President Donald Trump has been calling on Fed Chair Jerome Powell to lower interest rates. The Fed chair has been the object of intensifying schoolyard jabs from the President. "We have a stupid person, frankly, at the Fed," Trump told reporters following the Fed's stand-pat decision on Wednesday. "Am I allowed to appoint myself at the Fed? I'd do a much better job than these people."

Clearly, the Powell-led Fed made the smart decision to leave rates alone on Wednesday—and to signal that the Federal Open Market Committee (FOMC) is in no hurry to ease. As Powell observed in his post-decision presser, labor "conditions have remained solid" and inflation, while still "somewhat elevated" has "eased significantly." He added that "we're beginning to see some effects" from Trump's tariffs on inflation. Powell also reiterated, "we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance." However, as Powell made clear, the FOMC’s bias is toward lowering rates versus raising them.

Now, let's have a close look at the FOMC's quarterly Summary of Economic Projections (SEP), released after its Wednesday meeting and reflecting the forecasts of meeting participants, as the outlook is clouded by wildcards like Trump's tariffs and Israel's clash with Iran:

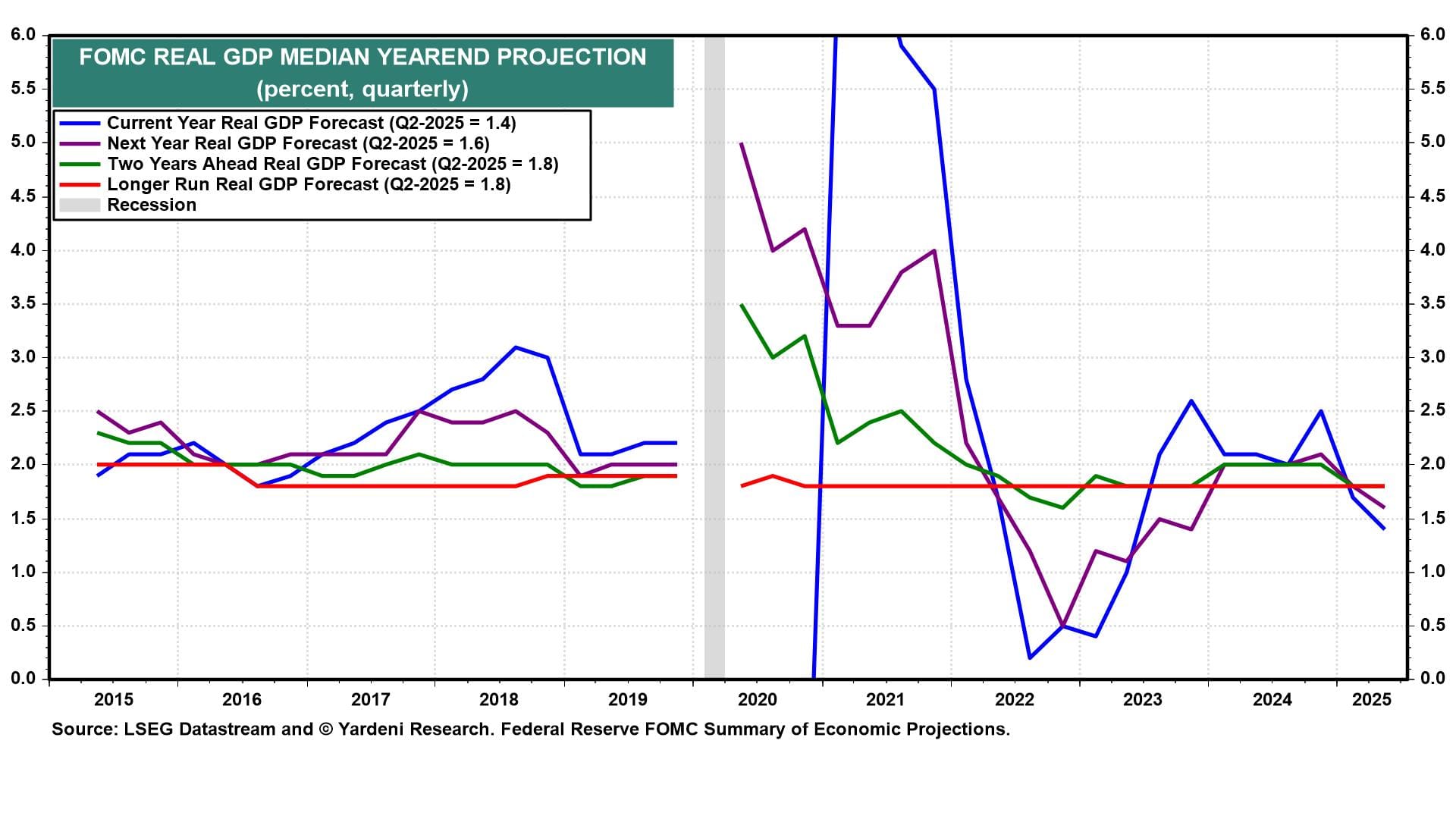

(1) Real GDP. The FOMC's forecast for current-year growth of 1.4% y/y seems awfully low to us given the persistent strength of the labor market (chart). It's not much better next year, at 1.6% y/y, or over the longer run at 1.8%. The economy has been growing closer to 2.5%-3.0% y/y over the past three years, and the historical average is 3.1%. Sure, Trump's tariffs and the Middle East war are major concerns. But the economy has been more resilient than the Fed's current assessment of it.

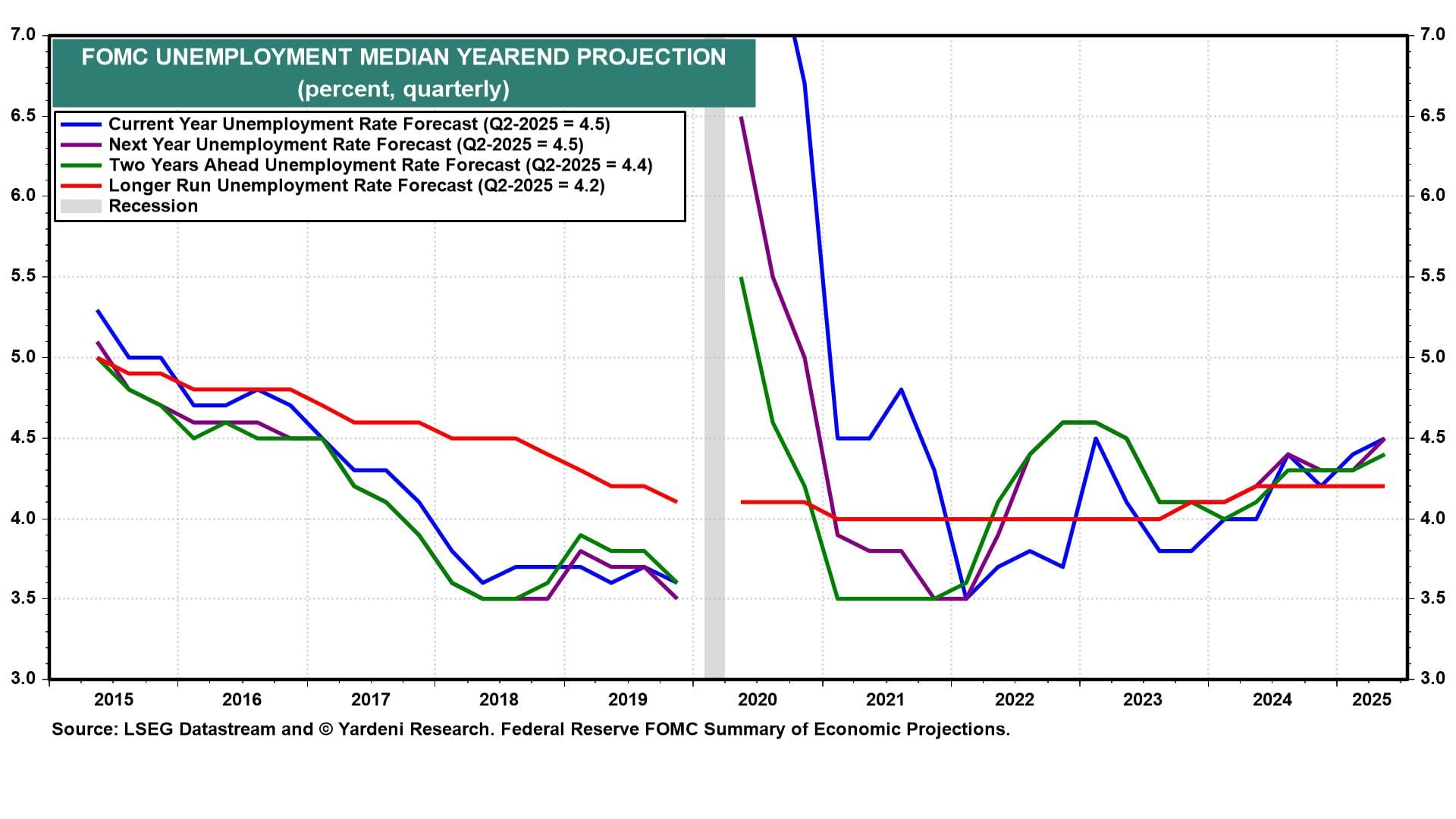

(2) Unemployment rate. The SEP reckons that today's 4.2% unemployment rate is headed to 4.5% by year-end and will remain there in 2026 (chart). That's possible, but would still leave the labor market very close to full employment.

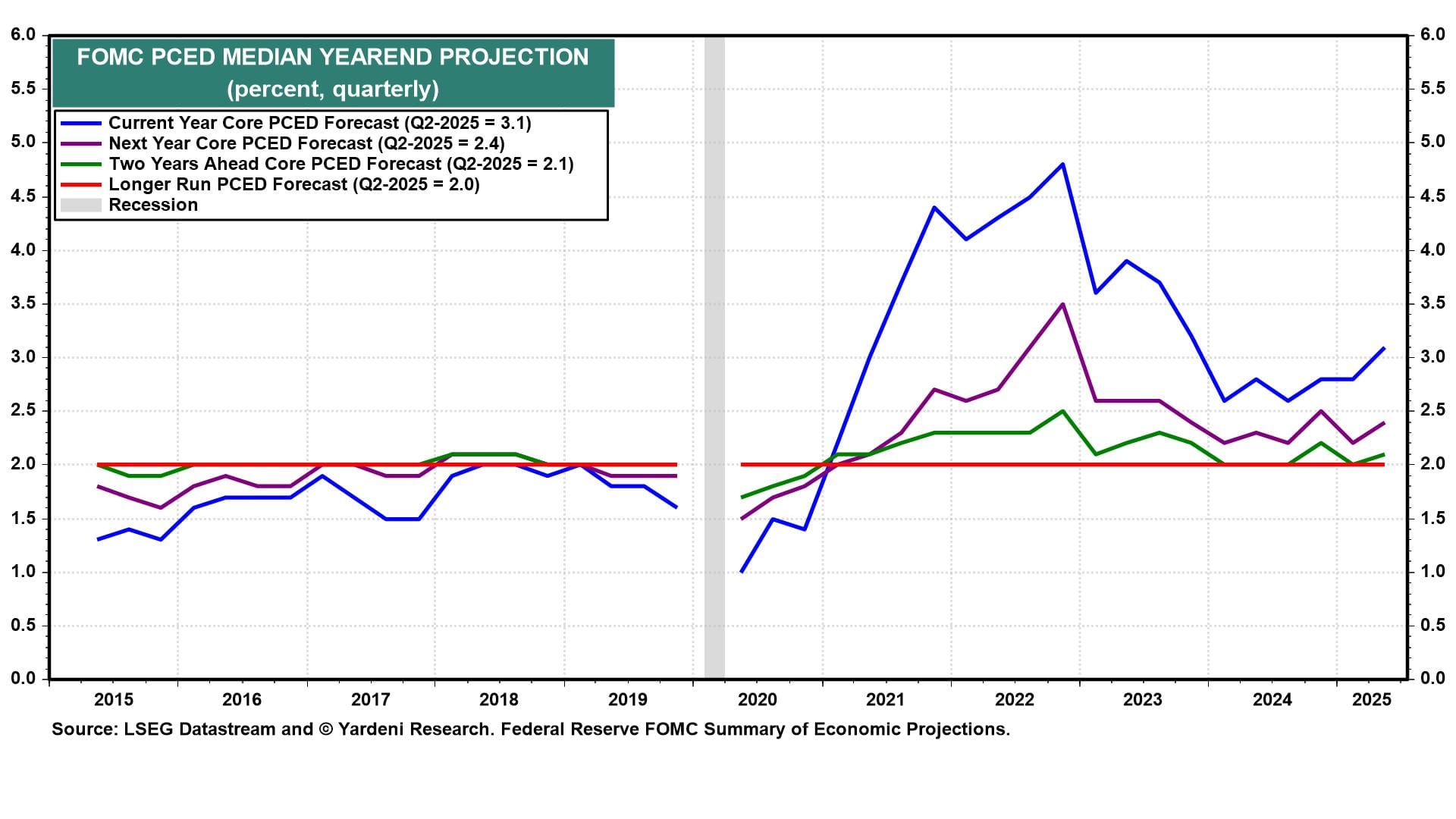

(3) Inflation. The SEP projects that the core PCED inflation rate will be 3.1% in the current year and come down to 2.4% next year (chart). We agree with that relatively subdued outlook for inflation under the circumstances.

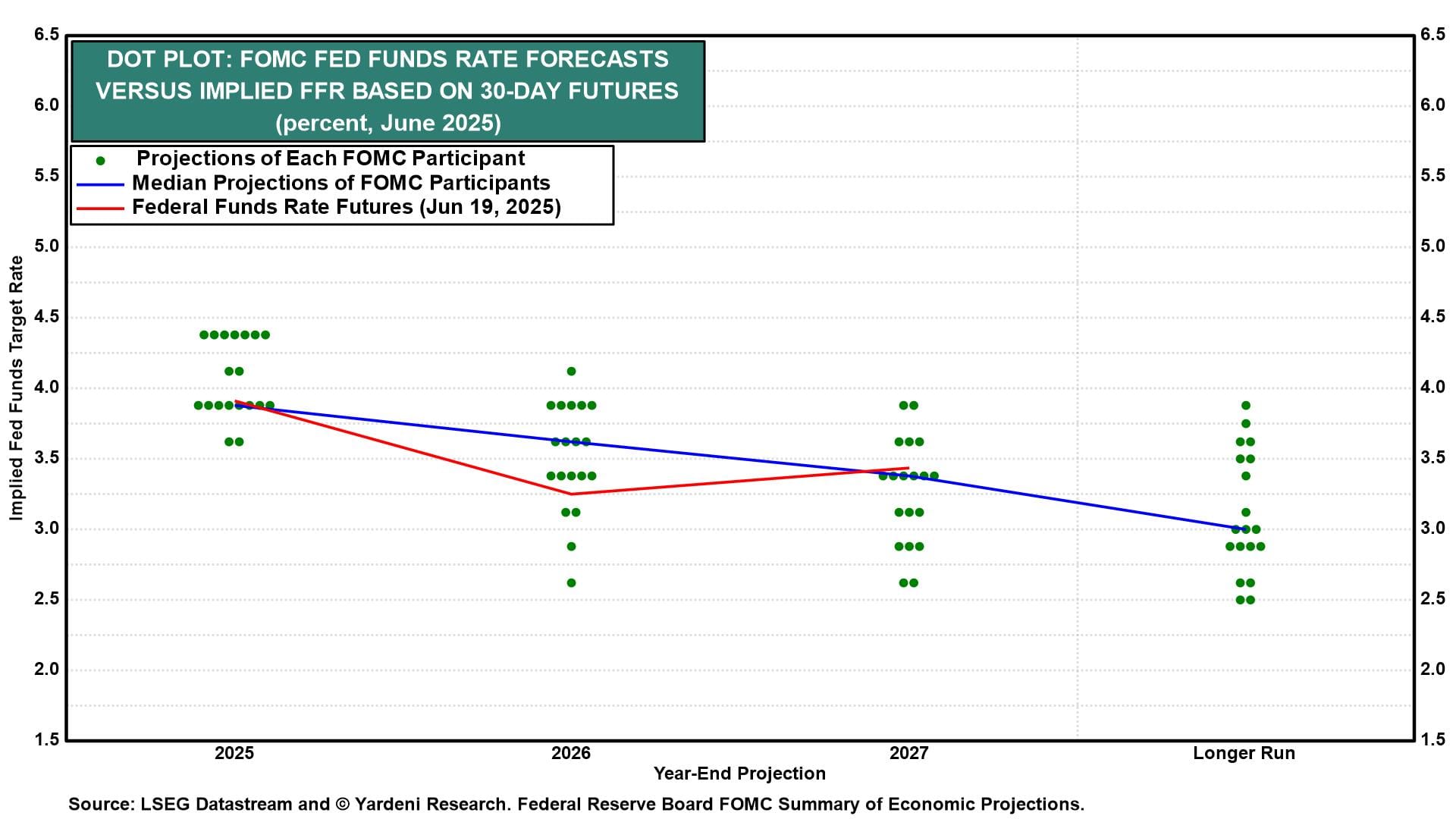

(4) Dot plot of federal funds rate (FFR). Interestingly, seven of the 19 FOMC participants indicated they wanted no FFR cuts this year (chart). That's up from four in March. This so-called dot plot suggests that Trump can't expect the Fed to respond to his calls for lower rates any time. Even if a Trump loyalist ran the Fed today, he or she might not be able to deliver for Trump if the majority of the FOMC’s voting members vote to do nothing.

(5) Median FFR projection. Nevertheless, those 19 participants collectively see the Fed's benchmark lending rate dropping to 3.90% by year-end, implying a range of 3.75%-4.00% and suggesting two easing moves later this year (chart). Then perhaps one more in 2026 would get the FFR down to 3.60%. We are still in the none-and-done camp for 2025.