Many of the questions the Fed has about how Trump's trade war is impacting the inflation outlook will get timely answers this week. Well, updates at least, since only President Donald Trump knows how long Trump's Tariff Turmoil (TTT) will continue disrupting the world's biggest economy.

On Friday, we learned that half of Fed's dual mandate is doing just fine. The full-employment part of the mandate is confounding the hard-landers, as evidenced by the 139,000 increase in payroll employment and 4.2% jobless rate in May. So, there's no urgent need for the Fed to hit the monetary accelerator—certainly not at next week's June 17-18 Federal Open Market Committee meeting.

The resilience of the economy should be confirmed anew by this week's economic data releases. And the extent to which Fed officials might have an inflation problem (at least in the short run) could come into clearer view. Highlights include:

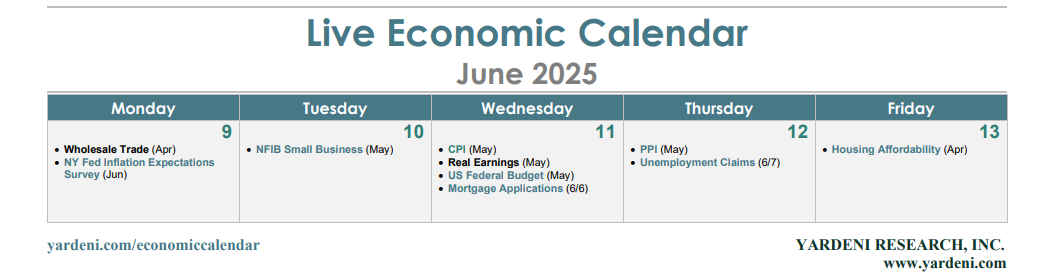

(1) Inflation: expectations. The New York Fed's closely watched survey of consumer expectations (Mon) will get the week started. The May survey showed inflation expectations over the year ahead edged up to 3.6%, while three- and five-years-ahead expectations both remained near 3.0% (chart). Fed officials would probably like to see all three below 3.0%.

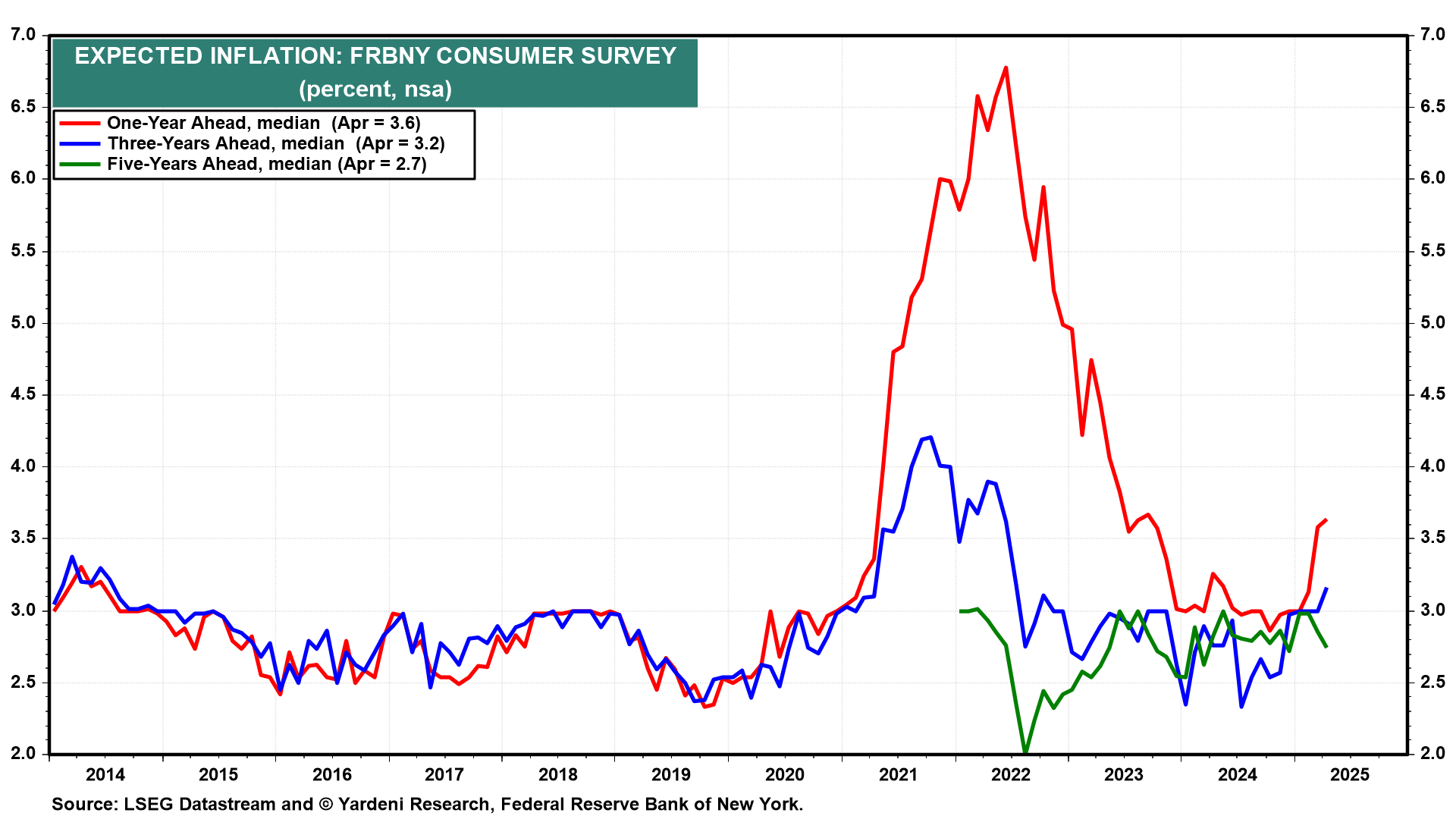

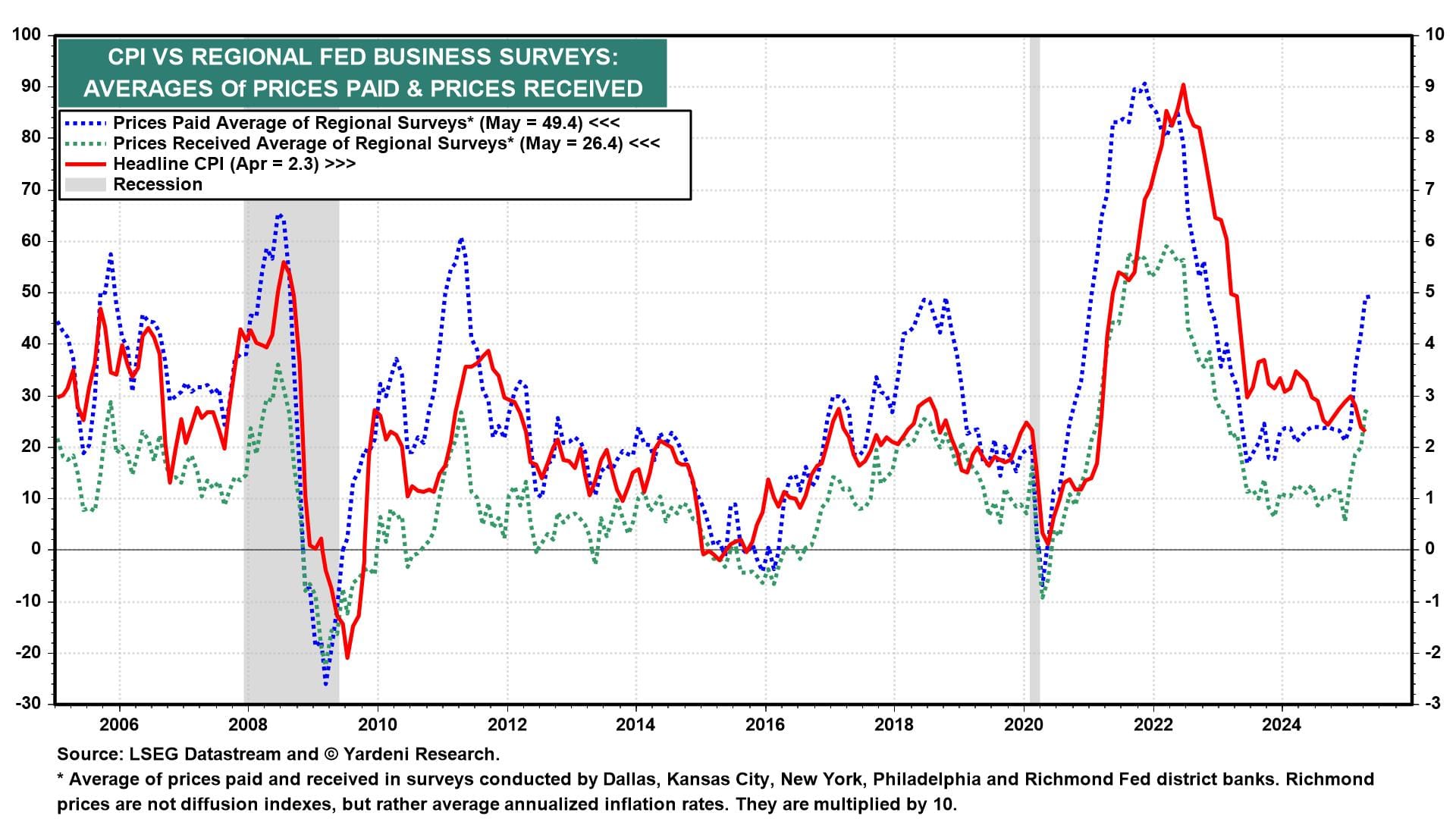

(2) Inflation: CPI. May's Consumer Price Index (Wed) could shed light on whether Trump's tariffs are starting to boost inflation. Since April's 2.3% y/y increase, the Cleveland Fed’s Inflation Nowcasting model has been signaling slight pickups in May (2.4%) and June (2.7%). However, gasoline prices were flat in May, and the Manheim Used Vehicle Value Index eased during the month. The big surprise could be how little Trump's tariffs are boosting inflation despite upward pressures on prices-paid and prices-received indexes in the Fed's regional business surveys (chart).

(3) Inflation: PPI. The US Producer Price Index (Thu) for goods has been highly correlated with China's PPI, which fell 2.7% y/y in April. The fact that Asia's biggest economy is grappling with deflation could offset tariff-related price pressures. Since the April drop in China's PPI was the steepest in six months, there's reason to expect its deflation isn't going away anytime soon.

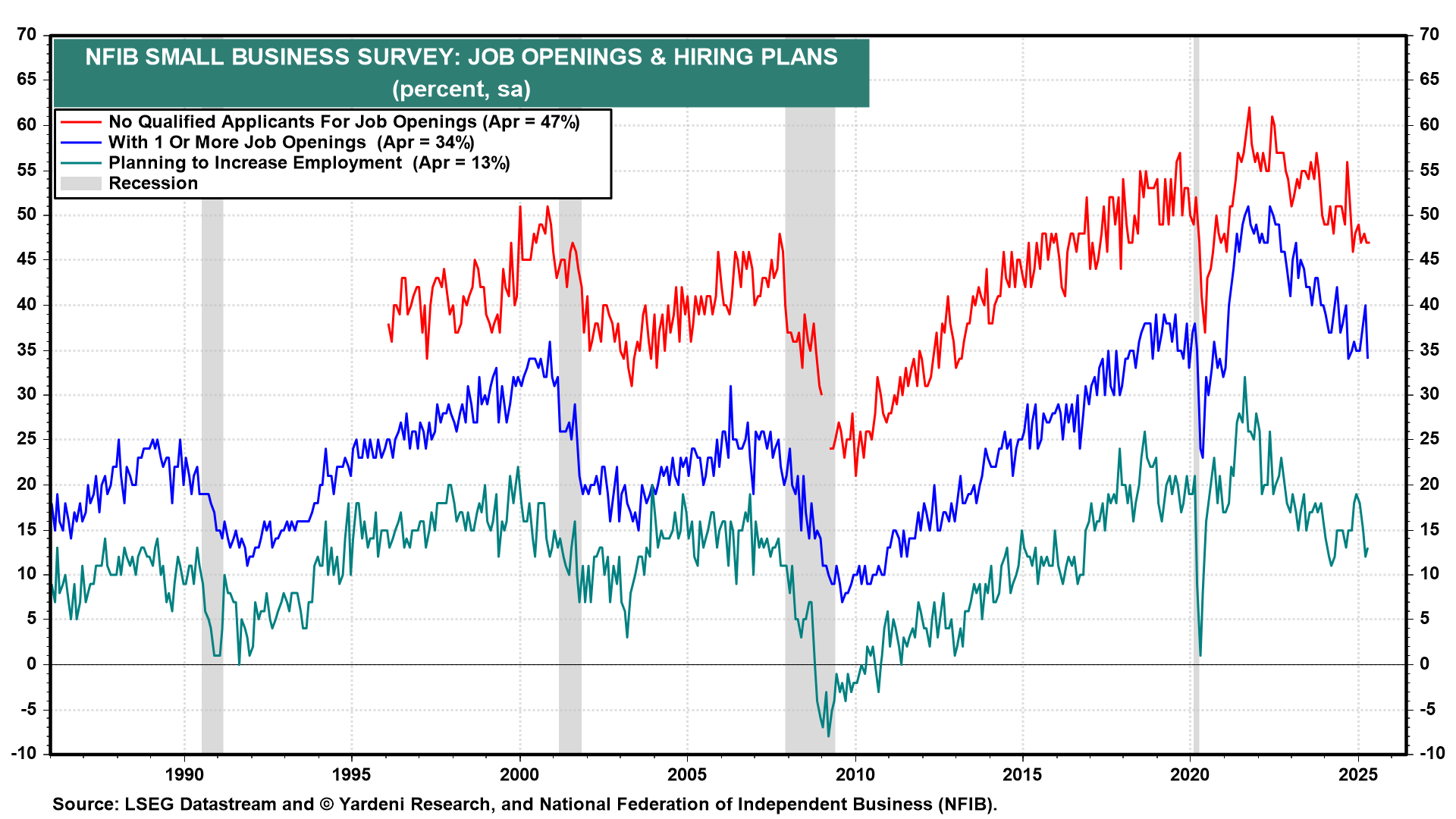

(4) Small business owners survey. When the National Federation of Independent Business releases its latest survey of small business owners (Tue), the real insights will come from the labor market indicators. We expect the May survey to confirm the resilience of employment conditions despite the tariffs. It should help, too, that the May data period coincided with Trump’s either postponing or lowering tariffs.

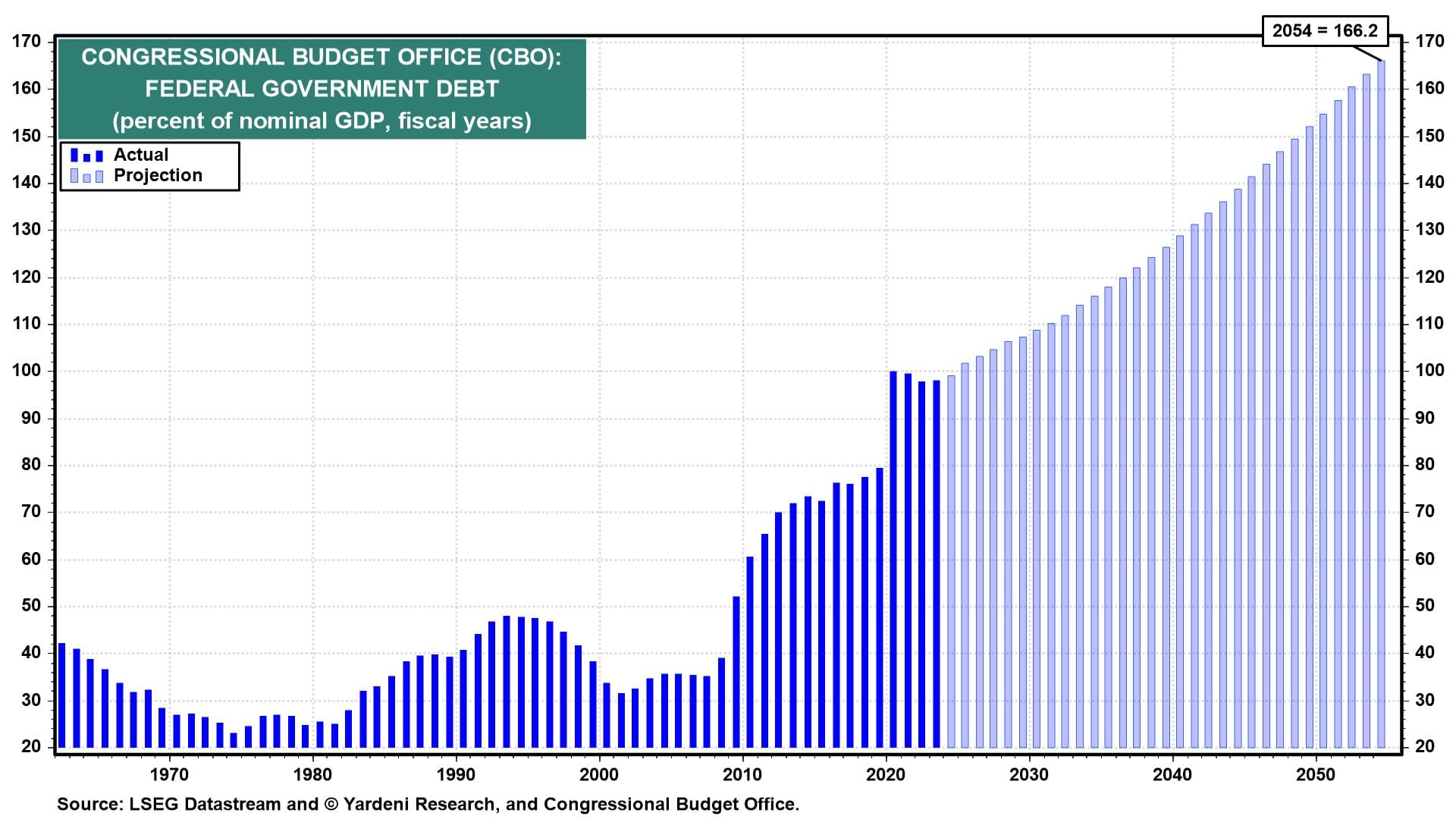

(5) Federal budget. It's anyone's guess what Trump's "Big Beautiful Bill" will look like after the Senate works it over this week, especially given how ugly the process has gotten as the Trump-Musk big beautiful bromance implodes in real time. Already, the current version is seen adding between $2-$5 trillion to the federal debt—on top of the $20 trillion increase the Congressional Budget Office currently projects over the next 10 years (chart). Expect the Bond Vigilantes to have lots to weigh in about this trajectory.

(6) Unemployment claims. The weekly jobless claims (Thu) release is garnering increasingly breathless attention because of the will-they-or-won't-they-ease debate among Fed watchers. For unemployment claims to stay within the recent range of roughly 205,000-243,000 will be key. The four-week moving average for claims is currently around 235,000, suggesting that the resilience we've seen in labor markets remains intact.