Next week, my wife and I will be on vacation visiting the bears (and bison) at Yellowstone National Park and Grand Teton National Park. We will be carrying some bear spray, just in case. The National Park Service offers the following advice:

“Bear spray is a non-lethal deterrent designed to stop aggressive behavior in bears. Its use can reduce human injuries caused by bears and the number of bears killed by people in self-defense. Bear spray uses a fine cloud of Capsicum derivatives to temporarily reduce a bear’s ability to breath, see, and smell, giving you time to leave the area.”

Given the selloff in the stock market, many of you undoubtedly are wondering if there is any bear spray to make the bears of the human variety go away. Here are a few pointers from the Yardeni Research service:

(1) Imminent recession? Unlikely.

An imminent recession is possible, but it is not probable, in our opinion. We continue to place the odds of a recession at 30%. [Recently raised to 40% odds of a mild recession.] If it happens, it is more likely to do so next year than this year. Recessions tend to be caused by credit crunches, which we doubt will happen anytime soon. It’s possible that consumers will respond to rising grocery and gasoline prices by spending less on other goods. But they are likely to continue spending more on services. Capital spending should remain strong as businesses scramble to increase productivity to offset labor shortages and to move their supply chains closer to home. Federal, state, and local governments are on track to boost their spending on infrastructure. Defense spending is heading higher.

(2) Tech Wreck 2.0? Not!

Notwithstanding the weakness in the Nasdaq and technology stocks so far this year, we don’t expect a repeat of the Tech Wreck of 2000. Over the past two years, the pandemic might have boosted tech spending in a way comparable to Y2K during the late 1990s. So some slowdown in tech demand is probably currently underway.

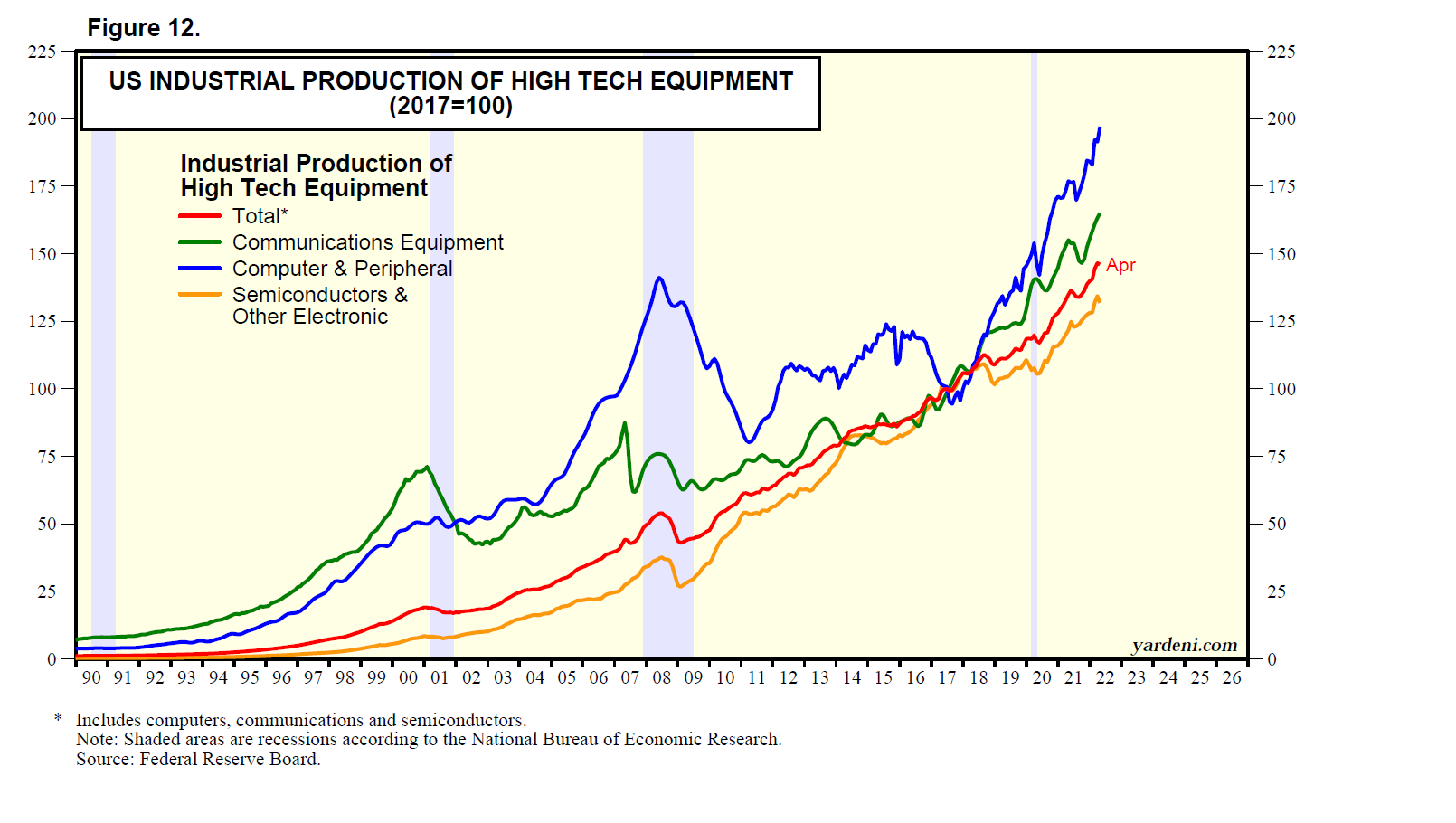

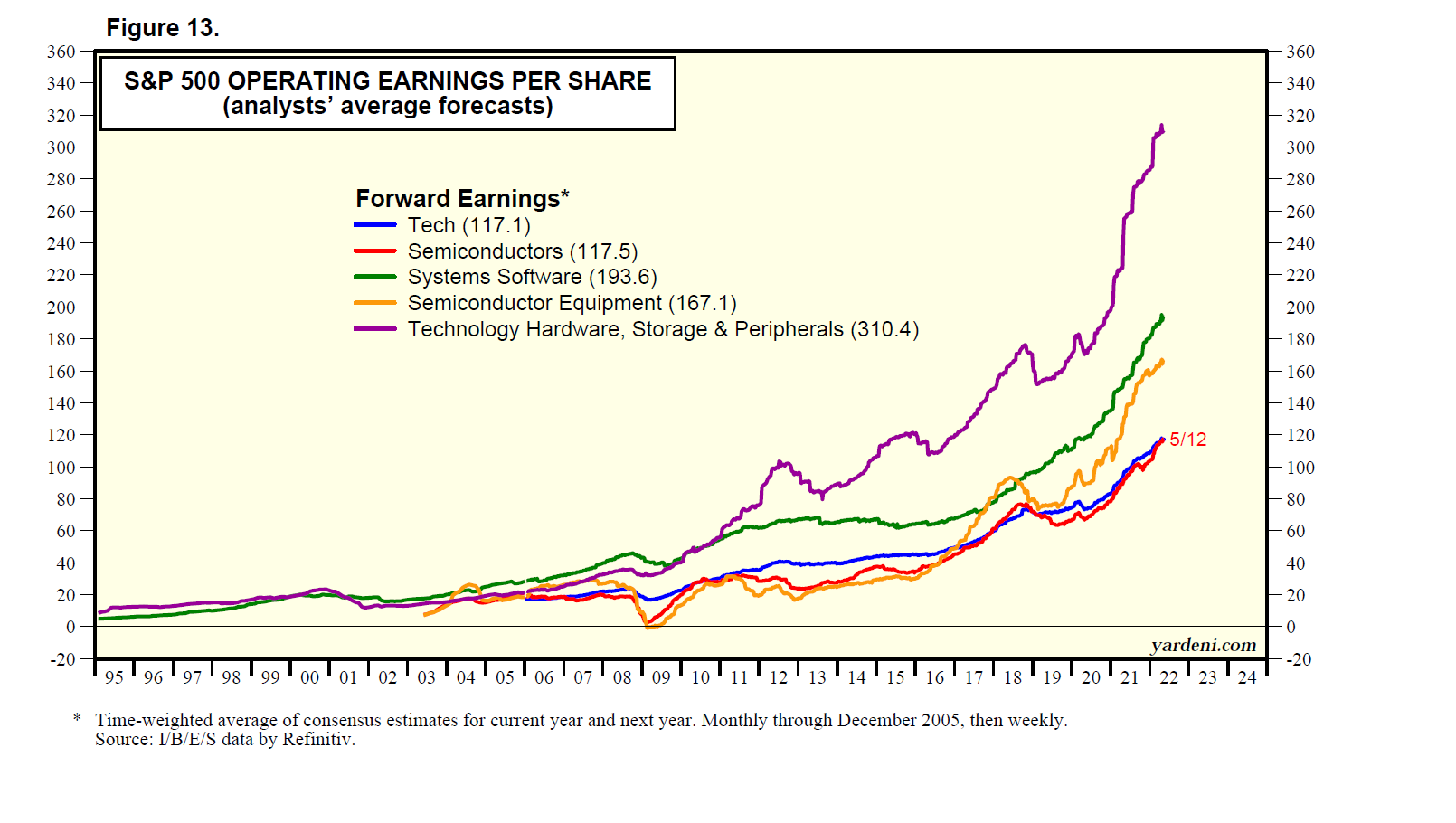

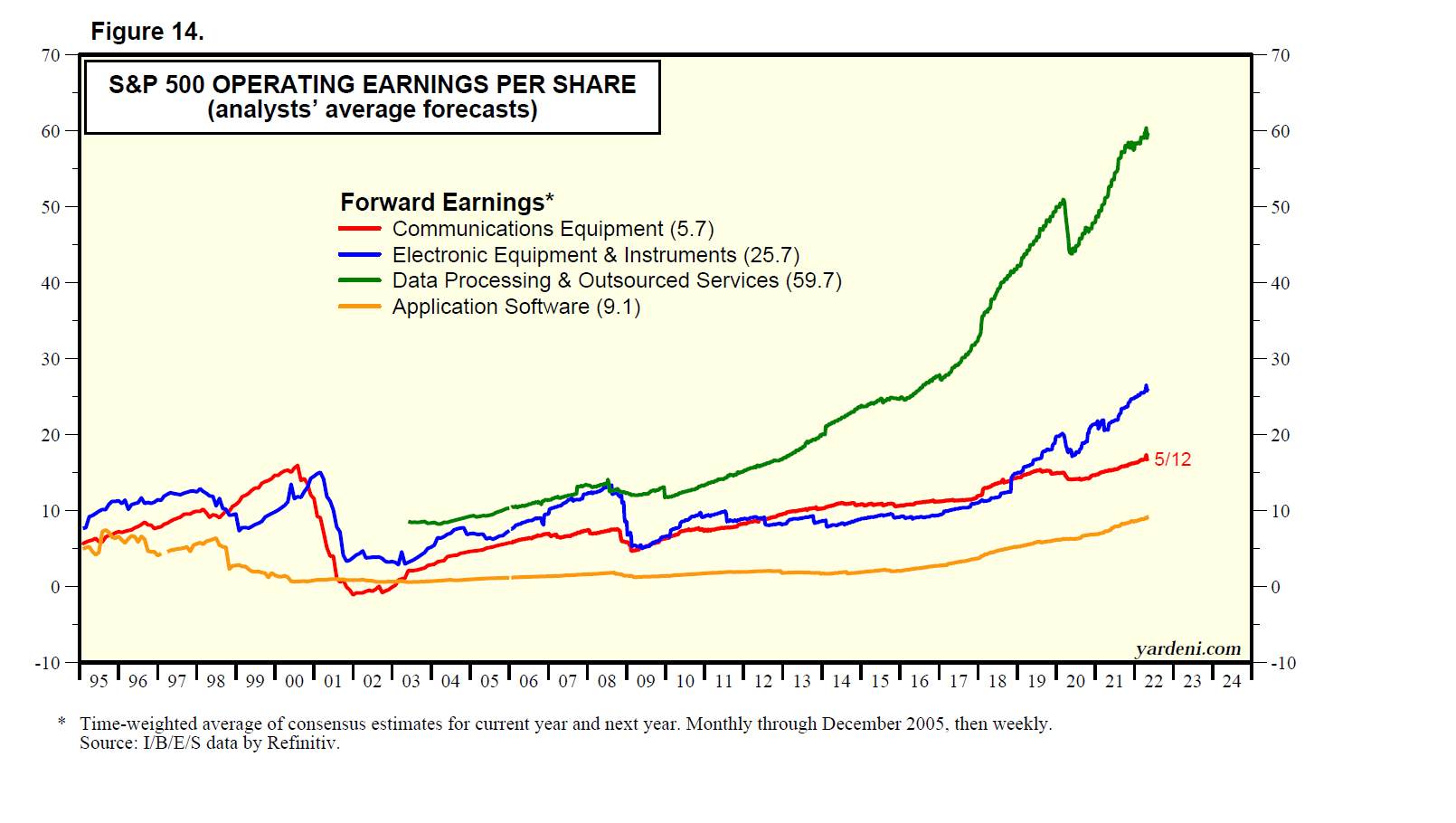

But this time, the underlying demand for technology is likely to remain much stronger, reflecting the need to boost productivity. We can see and monitor the trends in the output of high-tech equipment and in the forward earnings of the various industries in the S&P 500 Information Technology sector (Fig. 12, Fig. 13, and Fig. 14). The trends all look solidly on the upside, and much more resilient than those that occurred during Tech Wreck 1.0.

(3) Protracted inflation? Peaking.

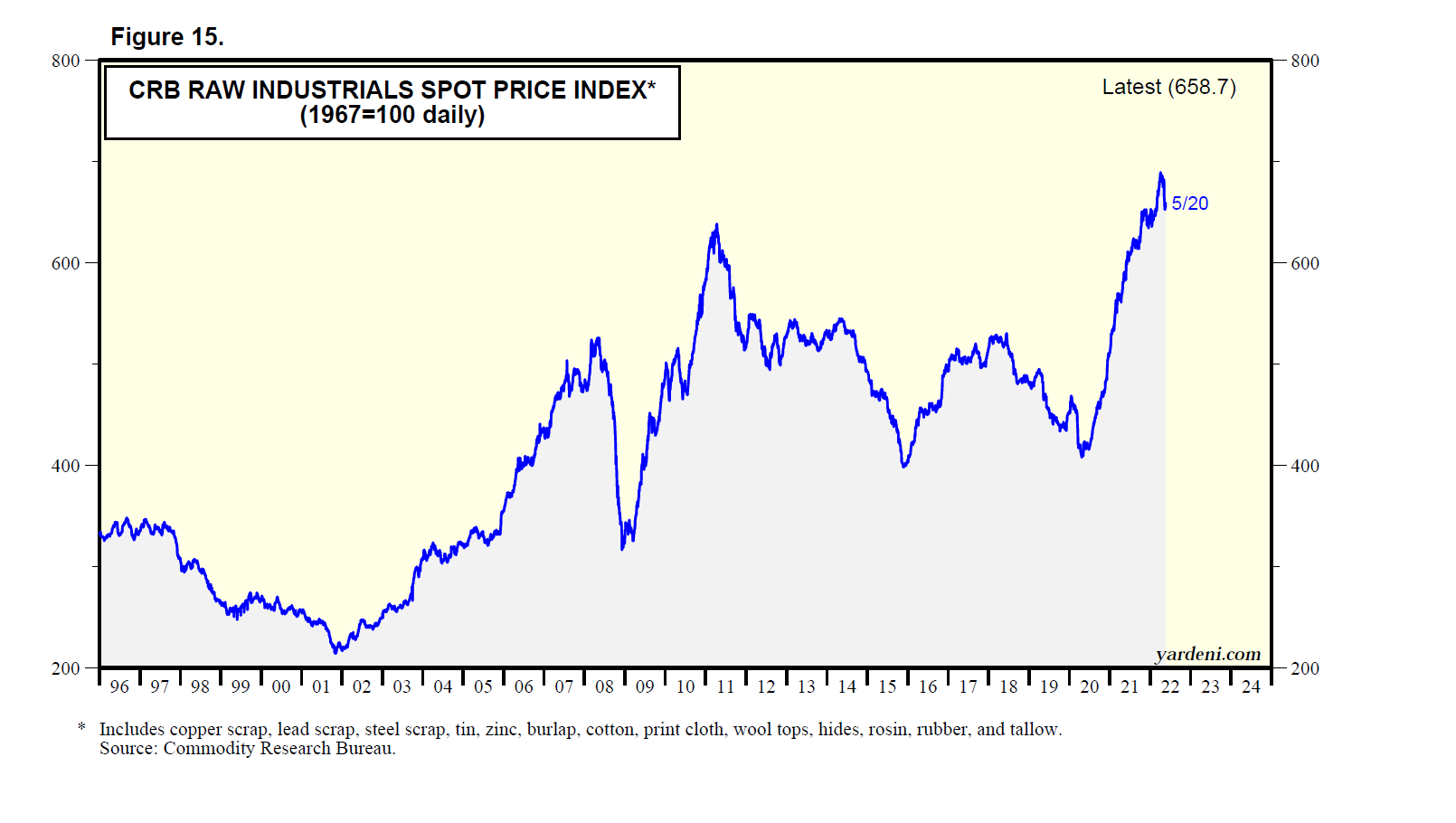

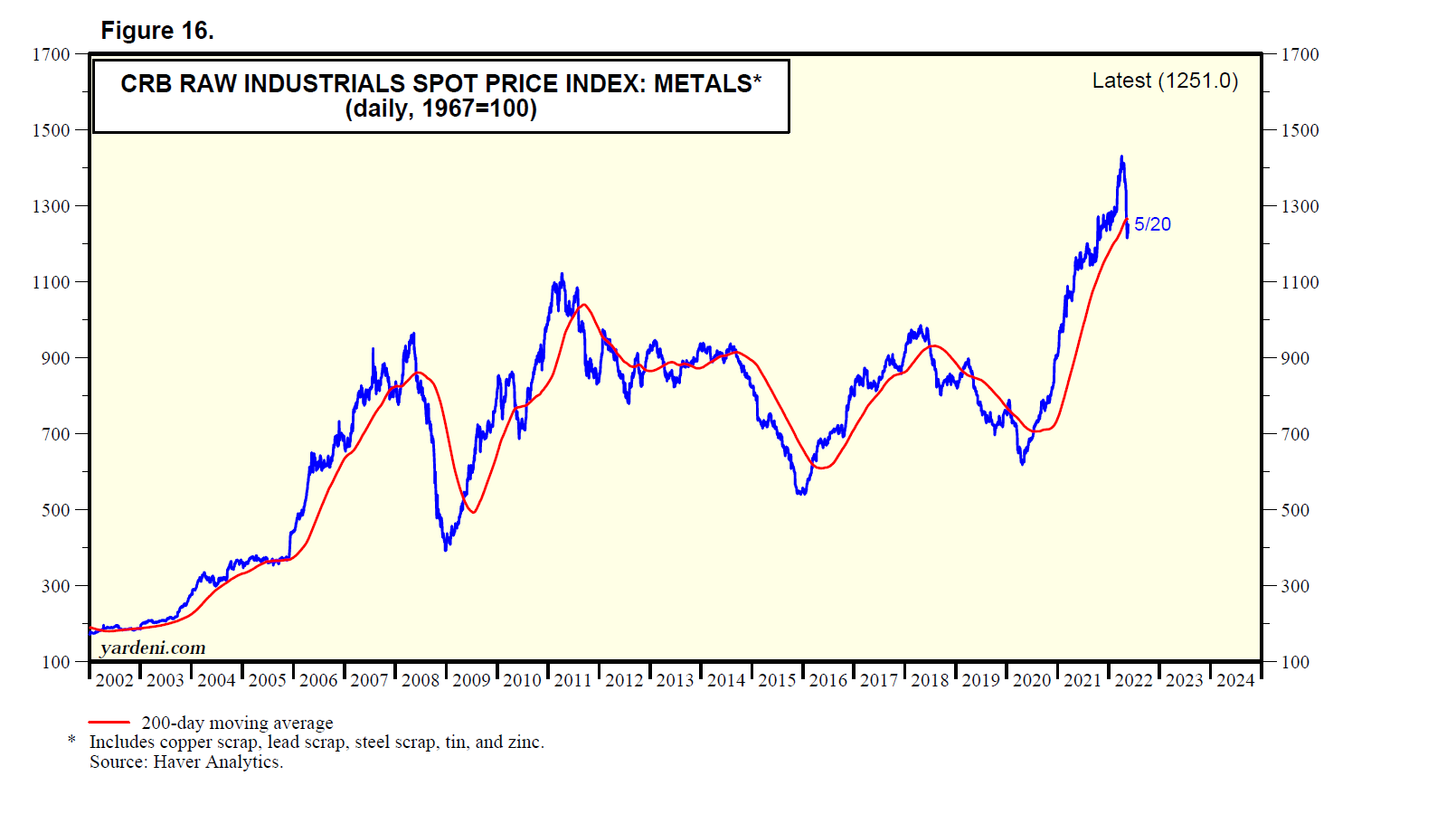

The bears will be right if inflation is no longer either transitory or persistent but rather protracted. In this scenario, the Fed will have no choice but to tighten monetary policy to a much greater degree until the resulting recession brings inflation down. It’s a plausible scenario, but we are counting on more signs that inflation has peaked appearing in coming months. We have recently written about more signs of possible peaks in wage inflation and consumer durable goods inflation. Now we observe that the CRB raw industrials spot price index is looking peakish, led by a significant decline in its metals component (Fig. 15 and Fig. 16).