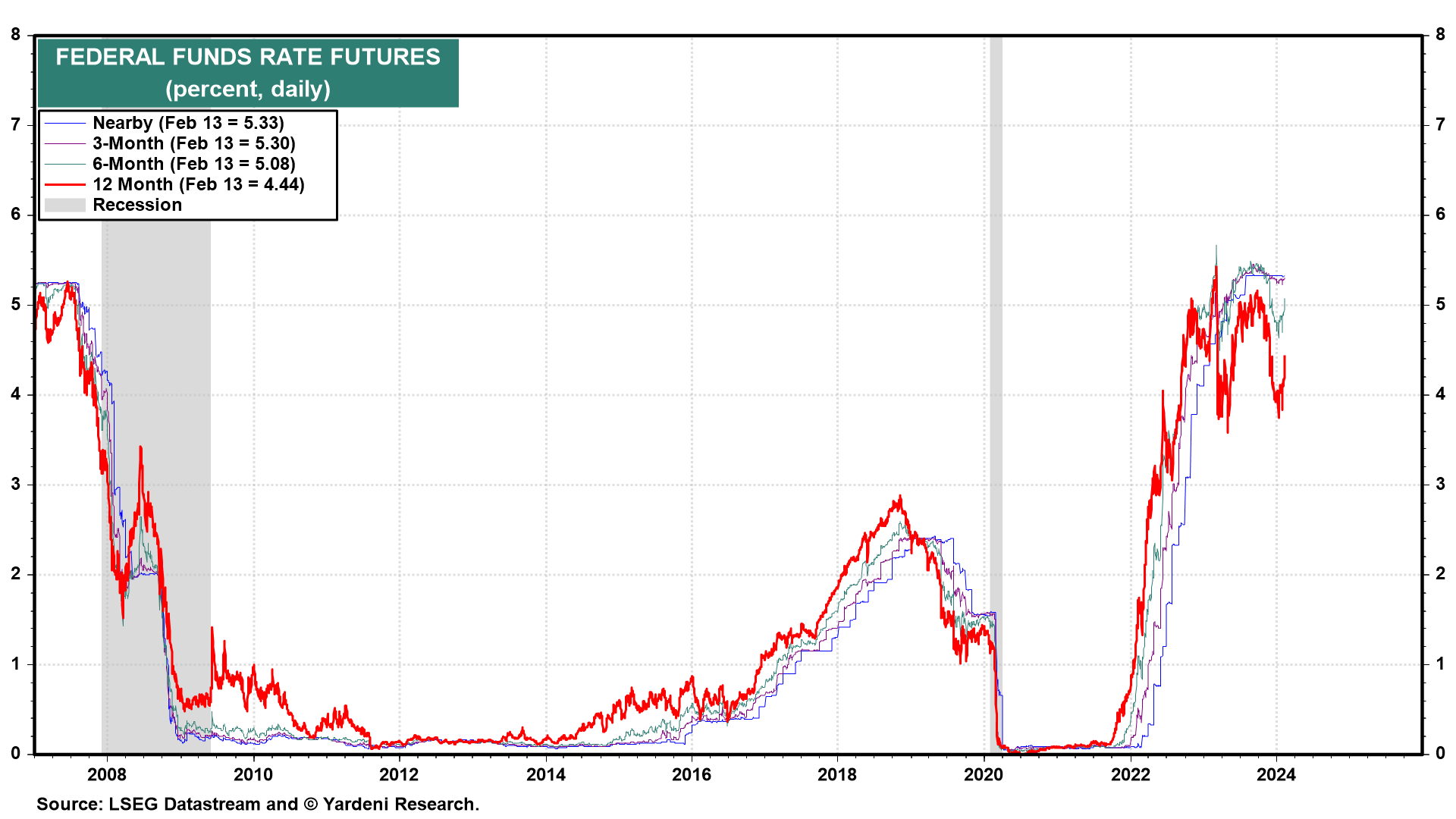

Today, January's CPI inflation rate was slightly higher than expected. But the upside surprise was enough to convince investors and traders that the Fed is less likely to cut the federal funds rate (FFR) soon or by as much as they expected over the next 12 months. The 12-month federal FFR futures rose to 4.44% today, up from 3.74% on January 15 (chart). That amounts to 4 cuts of 25bps rather than 7 cuts. We are still thinking more like 2-3 cuts during the second half of this year.

We still think inflation will fall to the Fed's 2.0% target by the end of this year. However, we are also expecting that the economy will remain relatively strong. So why should the Fed rush to lower the FFR?

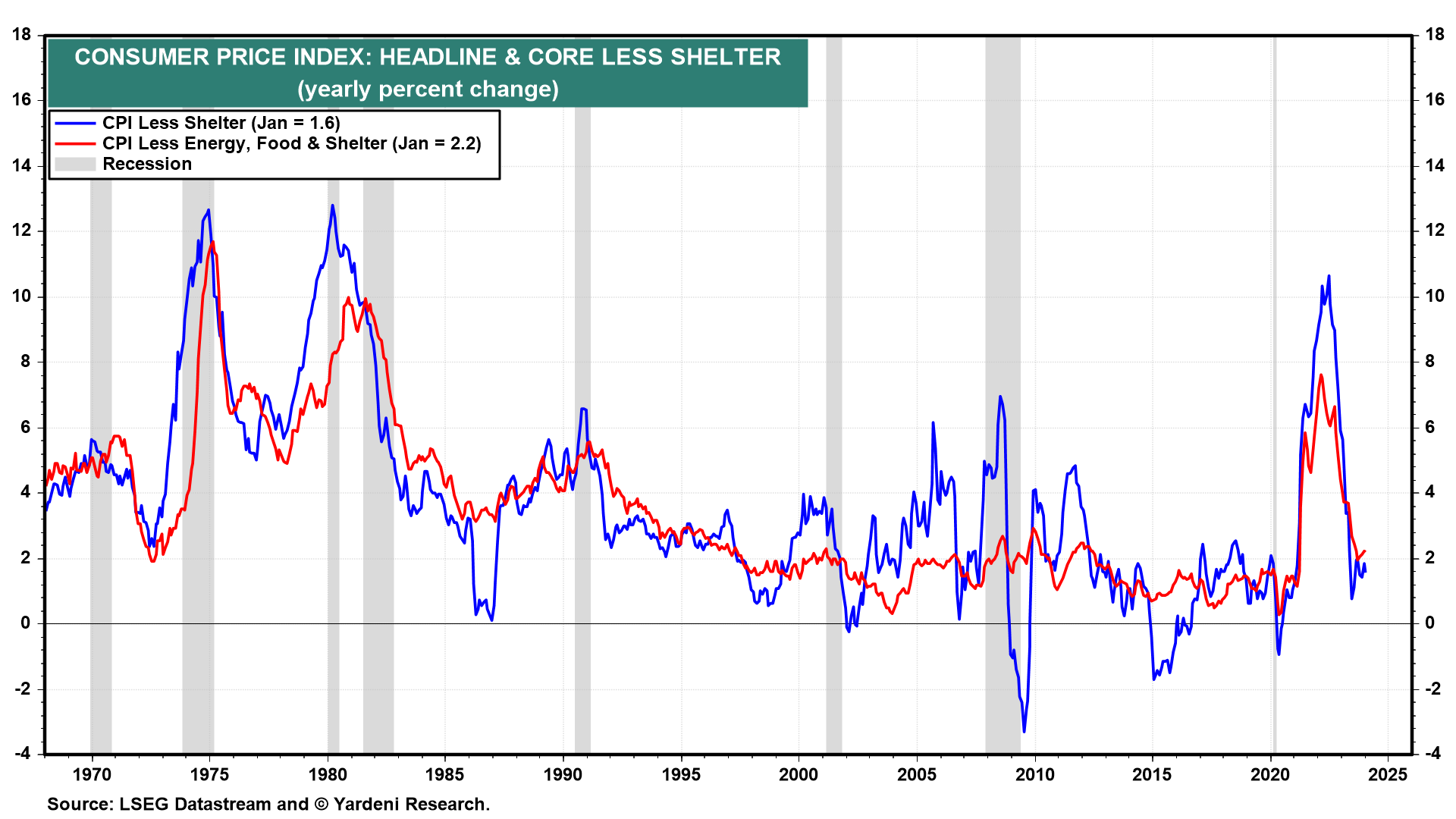

As promised, we are focusing on today's headline and core CPI excluding shelter. They were up just 1.6% and 2.2% y/y through January (chart)! Rent inflation is still moderating on a y/y basis, but it is doing so very slowly.

The S&P 500 and Nasdaq 100 fell 1.37% and 1.58% today as investors and traders took some profits. Remember: We aren't rooting for a meltup. So we aren't rooting for the Fed to cut the FFR too soon or too fast. We view today's setback as a healthy development for the sustainability of the bull market. Our hunch is that the S&P 500 might test and find support at 4800 (chart). We are still targeting 5400 for the S&P 500 by the end of this year NOT by the end of this month!