Will the stock market rally broaden? If it doesn't do so, will the rally fade? Below, Joe Feshbach offers his opinion from a trader's perspective. In our opinion, concerns about the market's bad breadth is just another brick in the wall of worry that the stock market has been climbing since the bear market bottomed on October 12, 2022.

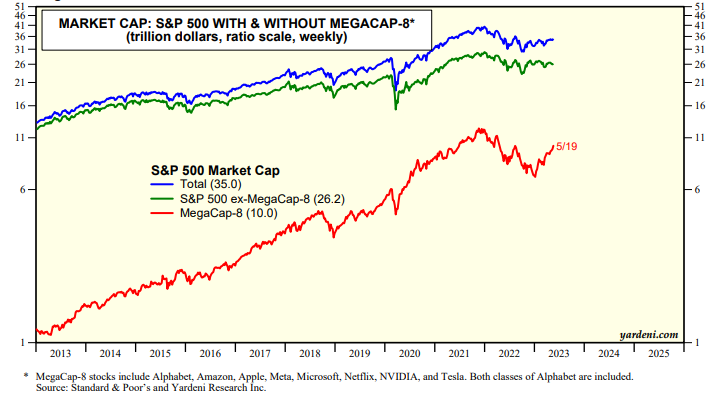

It has been widely noted that the S&P 500 has been led higher by the MegaCap-8 (chart). Excluding them, suggests that the rest of the market is barely up. However, that conclusion misses the fact that lots of industries that don't include any of the MegaCap-8 have performed very well since October 12 (table).

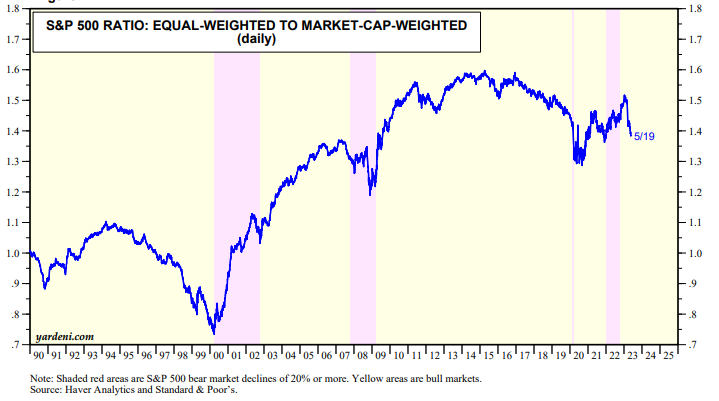

The breadth problem has been exacerbated by the banking crisis, which depressed the S&P 500 Financials sector, and weaker oil prices, which have weighed on the S&P 500 Energy sector. Both could rebound from their recent funk. The ratio of the equal-weighted to market-cap-weighted S&P 500 indexes is down sharply since the banking crisis started on March 8. The former is down 2.5%, while the latter is up 5.0% (chart).

Here is Feshbach's opinion: