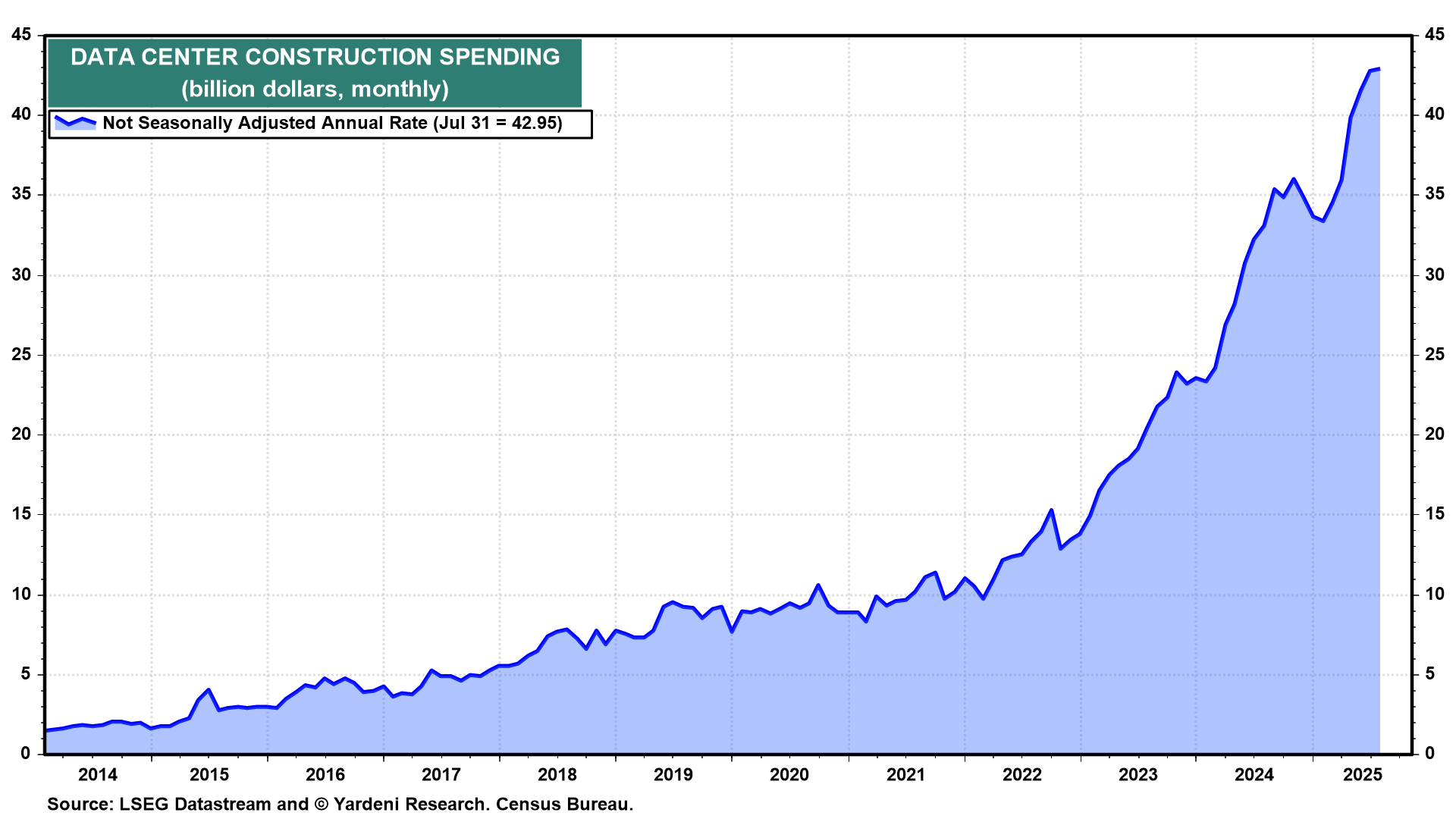

The lure of riches and tight capacity today has money flooding into the construction of artificial intelligence (AI) data centers. Data center construction—just the cost of building the building—has increased to an annual rate of $43.0 billion, up 30% y/y and 322% higher than $10.2 billion four years ago (chart). Add in the costs of chips and servers, and you’re talking about real money.

The irony is that, typically, the more money that floods into an area, the less likely any of the players will make the same juicy profits that attracted them, reaped in the years before the spending boom. Cloud providers like Microsoft, Alphabet, and Amazon enjoyed 20%-30% annual revenue growth rates last year. So it’s understandable that players like Oracle, xAI, Meta, and others would jump into the lucrative market.

One of the biggest users of AI data center capacity is OpenAI. The company—which is expected to generate $13 billion in revenue this year but earn no profit—recently said it was likely to spend around $16 billion to rent computing servers alone this year, and that the number could rise to $400 billion in 2029. And now it too is building data centers for its own use.

Let’s take a look at OpenAI’s grandiose plans and what the competition is doing:

(1) Moving beyond Microsoft. In 2019, OpenAI entered into an arrangement to exclusively use Microsoft Azure as its cloud provider. But this year with Microsoft reportedly capacity constrained, OpenAI amended the contract, adding more vendors to its data center lineup despite Microsoft’s early investment in the company.

In June, OpenAI announced plans to use Alphabet’s Google Cloud service, though the terms of the deal were not disclosed. More recently, CEO Sam Altman signed a $300 billion deal to purchase another 4.5 gigawatts of cloud-computing power from Oracle over five years.

OpenAI has also shown a willingness to buy capacity from new players. In March, OpenAI signed a five-year contract worth $11.9 billion with CoreWeave. As part of CoreWeave’s IPO, OpenAI received shares worth $350 million.

(2) OpenAI gets into infrastructure. Earlier this year, OpenAI, Oracle, SoftBank, and MGX announced plans to fund the $500 billion Stargate Project, which will develop AI data centers across the US. The first leg of the project is being developed by Crusoe Energy Systems in Texas; another five US sites have also been picked out.

Since then, OpenAI has gone on a chip-buying spree. In late September, the company announced that it would use the $100 billion Nvidia is investing in OpenAI over the next decade to purchase chips from Nvidia. Under the terms of the deal, OpenAI will use Nvidia’s chips to deploy up to 10 gigawatts of computing power in AI data centers.

“Usually … a cloud service provider buys from us, and [OpenAI] rents from a cloud service provider. And so now it’s going to be a direct partnership,” Nvidia CEO Jensen Huang said on CNBC. Nvidia’s OpenAI partnership is “incremental” to the work the company has done with other AI providers such as Oracle and CoreWeave.

Earlier this week, OpenAI committed to purchasing 6 gigawatts worth of AMD’s chips, starting with the MI450 chip next year. The ChatGPT maker will buy the chips either directly or through its cloud computing partners.

(3) Others building furiously, too. Elon Musk’s xAI has built Colossus 1, a data center with 200,000 Nvidia chips, and is in the process of building Colossus 2, which is expected to be even bigger. Both are in Memphis and will be powered by an electrical plant that xAI is also building. All of this is being done to have the computer capacity to train xAI’s Grok.

CEO Mark Zuckerberg says Meta Platforms will invest $65 billion into AI, mostly to build data centers this year. One of his projects in northern Louisiana is a 4 million-square-foot data center with two gigawatts of computing power that’s expected to cost $10 billion.

In Indiana, Amazon is in the midst of building around 30 data centers, which will consume 2.2 gigawatts of electricity. It is expected to serve a single customer, AI startup Anthropic (creator of Claude AI), in which Amazon has invested $8 billion. It’s part of Amazon’s Project Rainier, which will also include facilities in Mississippi and possibly North Carolina and Pennsylvania.

Microsoft plans on spending $7 billion on its Fairwater project in Wisconsin, which will include 1.2 million square feet of space. Earlier this month, Google announced the start of a data center project in Memphis that will involve $4 billion of investment through 2027. Overall, the company has said it will spend $25 billion over the next two years on data centers and AI infrastructure in the mid-Atlantic and parts of the Midwest and South.

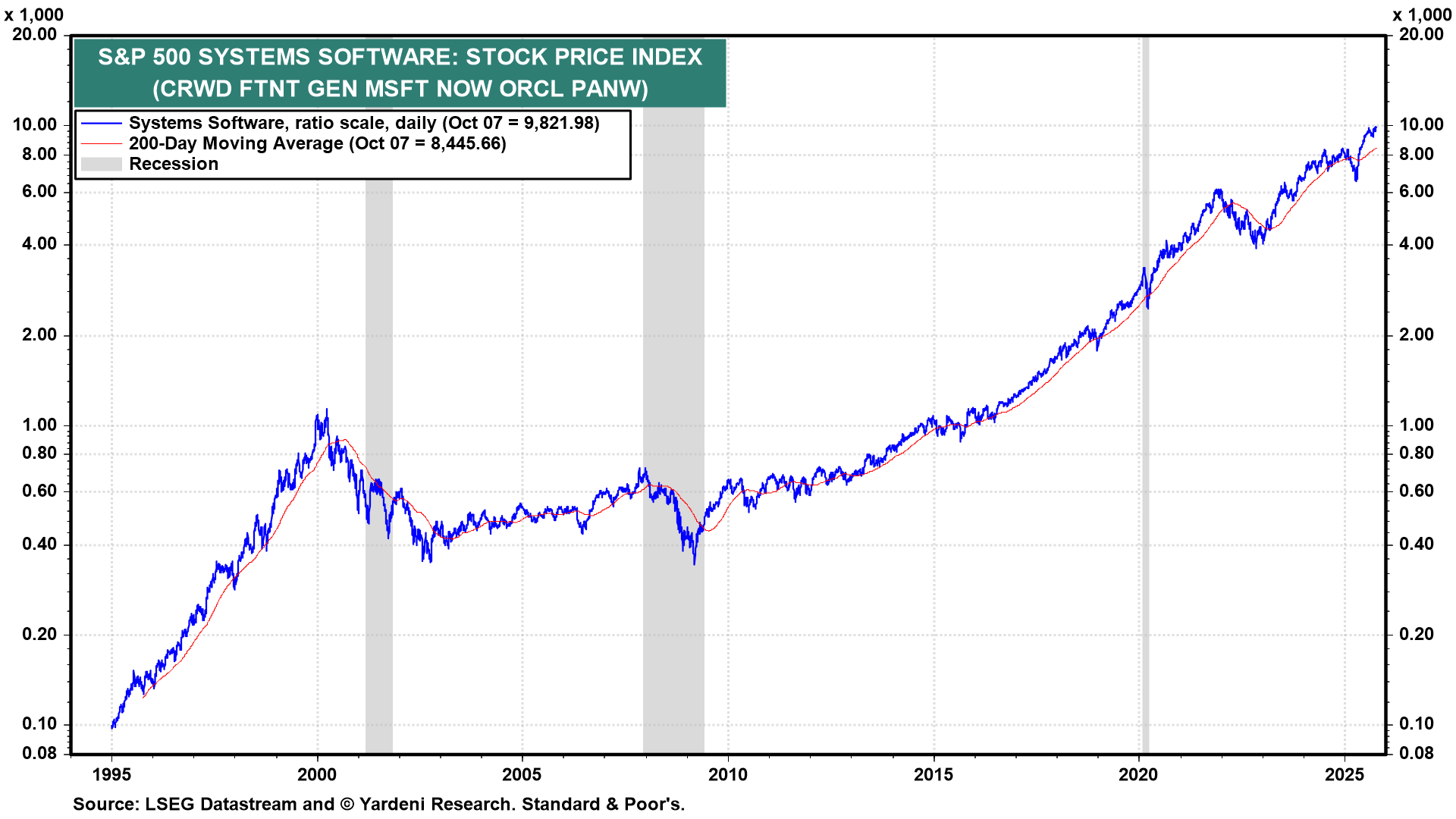

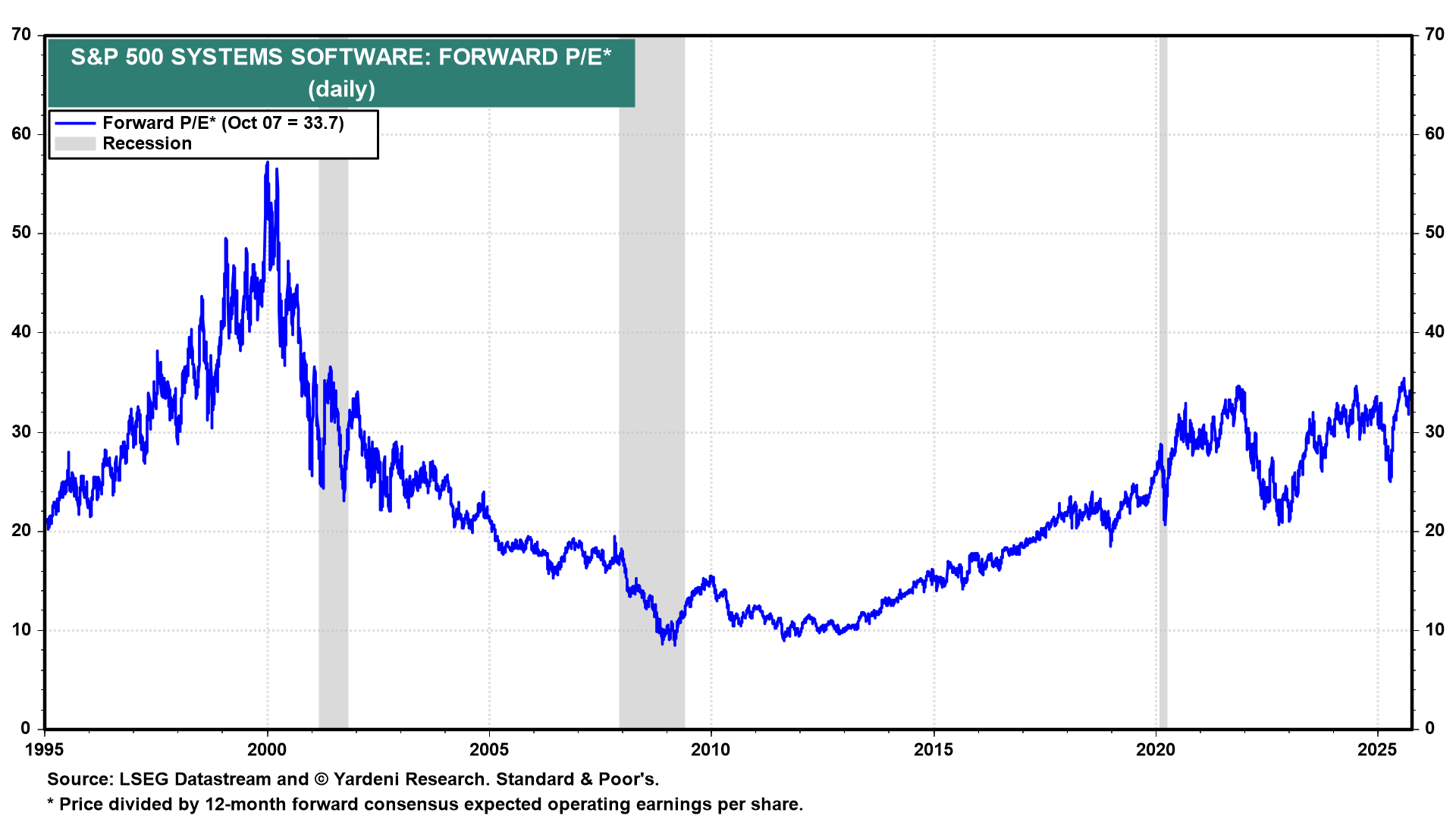

(4) A look at the numbers. OpenAI is privately held, but many of the other cloud providers are public. Microsoft and Oracle are members of the S&P 500 Systems Software stock price index, which has climbed 24.8% ytd through Tuesday’s close (chart). The industry is expected to grow earnings by 15.2% this year and 14.3% in 2026. Its forward P/E is 33.7, near the top end of its range in all periods except the 2000 dotcom bubble (chart).

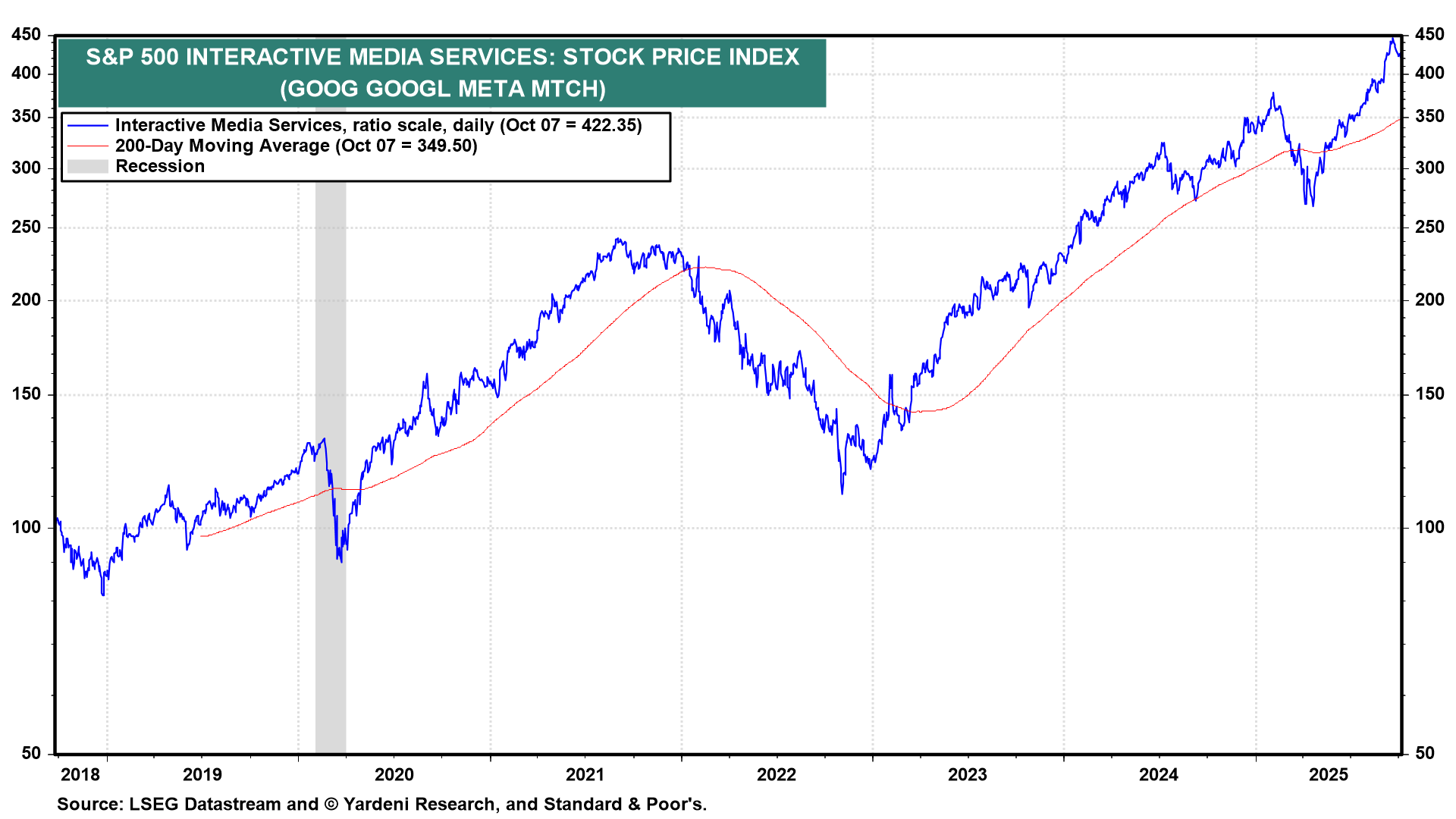

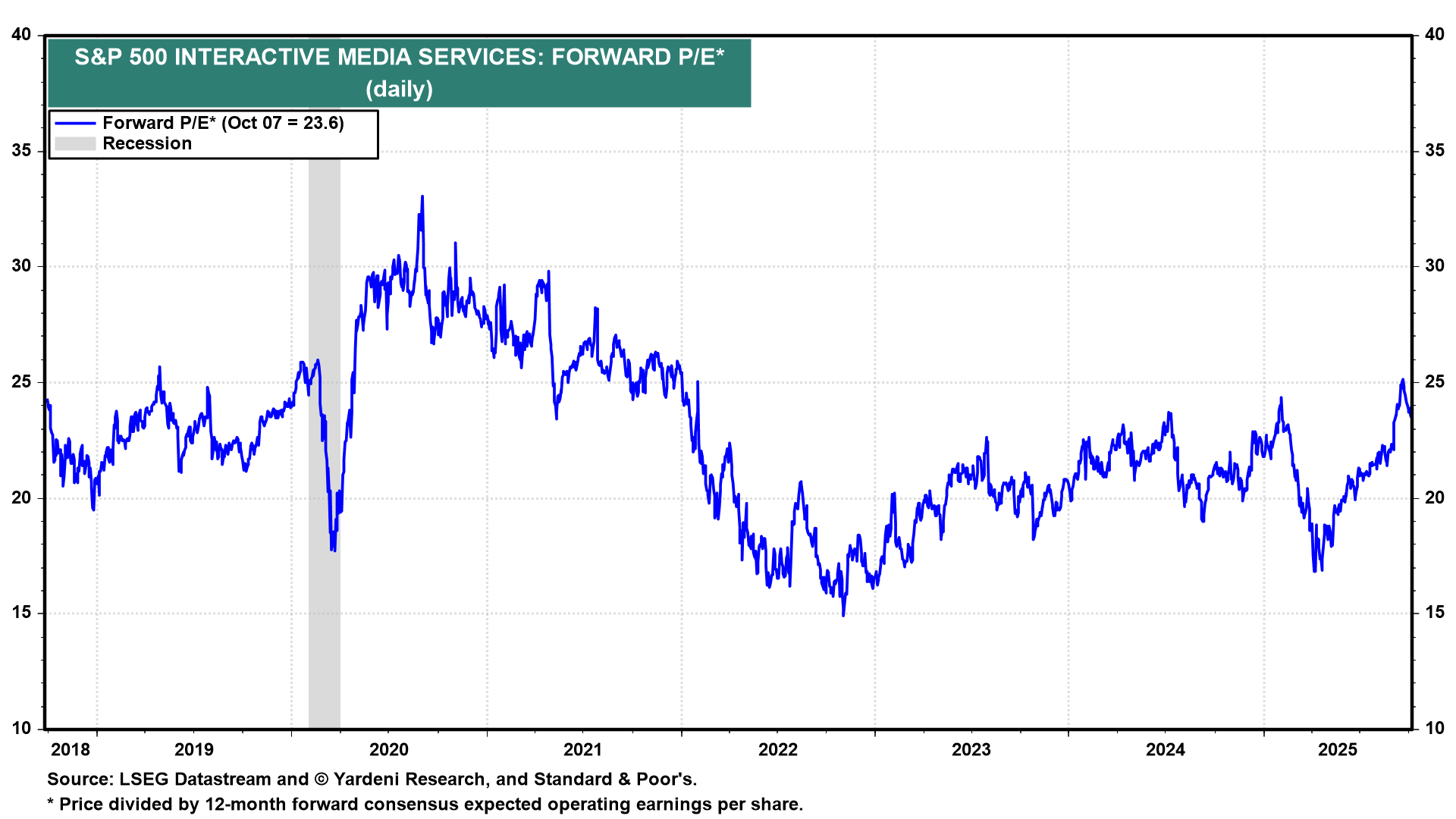

Alphabet and Meta are in the S&P 500 Interactive Media Services stock price index, which has climbed 26.6% ytd (chart). The industry is expected to grow earnings 21.5% in 2025 and 6.7% next year. At 23.6, the index’s forward P/E is near recent highs but still well below its highs around 30 back in 2020 (chart).