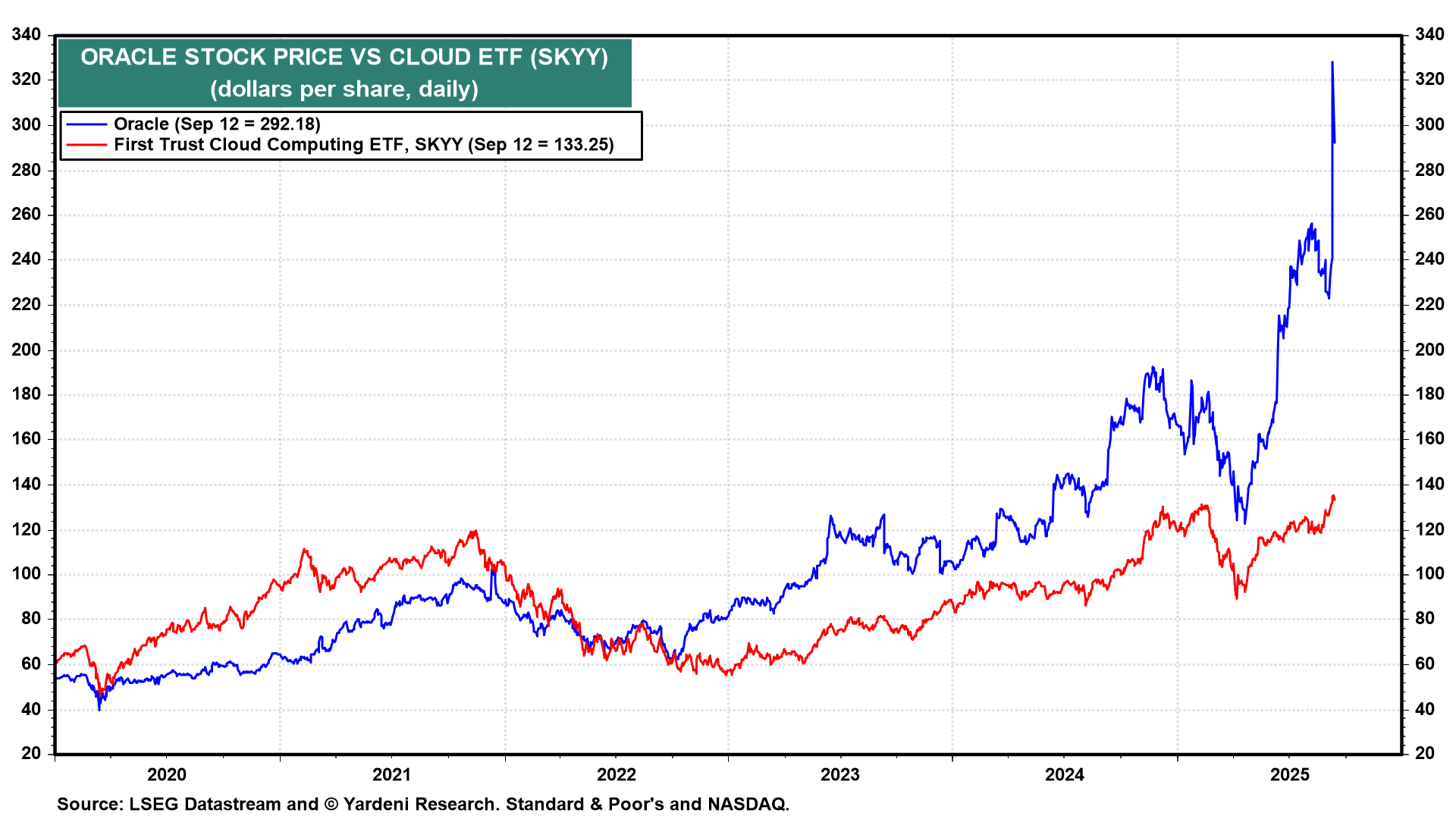

Last Wednesday, Larry Ellison, the executive chairman and chief technology officer of Oracle, saw his net worth jump by $101 billion—the biggest one-day increase ever recorded on the Bloomberg Billionaires Index—to $382 billion. That happened after the company announced at its quarterly earnings conference that Google's Gemini AI models would become available on Oracle's cloud infrastructure. That sent the company's stock soaring by 40% (chart).

In the August 10 QT, we wrote: "The sky seems to be the limit for the cloud providers. More and more of us are using AI's large language models, such as Gemini, GROK, ChatGPT, Claude, and Copilot, as tools to conduct research, write software, create content, and work more productively. These AI tools are all processing and storing our interactions with them in the cloud and learning from these interactions to become more useful to us. As the tools become more useful, the cloud companies earn more, and they must spend more to expand their data center capacity. Our collective ability to process more data leads us all to create more data to process. And so on. So the sky really is the limit!"

Also having a good move to the upside last week was the S&P 500 Investment Banking & Brokerage stock price index (chart). It has been rising into record-high territory in recent weeks. We've recommended overweighting the S&P 500 Financials since the start of the current bull market in October 2022. We've done the same for the Information Technology, Communication Services, and Industrials sectors of the S&P 500. So far, so good.