The US economy's resilience is attributable primarily to robust consumer spending despite widespread concerns that rising prices have squeezed the purchasing power of lower-income consumers. As a result, many economists have warned that the so-called “K-shaped” economy isn’t sustainable. How can the economy continue to grow if more households are confronting an “affordability crisis”? Surely, it cannot do so supported just by the spending of higher-income households.

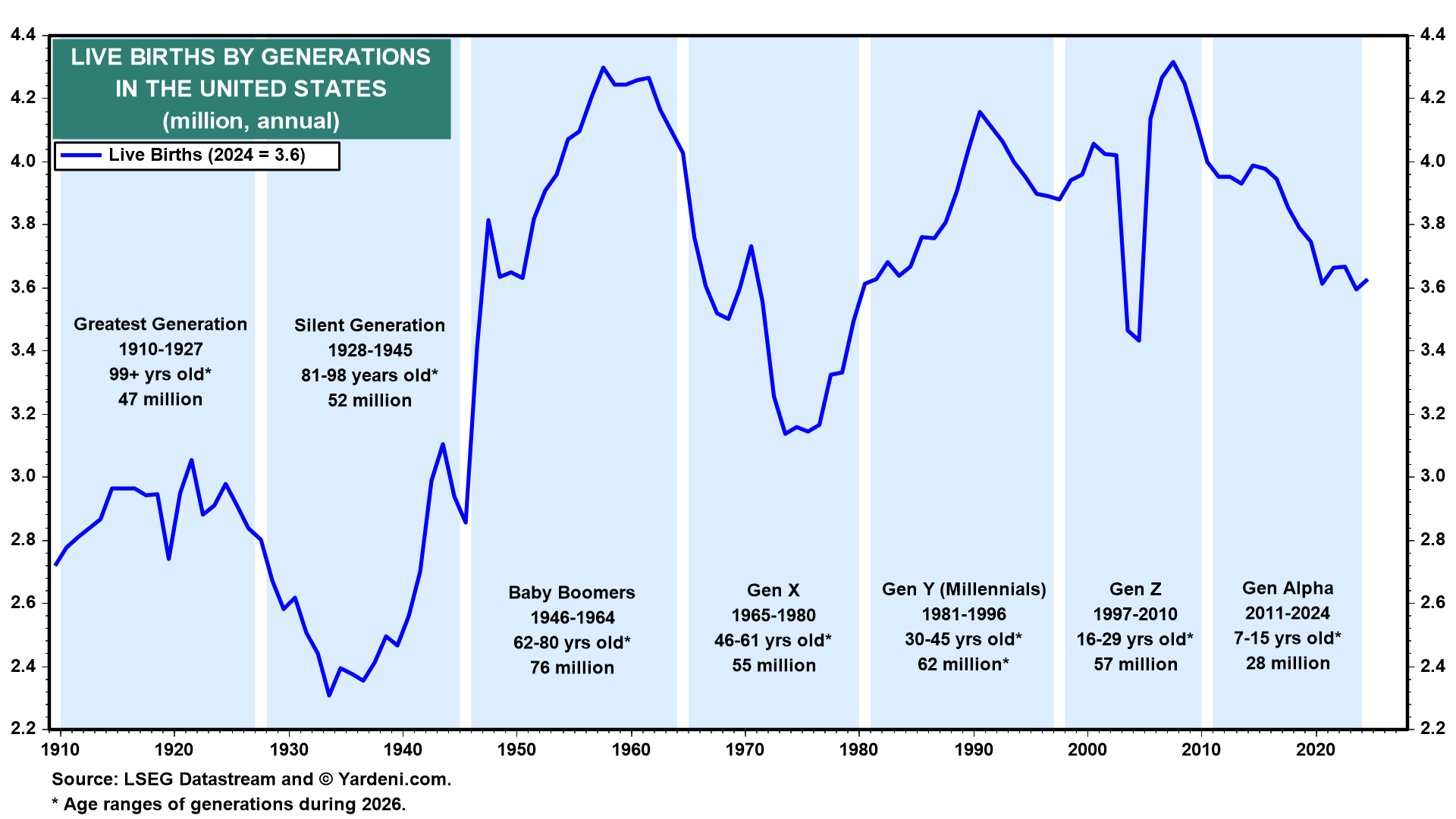

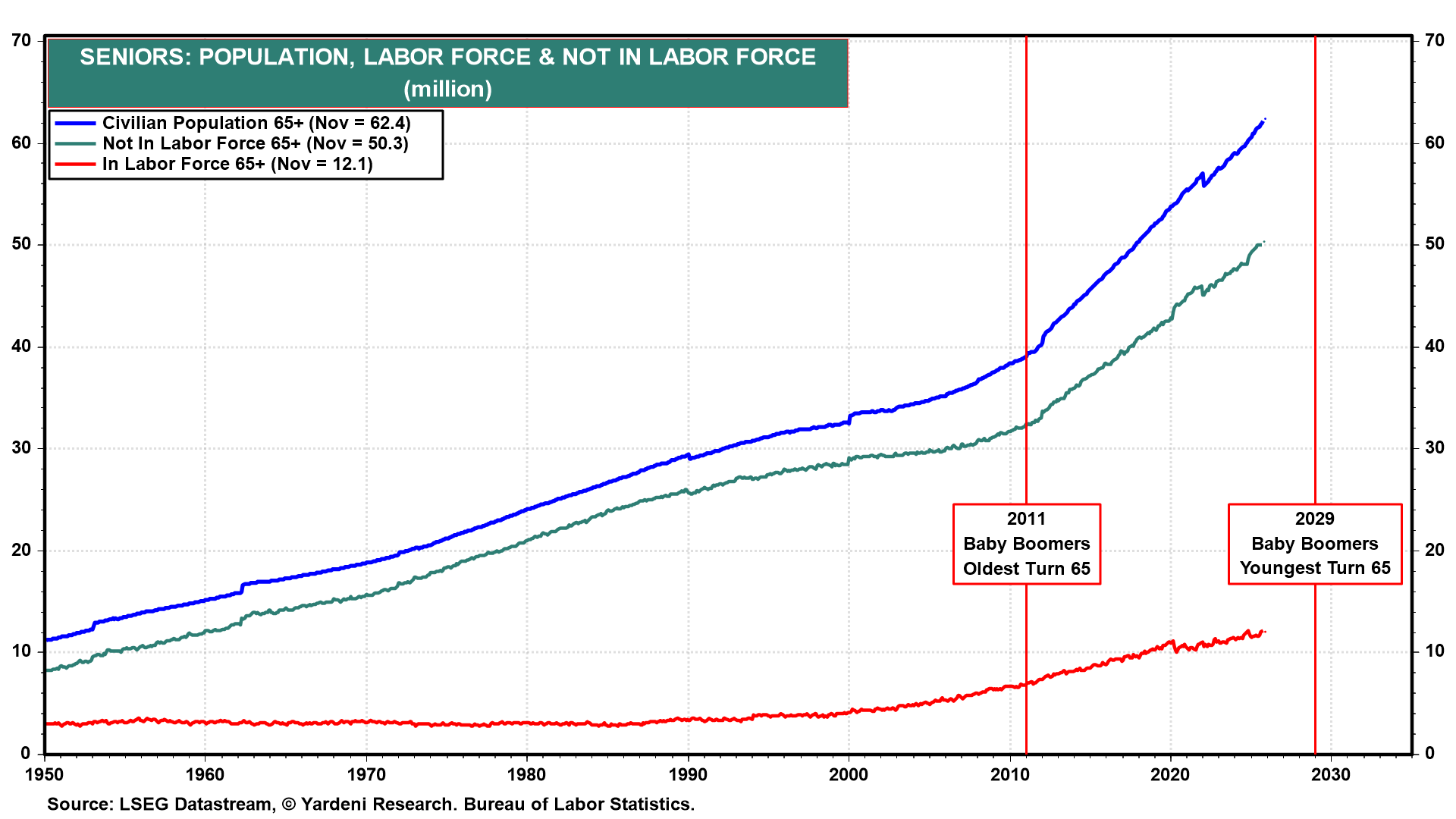

We believe that a better way to understand consumer resilience is to focus on what we call the “gen-shaped” economy. The economy has been significantly impacted by the 76 million Baby Boomers born between 1946 and 1964 (Fig. 12 below). They will turn 62 to 80 years old this year. The oldest of them turned 65 in 2011 (Fig. 13). Since then, the number of seniors who are not in the labor force increased by 17 million. Most of them have retired, and more Baby Boomers will be retiring this year and in coming years.

Such a surge of retirees has economic consequences that explain why consumer spending should remain resilient. Here are some of them:

(1) Disposable income may grow more slowly than in the past or remain flat. That’s because retiring Baby Boomers will no longer earn any wages and salaries. They undoubtedly earned much more than new entrants into the labor force.

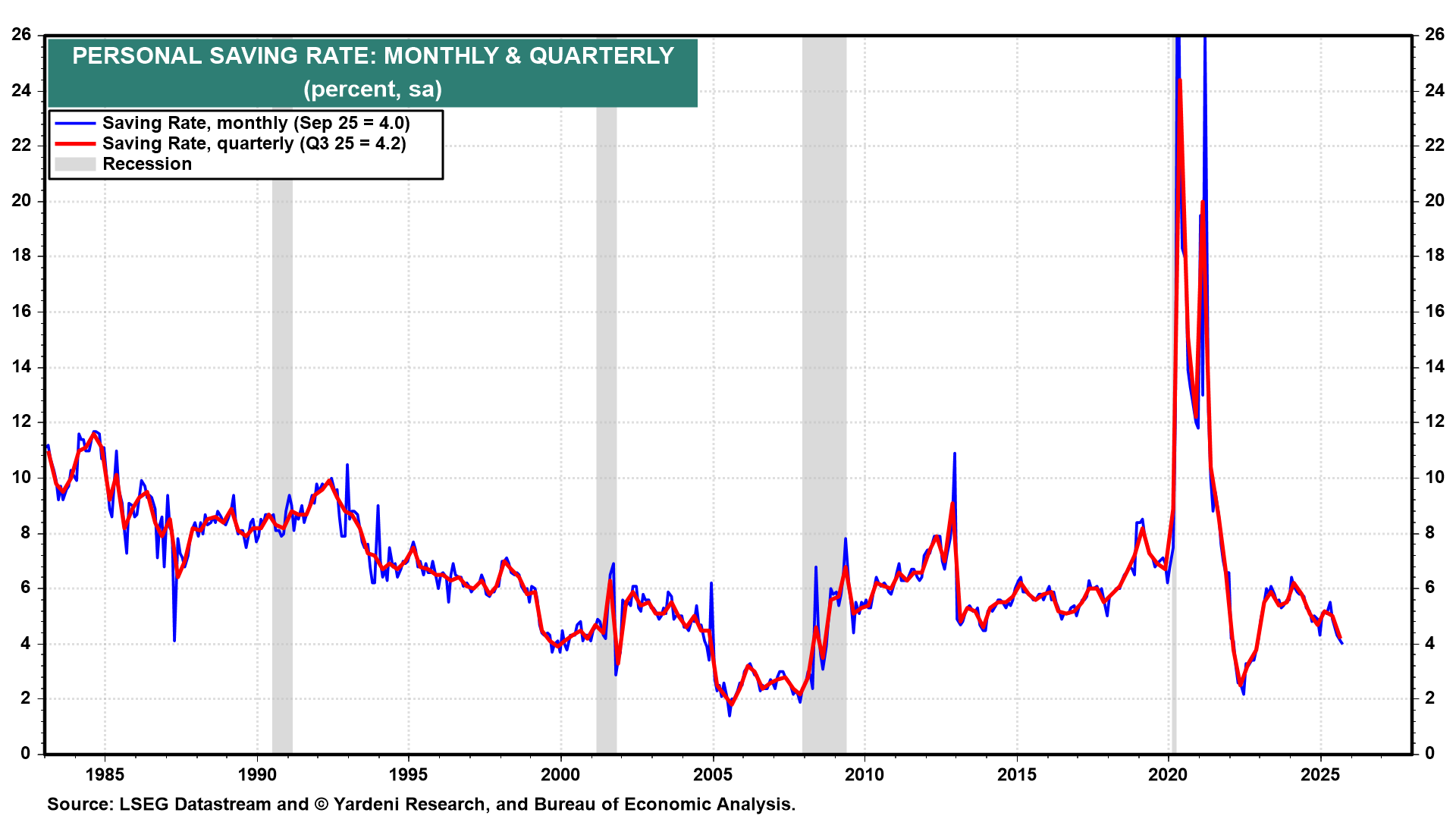

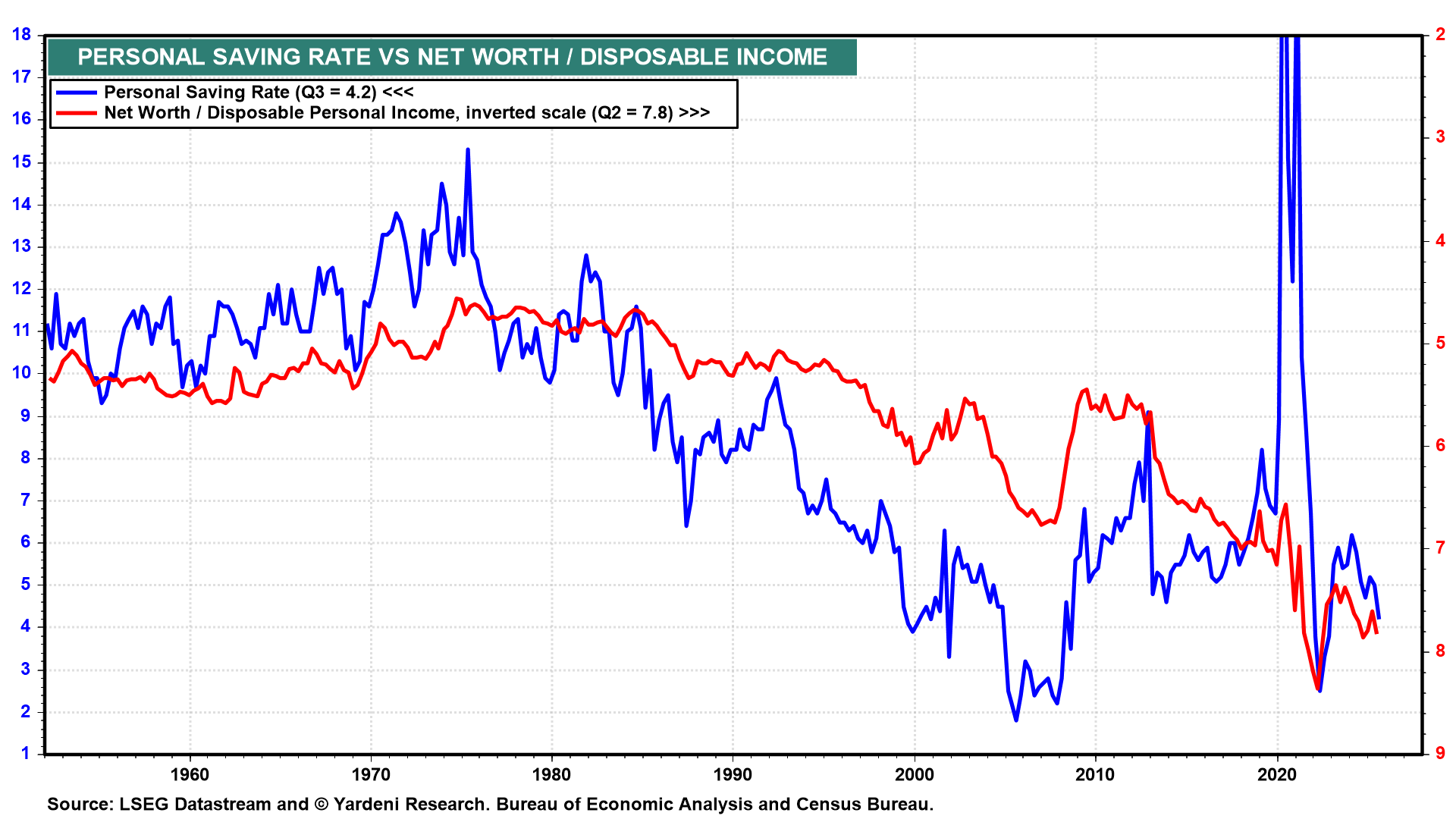

(2) The personal saving rate is likely to fall as the Baby Boomers continue to retire (Fig. 14 below). We are assuming that their consumer spending will remain robust even as they no longer get a paycheck. If so, then the national personal saving rate could turn negative in coming years.

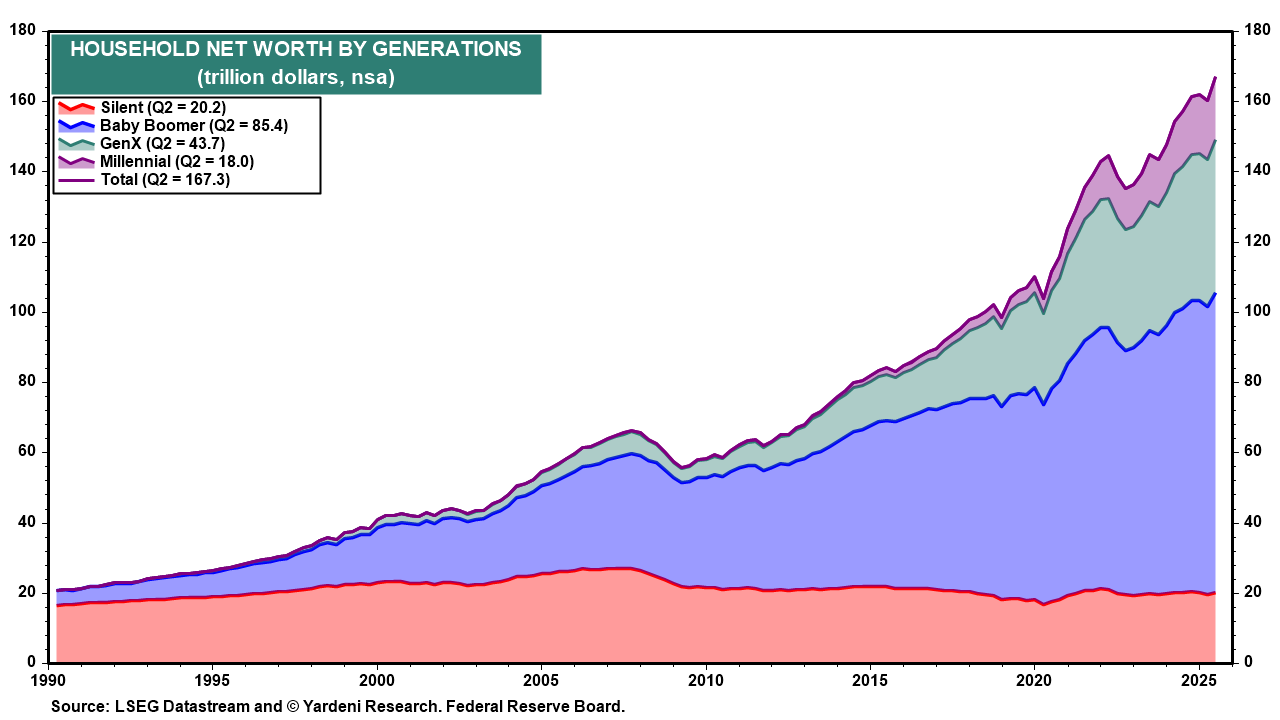

(3) The main reason we expect that Baby Boomers will be spending lots of money in their retirement years is that they’ve accumulated a record $85.4 trillion in net worth (Fig. 15 below). That’s about half of total household net worth. Not surprisingly, there is an inverse correlation between the ratio of net worth to disposable personal income and the personal saving rate (Fig. 16 below).

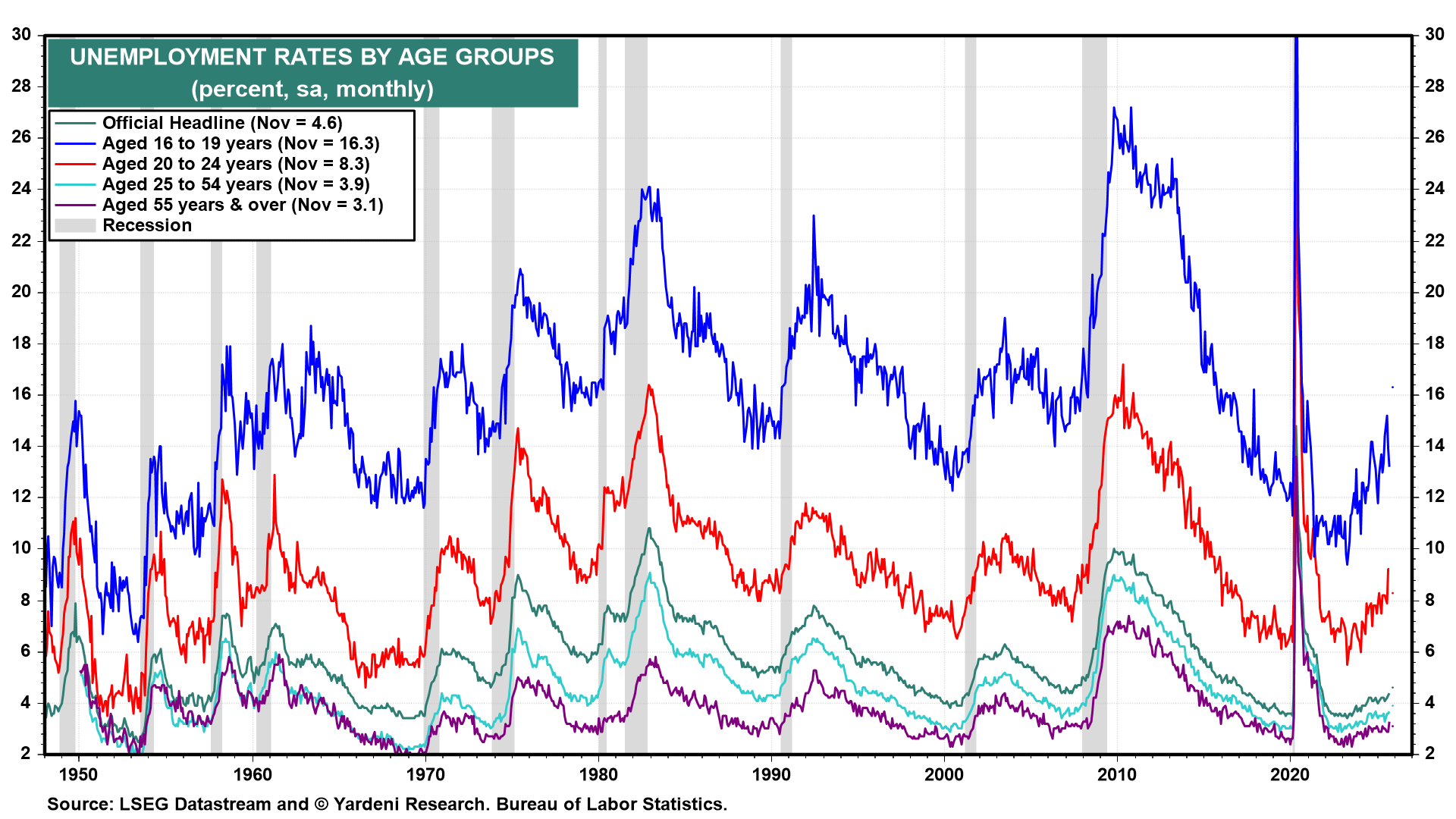

(4) Many of the low-income consumers who are struggling financially are in the Gen Z cohort, who are the children of the Baby Boomers and the Gen X cohort (born from 1965 to 1980). The Gen Z cohort includes 57 million people who will be 16-29 years old this year. They are having trouble finding jobs because the unemployment rate for 20- to 24-year-olds is 8.3%, up from 5.5% in April 2023 (Fig. 17 below). Many have graduated from colleges with majors that don’t match the requirements of the jobs that are available. In recent years, many companies have frozen their headcounts while they determine whether AI technologies can be used to boost the productivity of their current workforce. The Gen Z cohort also has lots of student and credit card debt.

Of course, as they grow older, Gen Zers’ incomes and net worth will increase. For now, many of them are receiving some financial assistance from their Baby Boom (and Gen X) parents.

(5) A July 2024 study by Bank of America reported that “46% of Gen Zers (ages 18 - 27) rely on financial assistance from parents. In addition, 52% of those surveyed said they don’t make enough money to live the life they want and cite the cost of living as a top barrier to financial success. Many said they are delaying milestones and are not on track to buy a home (50%), save for retirement (46%), or start investing (40%) within the next five years—even though they are working toward those goals.”

A January 2024 Pew Research Center study reported, “Overall, 44% of adults ages 18 to 34 who have a living parent say they received financial help from their parents in the past 12 months. This ranges from 30% among those ages 30 to 34 to 68% among adults younger than 25.”