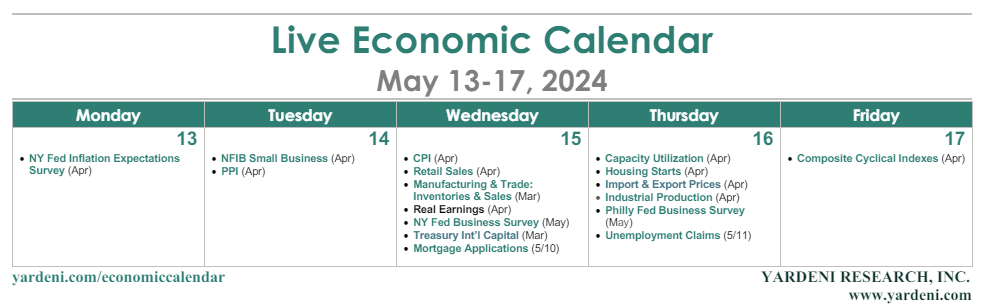

The week ahead is jampacked with economic indicator releases. The big ones are for inflation, retail sales, and production. They may be somewhat stagflationary on balance, showing inflation remains too high while economic growth is slowing. Nevertheless, we still expect to see inflation moderate with solid economic growth over the rest of this year. Here are a few observations on this week's key indicators:

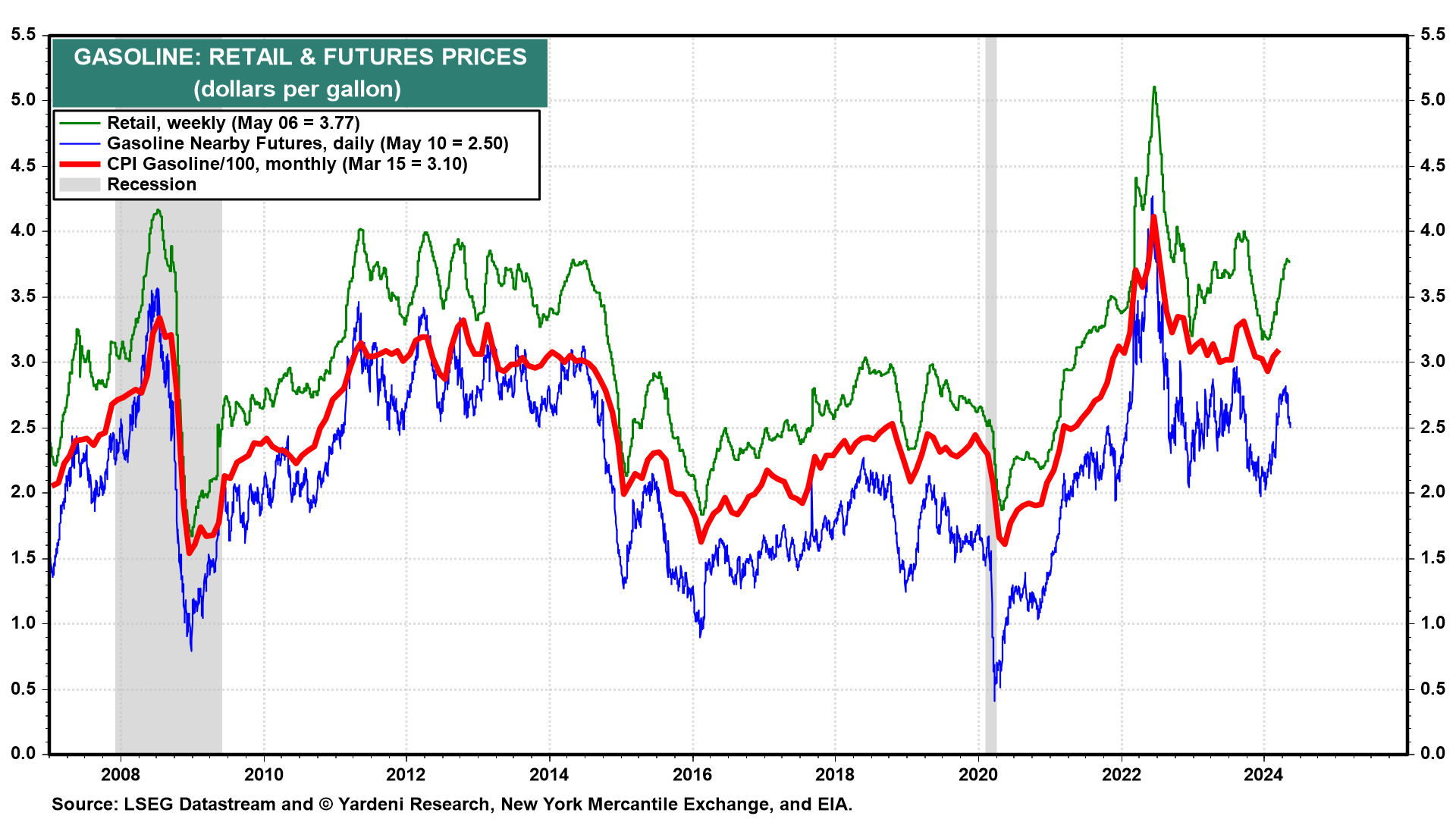

(1) CPI. The Cleveland Fed's Inflation Nowcasting model shows headline and core CPI rose 0.41% and 0.31% m/m (3.50% and 3.65% y/y) last month (chart). Those numbers might spook the markets when released on Wednesday because they suggest that inflation remains stuck above the Fed's 2.0% target. The headline rate was boosted by a jump in gasoline prices (chart).

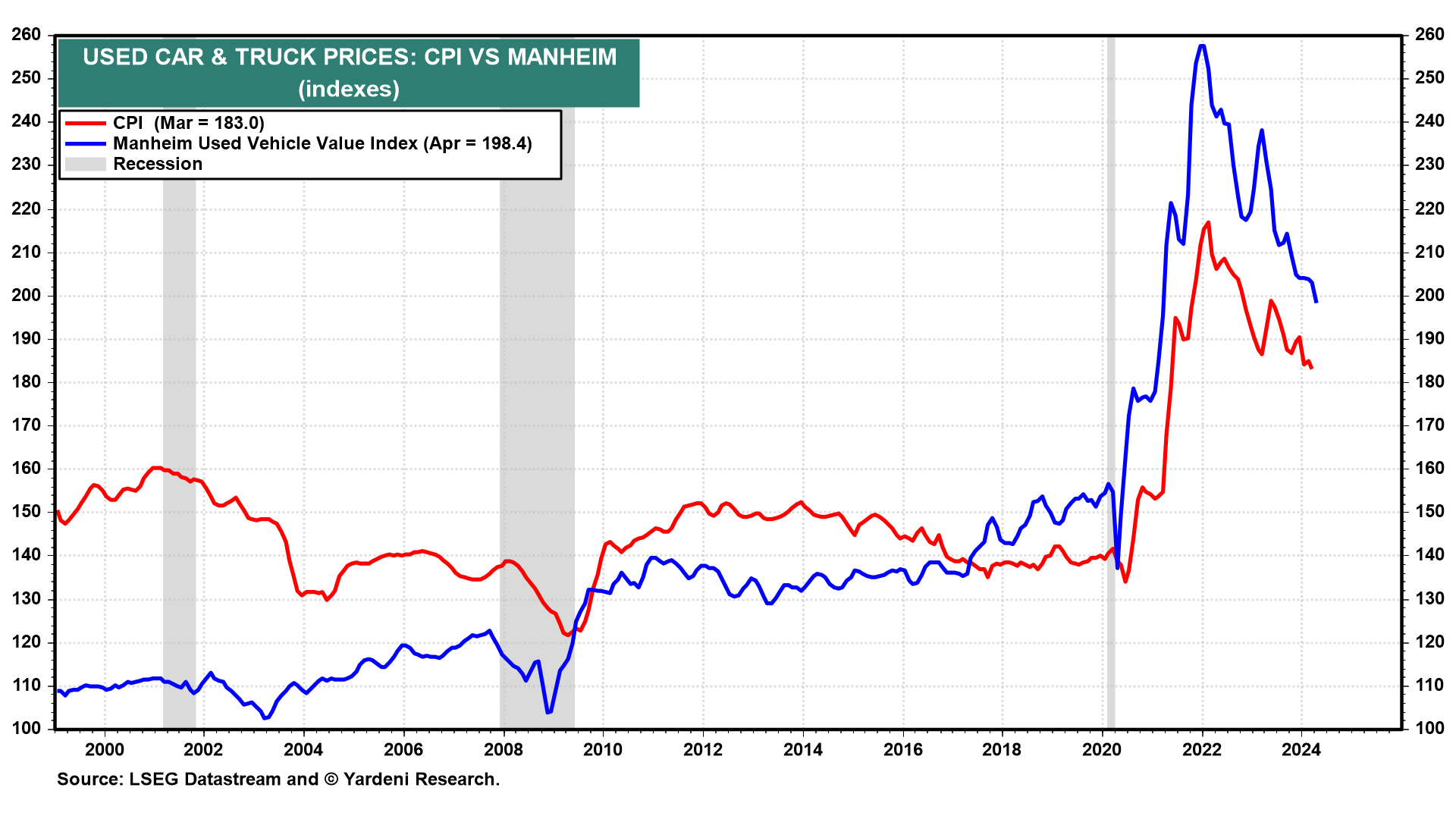

On the other hand, falling used car prices weighed on the core CPI last month (chart). However, more expensive auto maintenance & repairs and auto insurance might continue to boost inflation. Rent inflation should continue to show a moderating trend.

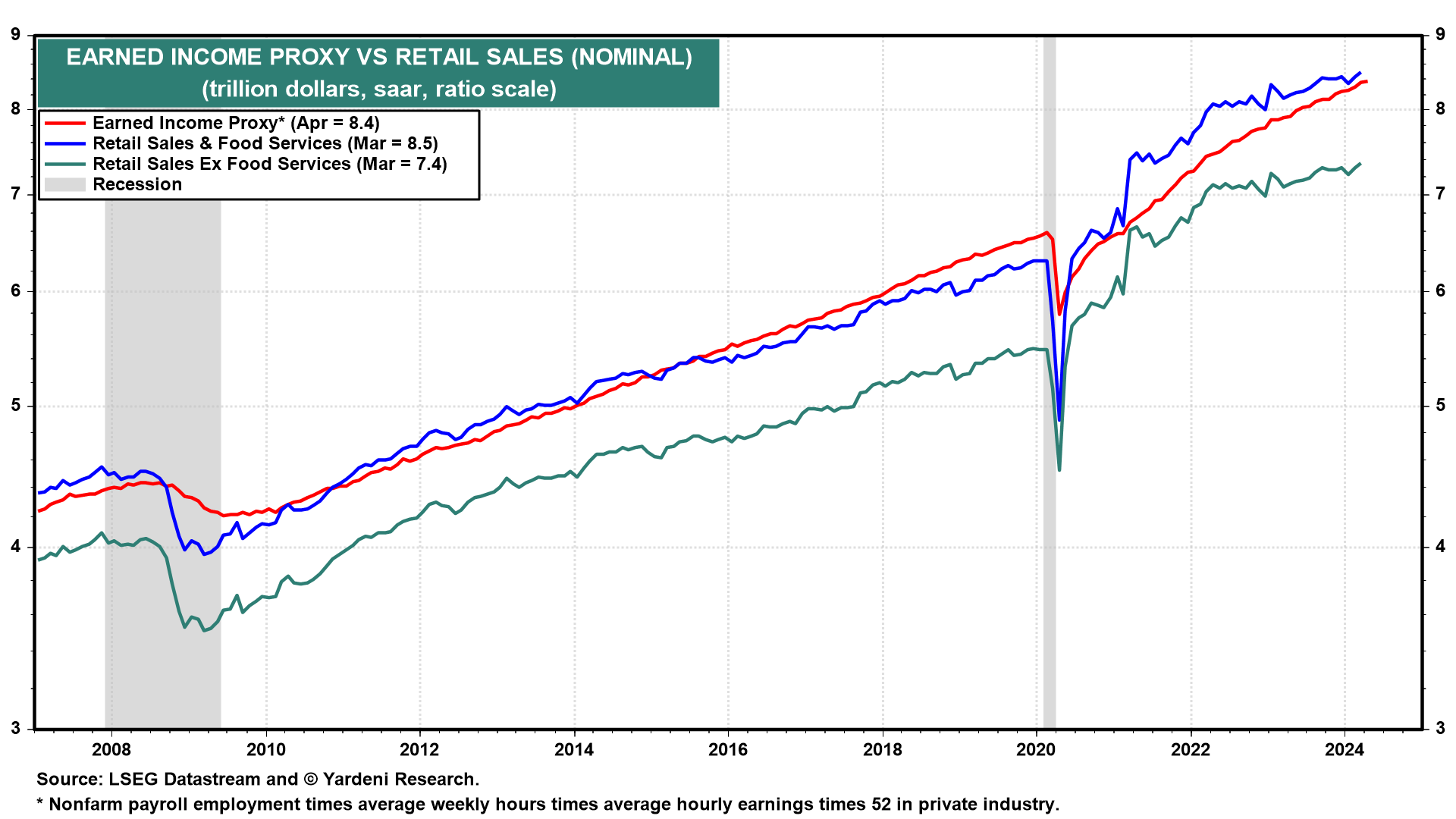

(2) Retail sales. We expect to see a weak April retail sales report (Wed). Our Earned Income Proxy for private industry wages and salaries was unchanged during the month, as a 0.2% m/m increase in average hourly earnings was offset by a 0.2% m/m decline in aggregate hours worked (chart). However, the trends in all these determinants of purchasing power are upward sloping ones and mostly in record-high territory.

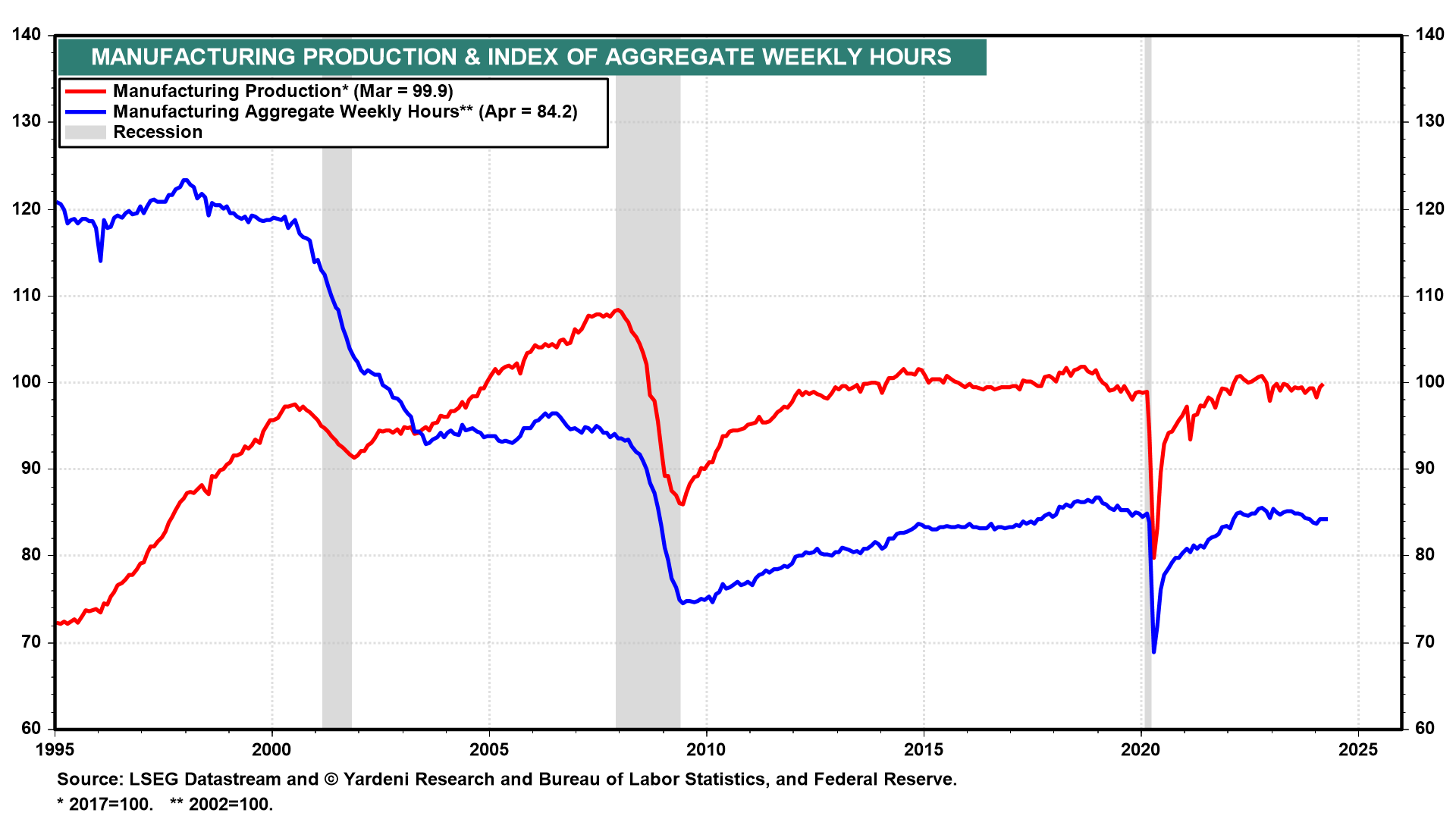

(3) Industrial production. Manufacturing aggregate weekly hours were flat in April, which we expect to weigh on the industrial production report (Thurs) (chart). Corroborating that story is April’s M-PMI, which fell below 50.0, though its production index was at 51.3.

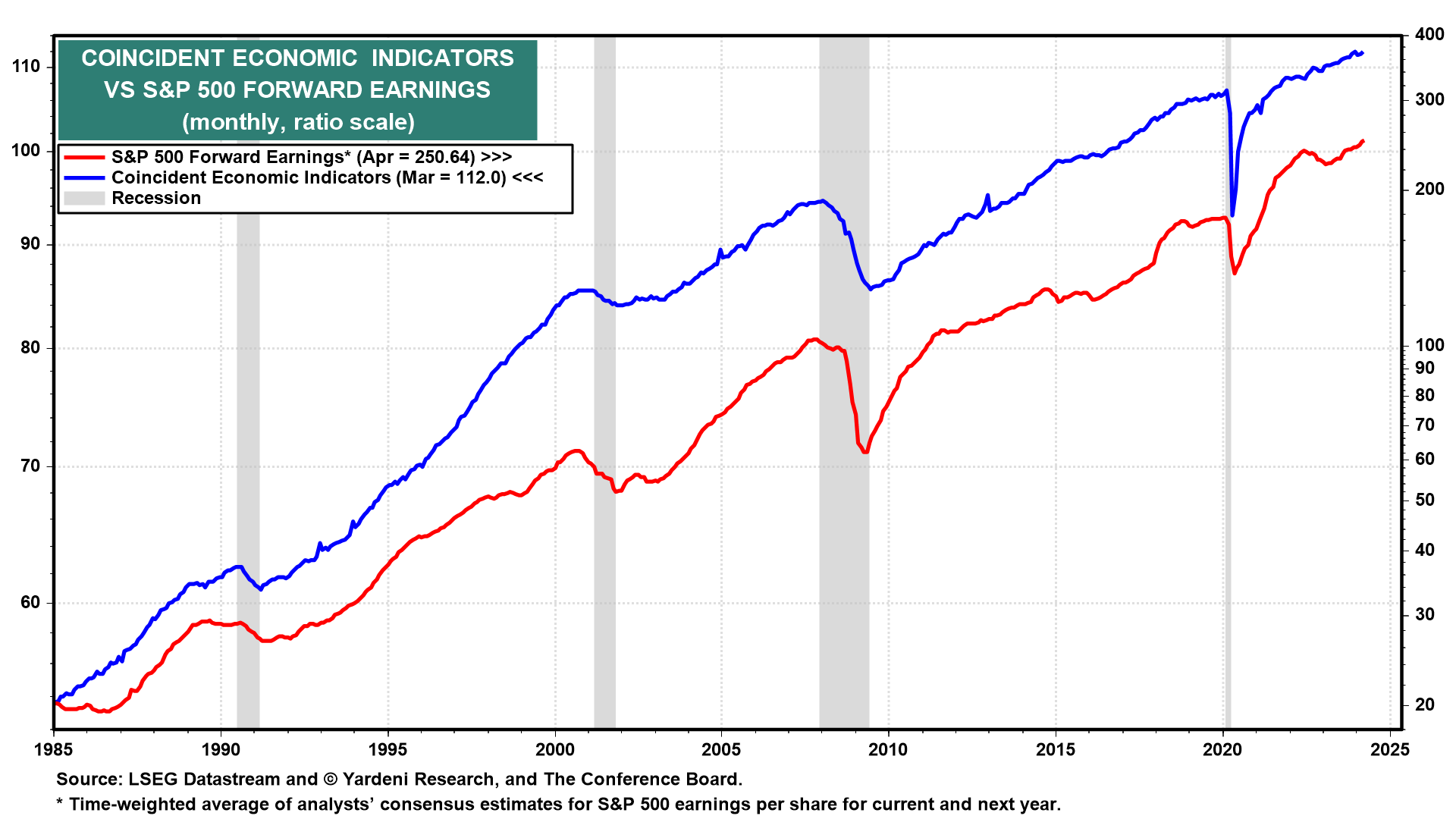

(4) CEI & LEI. S&P 500 forward earnings rose to a new all-time high in April (chart). This series tends to be highly correlated with the Index of Coincident Economic Indicators (CEI) and a very good leading indicator of actual S&P 500 operating earnings per share. April's CEI (Fri) probably edged up to another record high. April's Index of Leading Economic Indicators might confirm that this series is bottoming.