The following is an excerpt from our Morning Briefing (Oct. 6, 2025) for institutional investors.

US Economy I: ‘Resilient’ Is Still the Right Word

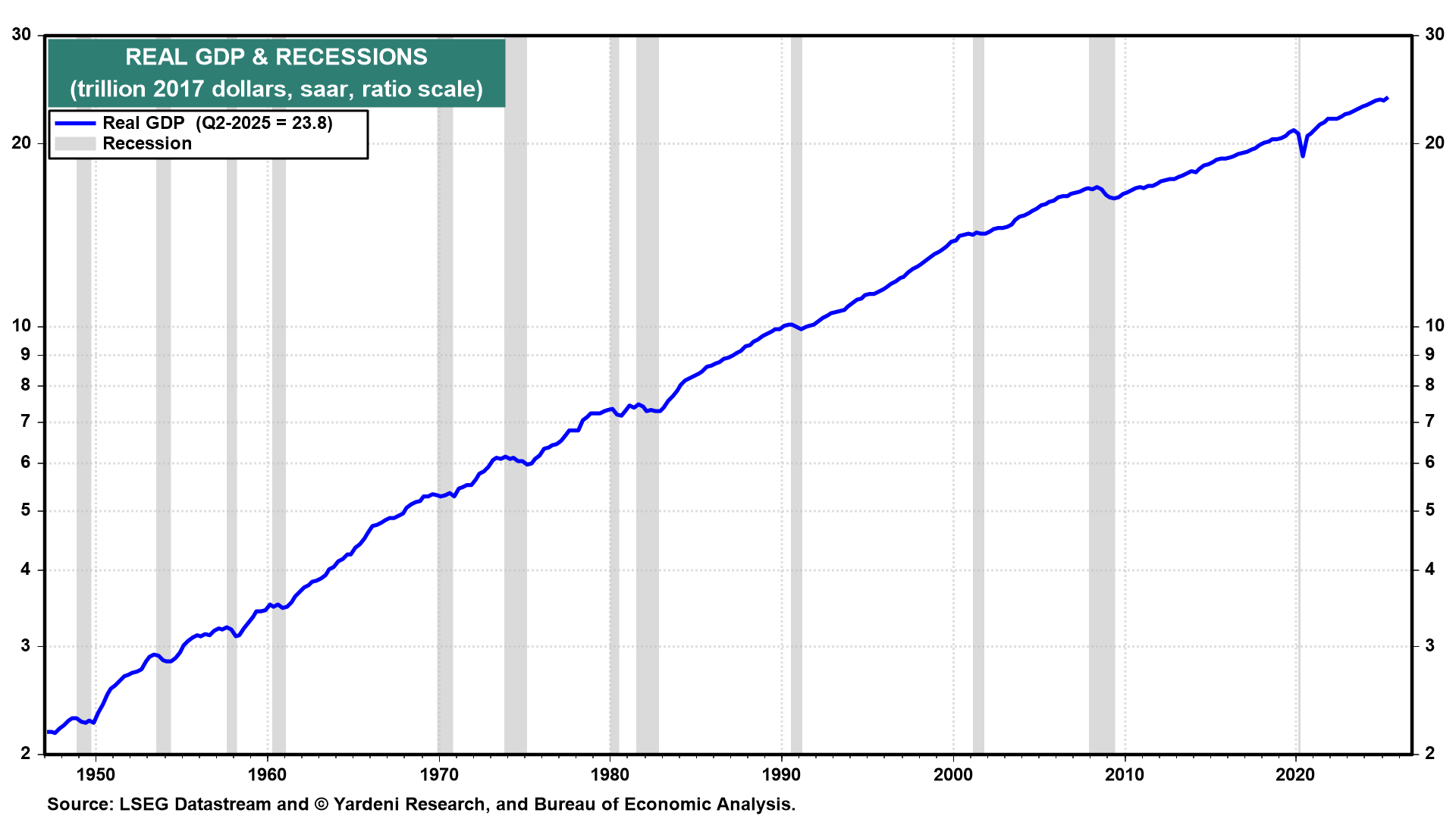

Since a very short, two-month recession in early 2020, the US economy has continued to grow despite numerous shocks (Fig. 3 below). The pandemic hit the US economy during February 2020 and quickly led to the March and April lockdowns that caused a recession during those two months. When the lockdowns ended, social distancing restrictions continued to weigh on the economy, but it continued to grow nonetheless.

Global supply-chain disruptions hit the US economy hard during 2021 and 2022, triggering a big spike in US inflation, led by soaring consumer durable goods prices (Fig. 4 and Fig. 5). To combat inflation, the Fed raised the federal funds rate from nearly zero on March 17, 2022 to 5.50% on July 26, 2023 (Fig. 6). The bond yield jumped from 0.50% on August 4, 2020 to 5.00% on October 19, 2023.

This year, the economy was subjected to Trump’s Tariff Turmoil. And the latest shock is the government shutdown that started on Wednesday.