As widely expected, the Fed lowered the federal funds rate (FFR) by 25 bps today. It has lowered the FFR by 75bps since September of this year. Since the start of the current easing cycle in September 2024, this rate has declined by 175 bps to 3.50%-3.75%.

In his prepared remarks at today’s press conference, Fed Chair Jerome Powell rightly observed the obvious: "The adjustments to our policy stance since September bring it within a range of plausible estimates of neutral and leave us well positioned to determine the extent and timing of additional adjustments to our policy rate based on the incoming data, the evolving outlook, and the balance of risks."

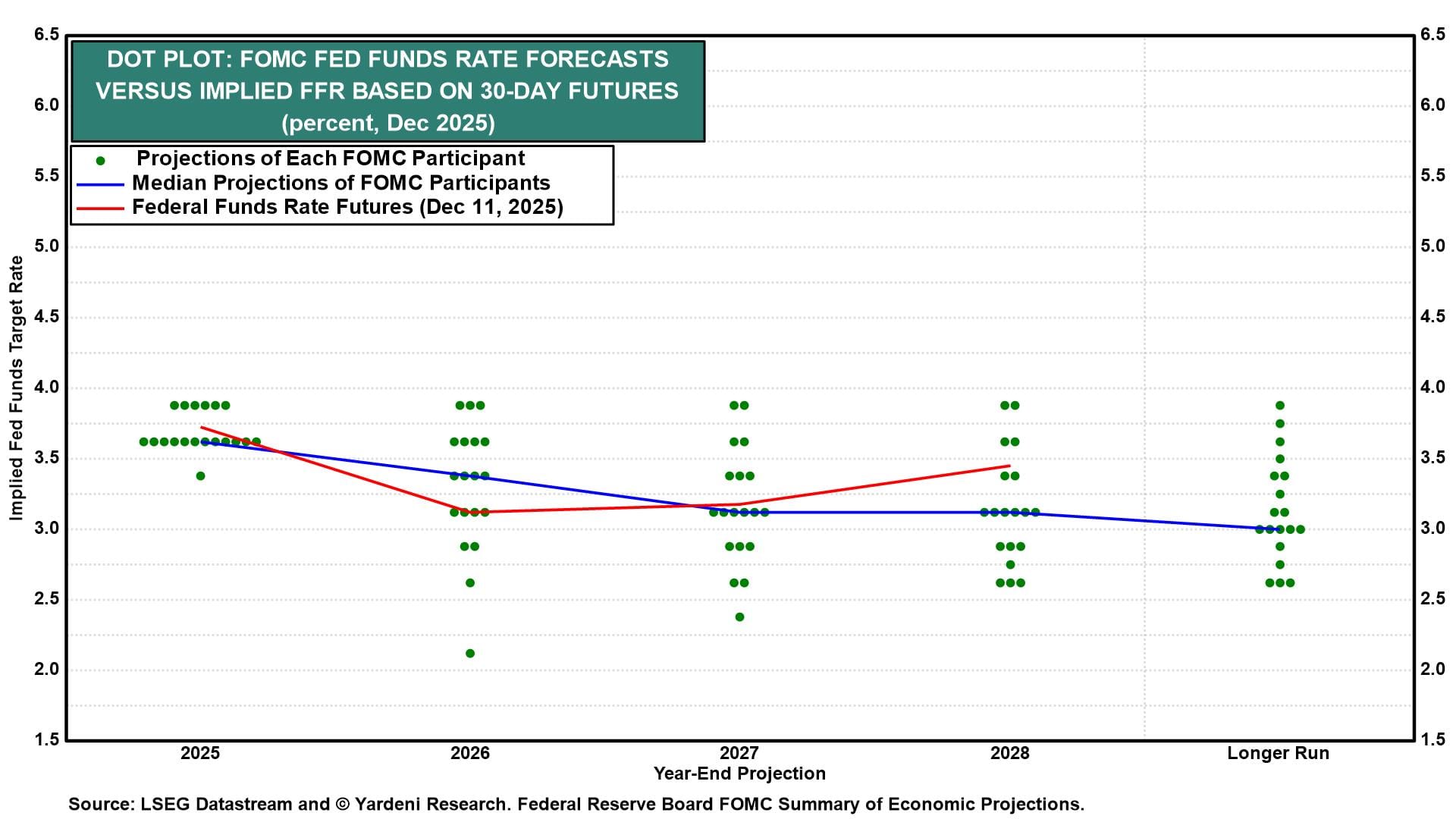

On average, Fed officials believe that the neutral federal funds rate is 3.00%. Two more 25bps rate cuts in 2026 would bring it to neutral. However, monetary policy should remain relatively restrictive until inflation falls to the Fed's 2.0% target. Powell seems to believe that will happen in 2026. Powell repeated his new "well positioned" mantra a few times, suggesting that the Fed might pause rate cutting for a while.

Stock prices rose on the news, which was widely described as a "hawkish rate cut." Bond yields edged a bit lower, but the 10-year Treasury bond yield remained above 4.00%, at 4.13%. Financials were especially strong today, as the yield curve continues to steepen.

There were three dissenters at the latest FOMC meeting: two opposed to today's rate cut and one calling for a 50bps cut. According to today's dot plot, three of the 19 FOMC participants estimate that the FFR is now below their neutral-rate estimates (chart). Seven of them expect no more rate cuts in 2026.

The Summary of Economic Projections (SEP) shows that the median estimate of the 19 participants is that the FFR will fall to 3.40% next year and 3.10% in 2027 (chart).

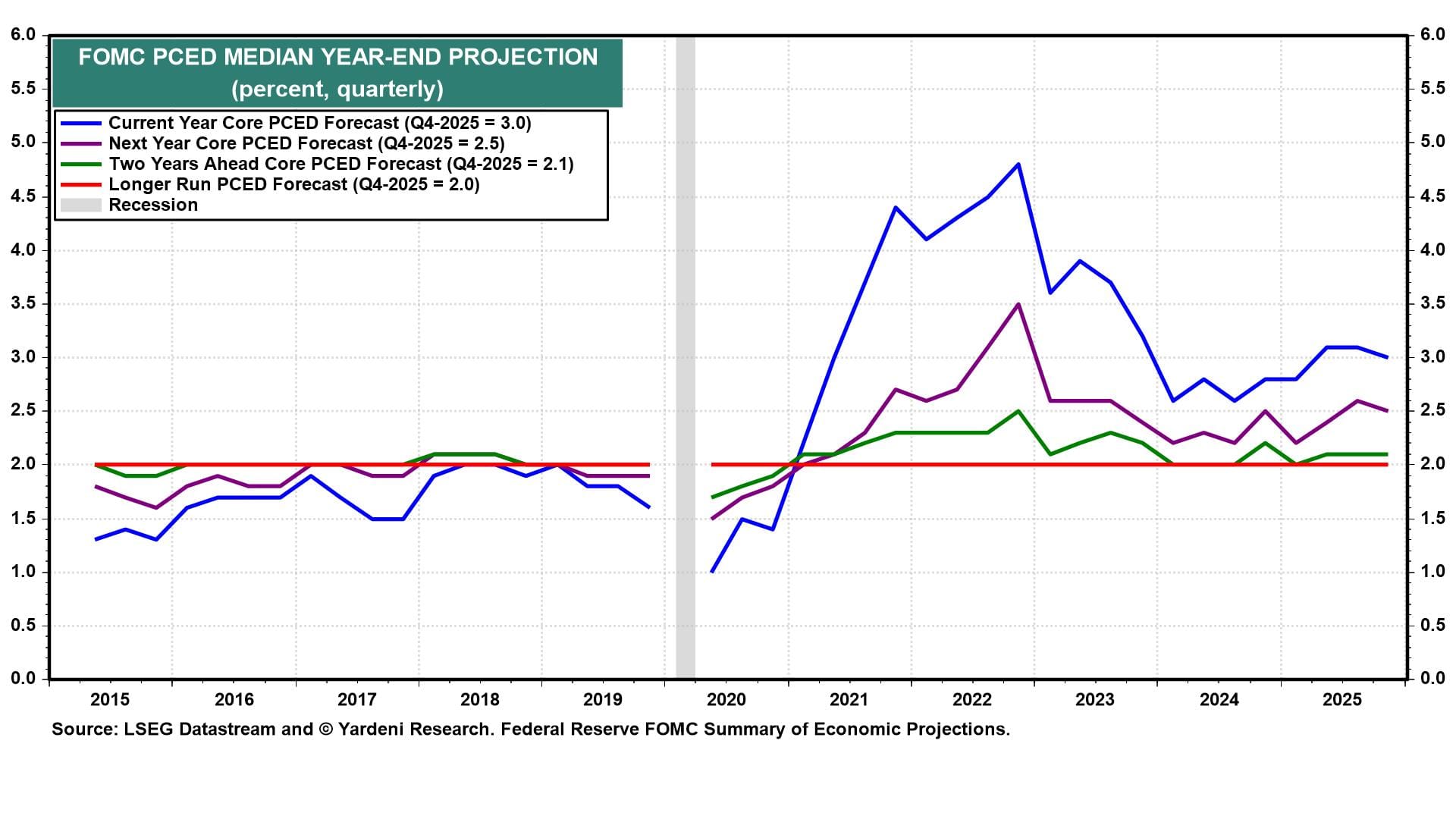

In his press conference, Powell said that the inflationary impact of Trump's tariffs should decline by next year. The SEP's median inflation forecast aligns with his view (chart). The PCED inflation rate is expected to fall from 3.0% this year to 2.5% next year and to 2.1% in 2027.

In his presser, Powell seemed more concerned about the unemployment rate going up than about inflation remaining stuck close to 3.0%. Nevertheless, the SEP's median unemployment rate projection is expected to edge up to 4.5% by the end of this year, then fall to 4.4% in 2026 and 4.2% in 2027 (chart). Presumably, that will require just one more rate cut in 2026 and one more in 2027.

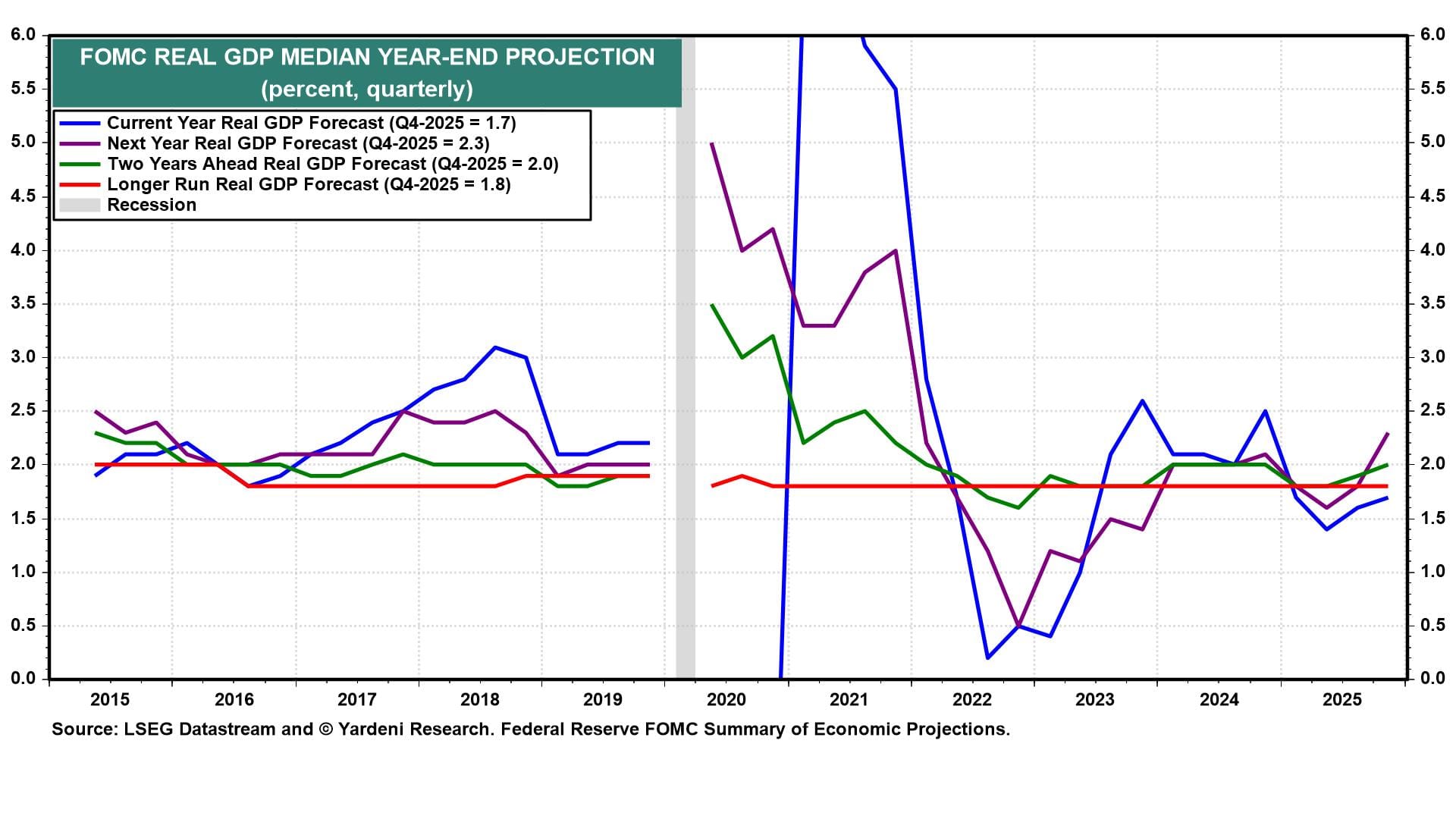

A couple of times in his press conference, Powell acknowledged that productivity growth has been boosting economic growth in recent quarters. Yet the SEP median projection for real GDP growth is only 1.7% this year, 2.3% next year, and 2.0% in 2027 (chart). The median "long run" growth rate of real GDP is pegged at a low 1.8%. The FOMC, as a whole, obviously doesn't share our Roaring 2020s view that faster productivity growth will significantly boost real GDP growth over the remainder of the decade.

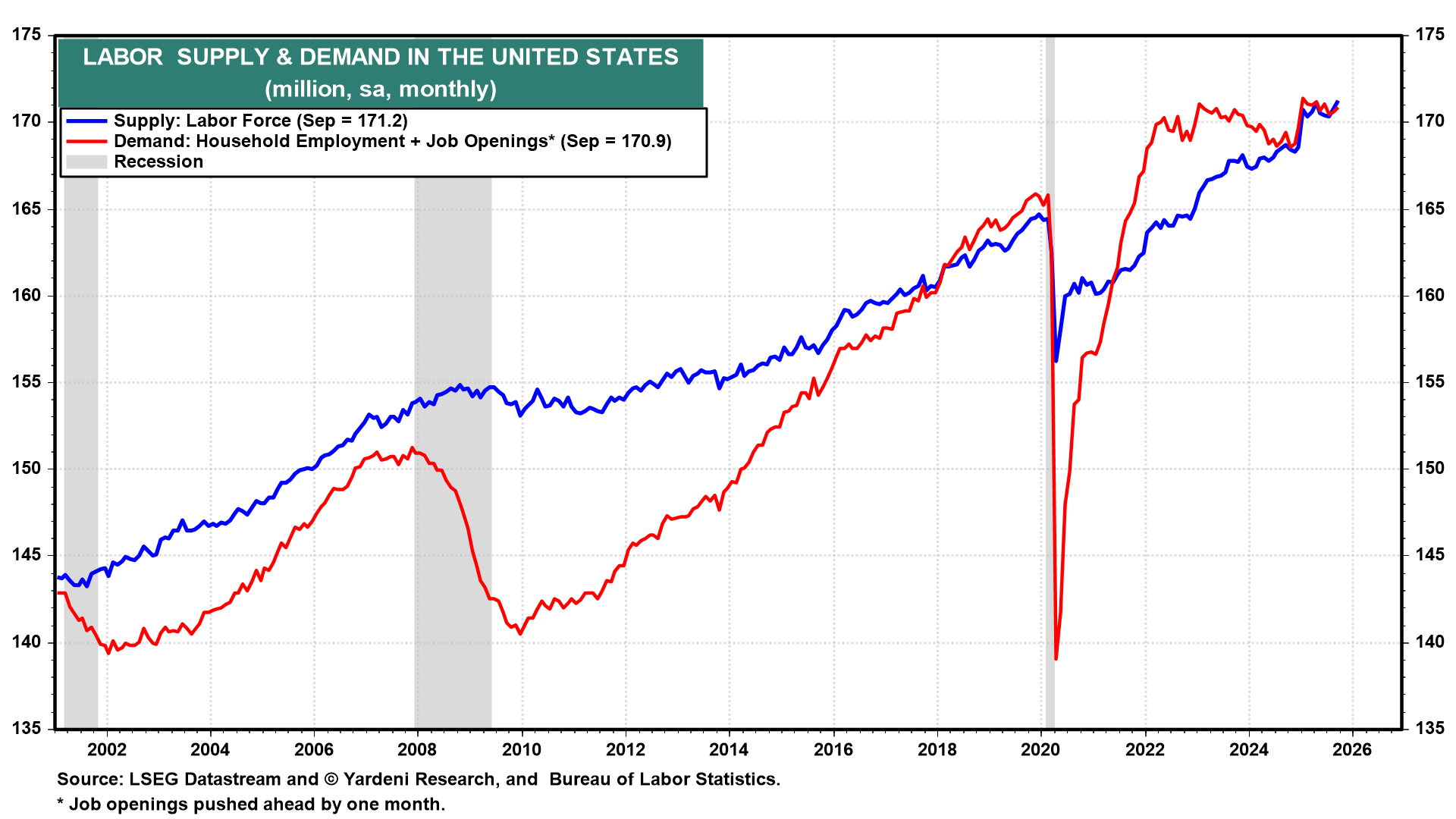

Powell also stated a few times that the labor supply is down sharply. That ain't so. The labor force actually rose to a record high of 171.2 million in September, according to the Bureau of Labor Statistics (chart).