A big week of economic releases is coming up, but the government won’t be reporting them because it is closed for business. Nevertheless, the week ahead will still be a big one for private-sector economic data. On balance, they are likely to show that the economy is expanding, consumers are spending, and employment is still growing, albeit at a slow pace. Consider the following:

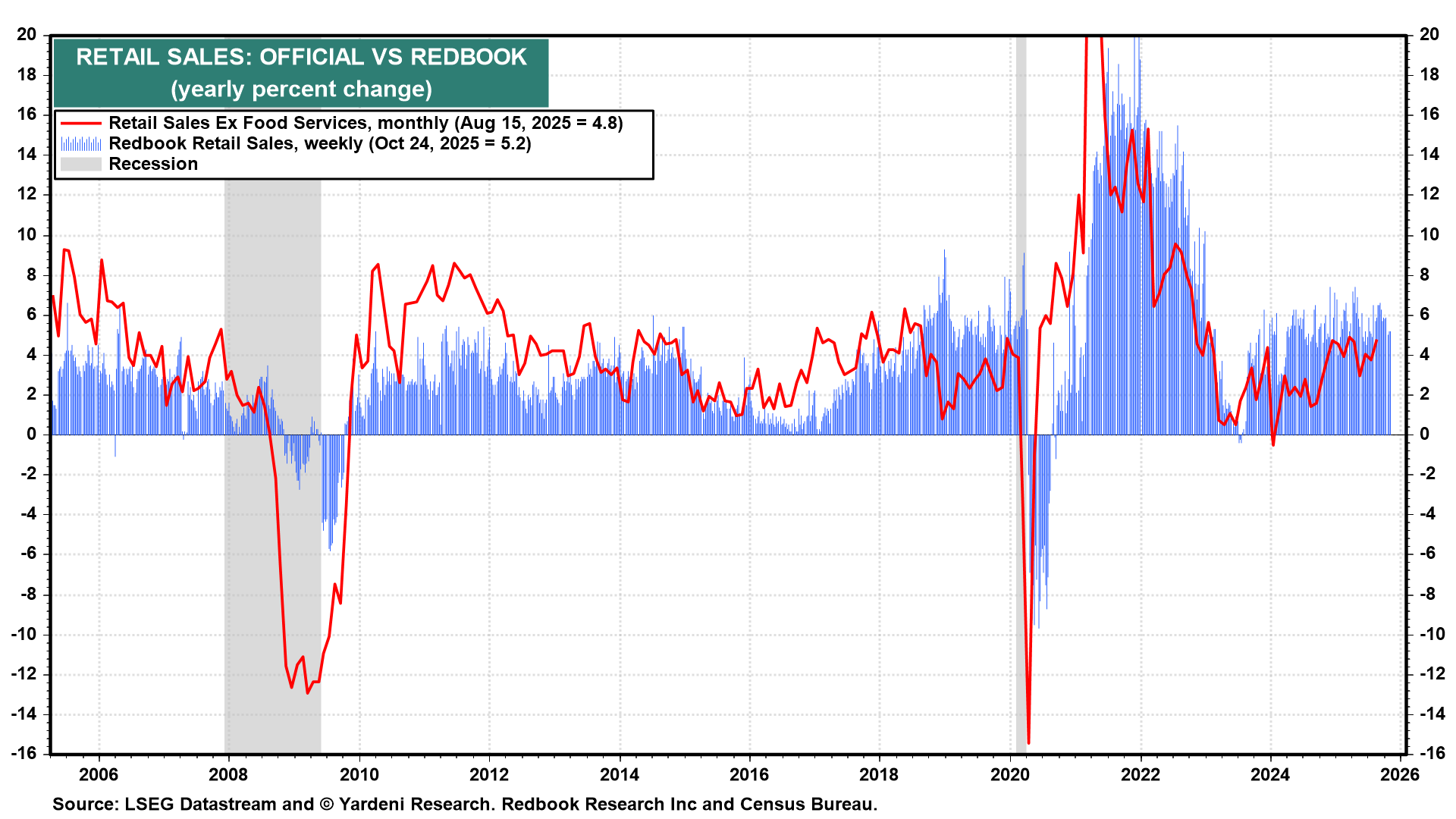

(1) Retail sales. The weekly Redbook Retail Sales Index is released on Tuesday mornings. It is likely to confirm that consumers are continuing to spend on merchandise at a solid pace (chart).

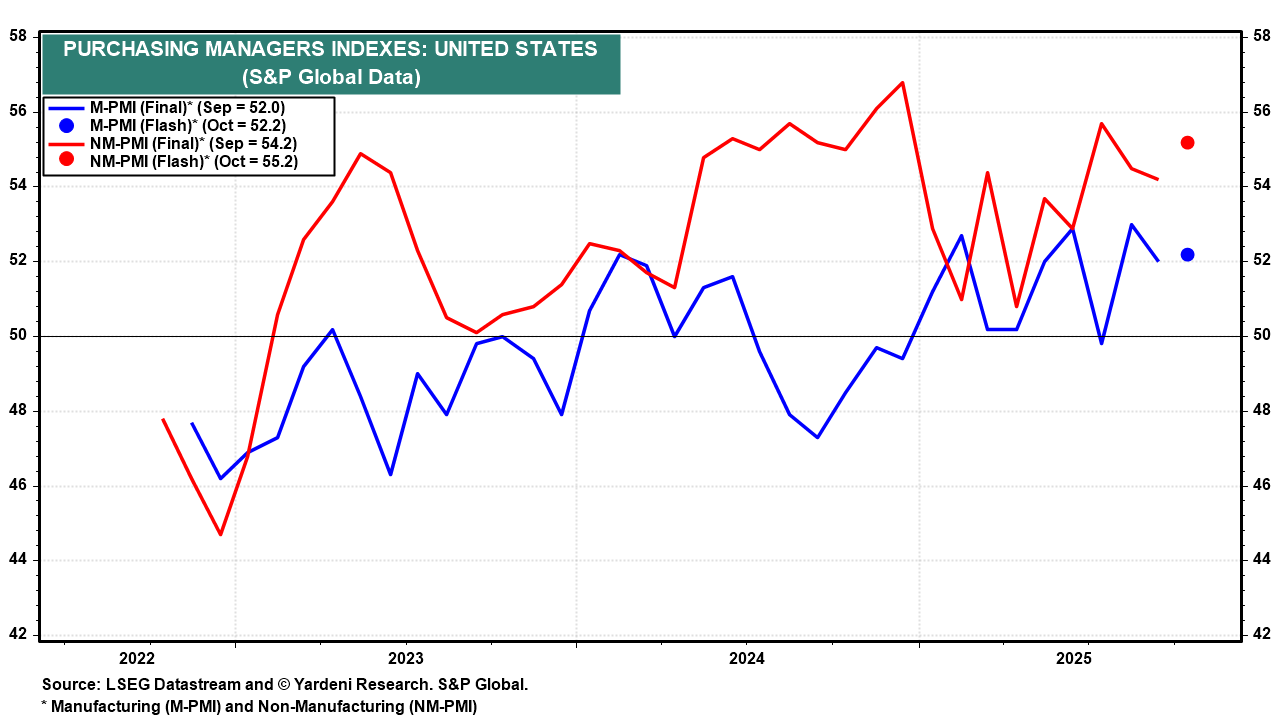

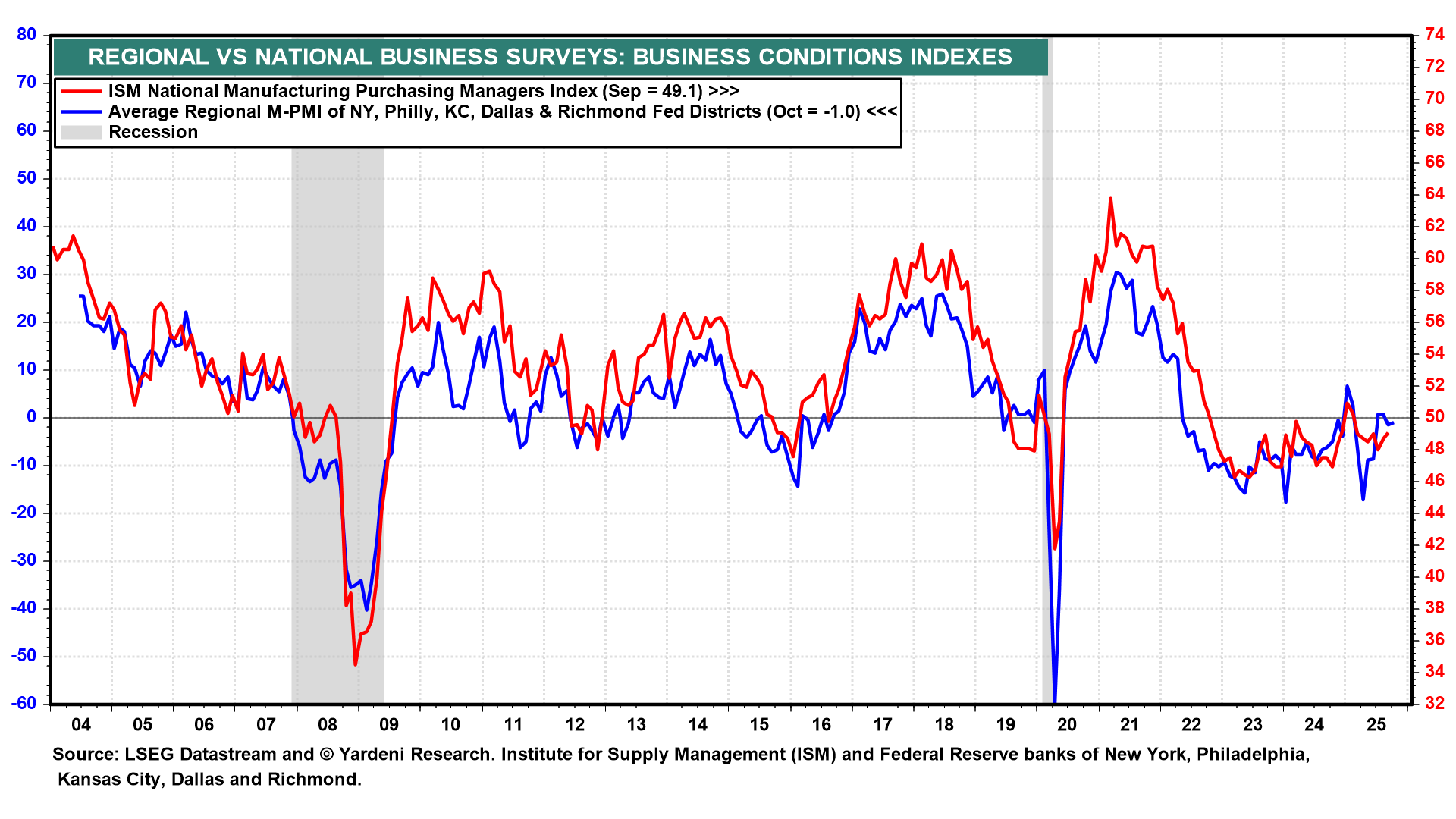

(2) Purchasing managers. October's ISM national purchasing managers' indexes for the manufacturing (Mon) and non-manufacturing (Wed) sectors might show some strength, based on S&P Global's flash estimates (chart).

The regional business surveys conducted by five of the 12 Fed district banks suggest that the M-PMI might have rebounded to 50.0 in October (chart).

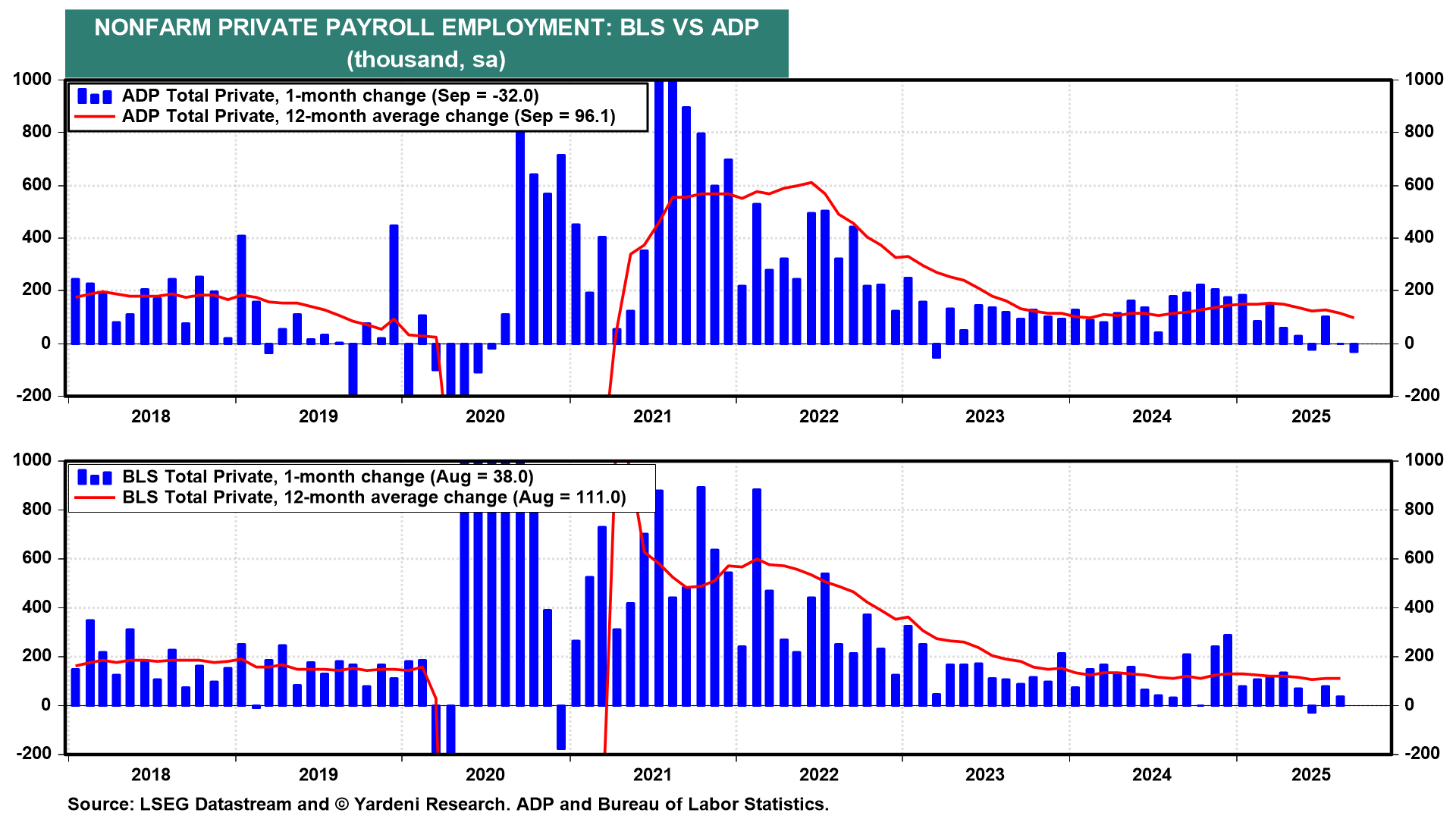

(3) Employment. October's ADP private payrolls report should show a modest increase of around 50,000 based on ADP's weekly estimates. That would be a welcome rebound from September's 32,000 decline.

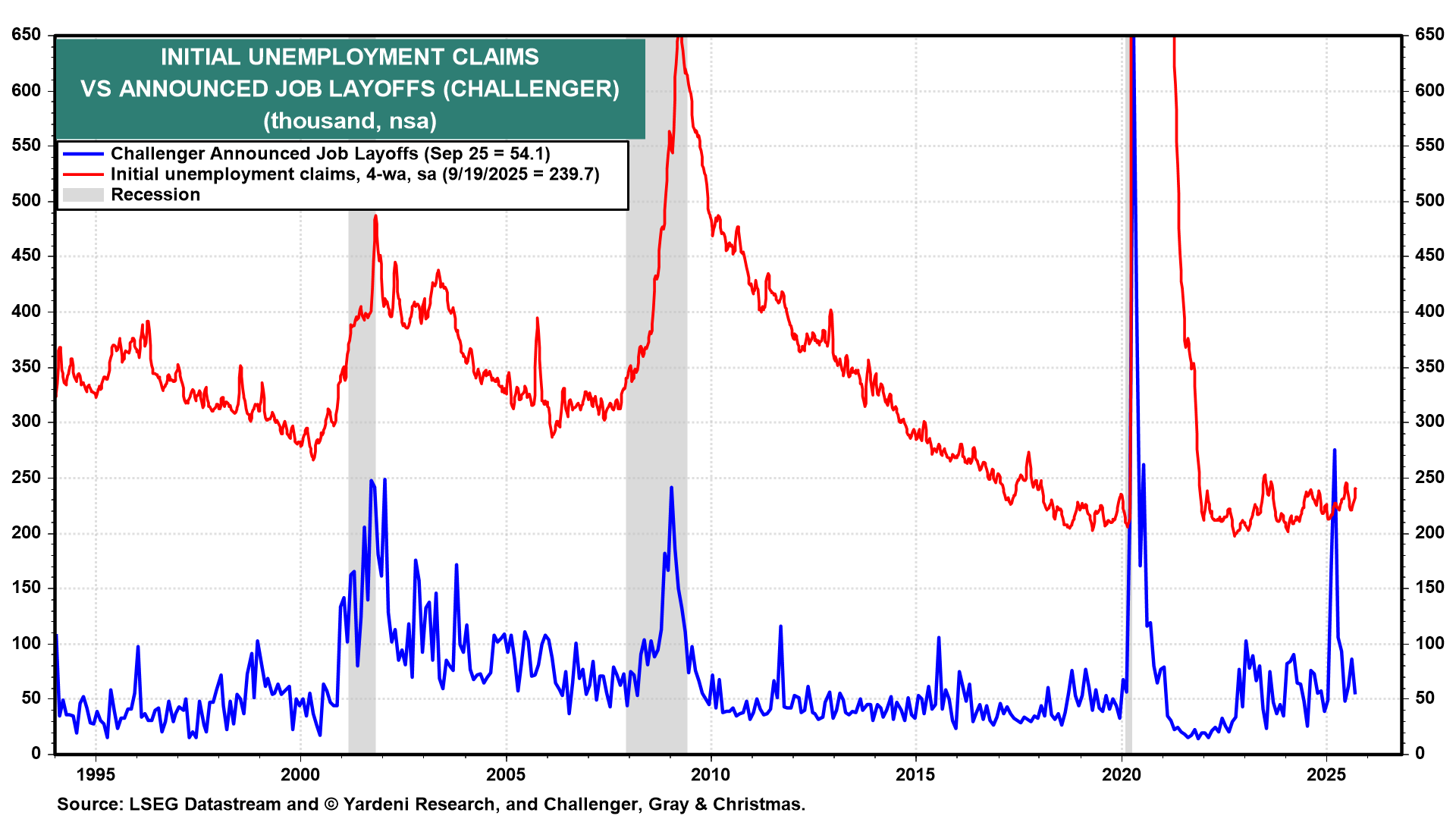

(4) Layoffs. October's Challenger announced job layoffs report (Thu) is likely to show an increase, especially among technology companies. A broader increase is unlikely since state data indicate that weekly initial unemployment claims remain subdued (chart). Bloomberg's latest estimate of US jobless claims is approximately 218,000 for the week ending October 25, 2025. This marks a decline from the previous week's revised figure of 231,000.