President Donald Trump said today that he had a "very good talk" with China's President Xi Jinping for an hour and a half mostly about trade. They also agreed to visit one another. The financial markets yawned. Stock, bond, currency, and commodity traders have become jaded about Trump's tumultuous trade dealmaking. Even rising concerns about a shortage of Chinese rare earth minerals (needed by lots of US manufacturers) haven't fazed the stock market so far.

Investors seem to be more focused on whether the US economy is slowing or not. On Tuesday, April's JOLTS report suggested that the labor market is just fine. On Wednesday, May's ADP employment report was very weak. Today's Challenger layoffs report showed a decline in May from the previous month, while initial unemployment claims edged up, but remained low.

Tomorrow's payroll employment report for May isn't likely to resolve the debate about the labor market, though we anticipate that it will be better than expected, exceeding 100,000. Stock and bond prices would likely stay firm if so. If the report is weaker than expected, both would probably rally on expectations of sooner-rather-than-later Fed rate cuts. Either good or bad news tomorrow should bolster stock prices, in our opinion.

Let's review today's data:

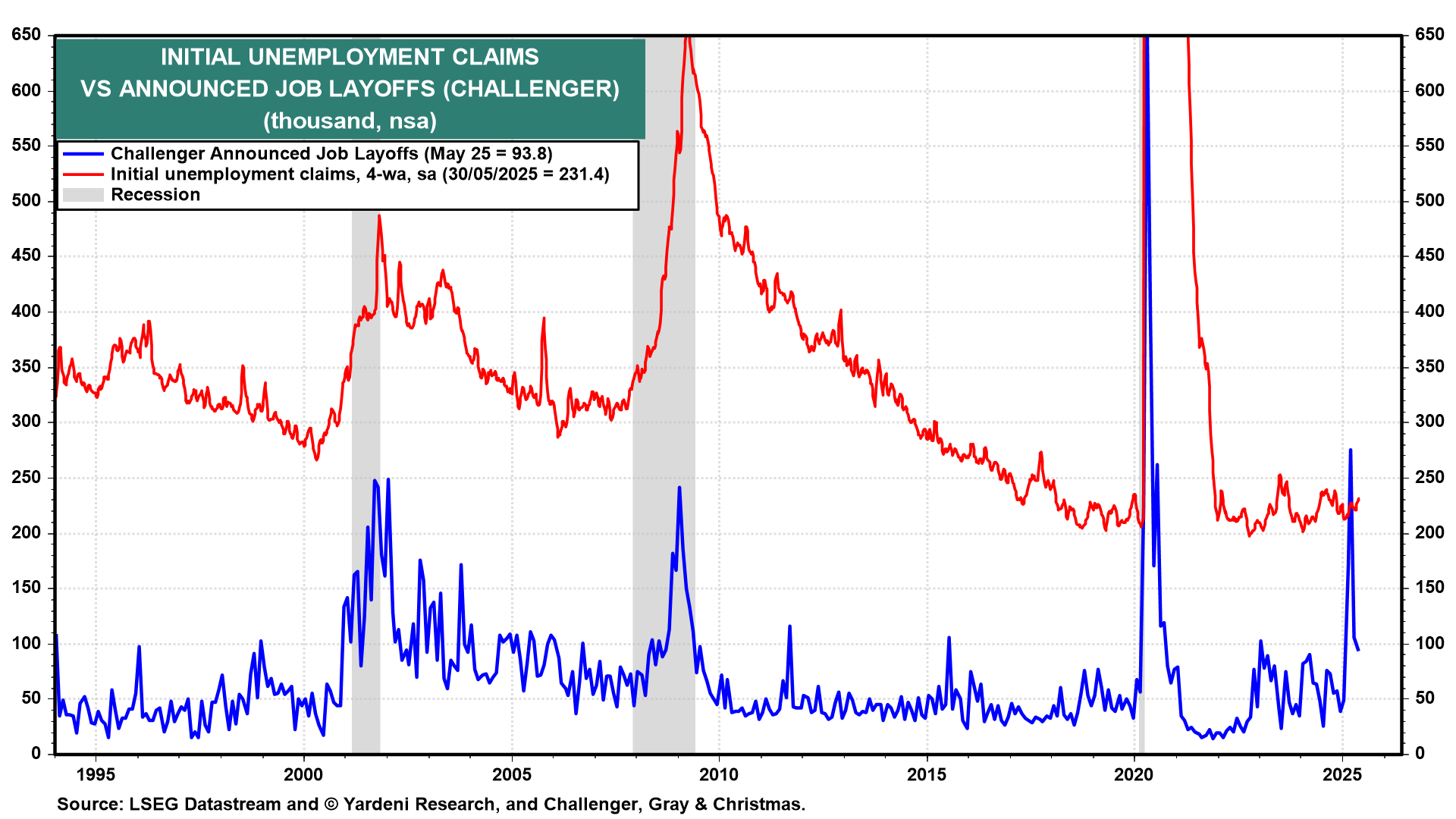

(1) Layoffs. US-based employers announced 93,816 job cuts in May, down 12% from 105,441 cuts in April, and up 47% from 63,816 announced in the same month last year, according to Challenger, Gray & Christmas (chart). In March, this series peaked at over 275,000. So far, there has been no similar spike in initial unemployment claims. In the past, they both tended to spike together.

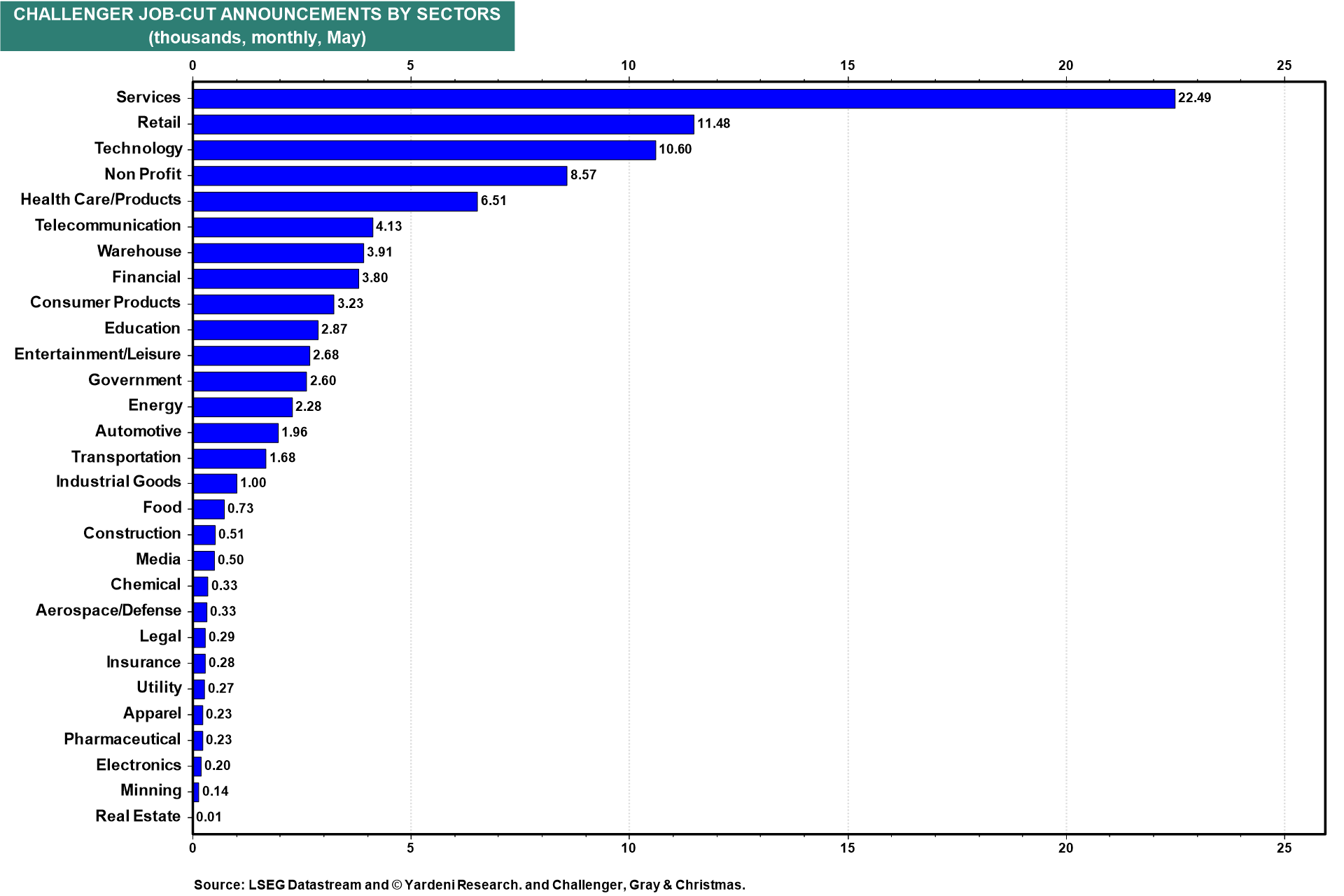

In recent months, layoffs have been concentrated in retailing and technology companies (chart). Both their layoffs have been declining over the past couple of months.

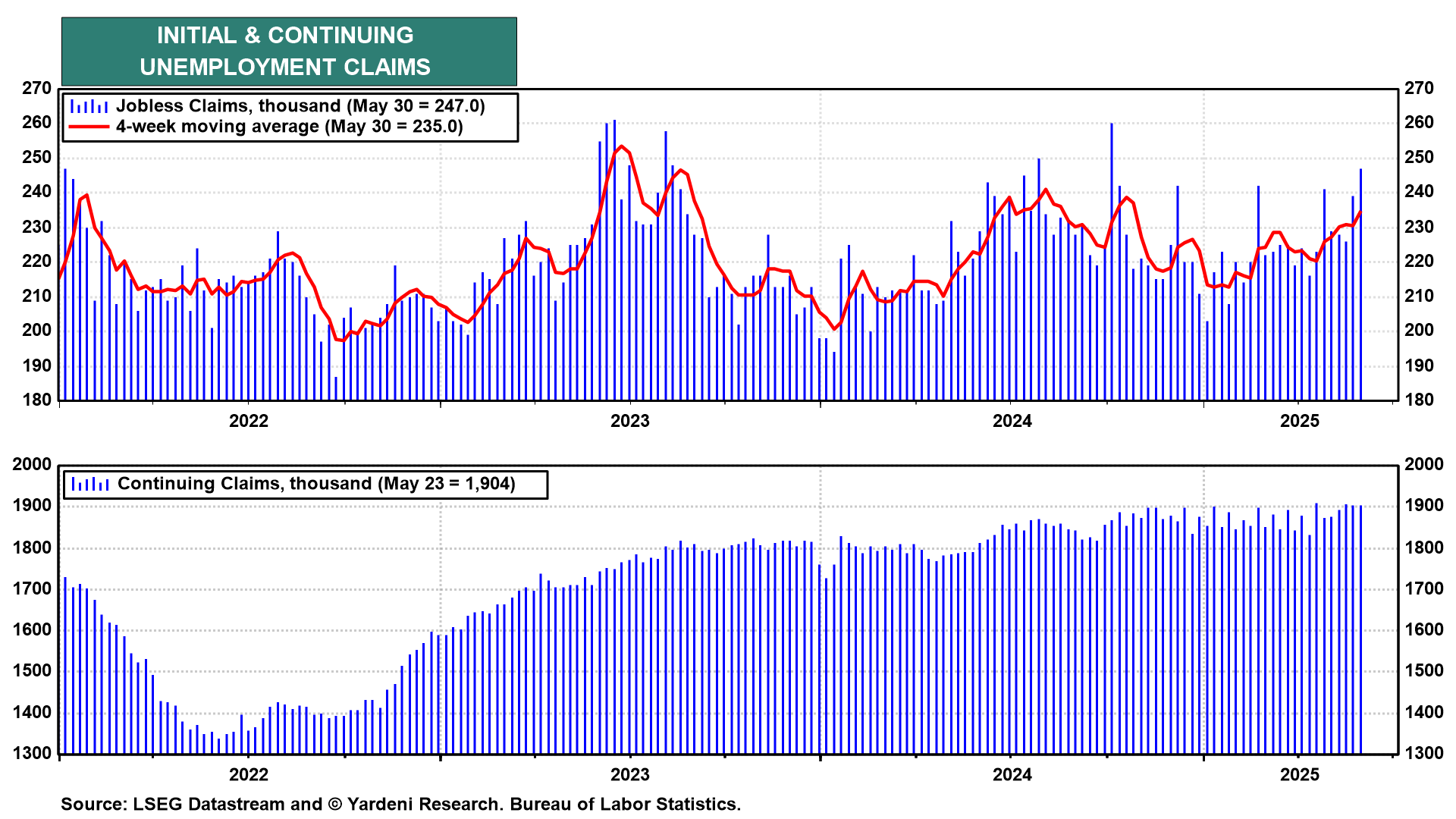

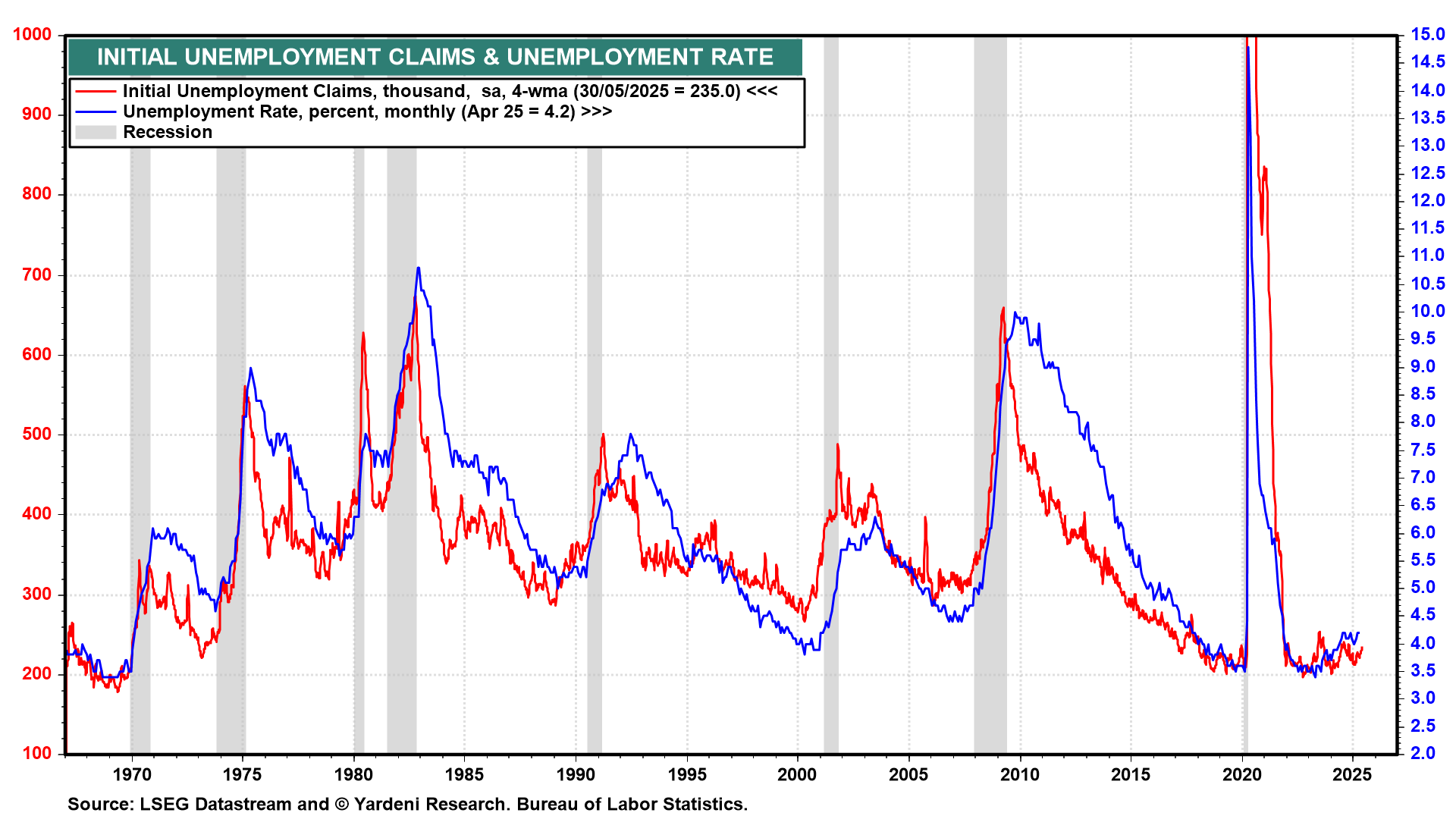

(2) Unemployment claims. Weekly initial unemployment claims rose to 247,000 during the May 30 week (chart), they remain in their low range since 2022.

The four-week moving average of initial unemployment claims closely tracks the unemployment rate, which probably remained around 4.2% in May given the 235,000 average reading on initial jobless claims over the last four weeks (chart).

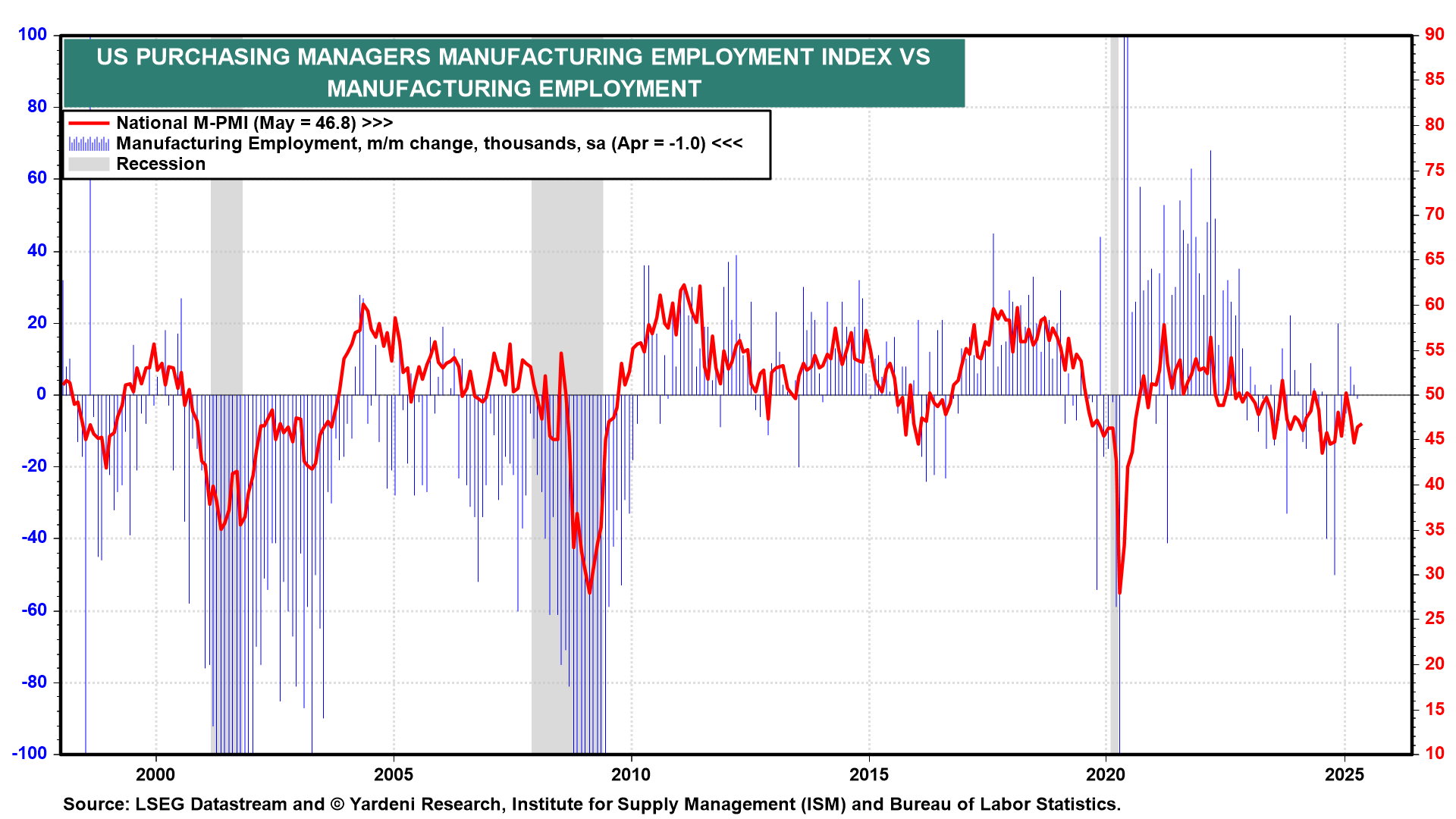

(3) Purchasing managers surveys. The employment index in the M-PMI remains weak, suggesting that manufacturing payroll employment isn't expanding (chart). That's been true for the past three years and hasn't weighed much if at all on GDP growth.

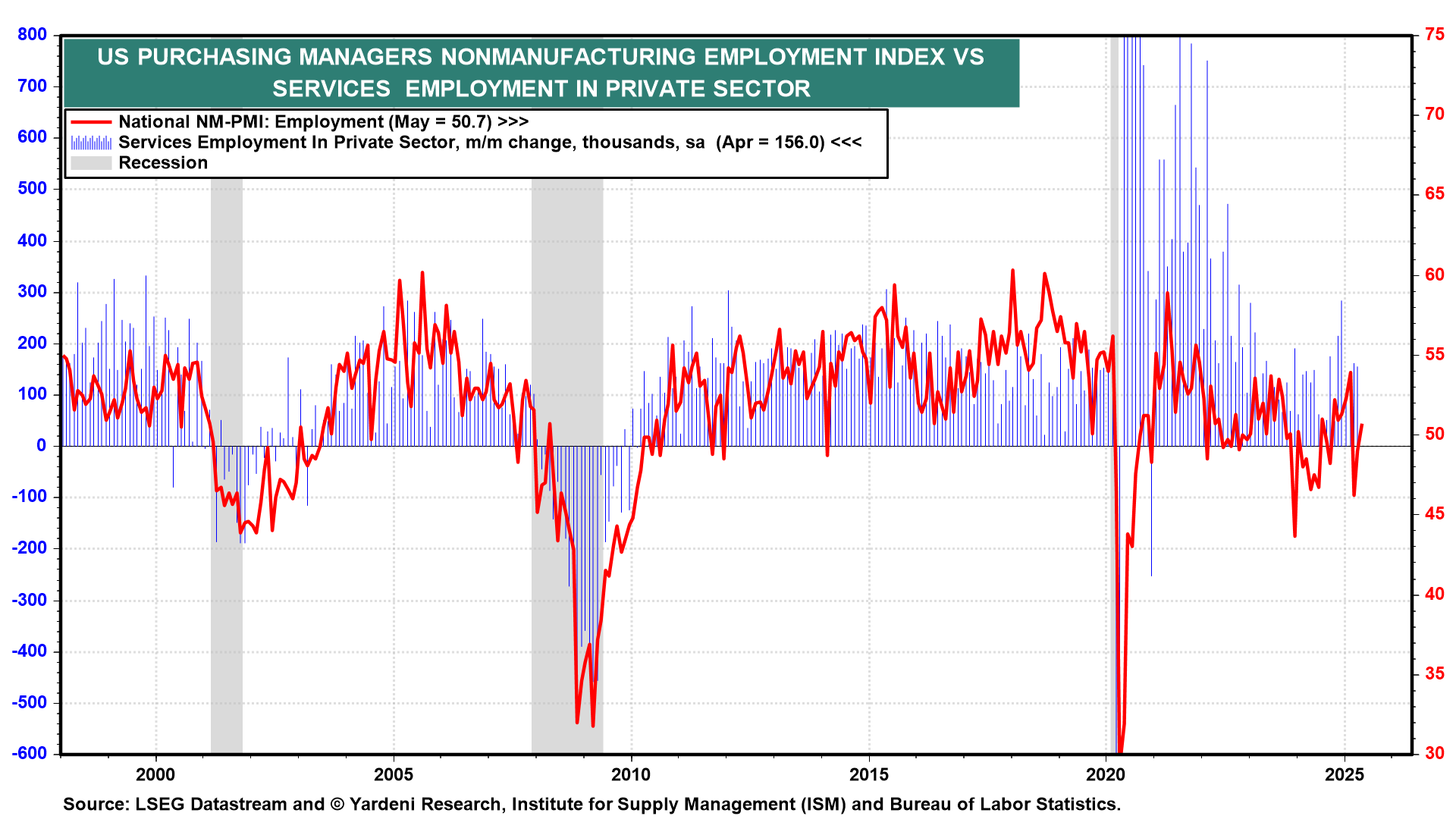

In recent months, the employment index of the NM-PMI has been volatile and a misleading indicator of employment in the services sector, which we believe remains strong (chart).

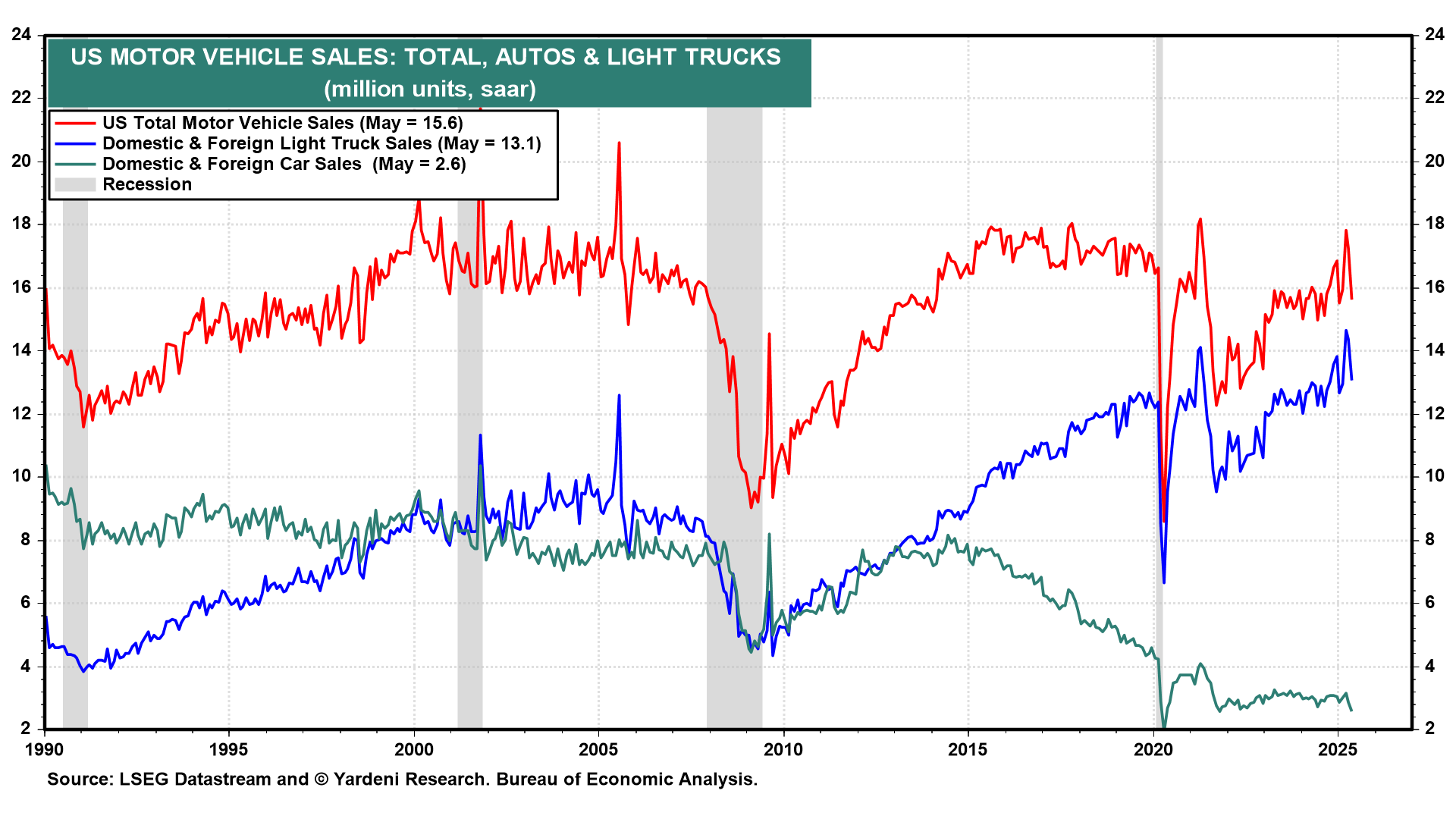

(4) Auto sales. US light vehicle sales dropped sharply in May, the biggest monthly decline in five years (chart). The pullback followed a surge in March and April as buyers rushed to beat expected tariff-driven price hikes. That mostly explains why the Atlanta Fed's GDPNow tracking model is showing Q2's real GDP up 3.8% (saar), a downward revision from 4.7% on Wednesday. Real consumer spending was revised down from 4.0% to 2.6%.

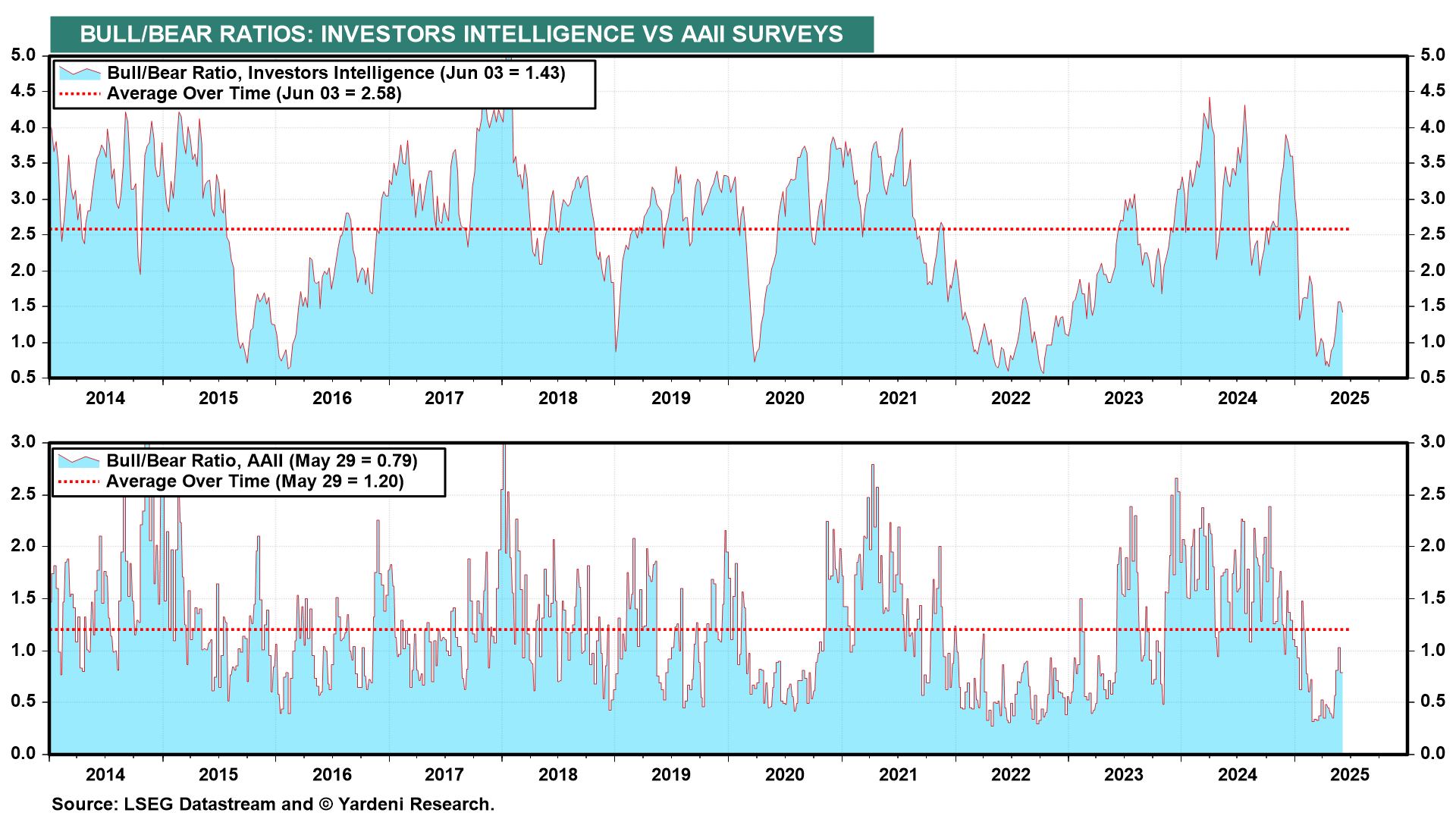

(5) Stock market sentiment. For the stock market, fundamentals matter a great deal over the long run. In the short run, sentiment is also important. The latest bull/bear ratios show that bullishness remains relatively low, which is bullish from a contrarian perspective (chart).