The following is an excerpt from our October 14 Morning Briefing for institutional investors. We are sharing it with our QuickTakes members today.

It isn’t easy being an economist when the government shutdown shuts off the flow of economic data. Nevertheless, the Fed is still open for business and issuing economic releases. So are several private-sector sources of economic indicators.

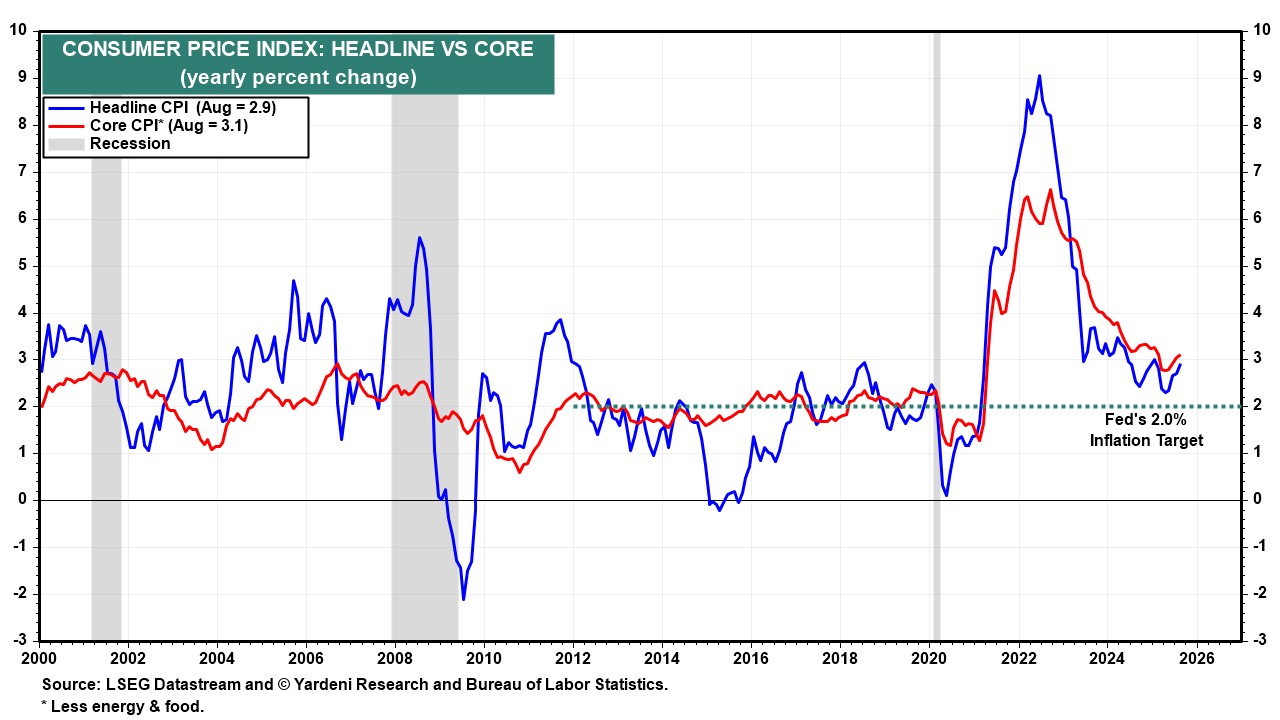

On balance, the data we do have suggest that the economy is continuing to grow, the labor market is lackluster, consumers are consuming, and inflation may be stuck around 3.0% y/y. That should give pause to the members of the Federal Open Market Committee when they meet again to decide whether to lower the federal funds rate again on October 29. The available data suggest that the economy remains resilient and continues to pass the latest stress tests, including the government shutdown, federal government layoffs, and the ongoing Trump Tariff Turmoil.

Let’s glean what we can from the available slim pickings:

(1) Inflation. On the inflation front, despite the shutdown, the Bureau of Labor Statistics (BLS) is working on September’s Consumer Price Index (CPI), which will be released on October 24, instead of Wednesday this week. The BLS reportedly will release September's Producer Price Index tomorrow. According to the Cleveland Fed’s Inflation Nowcasting tracking model, the headline and core CPI inflation rates remained stuck at 3.00% y/y last month, with the former at 2.99% and the latter at 2.96% (Fig. 7 below).