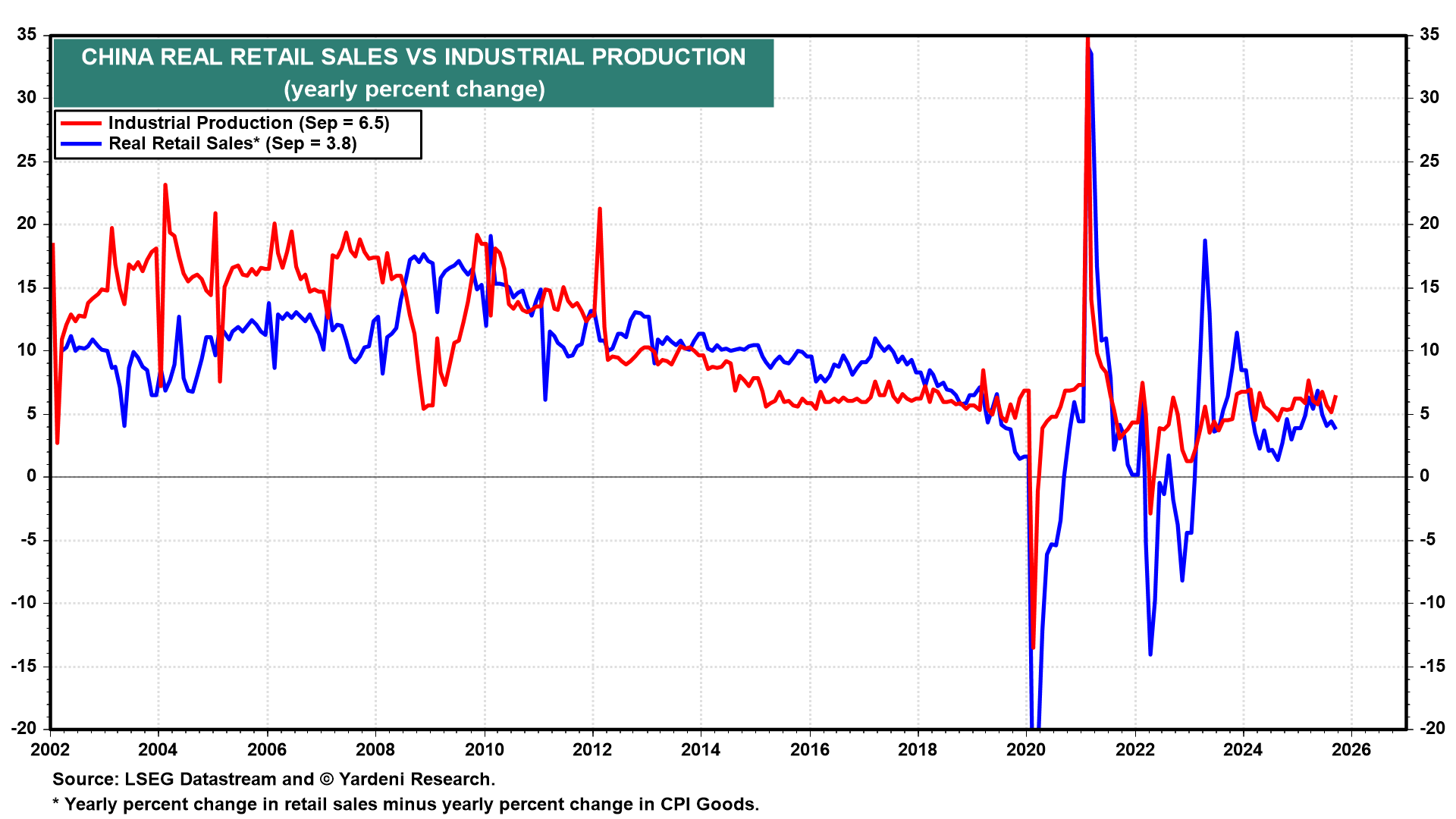

(3) Retail sales in China grew by 3.0% y/y in September 2025, marking the slowest expansion since August 2024. While the overall growth is positive, it reflects a cooling trend compared to the 3.4% increase in August. While some consumer categories are rebounding, others—especially discretionary goods—are losing momentum. Adjusted for the 0.8% y/y drop in China's CPI for goods, retail sales rose 3.8% (chart). However, this measure has been growing more slowly than industrial production since early last year, which is causing deflation.

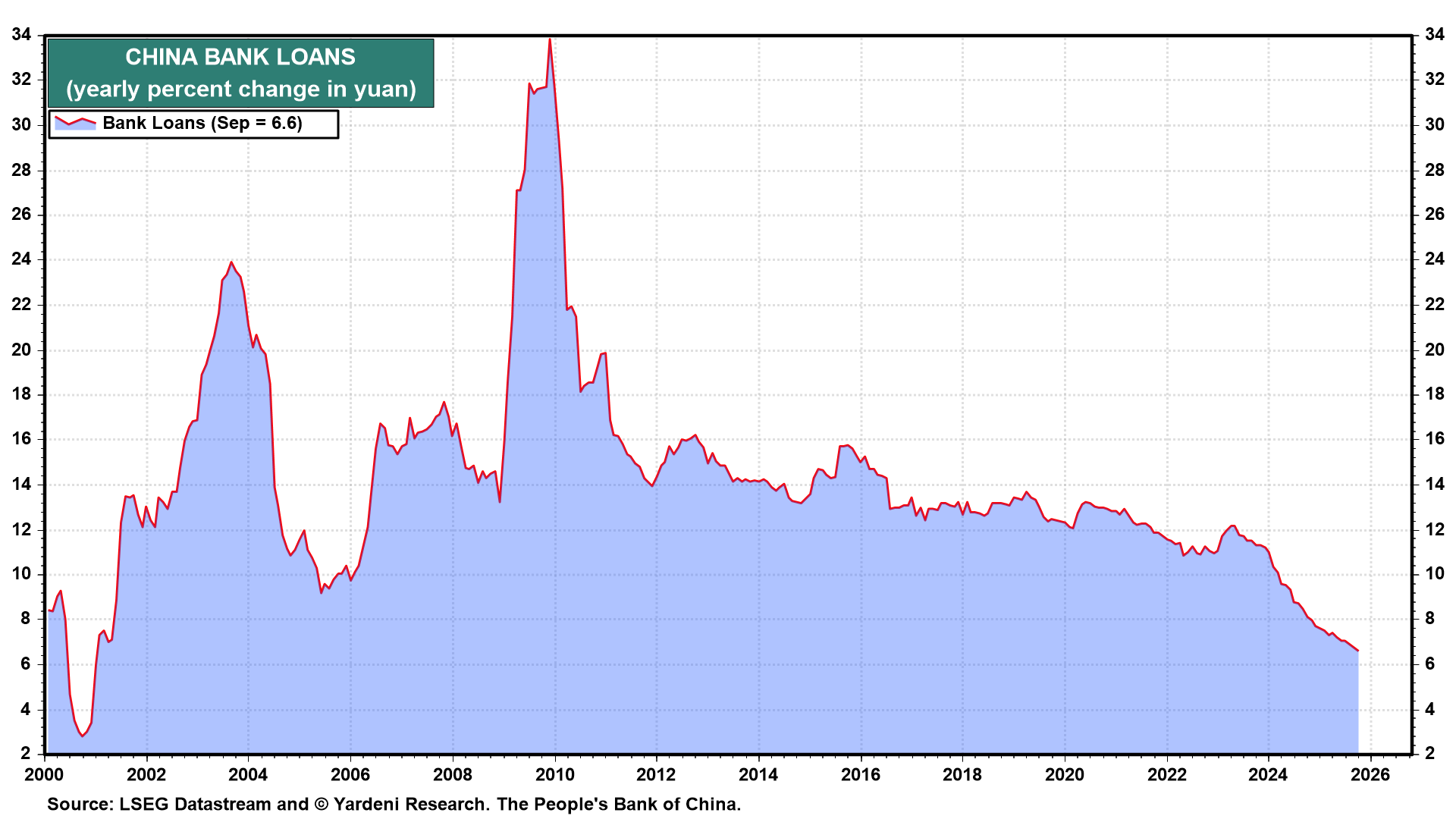

(4) The Peoples Bank of China has been providing a stimulative monetary policy by reducing bank reserve requirements and lowering its official interest rate. Yet the y/y growth in bank loans has dropped nearly in half over the past three years to 6.6% y/y (chart).

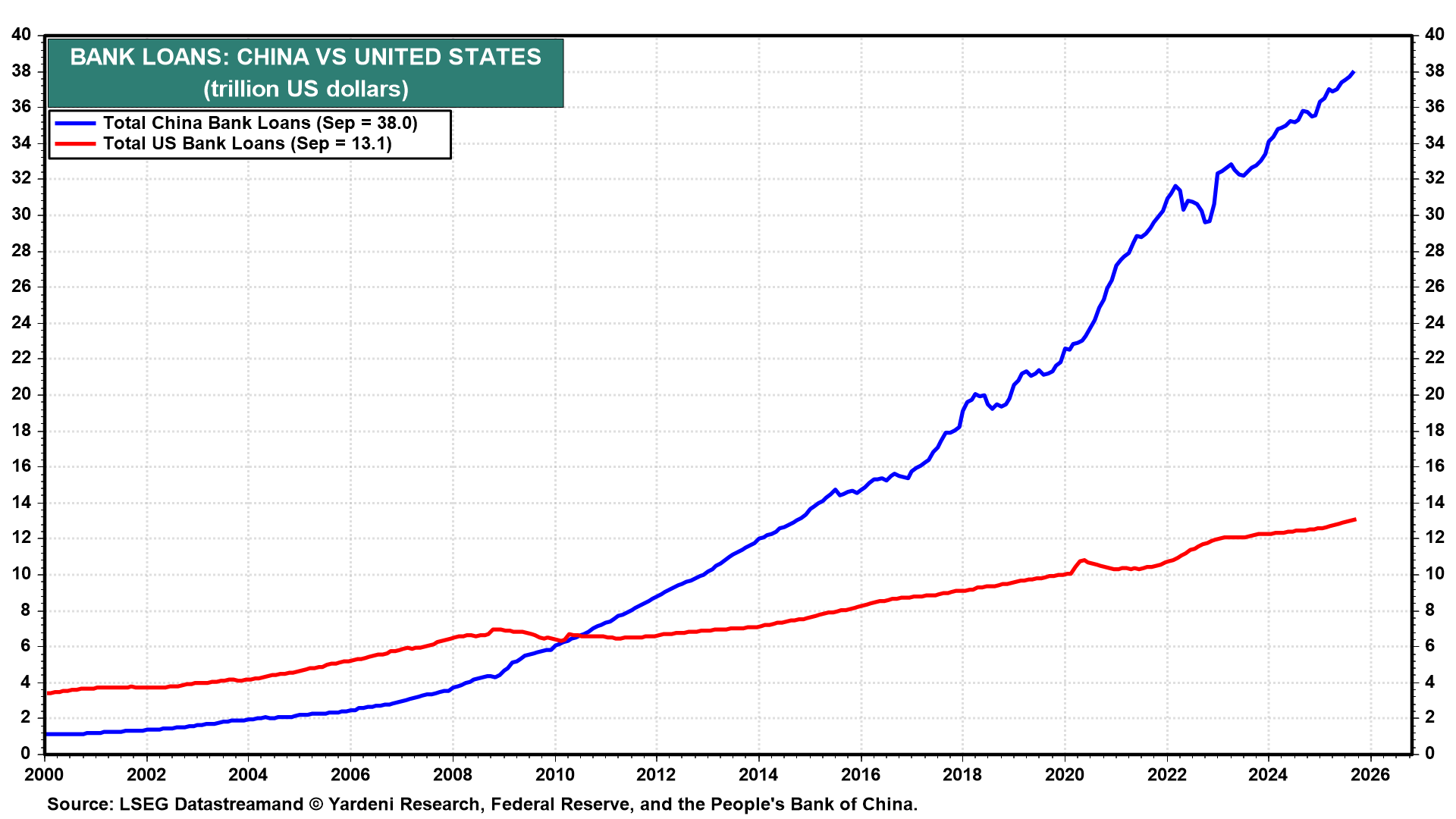

(5) China's bank loans rose to a record high of $38.0 trillion in September. That's a staggering amount of debt, and that is only bank loans (chart).

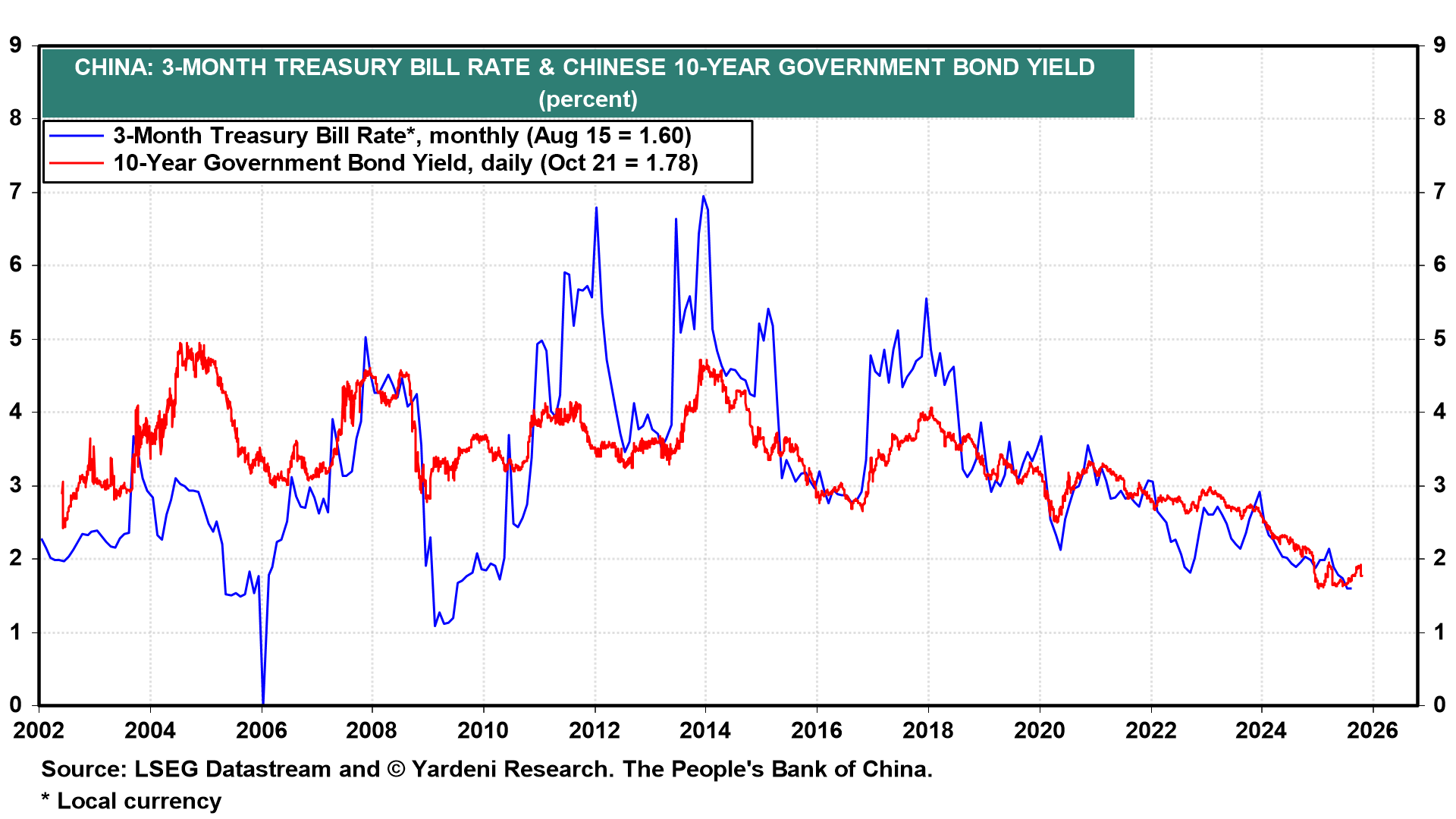

(6) Both short-term and long-term government interest rates remain depressed below 2.00% (chart).

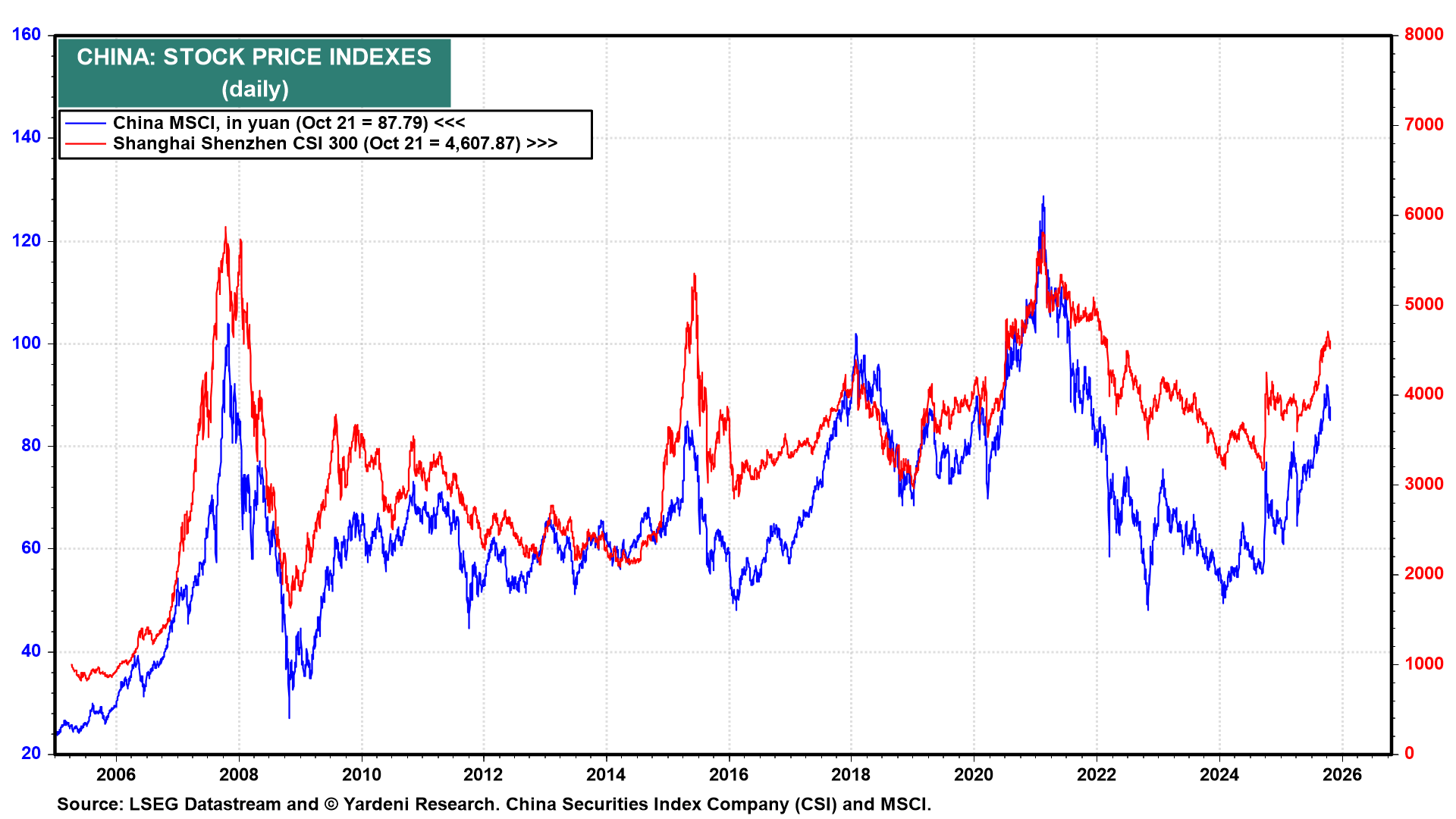

(7) China's major stock market indexes have been very volatile and nearly flat for 18 years (chart)!

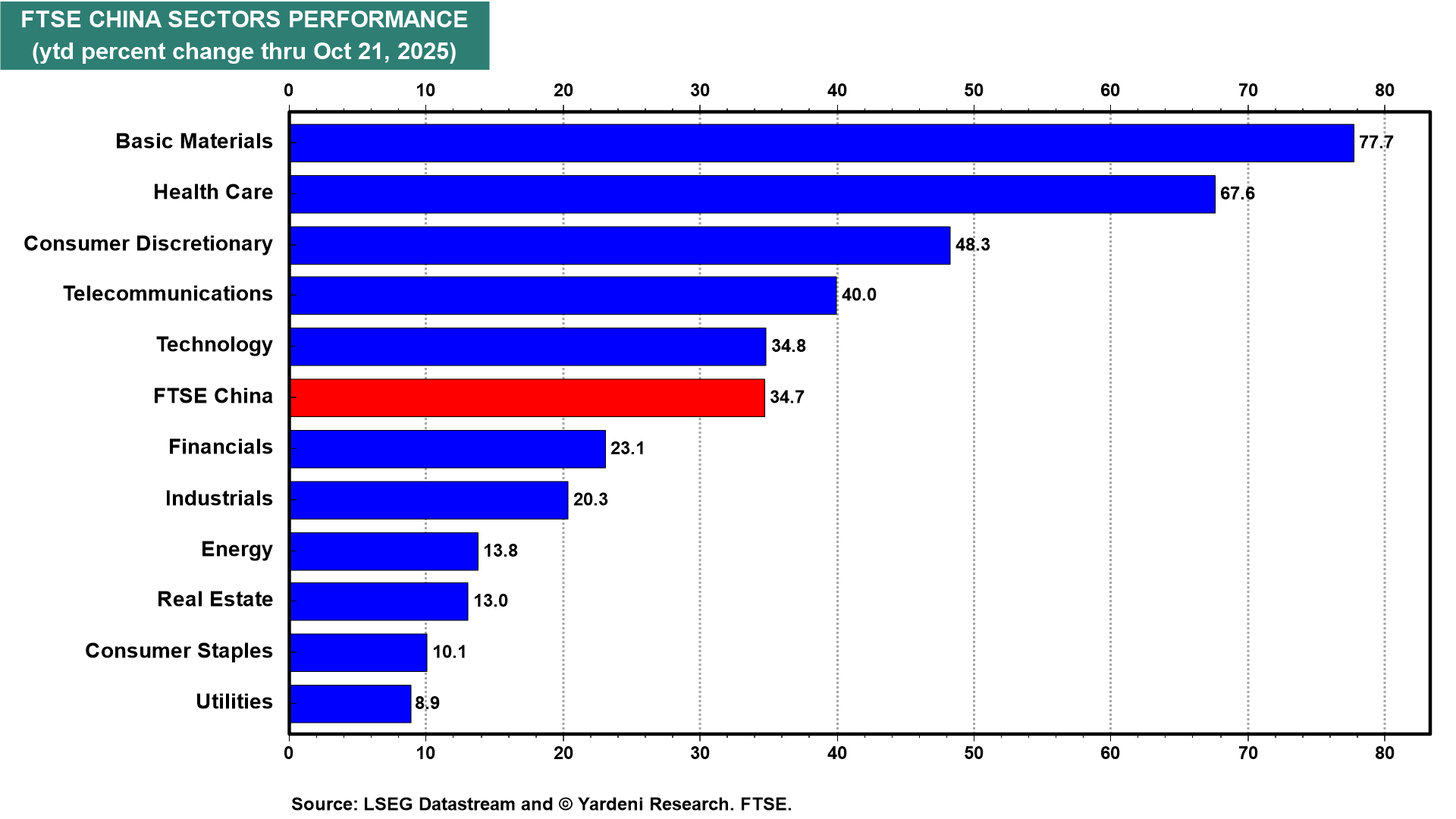

(8) China's stock market has performed very well this year, with the FTSE China index up 34.7% ytd. Technology (34.8%) has performed well, but even better-performing sectors include Basic Materials (77.7%), Health Care (67.6%), and Consumer Discretionary (48.3%).