This week is chock-a-block with data reports, all building up to Friday's pivotal employment report. The August jobs release will offer a reality check of sorts following July's surprisingly soft reading and significant downward revisions to results for May and June. It could determine whether the Federal Open Market Committee (FOMC) proceeds with a rate cut at its September 16-17 policy meeting.

The July jobs data led to two dissenting votes at the July 29-30 FOMC meeting. Since then, more Fed officials appear to have become comfortable with the possibility of an easing move at the September 16-17 meeting. Underwhelming data on consumer spending and confidence have many investors betting the full-employment half of the Fed's dual mandate will take precedence over worries about tariff-driven inflation.

Markets will be on the lookout for any such hints at public speaking events by Fed officials. They include St. Louis Fed President Alberto Musalem (Wed), who's currently a voting FOMC member. A day later (Thu), voting members Chicago Fed leader Austin Goolsbee and New York Fed President John Williams will hit the podium.

Yet the real verbal fireworks could come from Stephen Miran's confirmation hearing (Thu) before the Senate Banking Committee. Trump named his loyal Council of Economic Advisers chairman to serve out the remaining term of Governor Adriana Kugler, through January 31, 2026. Republicans are rushing Miran onto the Board in time for this month's FOMC meeting, where he could bolster a majority vote to ease.

Here are the data reports this week most likely to fill in the blanks for Fed officials on the fence:

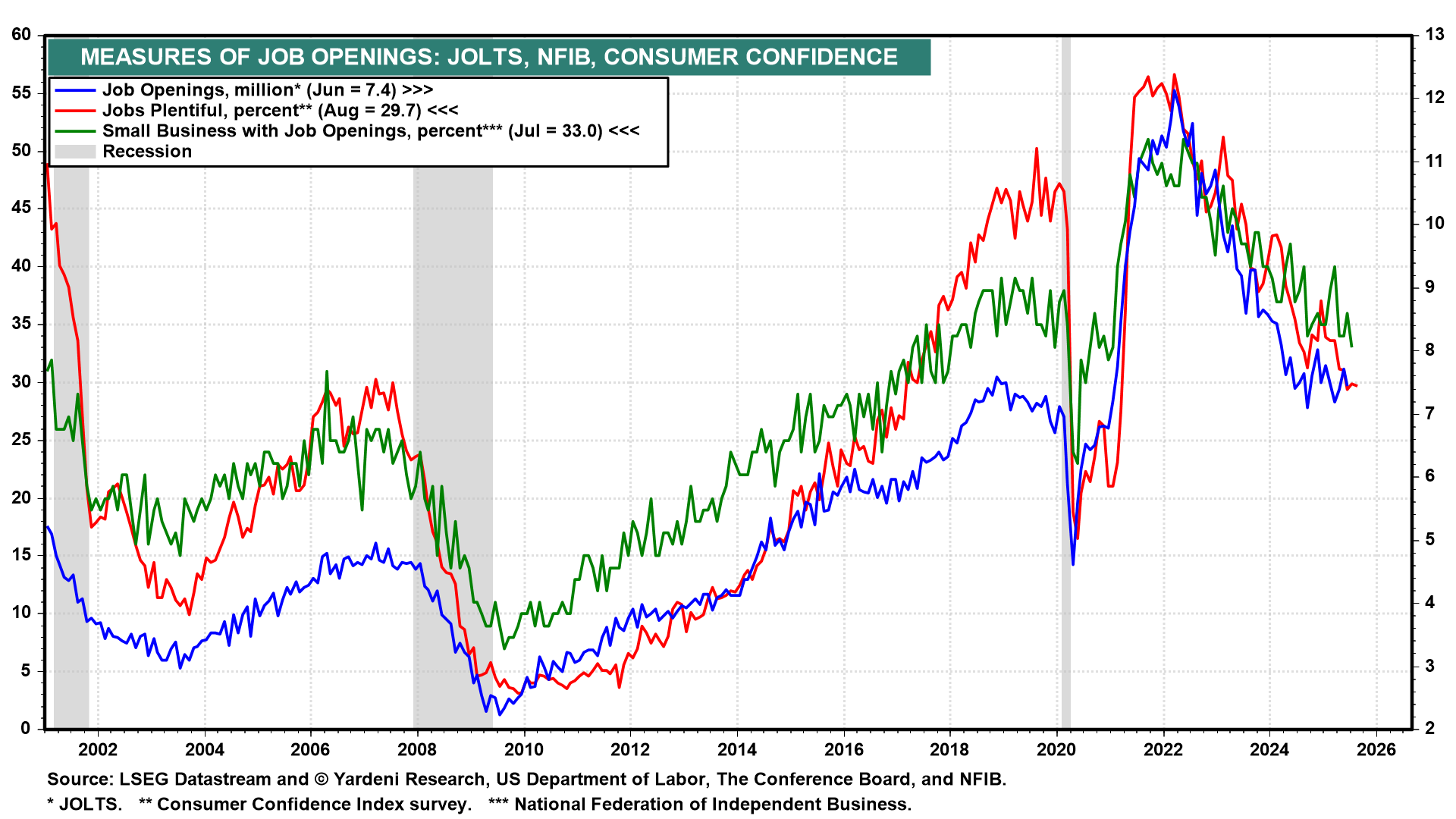

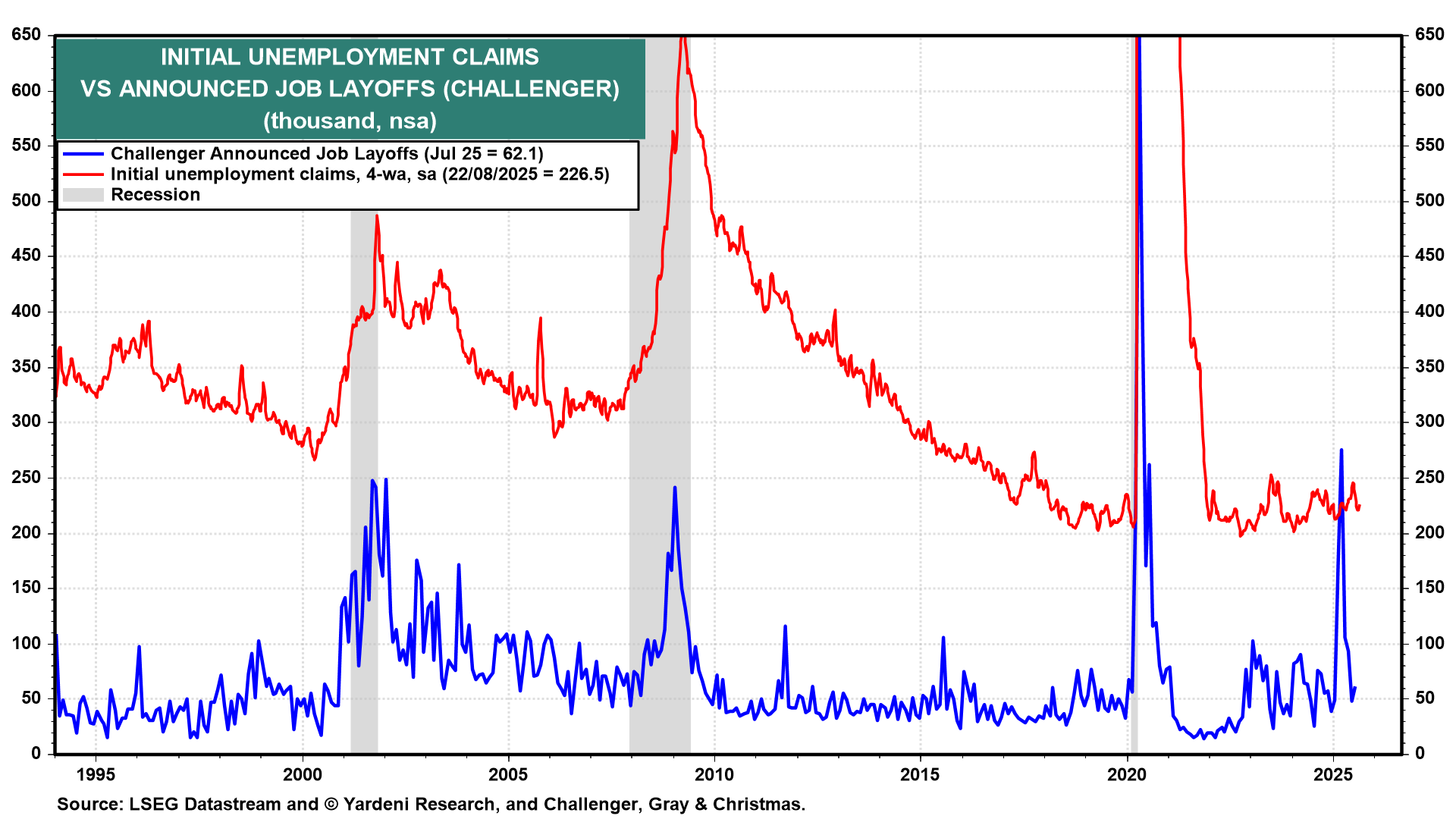

(1) Employment. The wait for the August jobs data (Fri) should end with a 100,000 increase in payrolls. That’s not a barnburner of a report, but it’s enough of a gain to allay fears that the economy is veering toward recession. Initial unemployment claims data (Thu) continue to show that layoffs remain low and the duration of unemployment isn’t surging. Nor are recent JOLTS (Wed) trends indicative of labor market weakness (chart).

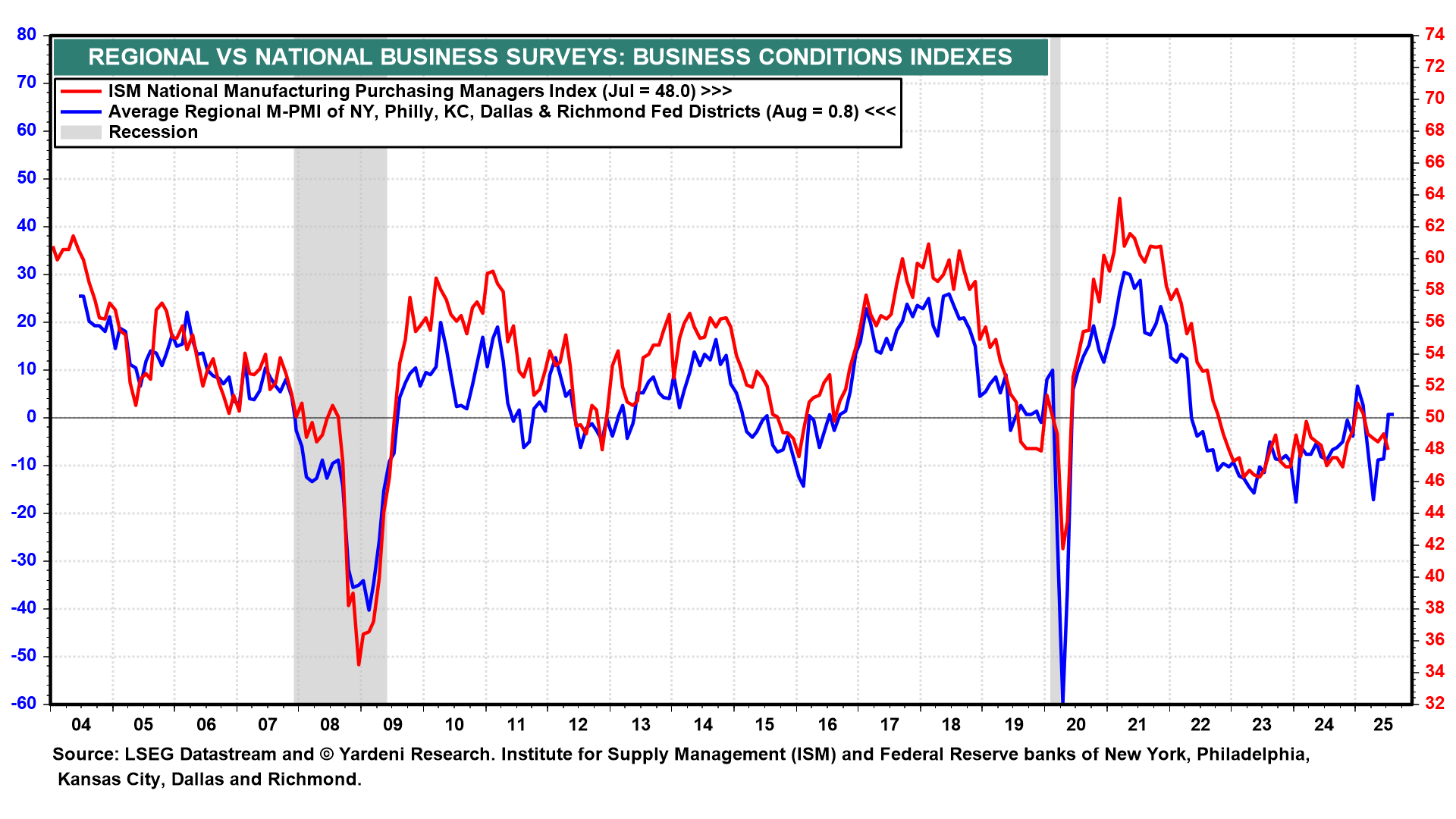

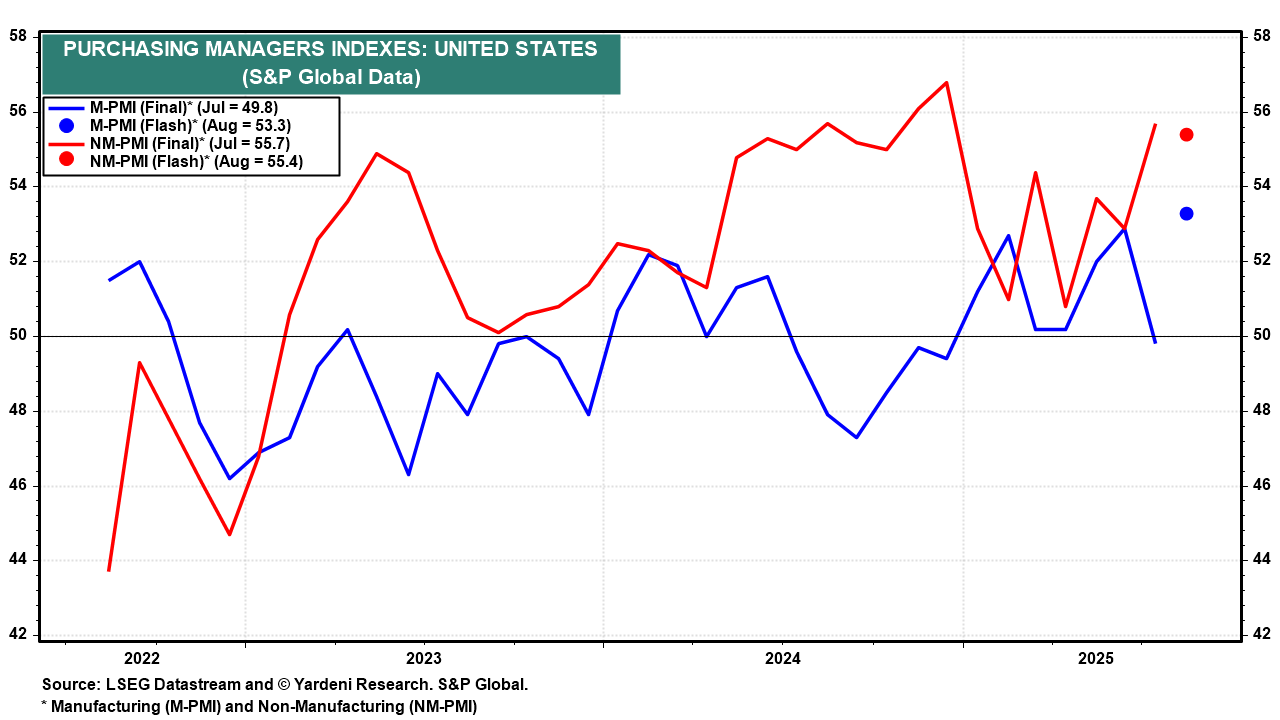

(2) Purchasing managers' surveys. Early in this holiday-shortened week, markets will get a telling update from the Institute for Supply Management (ISM), which releases its August manufacturing purchasing managers index (M-PMI, Tue). In July, it contracted for its fifth consecutive month to 48.0. August's regional business surveys suggest that the M-PMI might have rebounded closer to 50.0 (chart).

Also suggesting solid August readings for both the M-PMI and non-manufacturing purchasing managers index (NM-PMI, Thu) are the flash estimates provided by S&P Global (chart).

(3) Challenger layoffs. The Challenger and ADP reports (Thu) on August layoffs and private-sector payrolls will provide a good warm-up act for Friday's payrolls extravaganza. Initial unemployment claims (Thu) continue to show that layoffs remain subdued (chart).

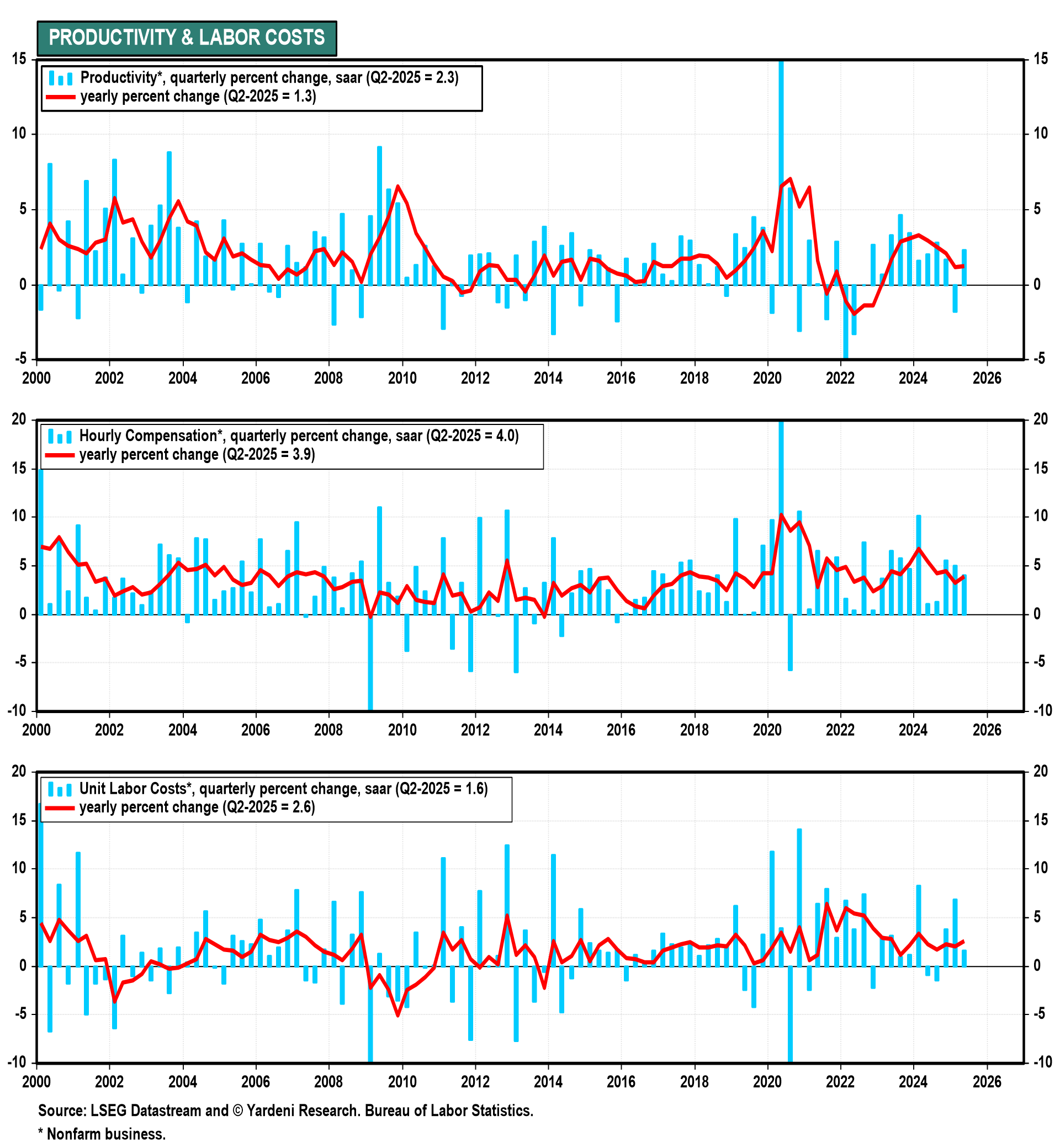

(4) Productivity & unit labor costs. Q2's real GDP growth rate was revised up from 3.0% (saar) to 3.3%. As a result, Q2's productivity growth rate should be similarly revised higher from 2.3% (chart). Q2's unit labor costs inflation rate should be revised down from 1.6%. We expect these data will increasingly support our Roaring 2020s (and 2030s) scenario, in which productivity growth boosts real GDP growth and keeps a lid on inflation, with real wages rising along with profits.