From time to time, we will review and update some of our good market calls. We hope this provides a helpful perspective on our approach to market forecasting.

Today, let's review and update our thoughts on the outlook for gold:

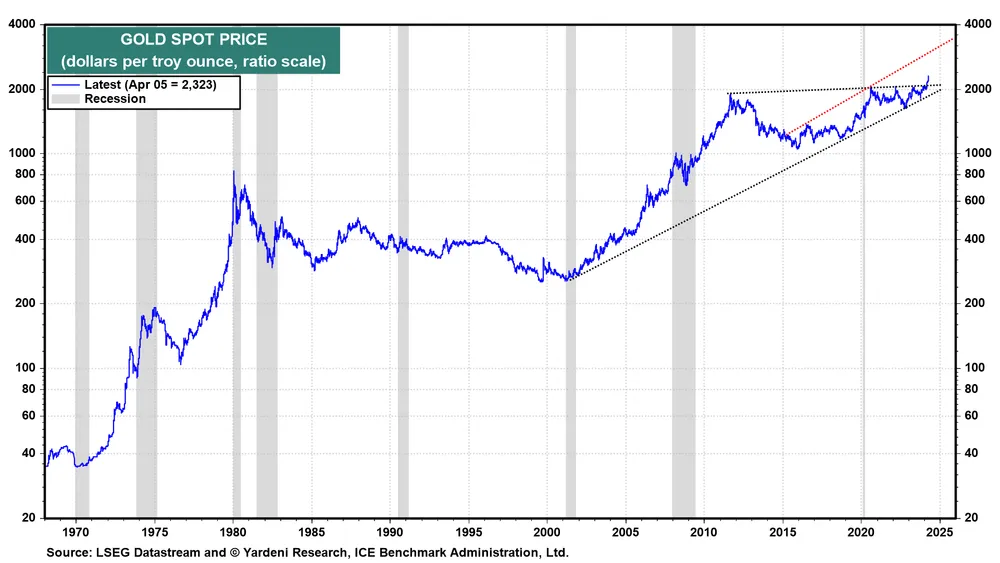

(1) We first turned bullish on the price of gold on April 7, 2024. We noted that it was breaking out above $2000 per ounce to new record highs (chart). We wrote that "$3,000-$3,500 per ounce would be a realistic price target for gold through 2025."

We also noted that the price of silver is also moving to the upside after breaking out of a long-term consolidation pattern (chart).

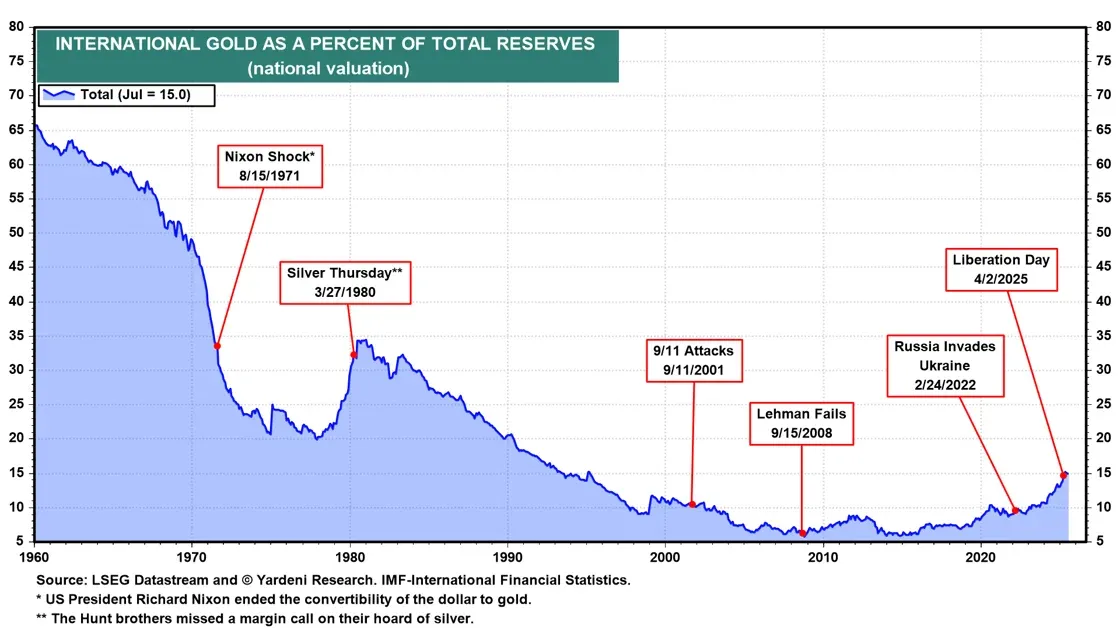

(2) On October 21, 2024, we wrote: "Gold is traditionally viewed as a hedge against inflation, yet it has rallied to new highs as inflation has moderated. Perhaps gold is now a hedge against US economic sanctions. After Russia invaded Ukraine in February 2022, Russia's foreign exchange reserves held by the US and its allies were frozen. Since then, some officials and commentators have proposed seizing those assets, which amount to nearly $300 billion, and using the proceeds to defend and rebuild Ukraine. Not surprisingly, China and other countries have been increasing their allocations of gold in their countries' international reserves."

The price of gold had risen to $2721 at the time. On January 30, 2025, we predicted that it would rise to $3,000.

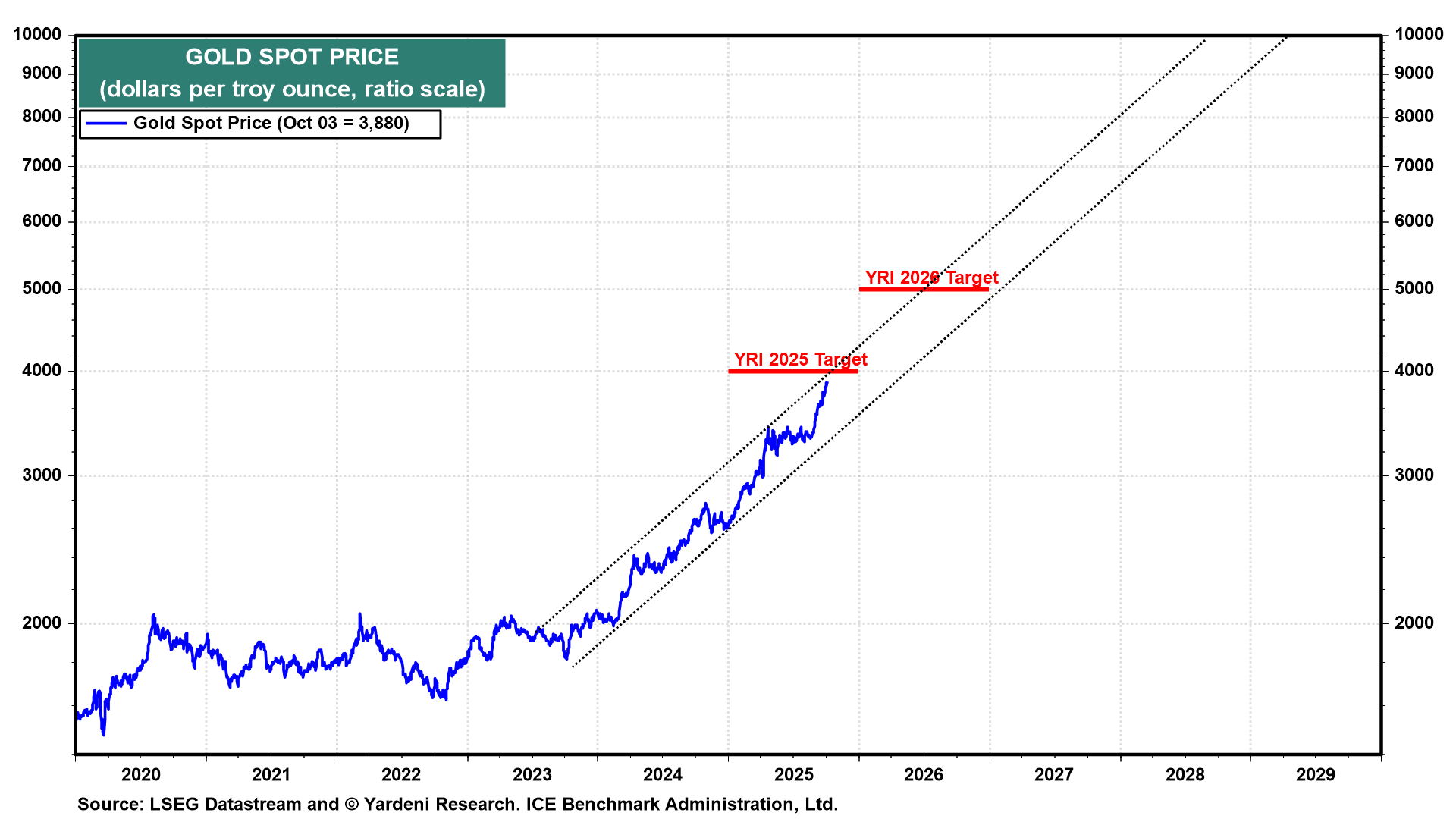

(3) On March 3, 2025, we first provided specific year-end targets for 2025 and 2026: "Meanwhile, the price appreciation of gold has been remarkably steady since late 2023 (chart). The recent pullback has been very moderate so far. We are targeting (not promising) a gold price of $4,000 per ounce by the end of this year and $5,000 by the end of 2026."

(4) On July 14, 2025, we noted: "We are still bullish on gold, though we think that the current consolidation may continue through the summer. The price has continued to be contained by its ascending channel."

(5) On September 2, 2025, we wrote: "We reckoned that President Donald Trump's attempts to reorder the world's geopolitical order, including America's relationships with its major trading partners, might be unsettling and bullish for gold. Similarly, his attempt to order the Fed to lower interest rates would compromise its independence and be bullish for gold. In addition, the bursting of China's housing bubble has had a significant adverse wealth effect on Chinese savers, who've flocked to gold as an alternative safe asset. Furthermore, the rising standard of living in India has increased wealth, thereby boosting demand for gold, which is widely regarded as a valuable asset."

We added: "Our bullishness is supported by the 'Gold Put,' provided by central banks that are increasing the percentage of their international reserves in gold (chart).

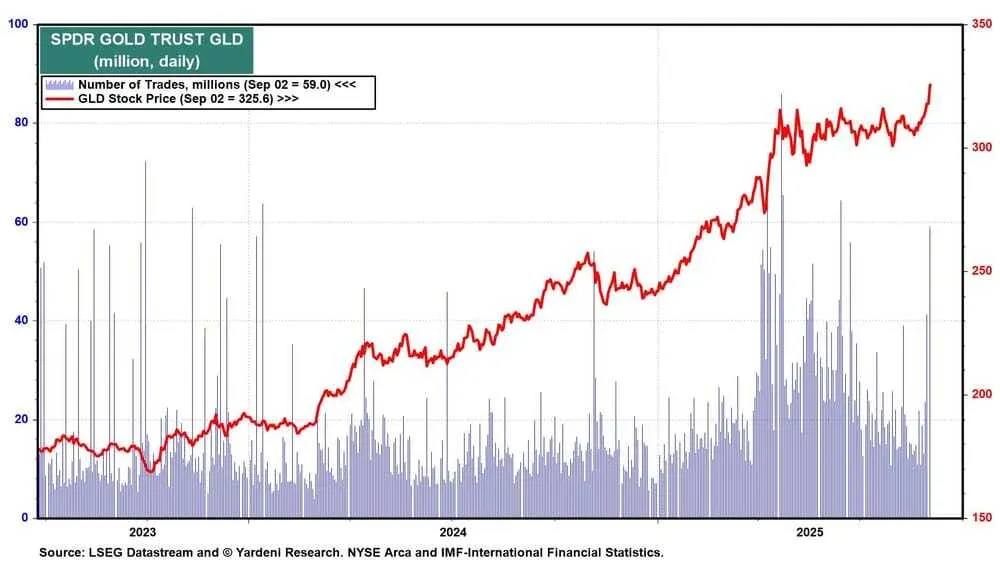

We also noted: "Over the past couple of trading days, the volume in the SPDR Gold Trust ETF (GLD) has increased significantly (chart)."

(6) So far, so good (chart). The price of gold is within shouting distance of our $4000 target for 2025. We are now aiming for $ 5,000 in 2026. If it continues on its current path, it could reach $10,000 by the end of the decade.

(7) The price of silver has also soared and should continue to rise along with the price of gold, though both may be due for a pullback or at least a short period of consolidation (chart).