I. AI Immunity Is The New AI Trade

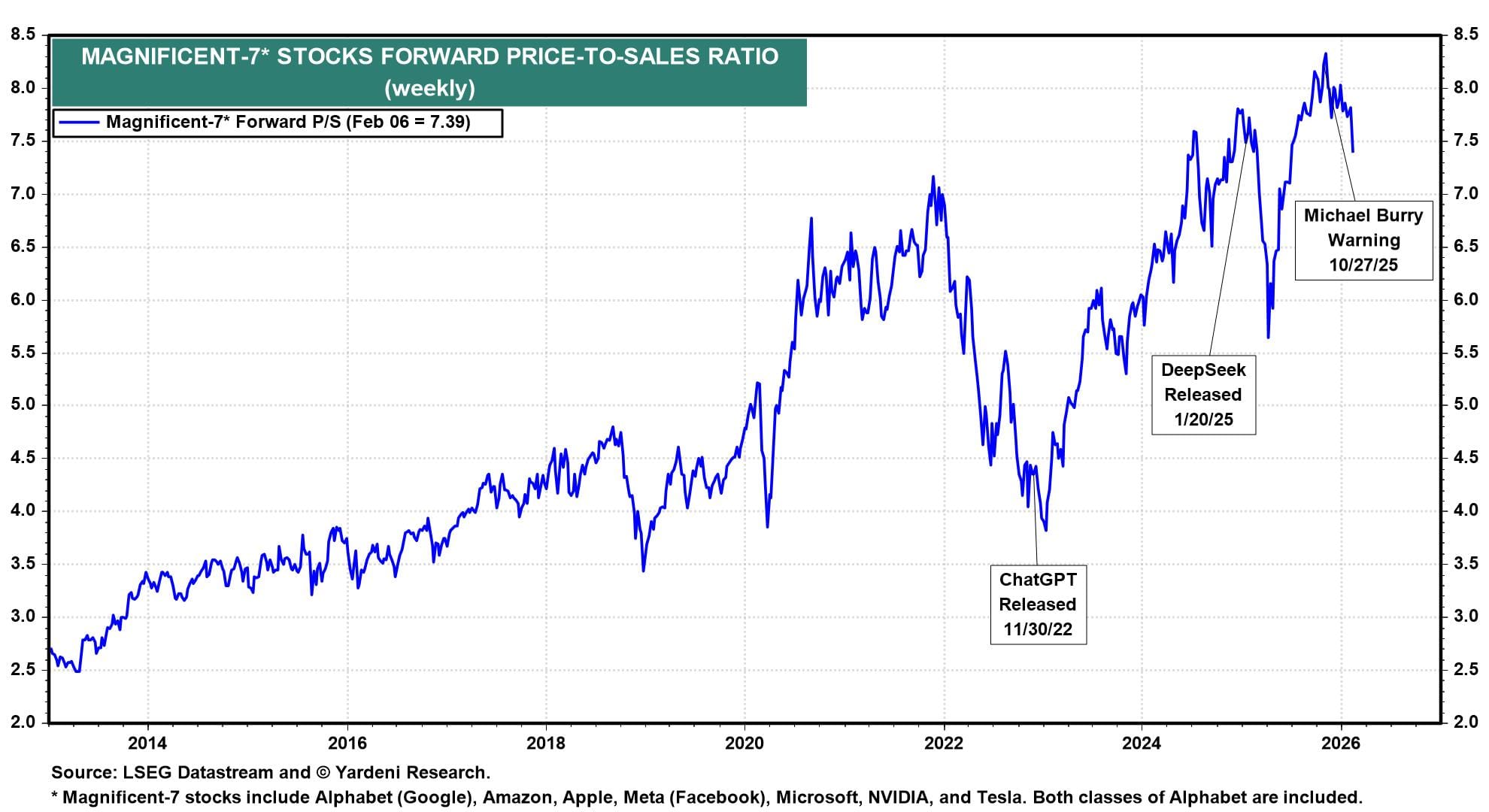

After ChatGPT was released on November 30, 2022, investors scrambled to overweight the AI trade, mostly by overweighting the Magnificent-7 (chart). That worked out great until the DeepSeek surprise on January 20, 2025. The AI trade made a big comeback on April 9, 2025, when President Donald Trump postponed his "Liberation Day" tariffs, and after datacenter hyperscalers reiterated their commitment to spending massively to meet booming demand.

But then, since October 27, 2025, Michael Burry has raised several questions on social media about whether all the investment in AI infrastructure will ever pay off. Investors quickly lost their confidence in the AI trade. More recently, they've been seeking to invest in companies with AI immunity after software stocks were pummeled by fears that AI would threaten their profitable business models. The stocks of wealth management companies were hard hit this week due to the same concern.

We continue to recommend underweighting the Magnificent-7, as we have since early December. We also lowered Information Technology and Communication Services from overweight to market weight back then. We maintained our overweight in Financials, which have also been hit recently by AI disruption fears. We believe the selloff in software and financial company stocks has been overdone because they will use AI to lower costs and deliver better products and services to their customers.

Nevertheless, given the uncertainty caused by AI disruptors, we would go with the flow. We are reiterating our overweight recommendation for the "old economy" Industrials and Health Care sectors. We've been bullish on precious and base metals and are now overweighting the Materials sector. We also continue to recommend overweighting foreign stock markets, particularly those of emerging markets.