This is an excerpt from the December 1, 2025 Yardeni Research Morning Briefing.

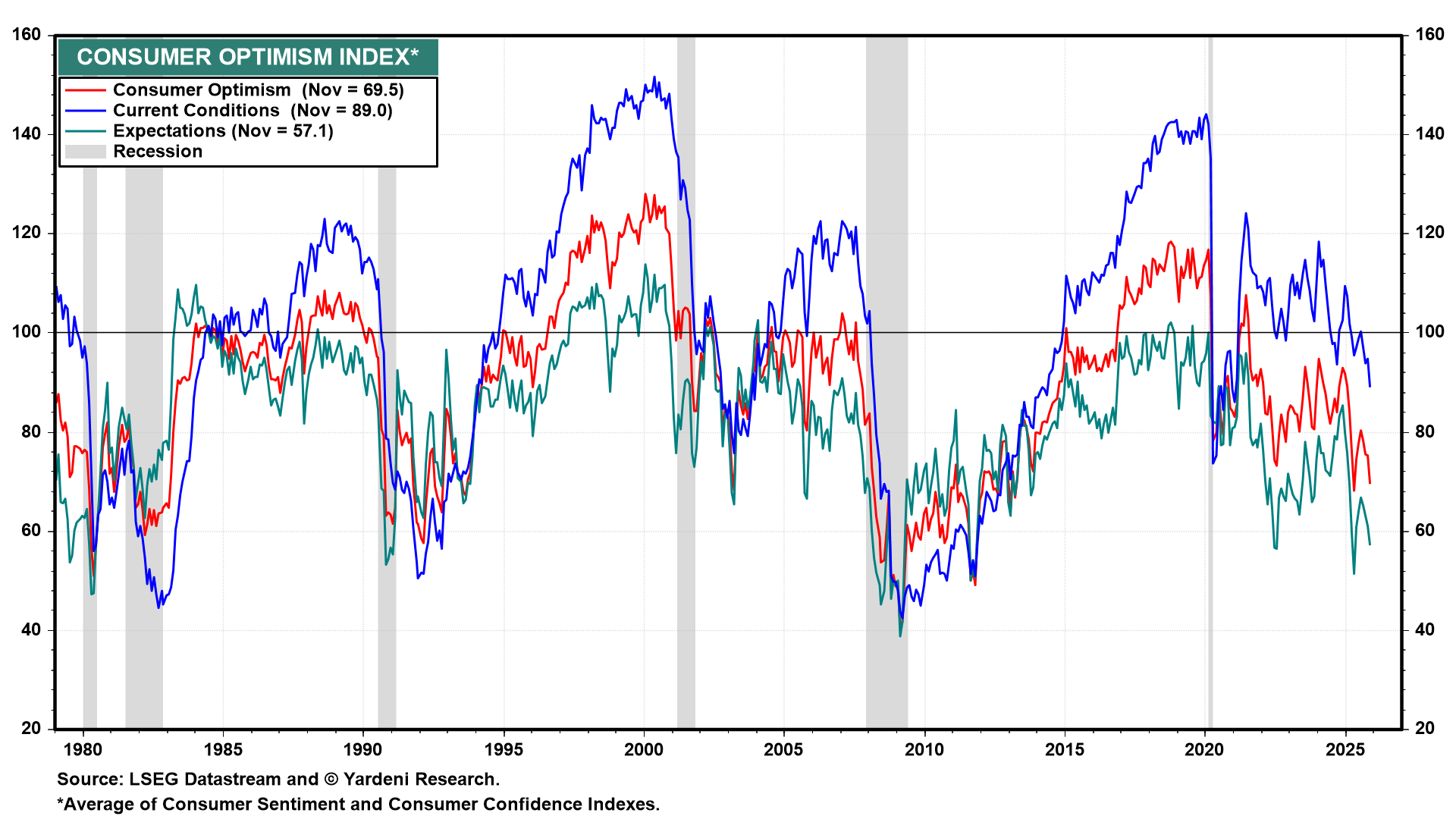

Affordability I: A Depressed State of Mind. Why are consumers so depressed? The monthly Consumer Optimism Index (COI), which is the average of the Consumer Sentiment Index (CSI) and the Consumer Confidence Index (CCI), fell to 69.5 in November (Fig. 1 below). That’s a level consistent with previous recession troughs in this average index.

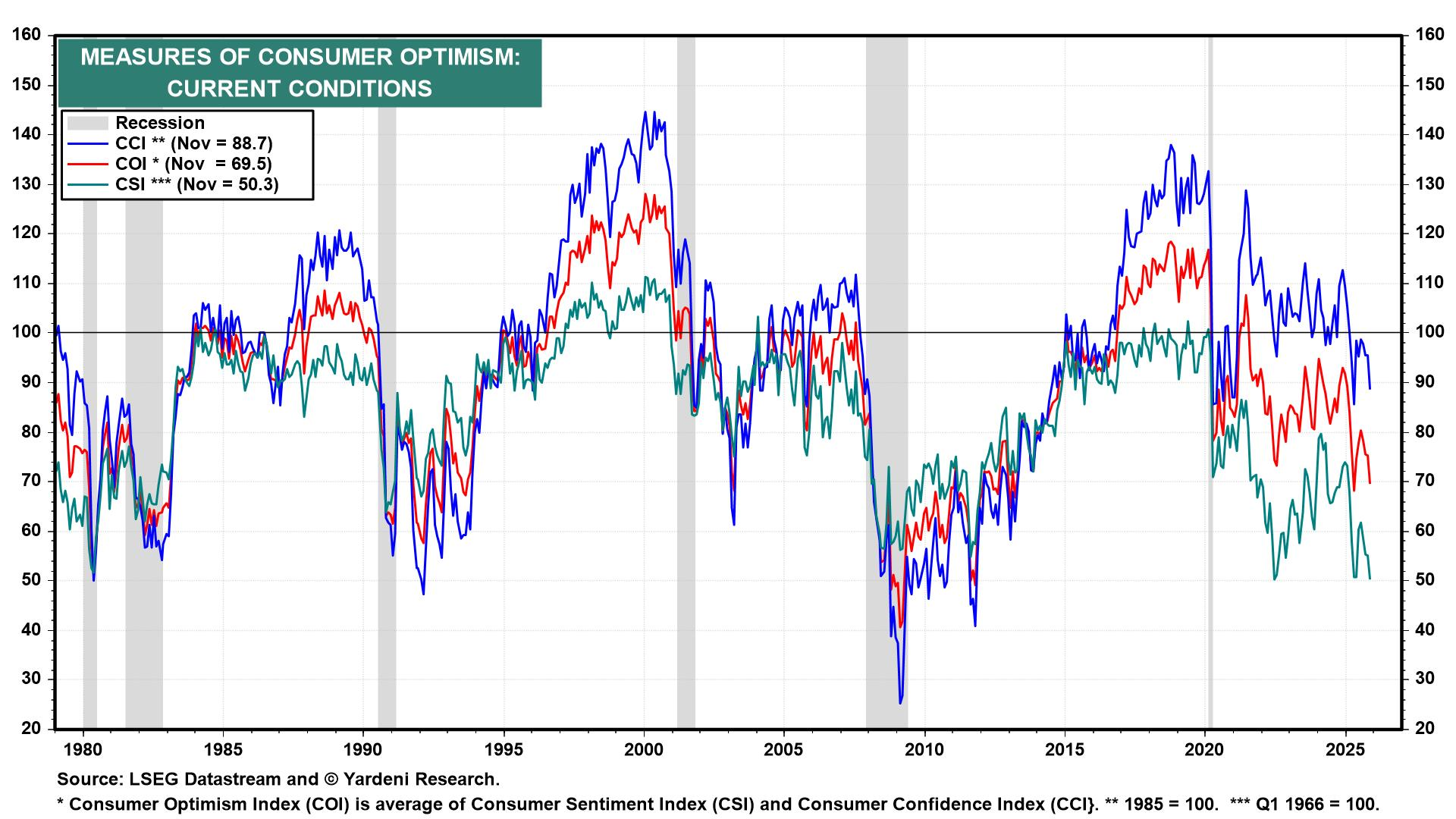

The current conditions component of the CCI fell to 88.7 in November, which isn’t as bad as the overall average COI (Fig. 2 below). However, the current conditions CSI, at 50.3, is much worse than the CCI’s 88.7 comparable current conditions component. The expectations component of the COI, CSI, and CCI are all down in the same depressing neighborhood, at 57.1, 51.0, and 63.2 (Fig. 3).

It’s not clear why consumer expectations are uniformly depressed. The divergence between the current conditions CSI and CCI is especially puzzling. The former tends to reflect inflationary expectations, while the latter reflects labor market conditions. As we’ve noted before, we have more confidence in the CCI than in the CSI, which seems to be chronically pessimistic, especially in recent years.

The Misery Index, which is the sum of the unemployment rate and the CPI inflation rate (on a y/y basis), is relatively low at 7.4% during September (Fig. 4 and Fig. 5). It has averaged 9.0% since the late 1940s. The Misery Index has been inversely correlated with both the CCI and CSI (Fig. 6 and Fig. 7). However, in recent years, the CSI has been depressed even though there is less misery.

Consider the following reasons for less misery, which one would expect to produce high levels of consumer optimism: