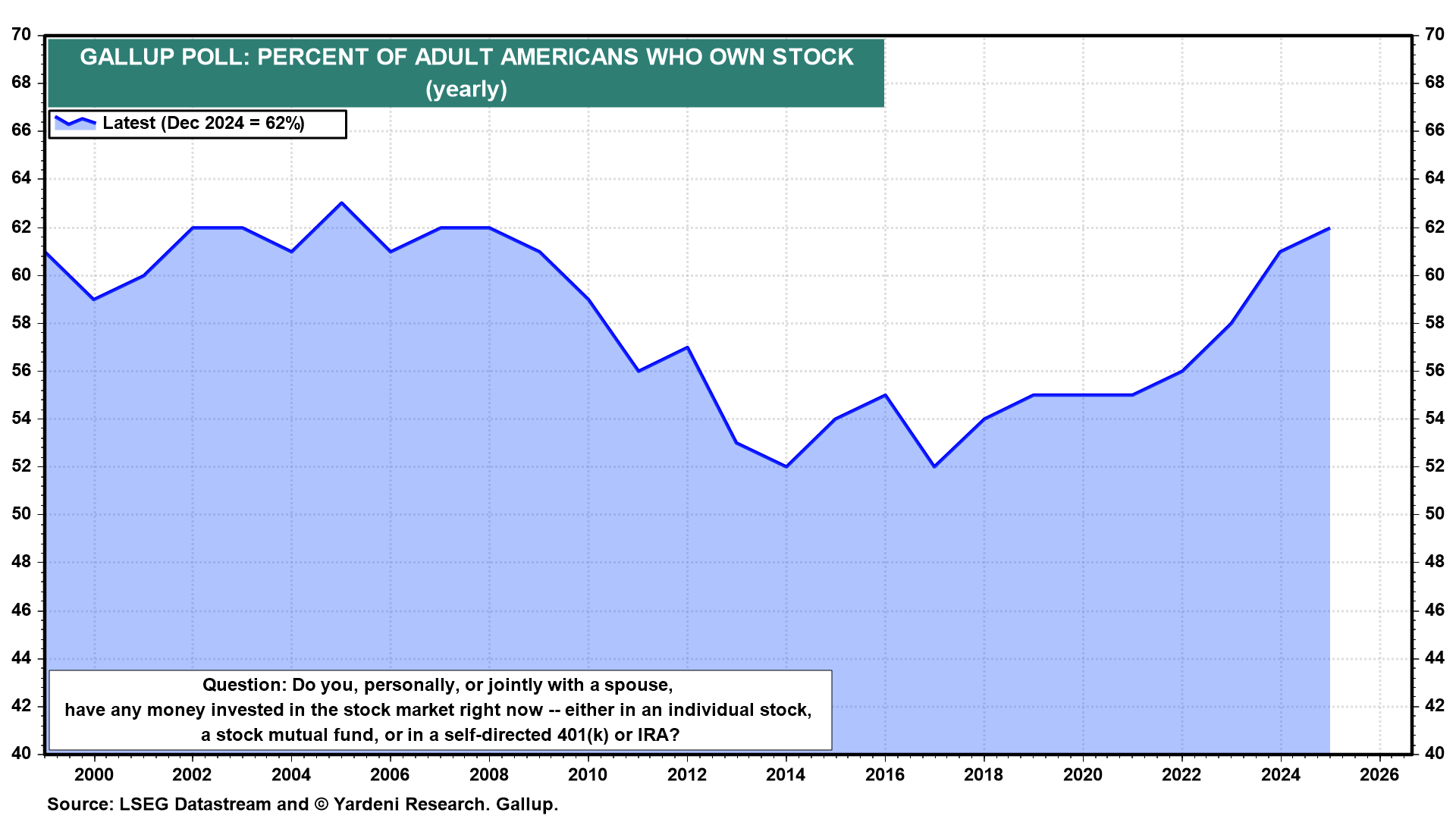

The bull market in stocks is making everyone who owns stocks richer. Gallup reported that 62% of Americans were invested in the stock market at the end of 2024 (chart). That's the highest since the end of 2008. We think the bull market is having a significant positive wealth effect on consumers who own equities, more than offsetting the debt effect on them of rising credit delinquencies.

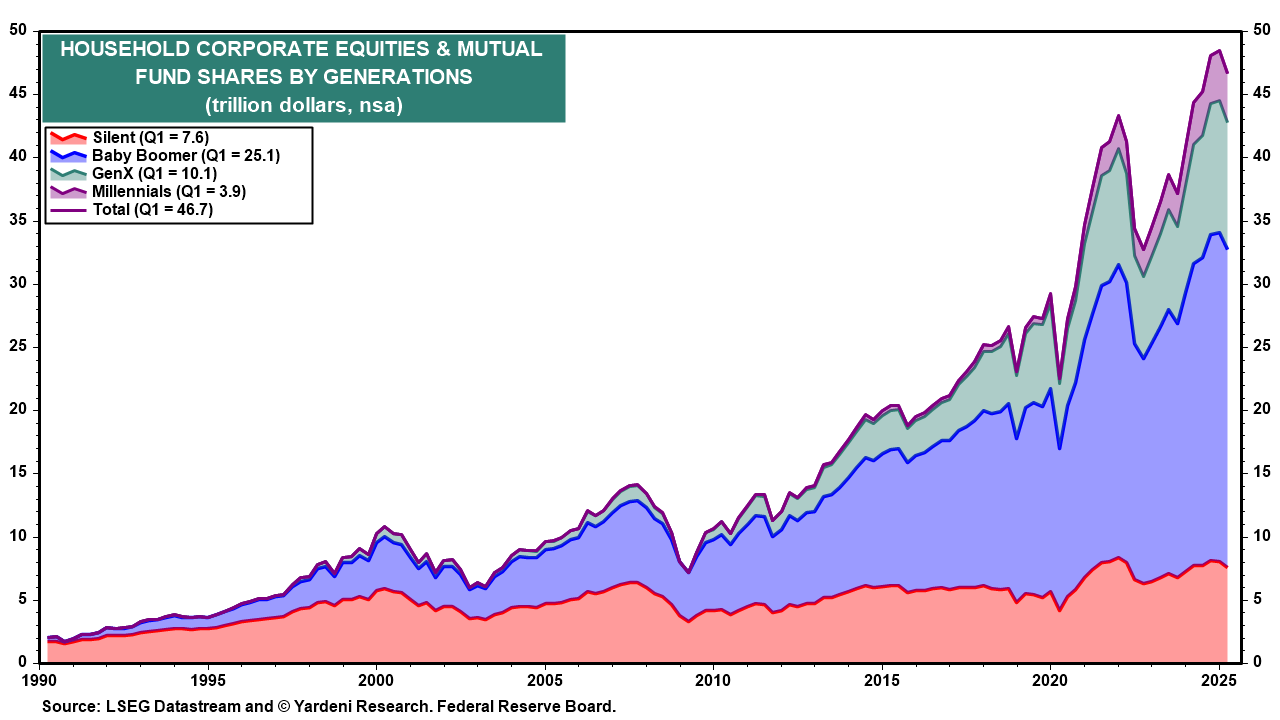

At the end of Q1-2025, American households owned $46.7 trillion in equities and mutual fund shares (chart). The Baby Boomers held 54% of that total. They are the richest retiring generation in history, with a combined net worth of over $82 trillion. They will spend more of their retirement assets and transfer a larger portion of these assets to their children (while the Boomers are alive) and to their descendants (after they have passed away). Yet many of them are still seeing their net worth increase thanks to the bull market in stocks, which pushed the S&P 500 to yet another record high today!

If the Fed cuts the federal funds rate on September 17, as widely anticipated, then the stock market will continue to rise as valuation multiples continue to melt up. The positive wealth effect will continue to stimulate the economy, which doesn't really need to be stimulated. Consider the following:

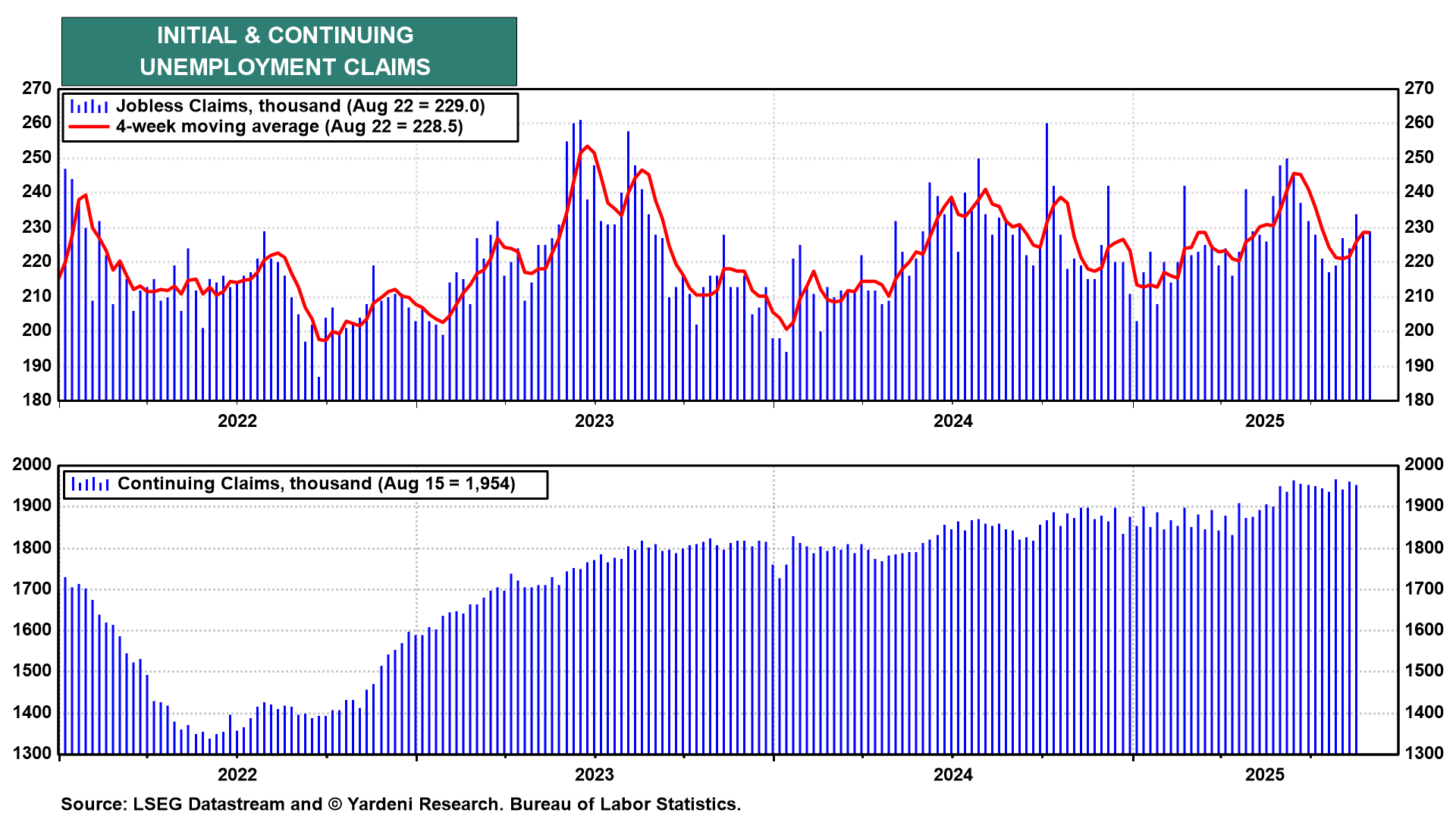

(1) Today's initial unemployment claims report confirmed yet again that layoffs remain low (chart). The duration of unemployment may be stabilizing, as suggested by the decline in continuing claims in the latest report.

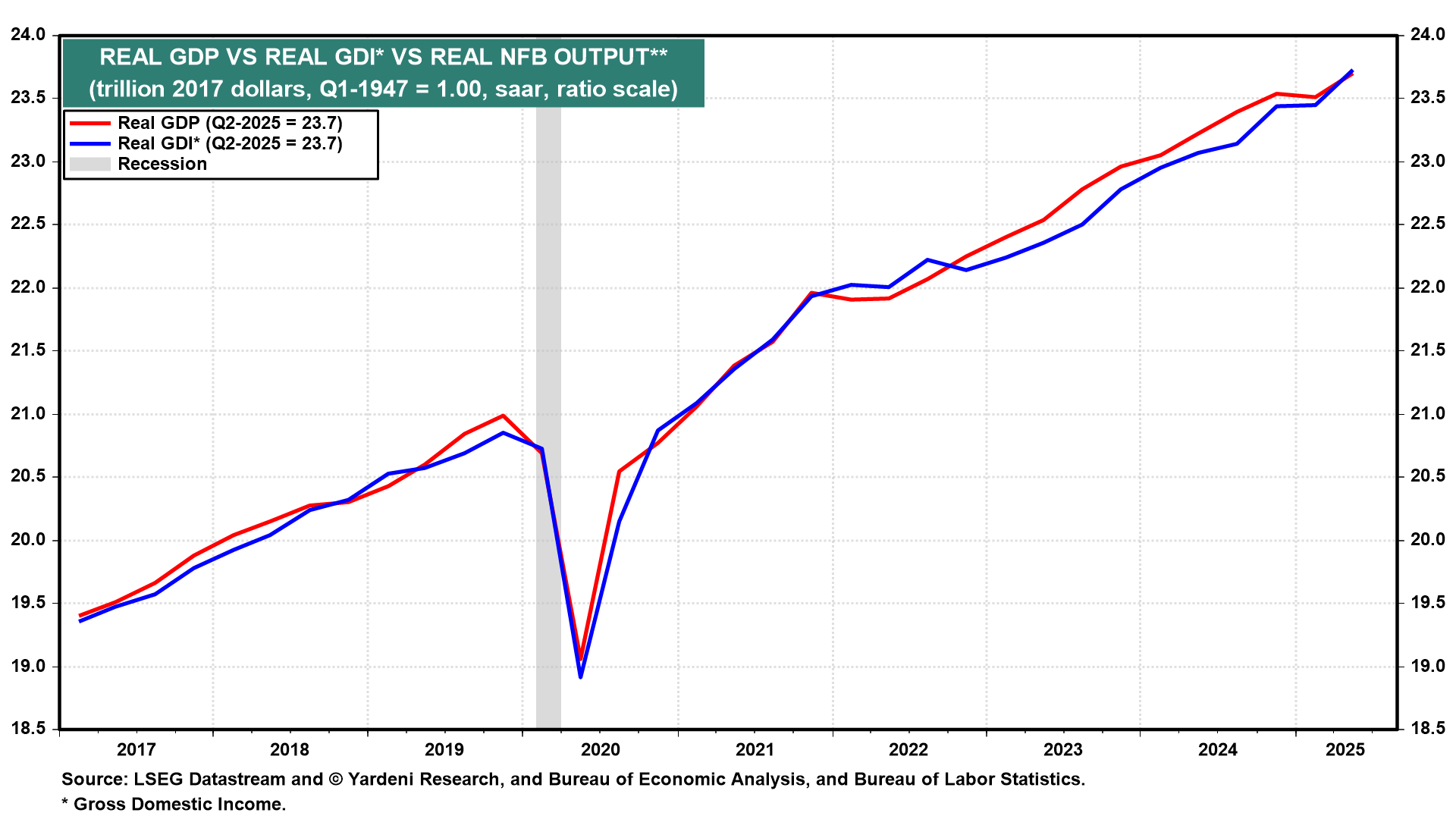

(2) Today, Q2's real GDP growth rate was revised up by 0.3% percentage points to 3.3% (saar). Even more impressive is that real gross domestic income (GDI) increased 4.8%. Both GDP and GDI rose to record highs during Q2 (chart).

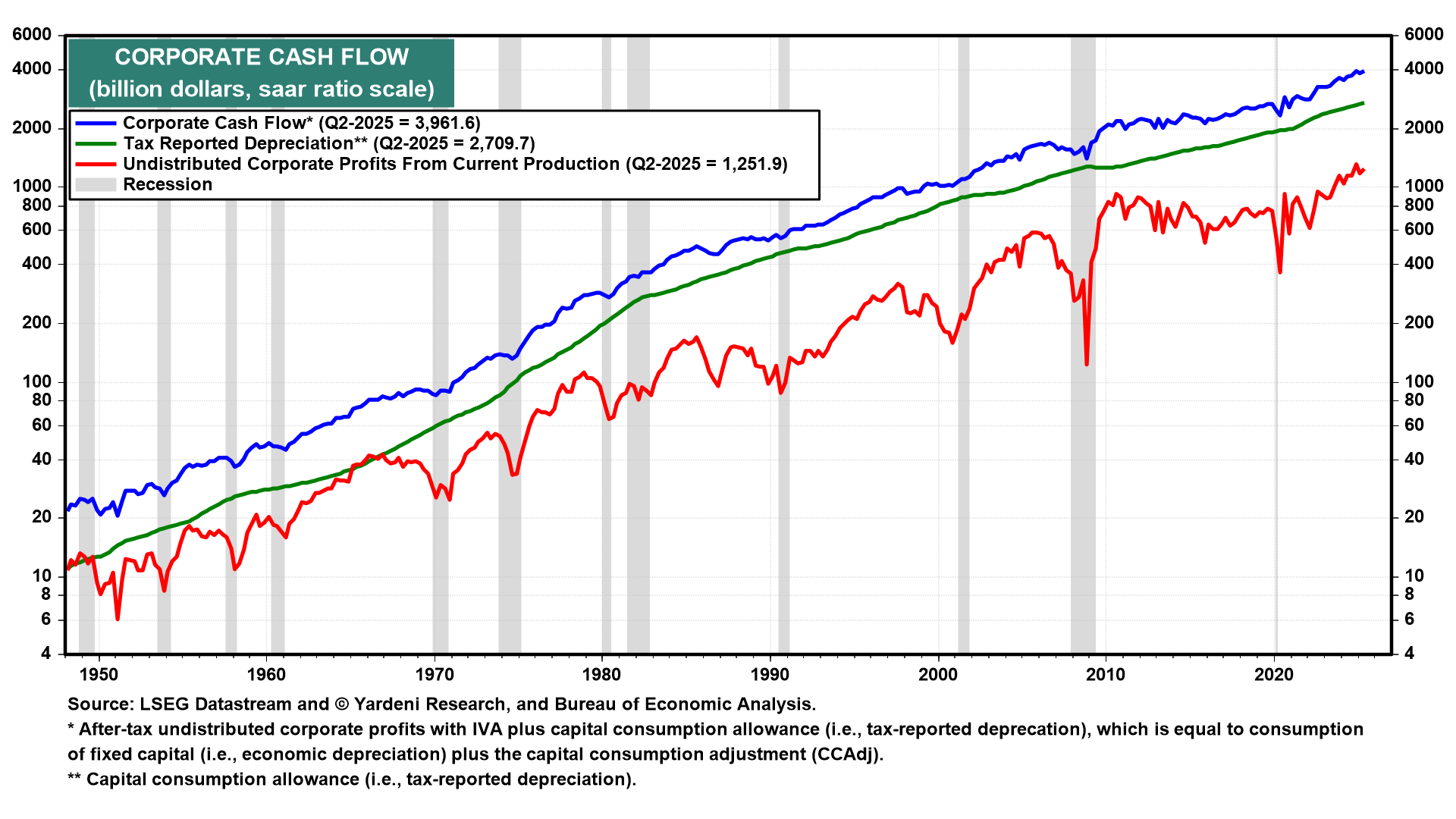

(3) Corporate cash flow remained at a record high of $4.0 trillion (saar) during Q2 (chart). That is helping to boost capital spending, especially on information technology.

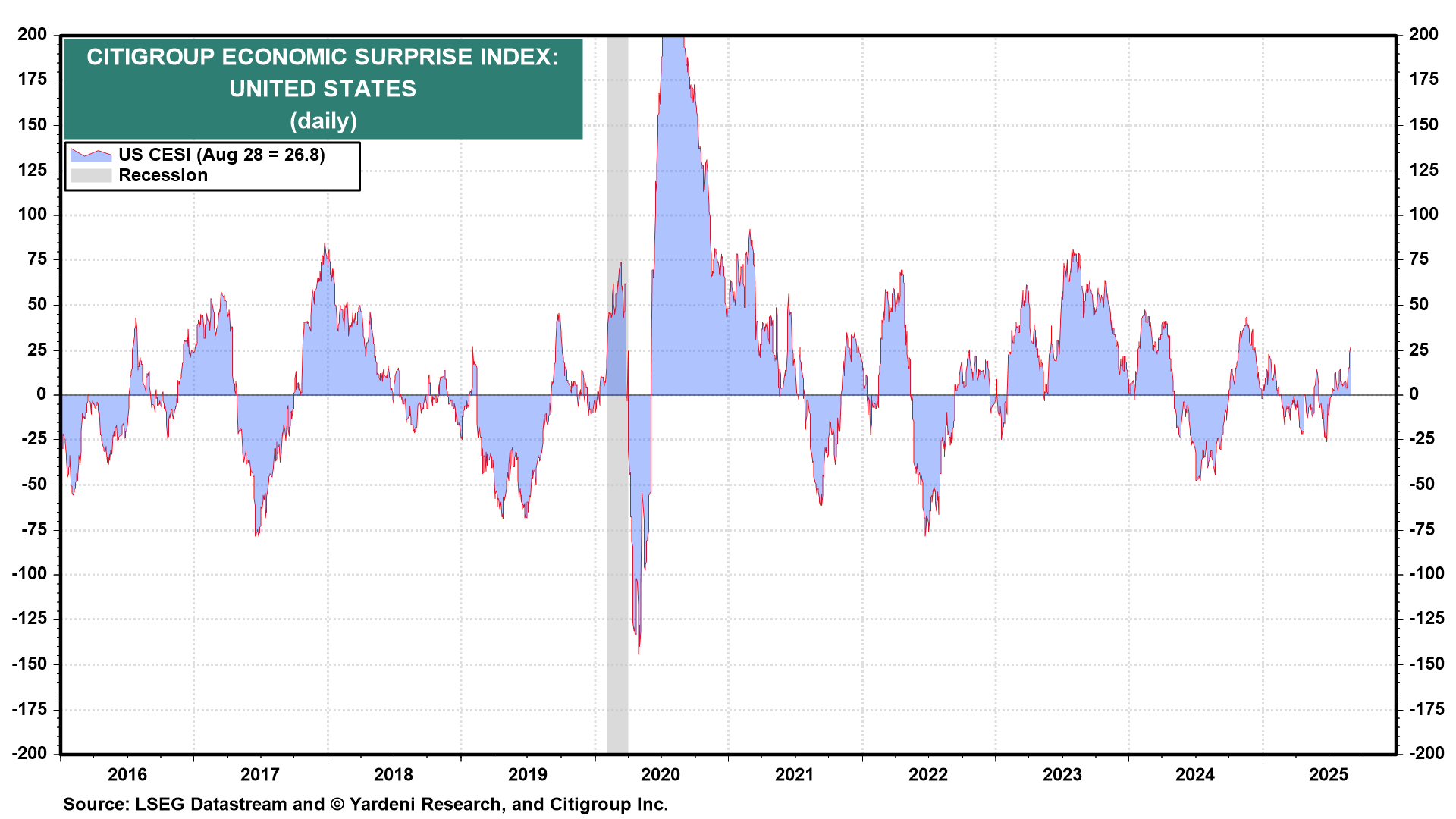

(4) The Citigroup Economic Surprise Index jumped today to 26.8 (chart).

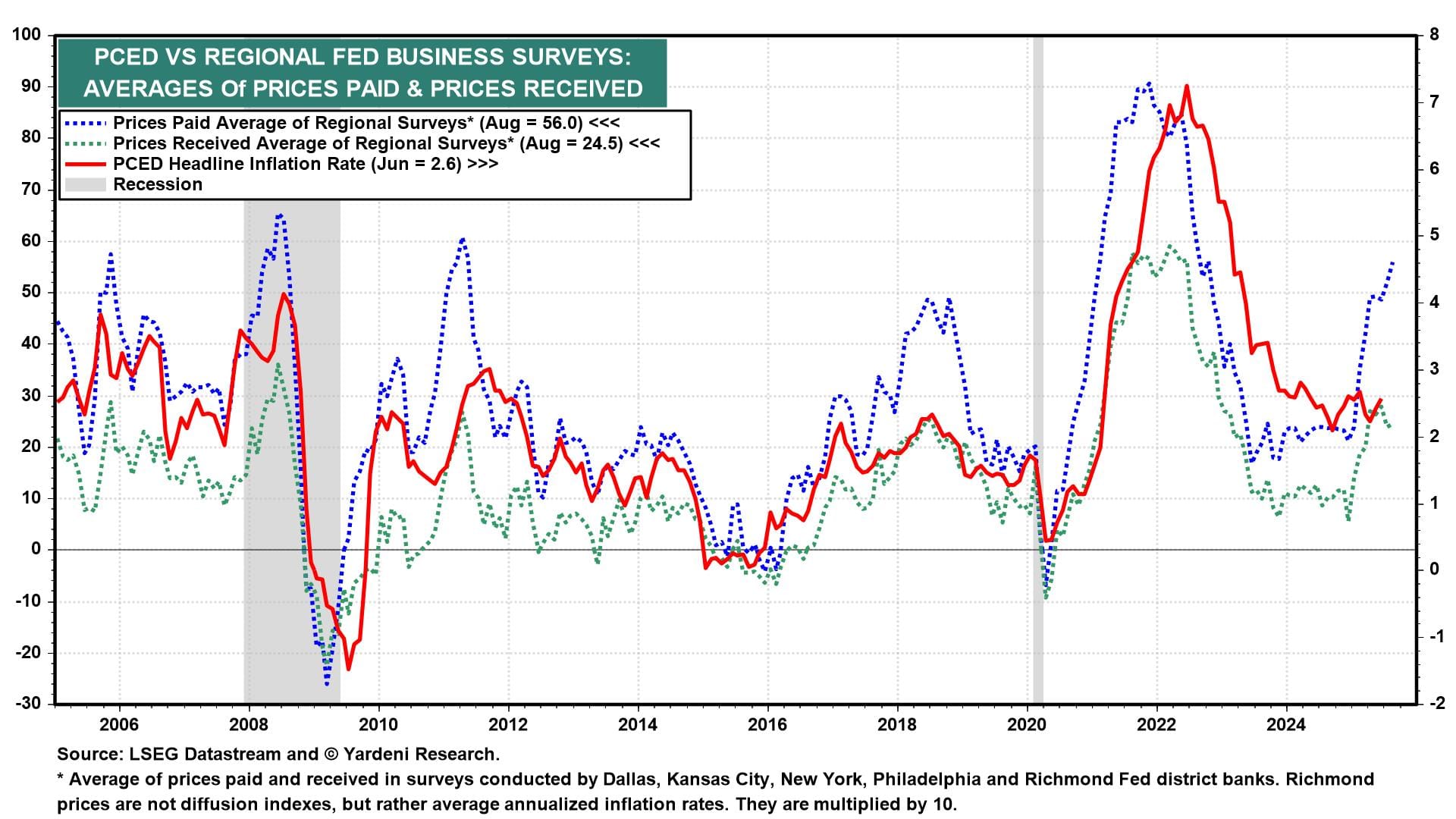

(5) The regional business surveys conducted by five of the 12 Federal Reserve district banks showed that inflationary pressures are building. The average of the prices-paid indexes jumped in August to 56.0, the highest reading since October 2022 (chart). The average of the prices-received indexes is lower at 24.5, suggesting that many companies are absorbing the increasing costs of tariffs and/or offsetting them with productivity gains. More companies may start to pass their costs on to consumers in the coming months.