Tomorrow will be action-packed. Wednesday morning, the US Treasury will issue its Quarterly Refunding Statement detailing how it intends to finance $1.0 trillion in marketable securities during Q3. The question is whether Treasury Secretary Scott Bessent will rely more on doing so in the Treasury bill market, as recently suggested by President Donald Trump.

Tomorrow afternoon, the FOMC will issue a press release at 2:00 p.m., most likely announcing that the voting members have decided to leave the federal funds rate unchanged. There is a good chance that Governors Michelle Bowman and Christopher Waller will dissent. They were both appointed by Trump. They have both stated that they want to cut the FFR now before the labor market weakens. If they don't dissent, then the stock and bond markets could rally significantly on expectations that the FOMC participants are leaning toward cutting the FFR in September, thus placating the two potential dissenters.

These two events will be warm-up acts for the star of tomorrow's show, i.e., none other than Fed Chair Jerome Powell. He will hold a press conference at 2:30 p.m. to review the FOMC's decision. He might reiterate that the Fed is in no rush to lower rates, or he might pivot toward a more dovish stance, confirming that the odds of a rate cut are high in September.

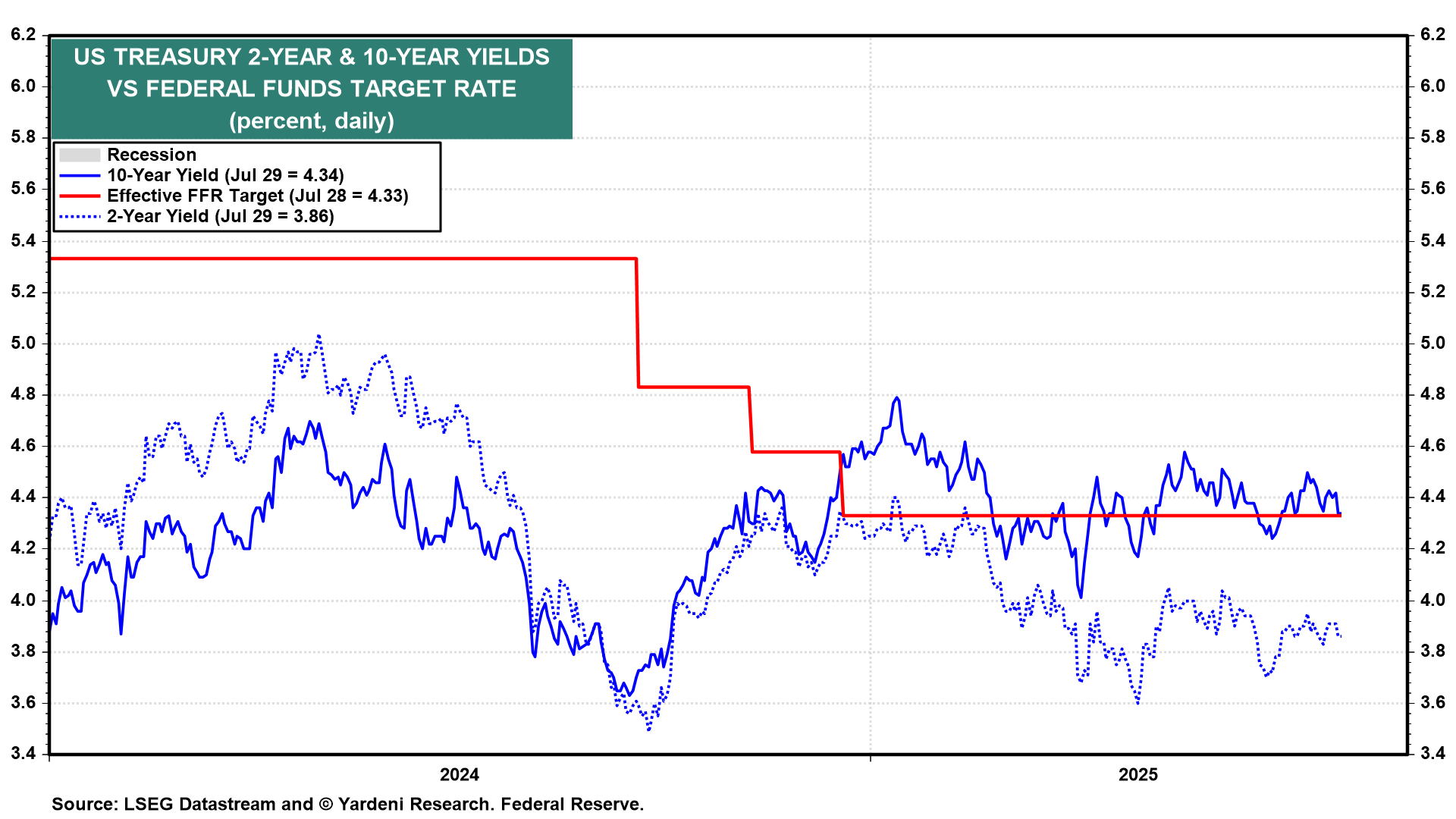

The co-star of the show is President Trump, who will probably berate the Fed in a social media post for not cutting rates now. Bessent should remind the President that when the Fed cut the FFR by 100bps during the final months of 2024, the 10-year Treasury bond yield rose 100bps (chart).