Fed Chair Jerome Powell isn't likely to upset the financial markets tomorrow if he says what he said at his press conference last week.

The word “disinflation” was uttered 11 times at Powell’s presser on February 1. He was the only one who mentioned the word at his presser. He repeatedly acknowledged that inflation was moderating but still had a ways to go before reaching the Fed’s 2.0% target. Nevertheless, Powell sounded much less hawkish than during his previous presser on December 14, 2022, when the word was mentioned only twice, both times by reporters. Here are three excerpts from Powell’s February 1 presser:

(1) “So, I would say it is a good thing that the disinflation that we have seen so far has not come at the expense of a weaker labor market. But I would also say that that disinflationary process that you now see underway is really at an early stage. What you see is really in the goods sector.”

(2) “We can now say, I think, for the first time that the disinflationary process has started. We can see that. And we see it really in goods prices so far. Goods prices is a big sector.”

(3) “It’s the early stages of disinflation. And it’s most welcome to be able to say that we are now in disinflation, but that’s great. But we just see that it has to spread through the economy and that it’s going to take some time, that’s all.

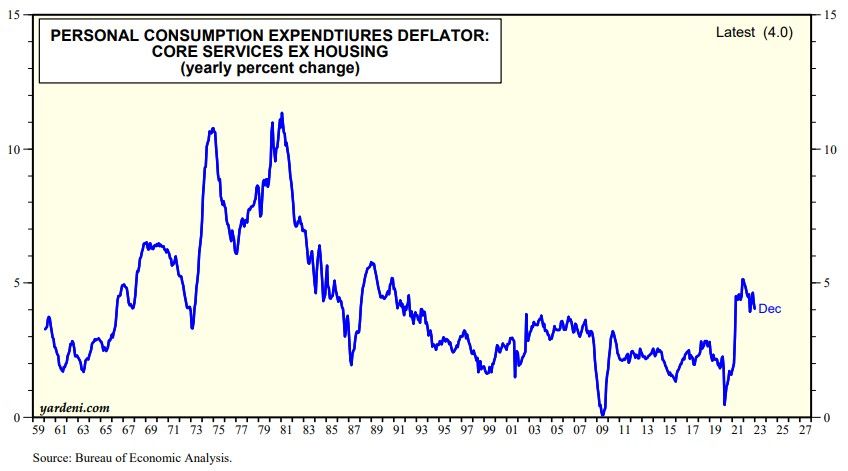

Powell’s only hangup is that “a large sector called … core non-housing services” is still inflating at a 4% annual rate (chart). Powell observed that there are “seven or eight different kinds of services” where inflation remains “persistent” and “will take longer to get down.” He pledged that “[we] have to complete the job.” Powell also said that the core services ex-housing sector is probably more “sensitive” to the tight labor market and wage inflation, which remains high.

Bottom line: What this all means, according to Powell, is that the FOMC will vote on “a couple of more rate hikes to get to that level we think is appropriately restrictive.” That would put the federal funds rate range at 5.00%-5.25% by early May assuming (as Powell suggested) two more 25bps hikes at the next two FOMC meetings. The FOMC then intends to keep it there until inflation falls to 2.0%. By the way, Powell mentioned the word “restrictive” in this context 10 times during his presser.