Have you heard? The FOMC meets on Tuesday and Wednesday and is widely expected to lower the federal funds rate (FFR) by 25bps from 3.75%-4.00% to 3.50%-3.75%. That would be a 175bps cut in the FFR since the Fed started its latest monetary easing cycle in September of last year. In his October press conference, Fed Chair Jerome Powell said, "Now we’re 150 basis points closer to neutral, wherever that may be, than we were a year ago."

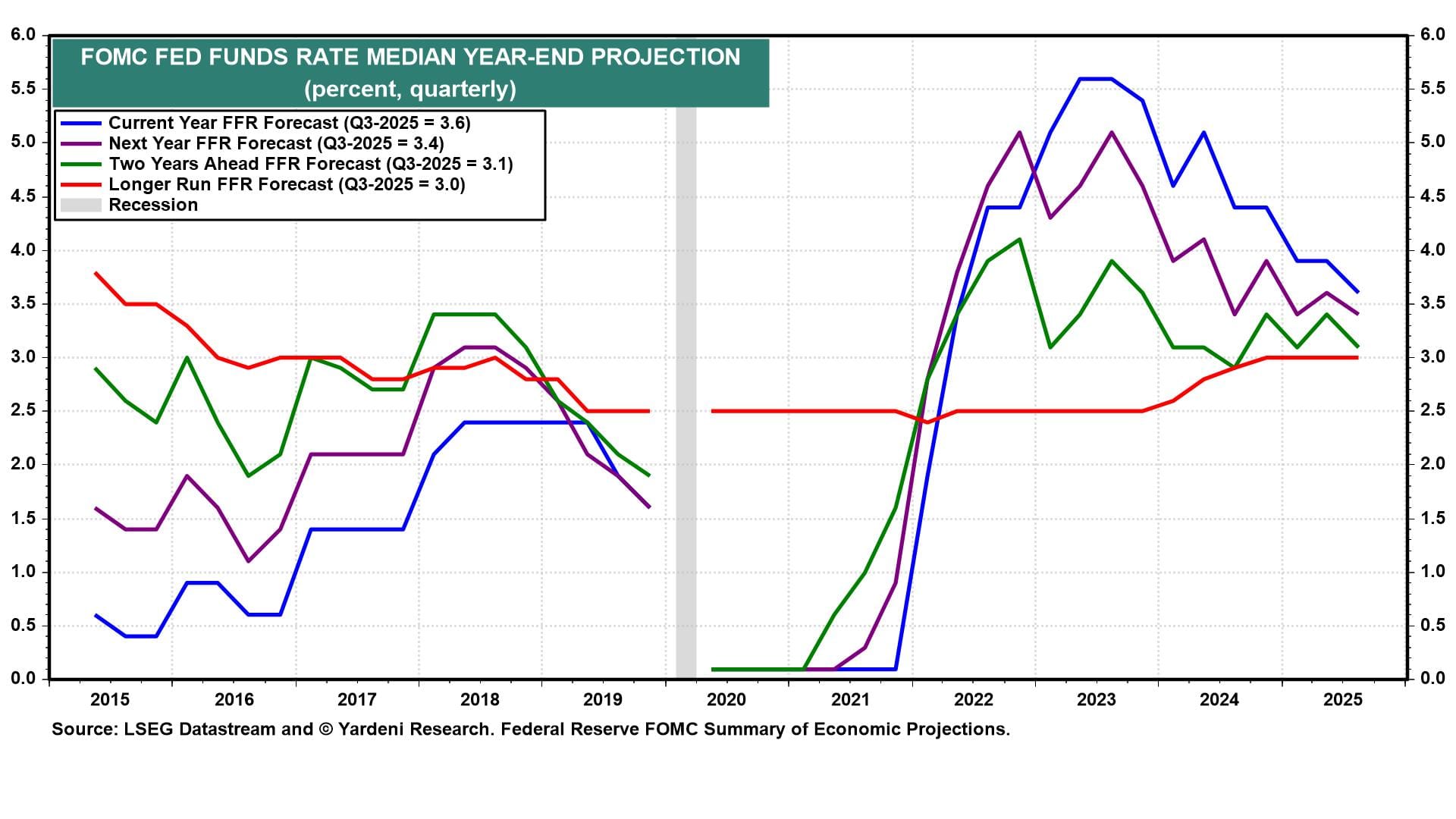

Powell was referring to the "neutral" FFR, which is thought to be consistent with full employment and stable prices. FOMC participants believe that it is 3.0%. That's based on the median of their projections for the "longer run" FFR as compiled quarterly in their Summary of Economic Projections (SEP) (chart).

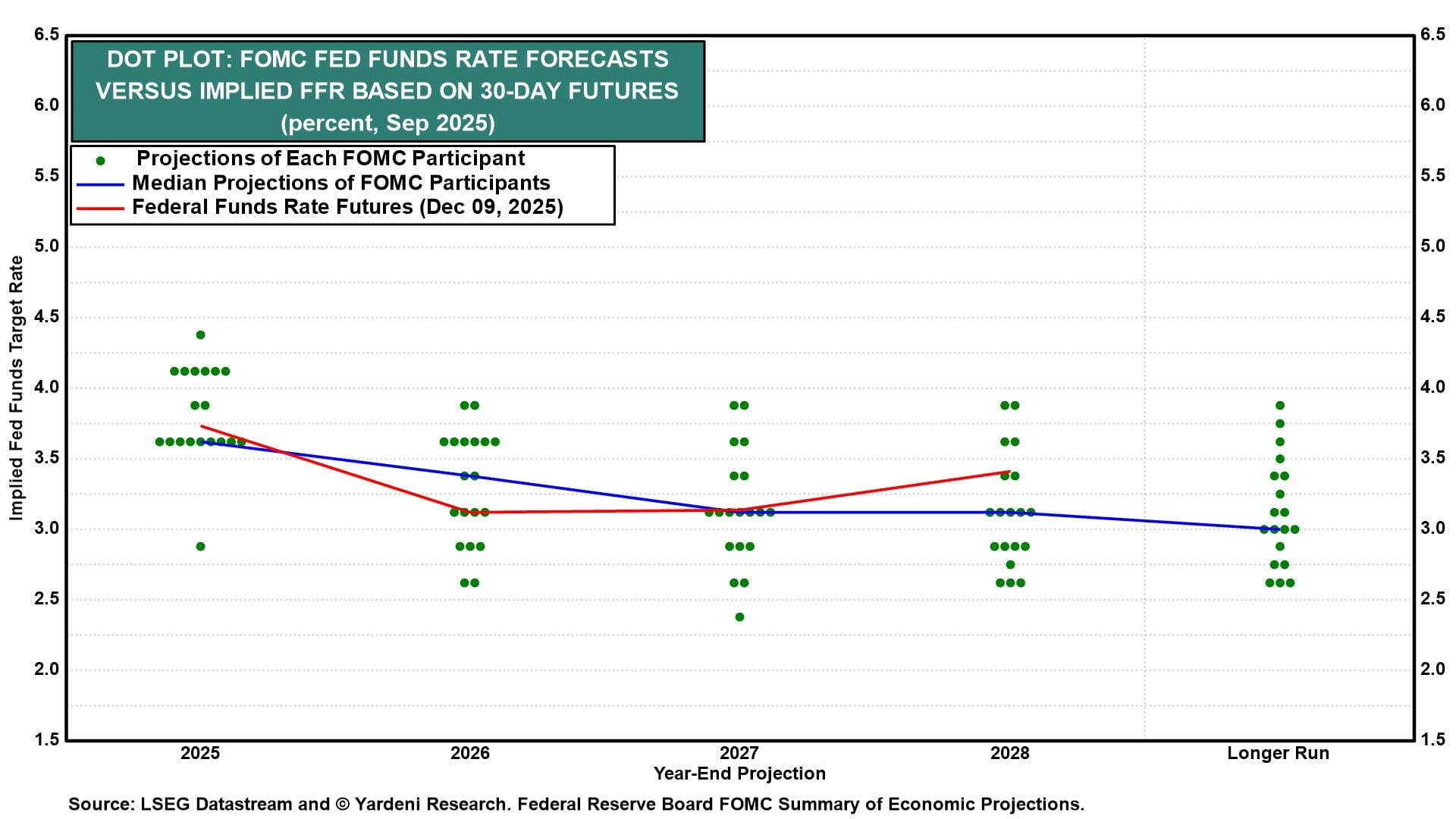

The next SEP will be released on Wednesday at 2:00 pm after the conclusion of the latest FOMC meeting. Included in the projection material will be the latest quarterly dot plot (chart). It will undoubtedly once again show a wide dispersion of the individual participants' estimates of the neutral FFR. Yet, collectively, Fed officials have been staying on script, saying that they have been easing because the FFR has been restrictive, i.e., above the 3.0% average long-run rate.

As we've said before, the neutral FFR concept is nonsense. Last year, the Fed eased by cutting the FFR by 100bps. We disagreed with that move, arguing that the economy didn't need such easing and that the Bond Vigilantes were likely to dissent. Sure enough, the 10-year Treasury bond yield rose 100bps late last year (chart).