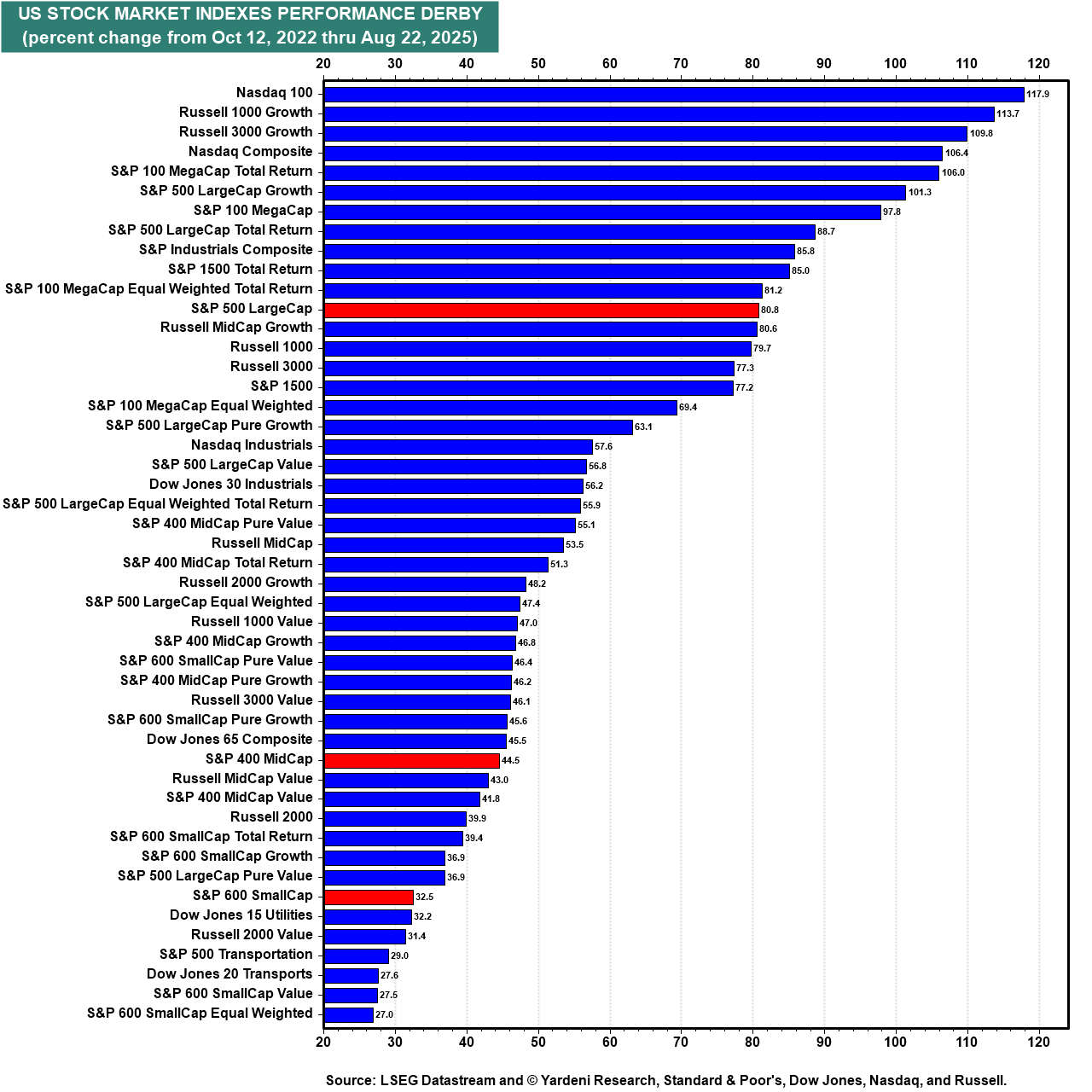

The Magnificent-7 stocks have been leading the charge of the current bull market that started on October 12, 2022. They are all in the Nasdaq 100, which is up 117.9% so far since the start of the bull market, beating all the other major US stock market indexes (chart).

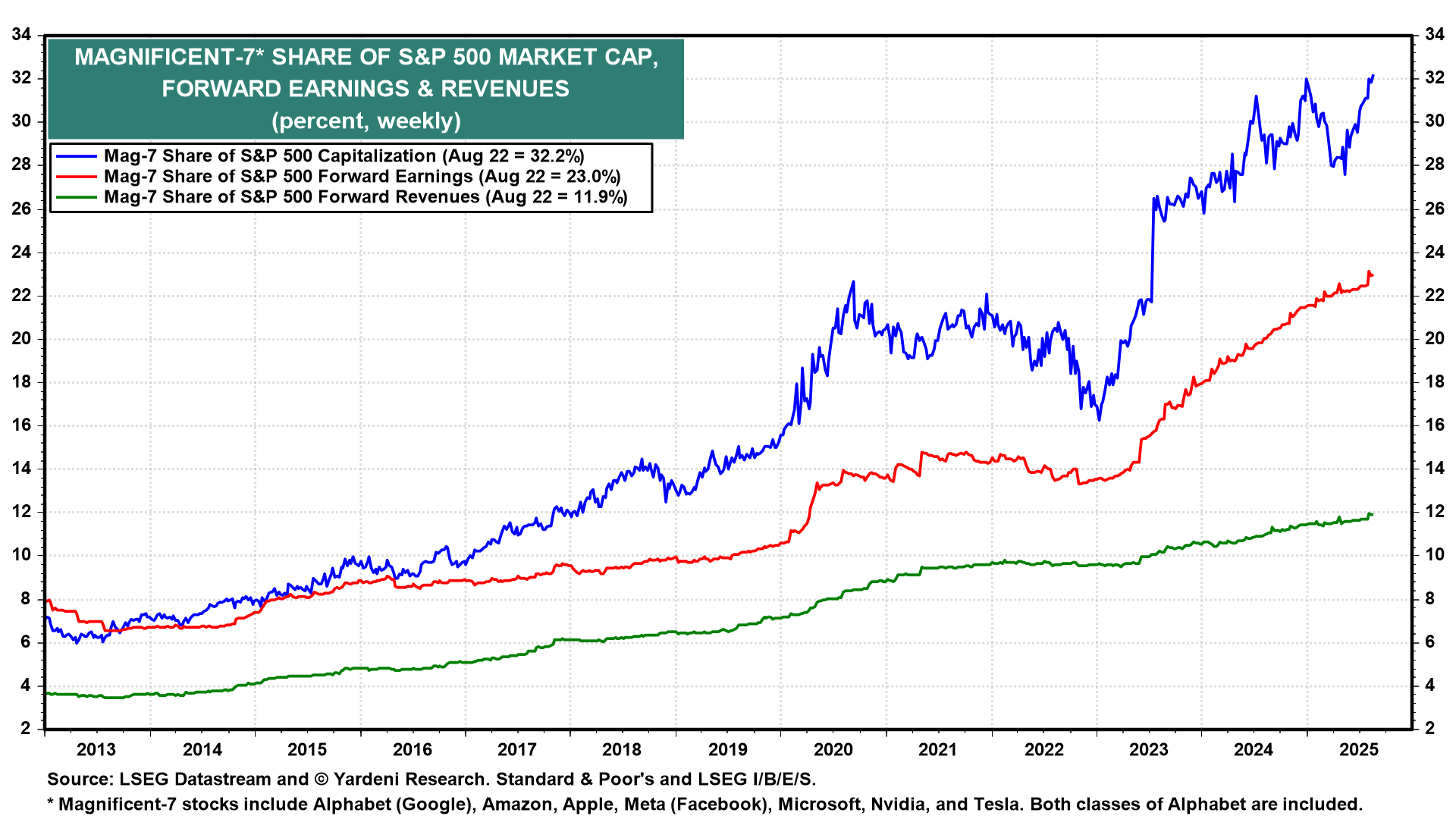

The Mag-7's market capitalization share of the S&P 500 has doubled during the current bull market from 16% to 32% (chart). The stock market has indeed become more concentrated, but that doesn't mean that the rest of the market has languished. The S&P 493, the S&P 400 MidCaps, and the S&P 600 SmallCaps have had impressive gains too, just not as impressive as the Mag-7 and the Nasdaq 100.

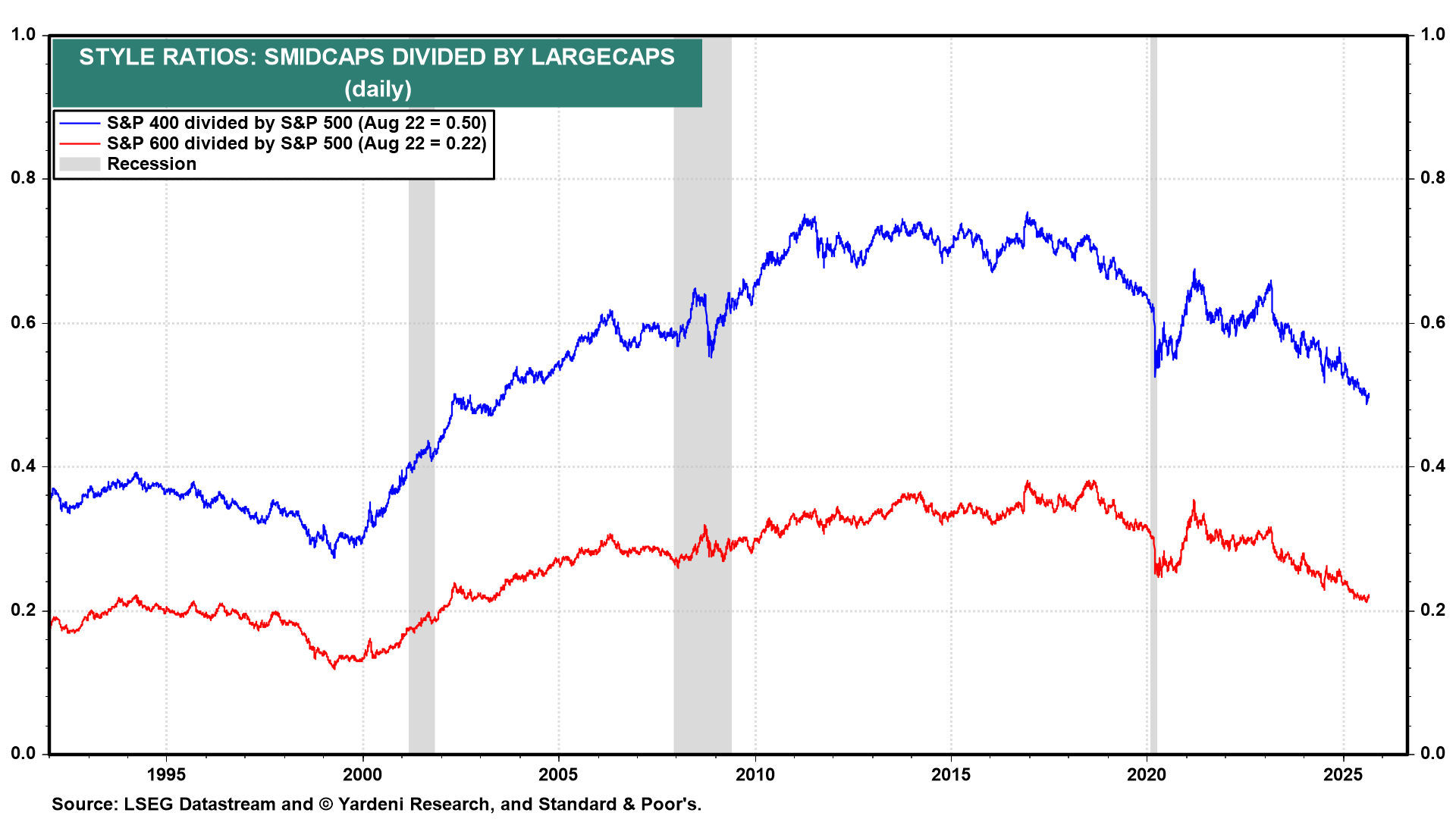

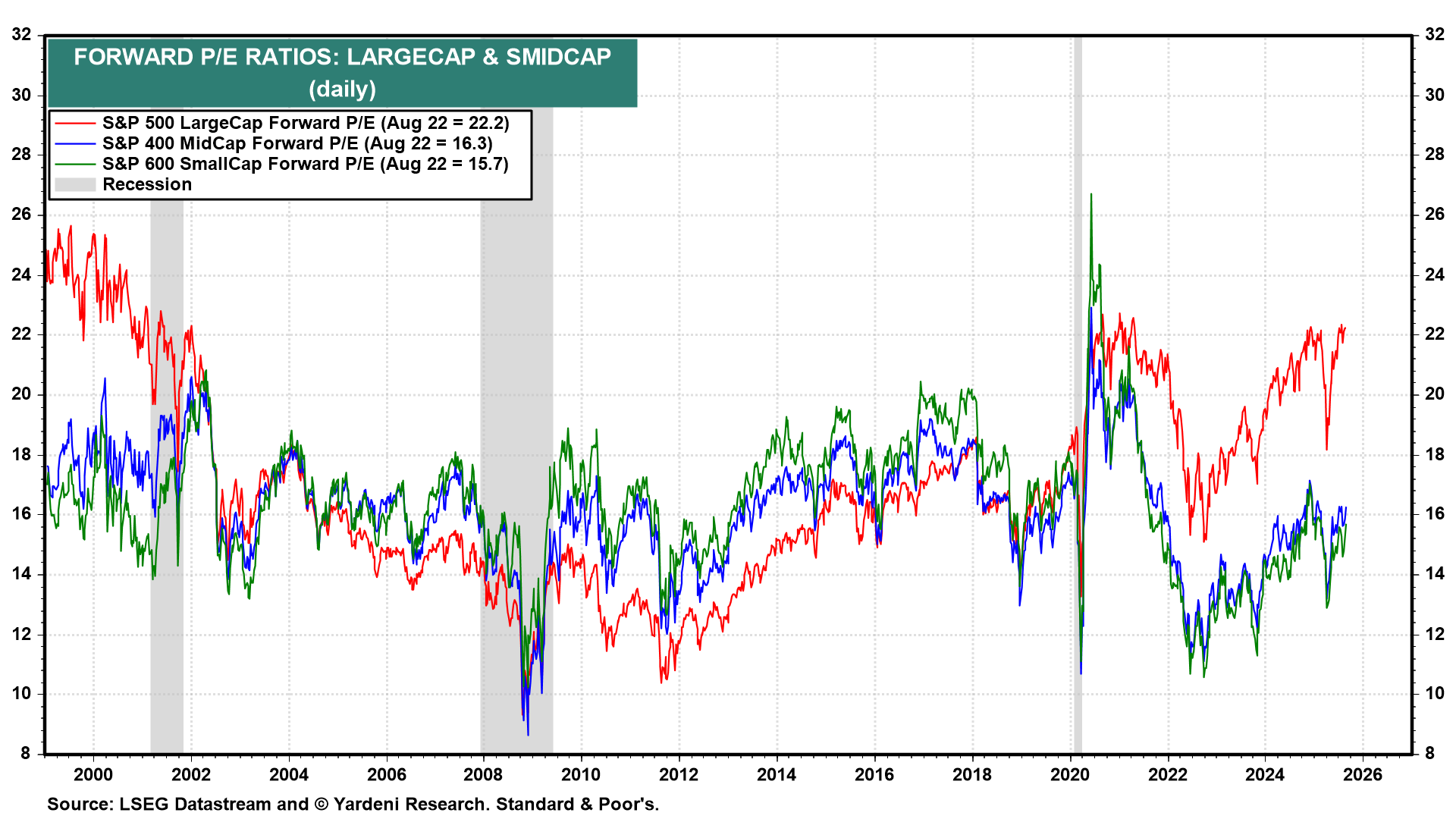

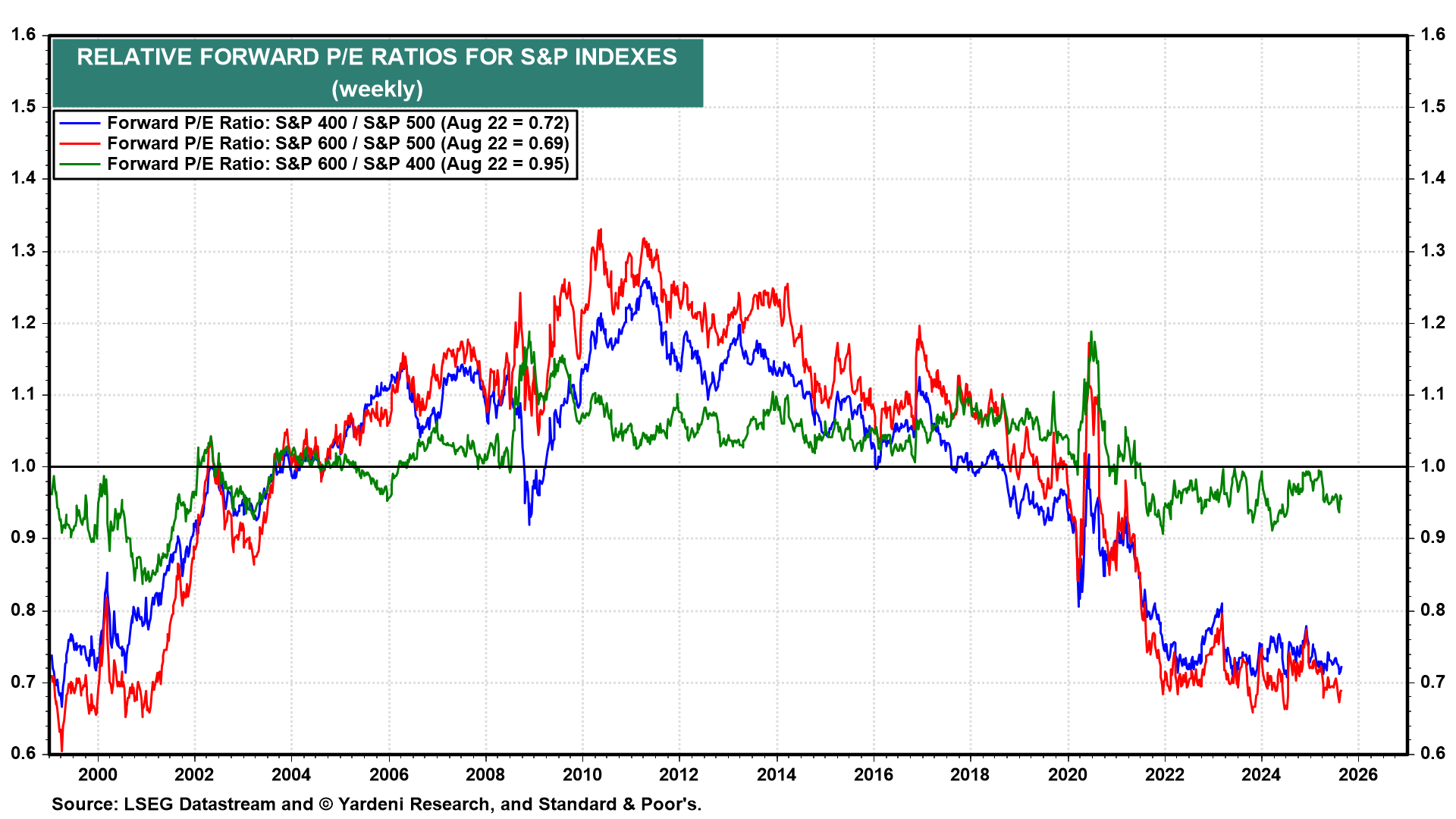

The S&P 1000 SMidCaps have clearly lagged behind the S&P 500 since the start of the current bull market. They outperformed last Friday on expectations of another Fed easing cycle. However, they've disappointed many times before since the second half of the 2010s (chart). We aren't convinced they are set to outperform the S&P 500 on a sustainable basis. However, we would take some of the profits in the large-cap sectors we've favored (Information Technology, Communication Services, Industrials, and Financials) and rotate into their SMidCap equivalents, which have lower valuation multiples.

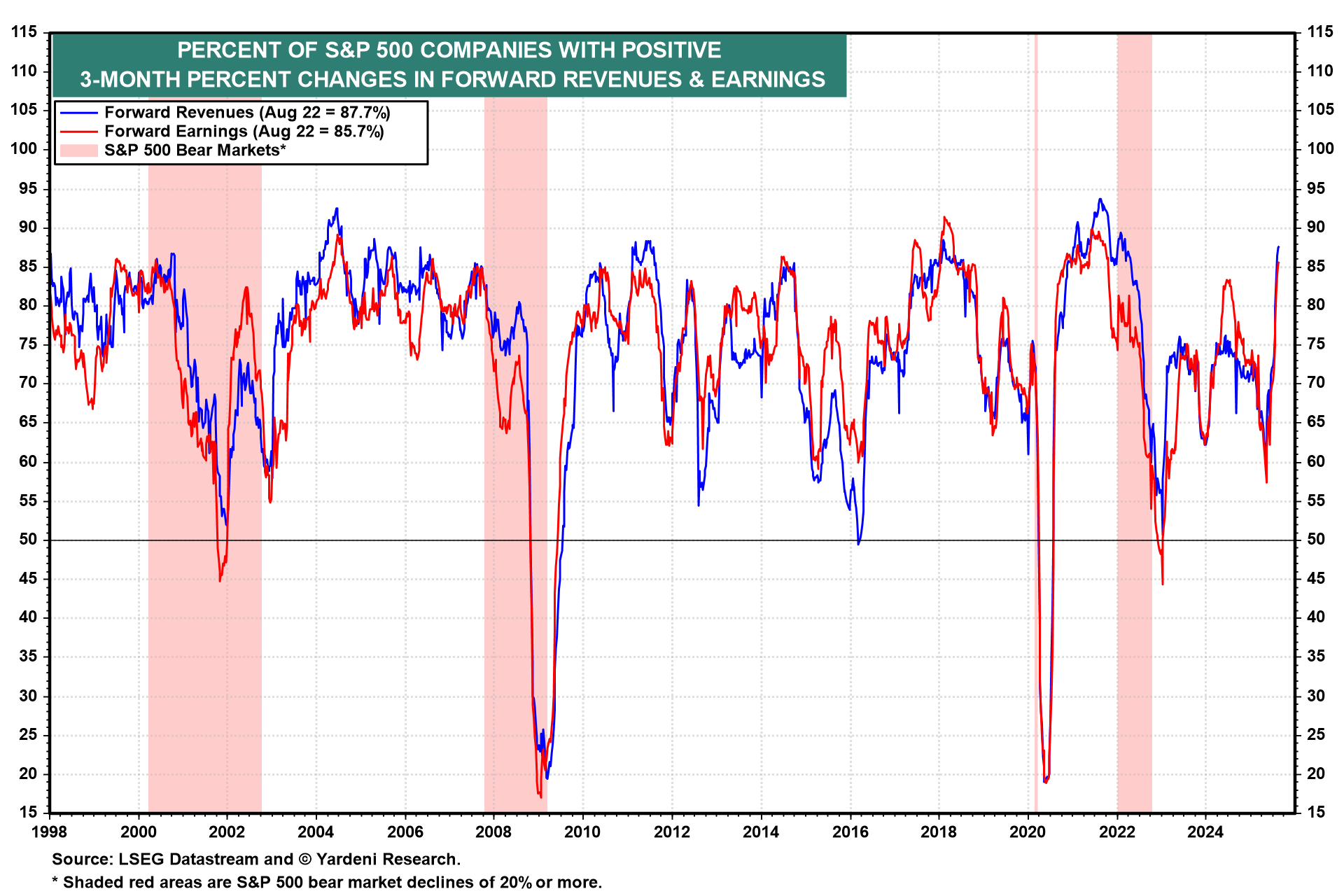

We are seeing signs that S&P 500 company earnings gains are broadening (chart). The percentages of S&P 500 companies with positive three-month changes in forward revenues and forward earnings have increased significantly in recent weeks. That suggests that the S&P 493 should do well.

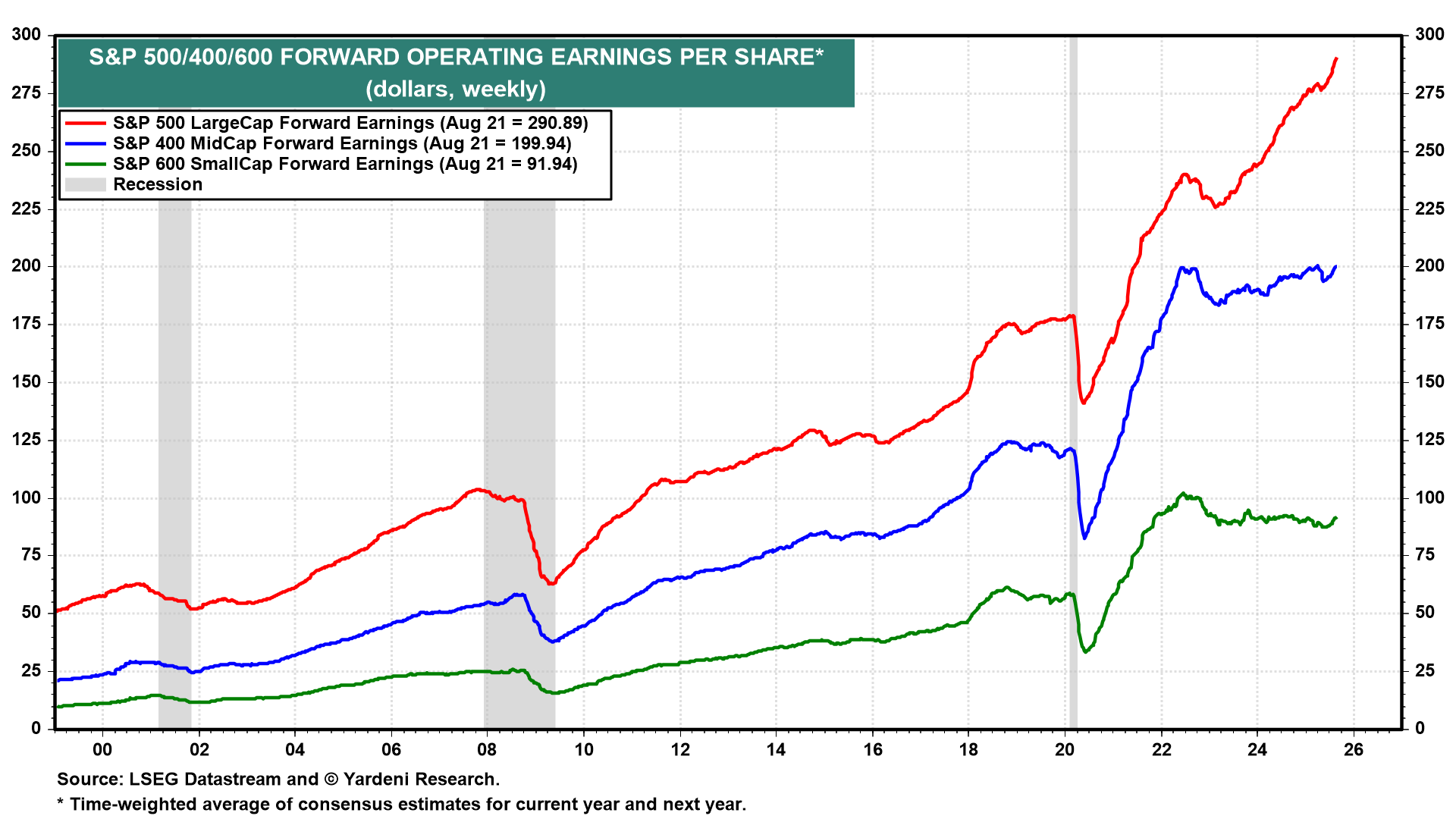

The forward earnings of the S&P 500 continues to soar to new record highs, while the forward earnings of the SMidCaps continue to meander below their 2022 highs (chart). However, the latter edged up over the past couple of weeks.

We doubt that the valuation gap between the SMidCaps and the LargeCaps will narrow much unless SMidCap forward earnings stop flatlining and start rising to new record highs (charts).

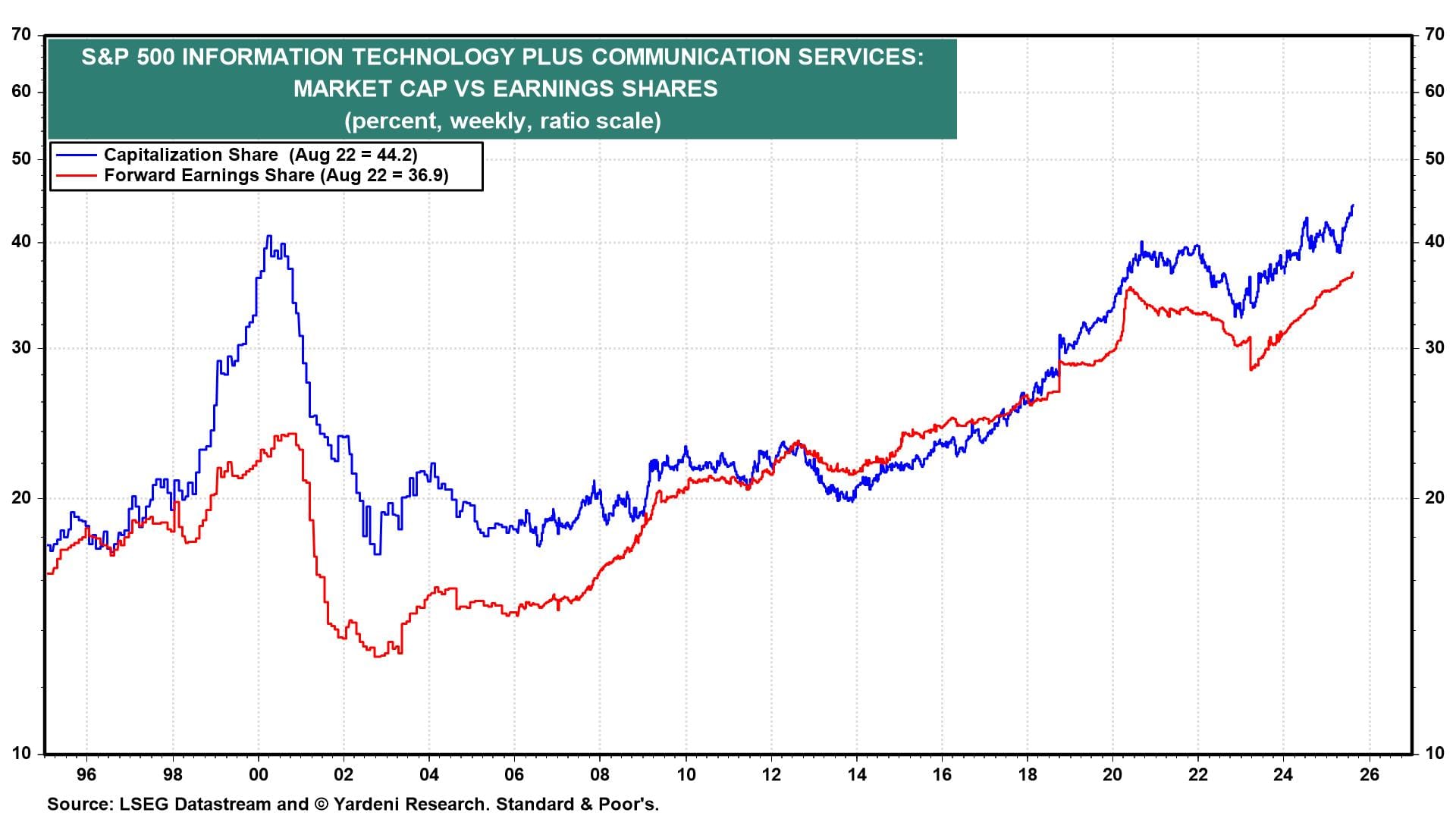

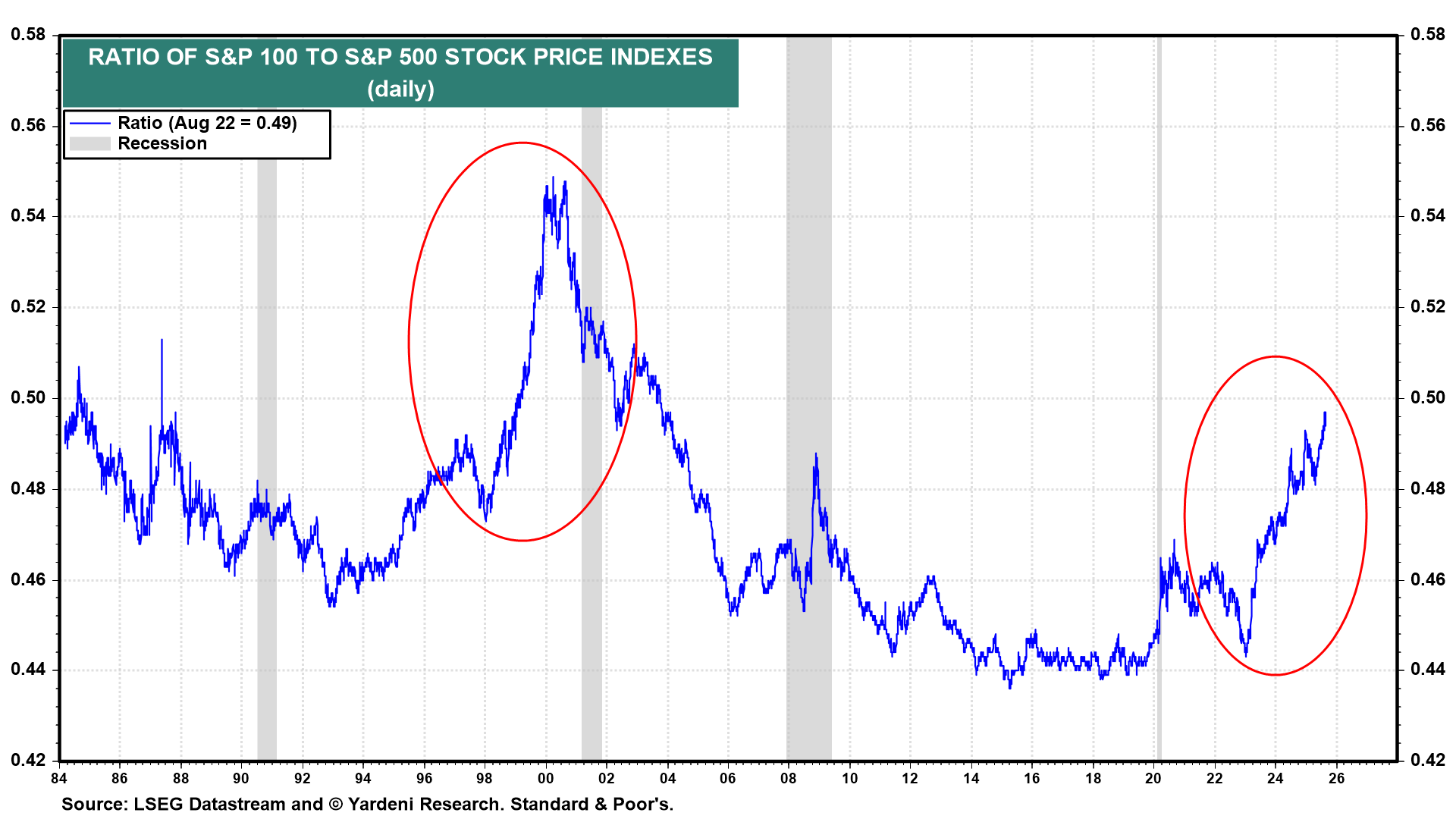

The outperformance of the S&P 100 relative to the S&P 500 is starting to remind us of the late 1990s Tech Bubble (chart). The Fed eased on September 29, 1998, and again on October 15 and November 17 of that year in response to the Long-Term Capital Management financial crisis. That Fed Put helped to inflate the Tech Bubble during 1999.

Will it be different this time? The Fed Put may be back on September 17, when the FOMC is widely expected to cut the federal funds rate. That could fuel a meltup in stock prices. However, there is less air in today's Tech Bubble than in the 1999 Tech Bubble because the forward earnings of the S&P 500 Information Technology and Communication Services sectors currently accounts for 36.9% of the S&P 500's forward earnings versus an early-2000 peak of 24% (chart).