China’s Consumer Bust I: Blame Xi, Not Trump.

As US President Donald Trump does his worst to hobble China’s economy, China’s President Xi Jinping may be beating him to the punch.

There’s no doubt that Trump’s tariffs are destabilizing Asia’s biggest economy. Though the current 30% US tariff on Chinese imports is a fraction of Trump’s earlier 145% China tax, it’s still prohibitively high—Smoot-Hawley Act high. It’s complicating President Xi’s ability to stimulate China’s hamstrung economy sufficiently to make this year’s 5% real GDP growth target.

Ironically, among the biggest wounds limiting China’s growth potential is a Xi-inflicted one: The troubling chronic weakness of consumer spending, which shows no signs of picking up sustainably. Chinese consumers prioritize saving, to the detriment of spending, owing to the absence of a social security safety net. Xi has struggled to reverse this trend but could be doing more to incentivize spending.

There are, of course, months when Chinese state media will jump on a particular economic statistic as a harbinger of a consumption boom to come. Case in point: the 6.4% y/y rise in retail sales in May, the biggest since December 2023 (Fig. 1). Yet China has produced such short-term blips many times before. The latest can be attributed to a mix of central bank easing, government trade-in programs and subsidies targeting home appliances and tech goods, and optimism over Trump’s tariff downshift.

However, such policies treat the symptoms of China’s troubles, not the underlying conditions, which are flaring up anew:

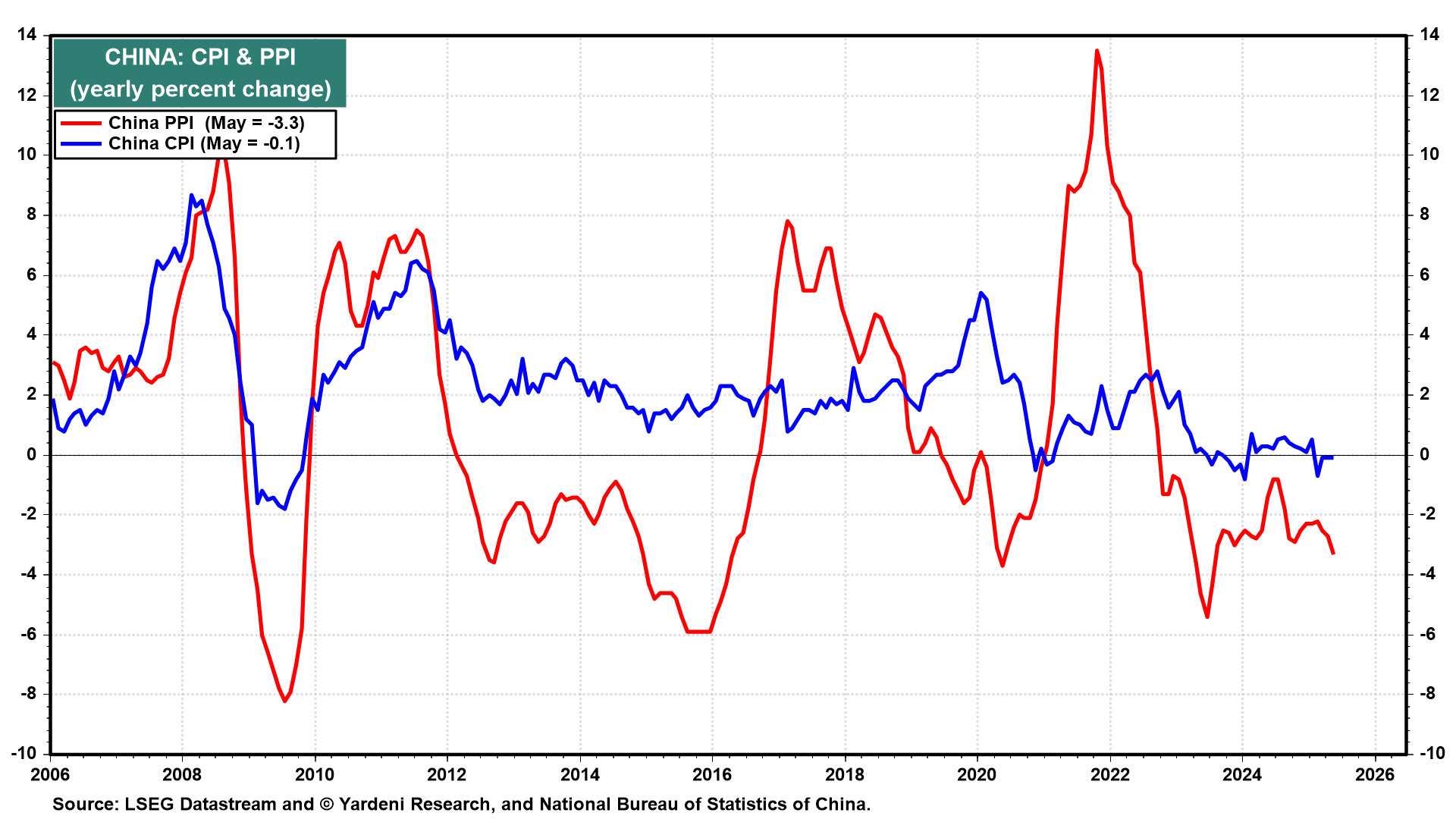

(1) Weak consumer confidence is fueling deflation. Consumer prices fell for a fourth straight month in May despite Beijing’s stimulus moves. In the latest month, China’s consumer price index fell 0.1% y/y (Fig. 2 below).

Price wars in the auto sector may be exacerbating the nation’s deflation trend going forward. Under the surface, meanwhile, this falling-price dynamic is thriving. Producer prices fell 3.3% y/y in May, the largest drop since July 2023.

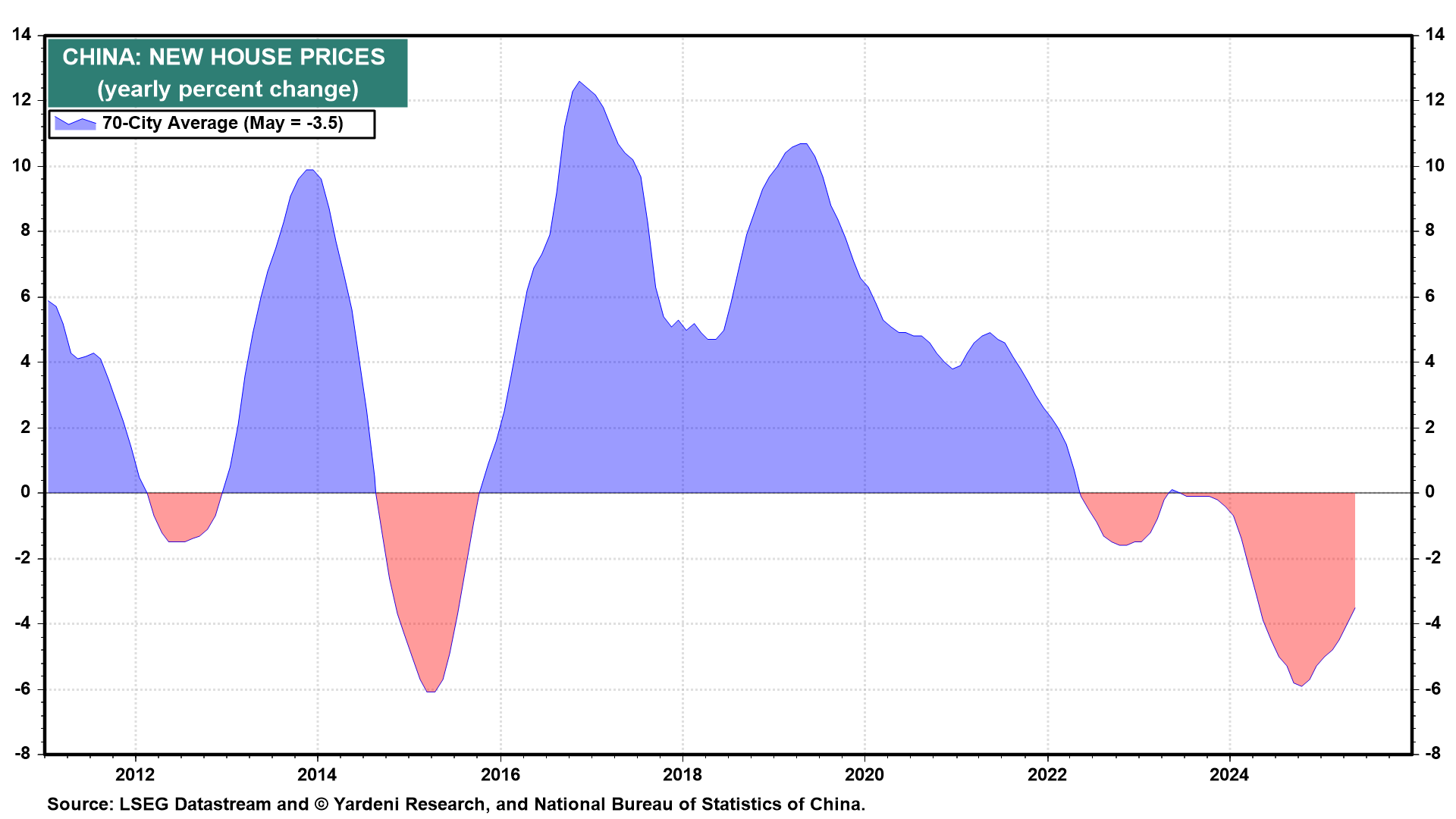

The main drivers of weak household confidence—the property crisis, which is eroding consumers’ wealth, and disappointing wage growth, hurting their incomes—show no signs of improvement (Fig. 3 below).

“Things are not getting much worse, but they will probably not get better without more government support,” warns Larry Hu at Macquarie Group.