The Fed is required by law to keep inflation low and stable while also maintaining full employment. Achieving that dual mandate isn't always easy. Currently, the labor market is at full employment, but there are a few signs of weakening. Inflation was on track to fall to the Fed's 2.0% inflation target, but has been stuck around 3.0% recently. Some Fed officials believe that Trump's tariffs are only temporarily boosting inflation and that the Fed should ease as soon as possible to avert any further weakening of the labor market. Other Fed officials are opposed to easing until they can be more certain that inflation is declining to 2.0%.

Fed Chair Jerome Powell has sided with the hawks and has been insulted almost daily in recent months by President Donald Trump for not cutting the federal funds rate as Trump demands. On Friday, Powell will speak at the Fed's annual Jackson Hole conference. He will probably remain hawkish because inflation remains elevated. If so, we side with him. Consider the following:

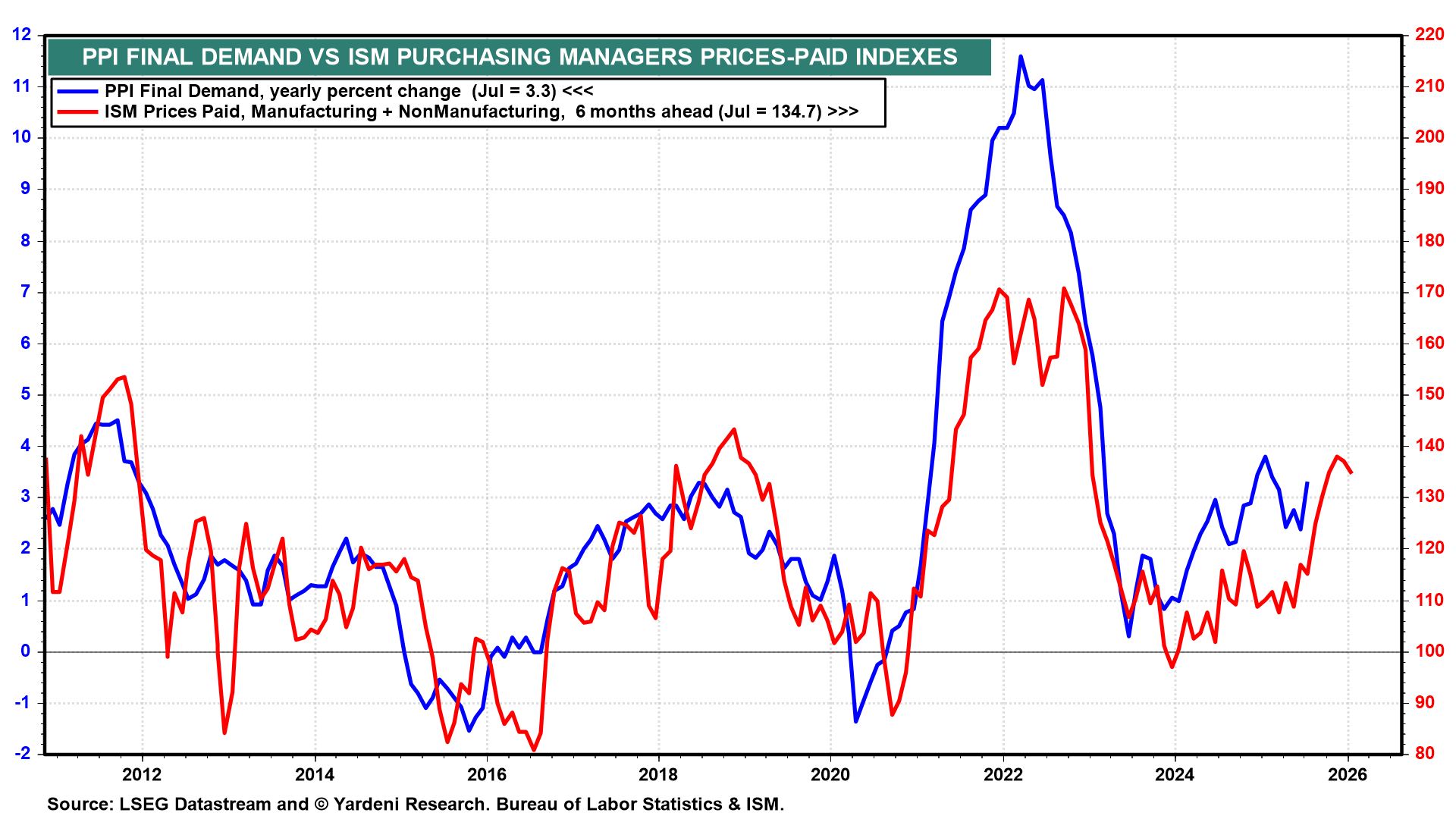

(1) Inflation: purchasing managers surveys. The sum of the national purchasing managers' indexes for manufacturing and non-manufacturing is a good six-month leading indicator of the PPI final demand inflation rate (chart). The former suggests that inflationary pressures have increased and will persist through the end of this year.

(2) Inflation: consumer durable goods. Tariffs undoubtedly have boosted durable goods inflation in both the CPI and PCED (chart). From the mid-1990s through the pandemic lockdowns, durable goods prices usually deflated. They were falling again following the inflation surge of 2022 and 2023. Since the spring, durable goods prices have been rising again as a result of Trump's tariffs.