Consider the following relevant points:

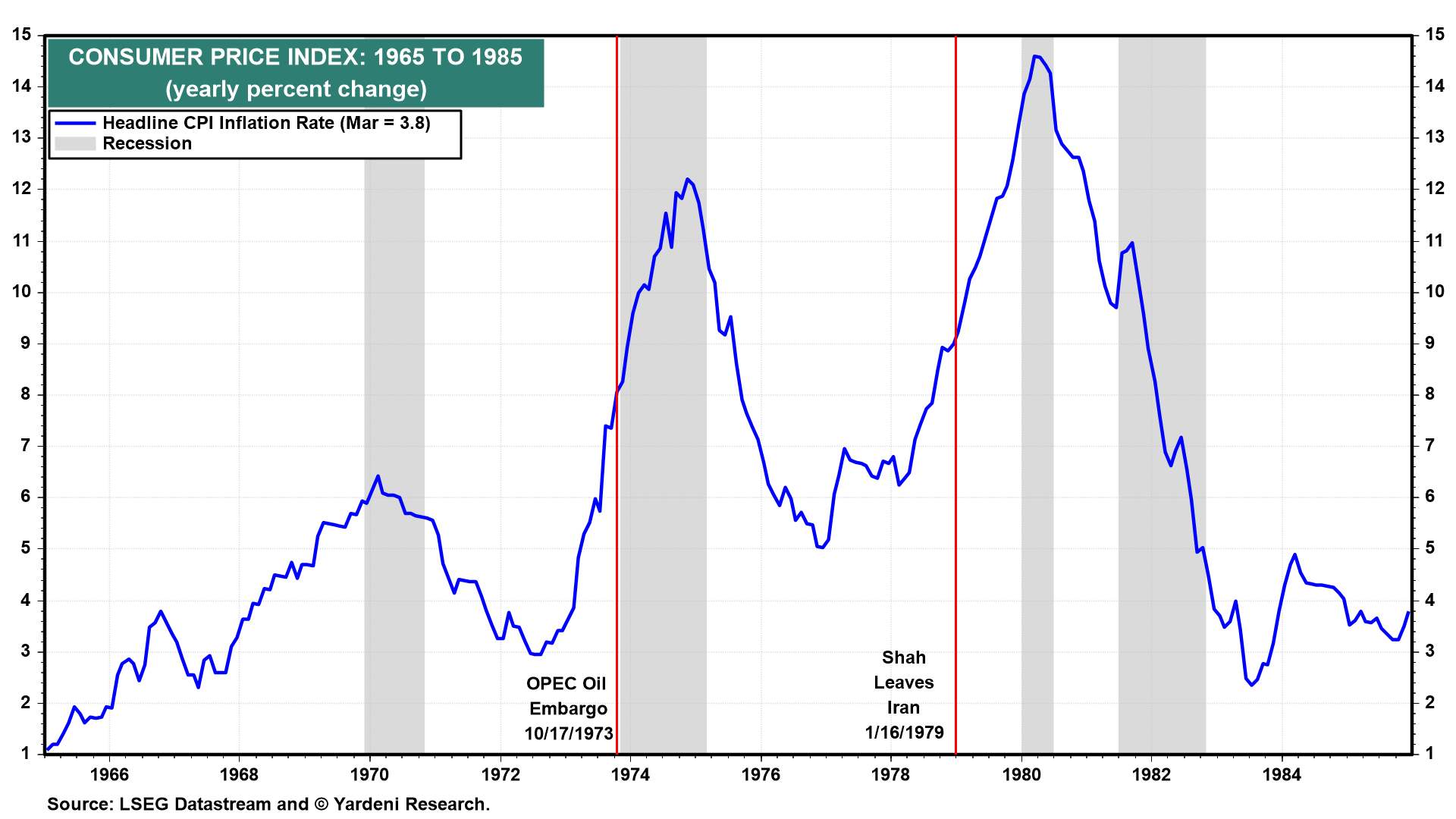

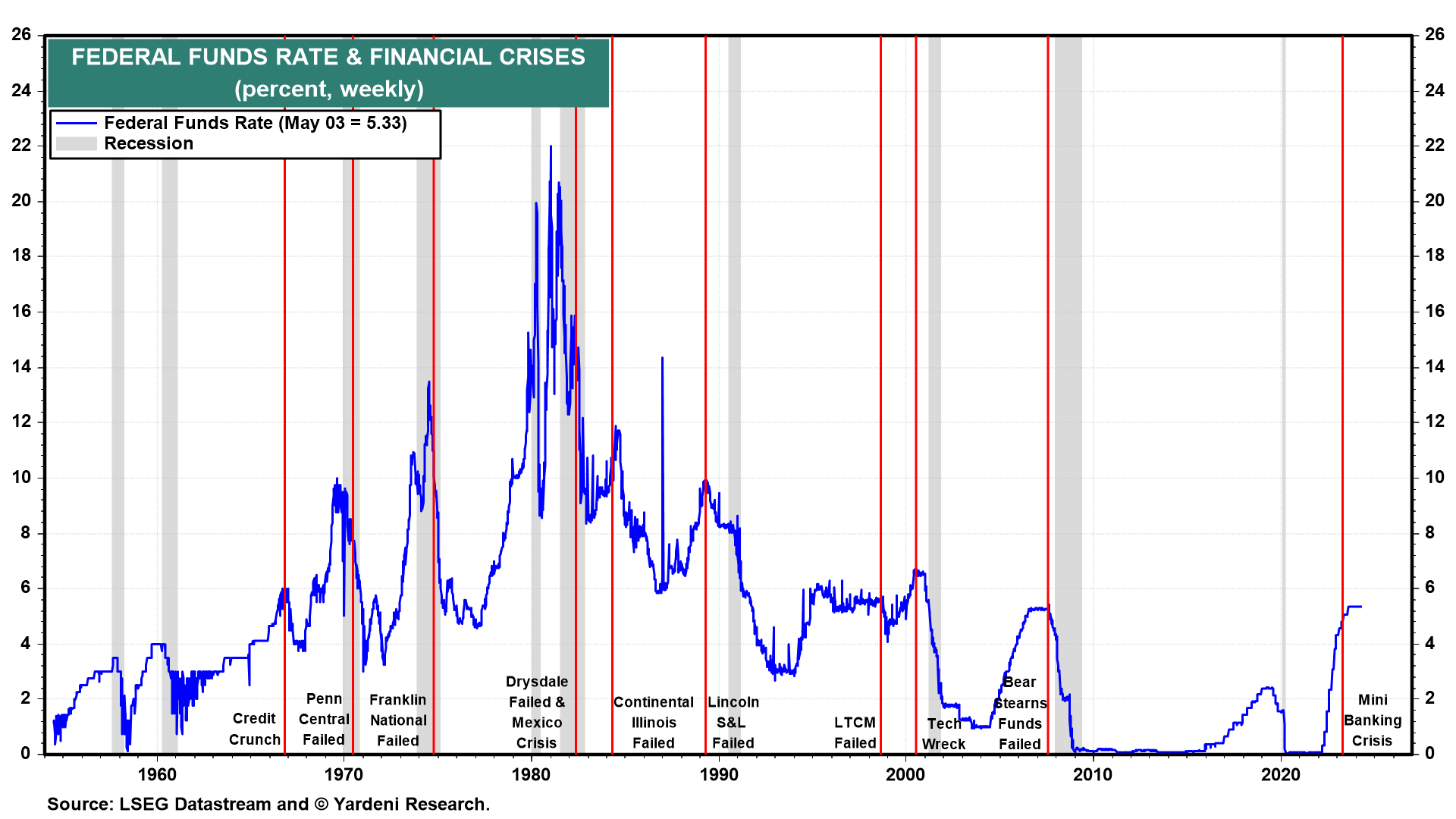

(1/6) The most common reason recessions have occurred in the past is the tightening of monetary policy, usually as the Fed became concerned about consumer price inflation. Along the way, the yield curve inverted, signaling that investors were starting to buy bonds on their expectations that something would break in the financial system. They were usually right; the resulting financial crisis quickly morphed into an economy-wide credit crunch, when even borrowers with good credit histories found it hard to borrow. The credit crunch would then cause a recession (Fig. 1 below). Melissa and I started writing about this in our 2019 study “The Yield Curve: What Is It Really Predicting?” (You can find a pdf of it here on our website.)

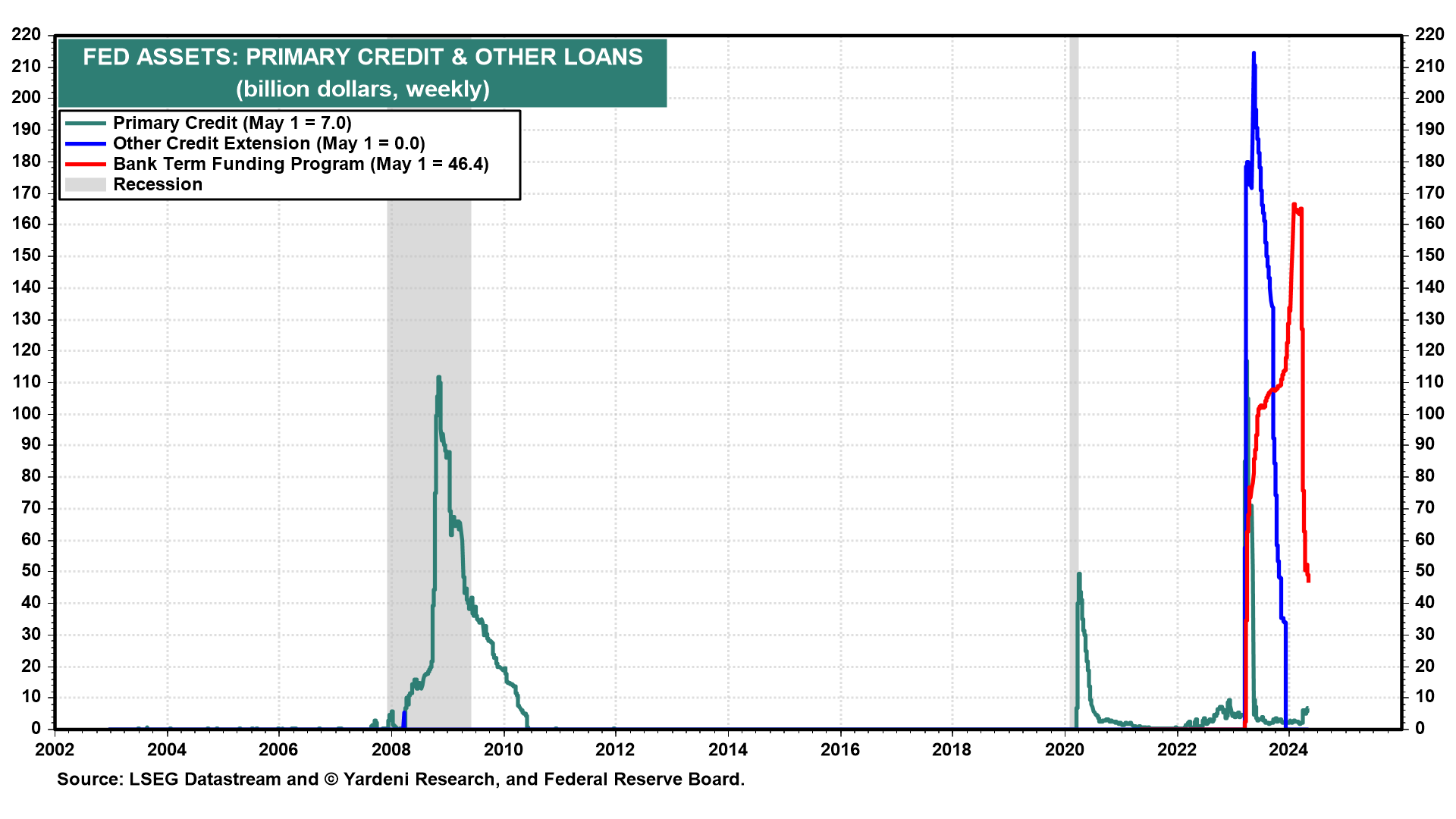

That hasn’t happened so far during the latest round of tightening. There was a financial crisis last year in March. But it turned out to be a mini-banking crisis limited to three banks because the Fed responded rapidly by establishing an emergency banking facility—the Bank Term Funding Program—that contained the crisis quickly, thus averting a credit crunch and a recession (Fig. 2 below). The program was terminated on March 11.

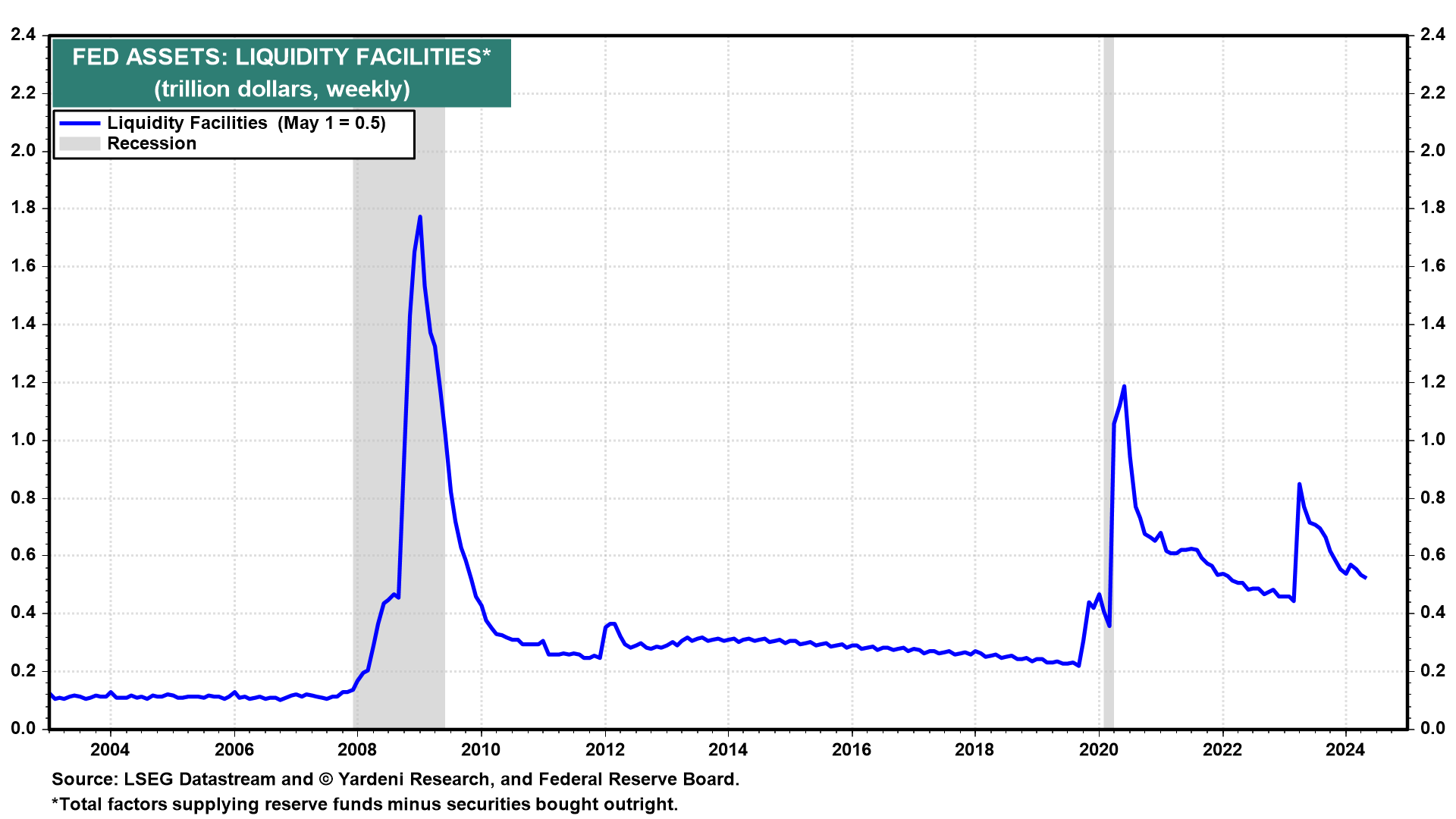

Fed officials got lots of experience setting up these facilities during the Great Financial Crisis (GFC) and the Great Virus Crisis (GVC) (Fig. 3 below). They’ve learned how to play Whac-A-Mole in the financial system very effectively.

(2/6) Geopolitical crises can trigger recessions if they cause the price of crude oil to soar. That happened during the two energy shocks of the 1970s (Fig. 4 below). It happened again in 1990, when Iraq invaded Kuwait (Fig. 5). The price also soared during the GFC to almost $150 a barrel. It wasn’t attributable to a geopolitical crisis; it might have been related to strong Chinese demand. In any event, this didn’t cause the recession associated mainly with the GFC but probably exacerbated it. There was also no recession in the US after the price of oil spiked when Russia invaded Ukraine in early 2022.