There's never a dull moment in our business these days. Events impacting the financial markets are happening so fast that we probably need to stop every now and then to update you on our latest forecasts.

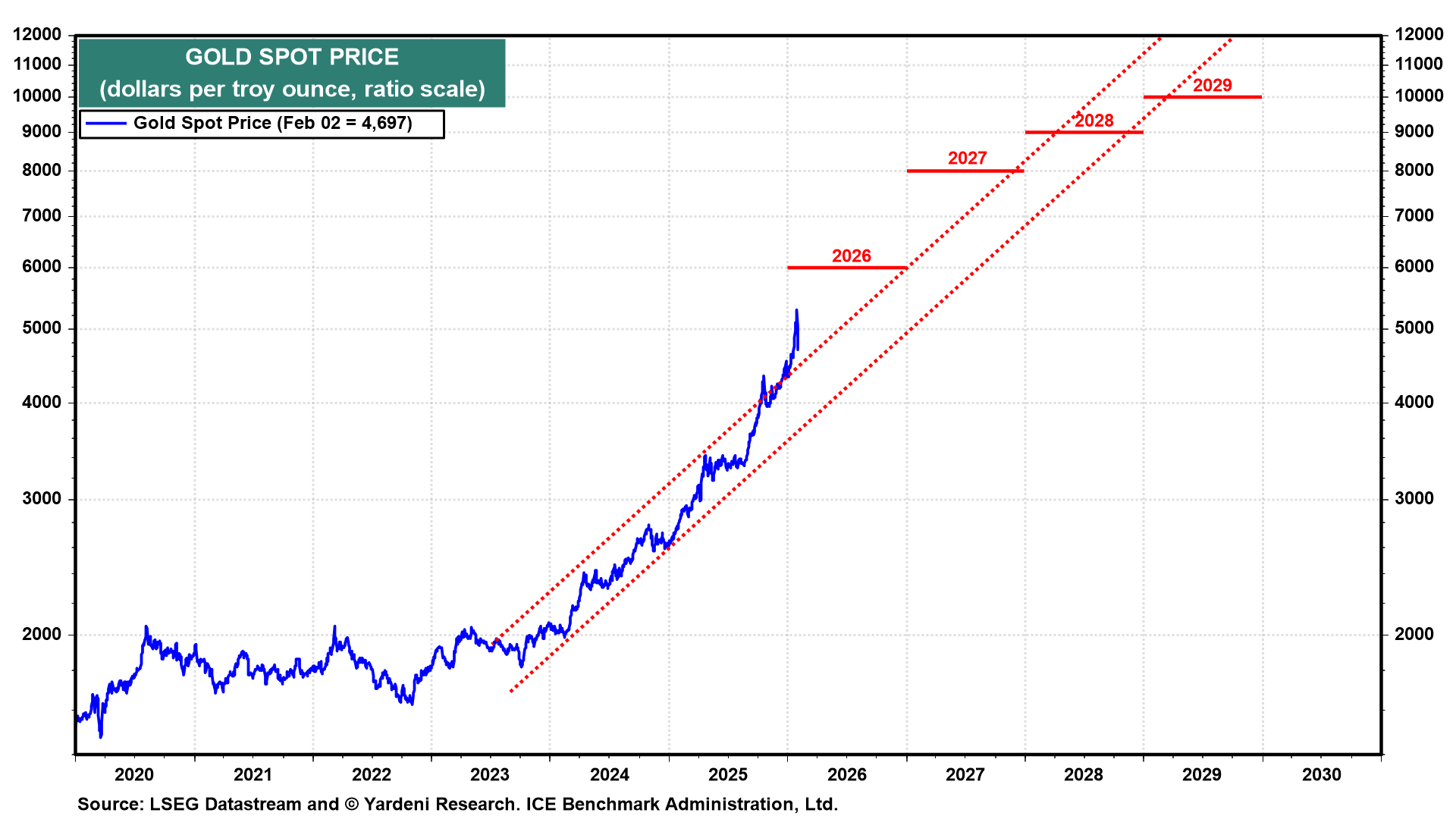

We are still targeting the S&P 500 at 7,700 by the end of this year and 10,000 by the end of the decade. The 10-year Treasury bond yield should range between 4.25% and 4.75% this year. We are still targeting a gold price of $6,000 per ounce by the end of this year and $10,000 by the end of the decade (chart).

We don't expect any rate cut by the Fed through the June FOMC meeting, which will be the first one with Kevin Warsh as Fed chair if his appointment is confirmed by the Senate. We think that inflation will moderate to the Fed’s target of 2.0% y/y by the end of this year, but it could remain sticky around 3.0% through the summer. The economy should be booming this year thanks to the very stimulative fiscal and monetary policies. If so, then there may be no Fed rate cut at all this year. (See today's Financial Times for my op-ed "Markets are set to test Warsh.")

Let's review the latest booming economic data and then do the same for the booming earnings data: