All eyes will be on tomorrow's US employment report for November. That will obviously be our focus too. However, we will also be monitoring the price of a barrel of Brent crude oil regularly tomorrow and in coming days. That's because it seems to be on the verge of slipping below $60 (chart). Why does that matter? From a technical perspective, it might signal a significant break below a triangular consolidation pattern, similar to what happened in 2014 and again in 2020.

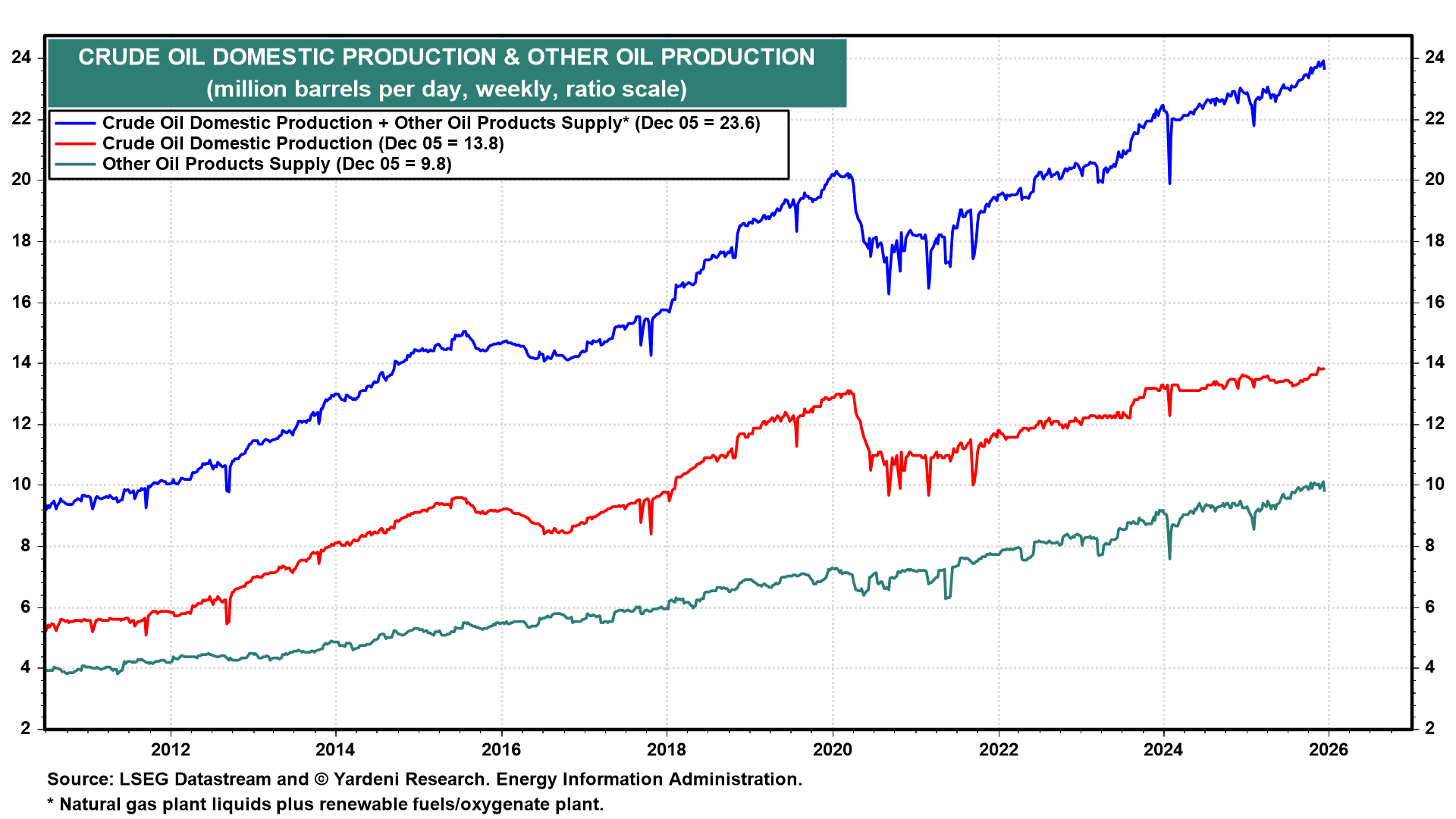

From a fundamental perspective, there is ample crude oil supply, driven by record US production and sluggish demand in China. US crude oil production rose to a record 23.6mbd during the week of December 5 (chart). Oil field production is at a record 13.8mbd, and natural gas plant liquids plus renewable fuels is at a record 9.8mbd.