Bond yields fell and stock prices rose in response to Fed Chair Jerome Powell’s speech today at the Brookings Institution. Most importantly, he confirmed that the FOMC is on track to raise the federal funds rate by 50bps rather than 75bps at the December 13-14 meeting of the committee. Here is how he concluded his speech:

“Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

“Moderation” is the key word. The markets seem to believe that the Fed is getting closer to the terminal federal funds rate, which is widely deemed to be around 5.00%, and that the economy can handle that “restrictive” level even if it stays there for a while. Indeed, during the Q&A session following his speech, Powell repeated that he still believes that there is a path to a soft (or “softish”) landing for the economy.

Investors have been fearing that the Fed might turn too restrictive, causing a recession. Powell specifically said that the Fed is aware of that risk and does not want that to happen. Of course, Fed officials are also expecting (hoping) that inflation will continue to moderate to validate the Fed’s moderation pivot.

Powell spent a good part of his speech talking about inflation:

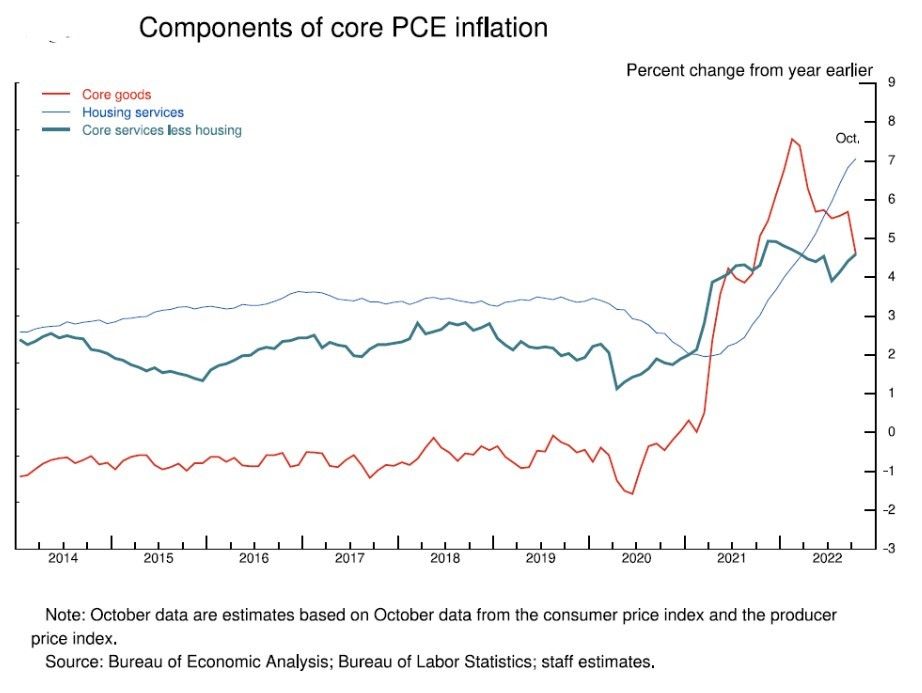

(1) Inflation remains high and uncertain. Powell started his prepared remarks by “acknowledging the reality that inflation remains far too high.” He reiterated a frequent theme from his past statements about inflation: “Without price stability, the economy does not work for anyone.” He also stated that “[t]he truth is that the path ahead for inflation remains highly uncertain.” Then he proceeded to drill down on the outlook for the core PCED inflation rate: “To assess what it will take to get inflation down, it is useful to break core inflation into three component categories: core goods inflation, housing services inflation, and inflation in core services other than housing.”

(2) Focusing on three major components of inflation. Powell noted: “Core goods inflation has moved down from very high levels over the course of 2022, while housing services inflation has risen rapidly. Inflation in core services ex housing has fluctuated but shown no clear trend. I will discuss each of these items in turn.”