I. Overview

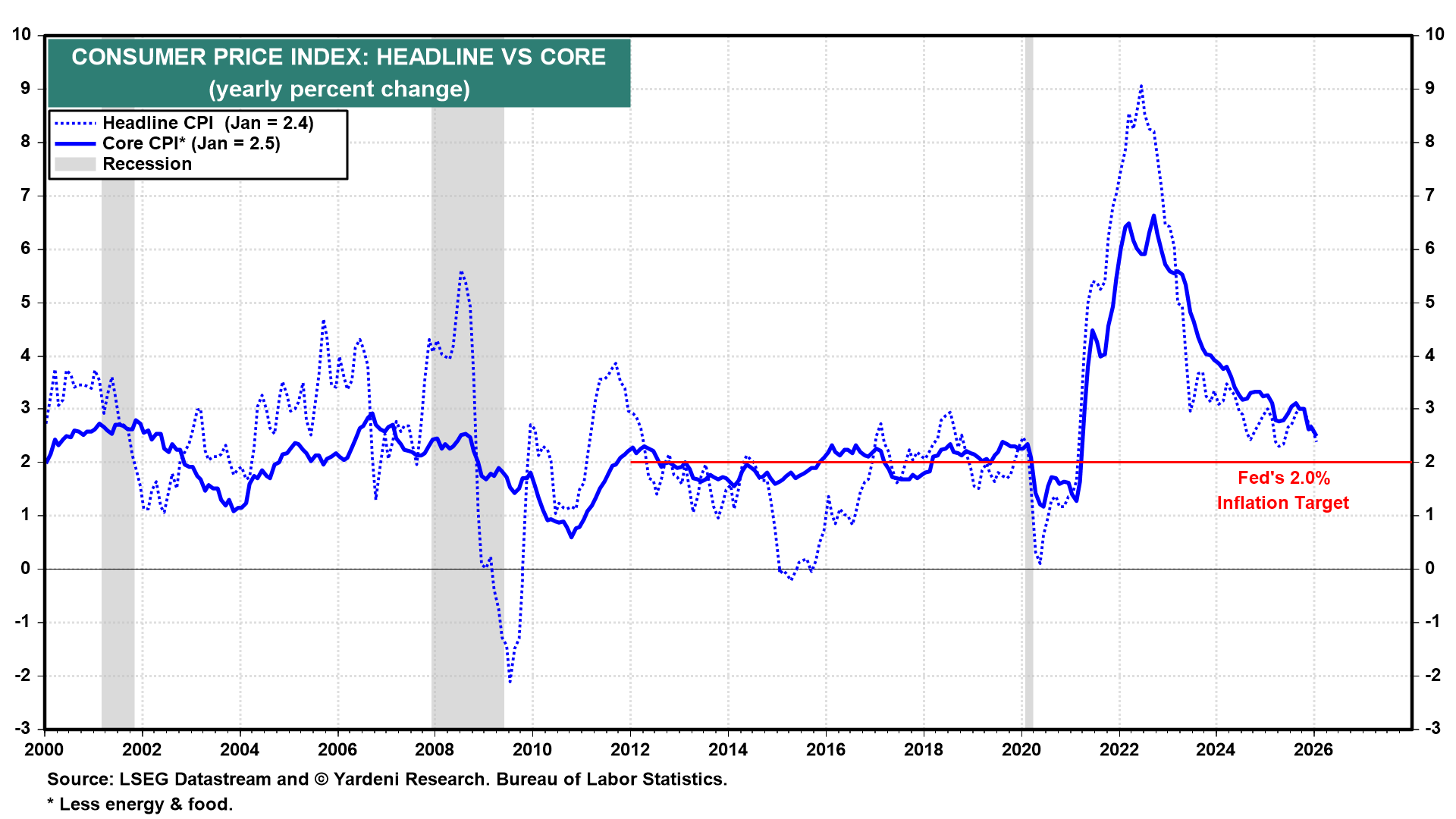

On long car rides, the kids in the backseat often ask their parents, "Are we there yet?" That's the question investors are asking about inflation: "Are we at the Fed's 2.0% inflation target yet?"

Our answer: "Not quite, but we are getting close." January's CPI report showed headline inflation at 2.4% y/y (chart). The core rate was 2.5%, which is the lowest pace since March 2021. January data are sometimes hotter than expected due to typical start-of-the-year price resets, even after seasonal adjustment. Encouragingly, there was no meaningful upside surprise last month.

Durable goods inflation, currently at 0.4% y/y, is likely to revert to its pre-pandemic deflationary trend once the effects of last year's tariff hikes wear off (chart). Nondurable goods inflation remains more volatile, driven largely by swings in energy and food prices. But it remained subdued in January at 1.3% y/y. Services inflation, however, continues to run around 3%, a bit hotter than its pre-pandemic pace.