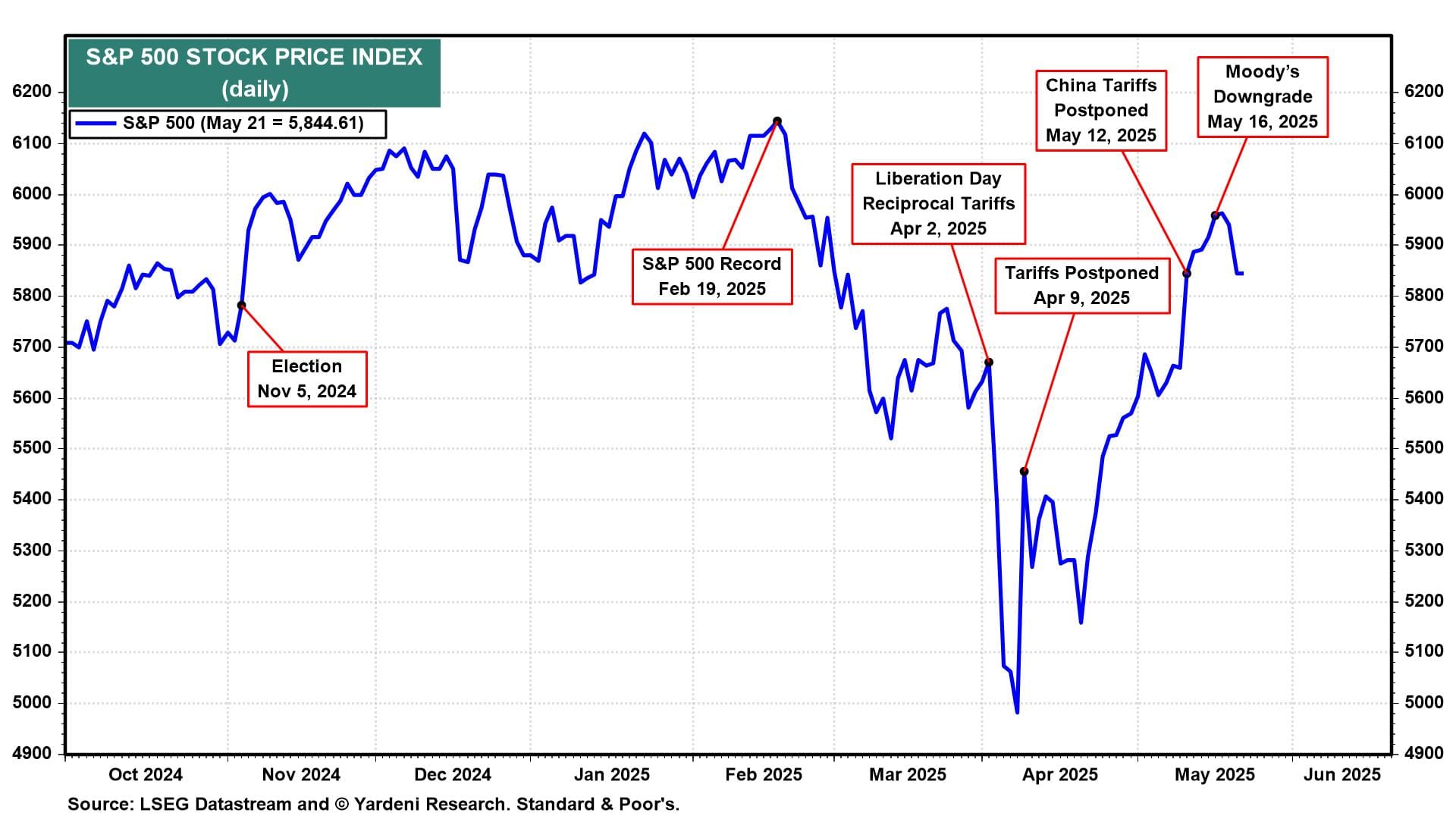

Stock investors have been less "tarrified" about President Donald Trump's tariffs since April 9, when he postponed most of his proposed reciprocal tariffs by 90 days (chart). However, they may now be getting spooked that the bond market might be on the verge of a debt crisis, especially after Moody's downgraded US government debt on Friday and Japanese bond yields soared in recent days. The S&P 500 fell 1.61% today mostly after the sloppy results of the 20-year US Treasury auction.

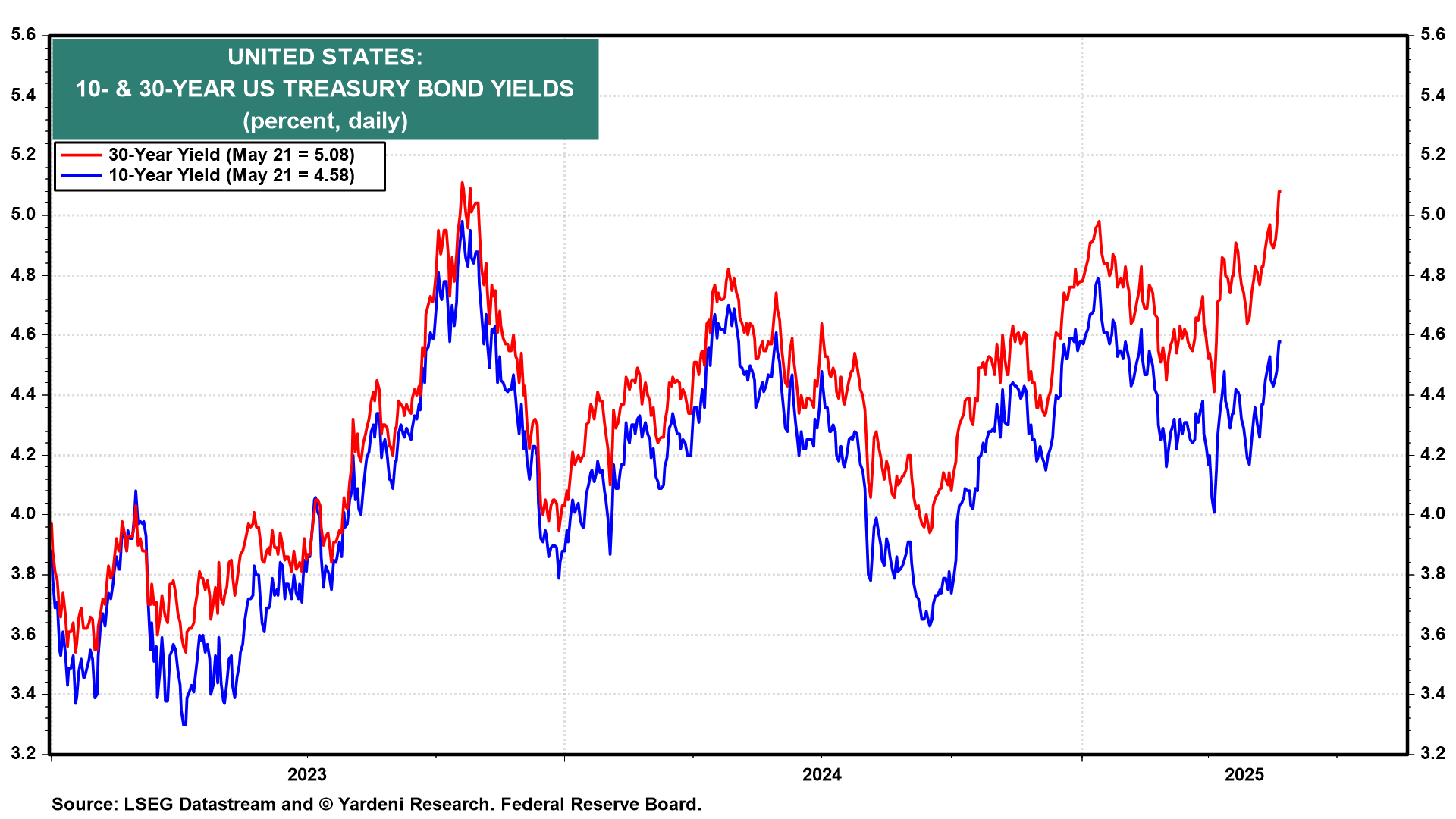

In addition, the 30-year US Treasury bond yield closed above 5.00% today for the first time since late October 2023 (chart). The 10-year yield is still well below its October 2023 peak, but the financial press rang the alarm bell about the 30-year yield exceeding 5.00%.

Furthermore, stock and bond investors may be starting to get jittery over the implications of Trump's "Big Beautiful Bill" for federal deficits and debt. The debt is up to a record $36.2 trillion with $28.6 trillion in marketable securities held by the public (chart).