Just after the S&P 500 nearly hit our year-end target of 4600 ahead of schedule on July 31, we concluded that the index might fall to its 200-day moving average, which is currently around 4200. It could easily do so during October since it closed at 4288 on Friday. Then we see a yearend Santa Claus rally back to 4600, or close to that level.

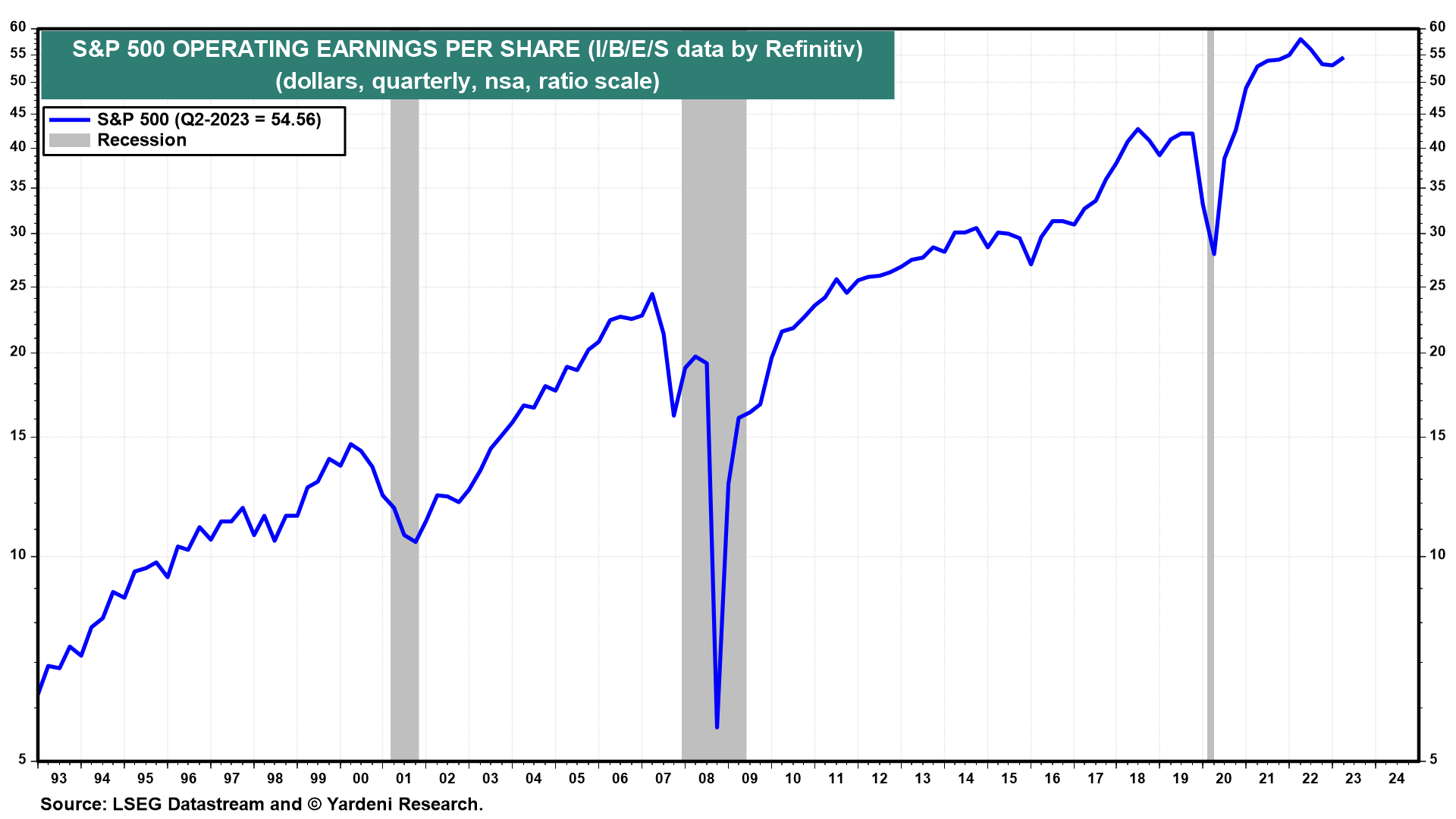

That's because we believe that the Q3 earnings reporting season (during October and early November) will be much better than widely expected. After all, Q3's real GDP looks likely to be well above consensus forecasts. We predict that S&P 500 operating earnings per share will be at a record high during the final quarter of this year (chart). That's barring a long auto strike, a government shutdown, and surprising credit losses at the banks.

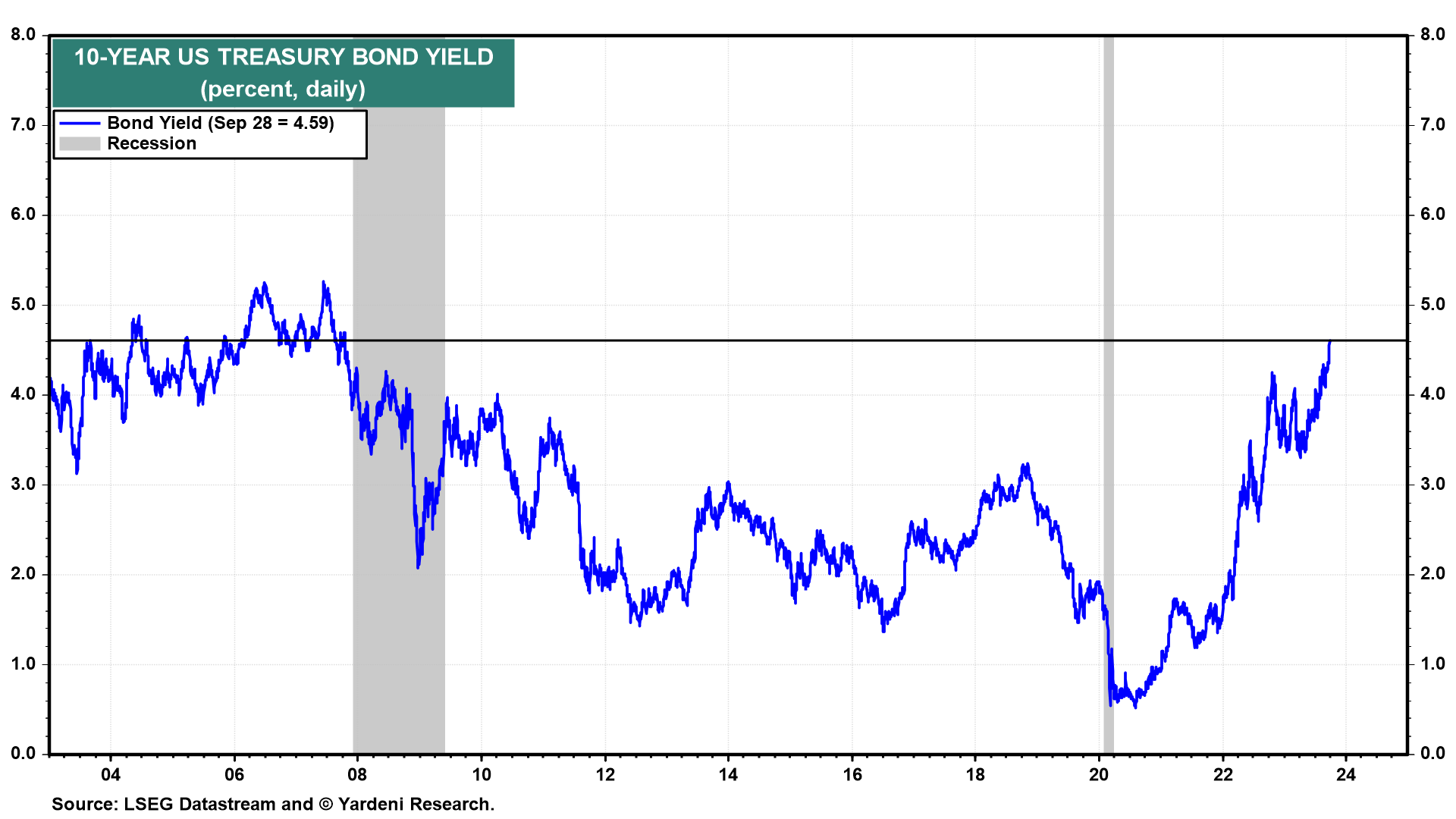

The biggest risk to our optimistic outlooks for the economy and stock market is that the Bond Vigilantes may be about to send a very loud message to Washington: “Cut the deficits or we will raise bond yields until they cause a credit crunch and a recession."

The Wild Bunch has already sent the 10-year US Treasury yield up to 4.59% on Friday (chart). In a matter of three years, they've managed to fully reverse the drop in the yield to historical lows during the "New Abnormal" from the Great Financial Crisis (GFC) through the Great Virus Crisis. Before the GFC, the old normal bond yield was around 4.50% (+/- 50bps). We think that's where it should be now, assuming as we do that inflation will continue to moderate in coming months.

We asked our good buddy Joe Feshbach for an update of his market call from a trader's perspective:

"As I expected, the Nasdaq broke below its prior low of 13162 and followed through with a 1.5% decline last Wednesday. It then staged a quick reversal of 3.2% from low to high. I discussed this trade in last week's Market Call. Breaking an important low can be scary; however, when it happens with sentiment already bearish, it's highly unlikely to lead to a plunge. Instead, it frequently can lead to a short-term sharp reversal as stops are taken out.

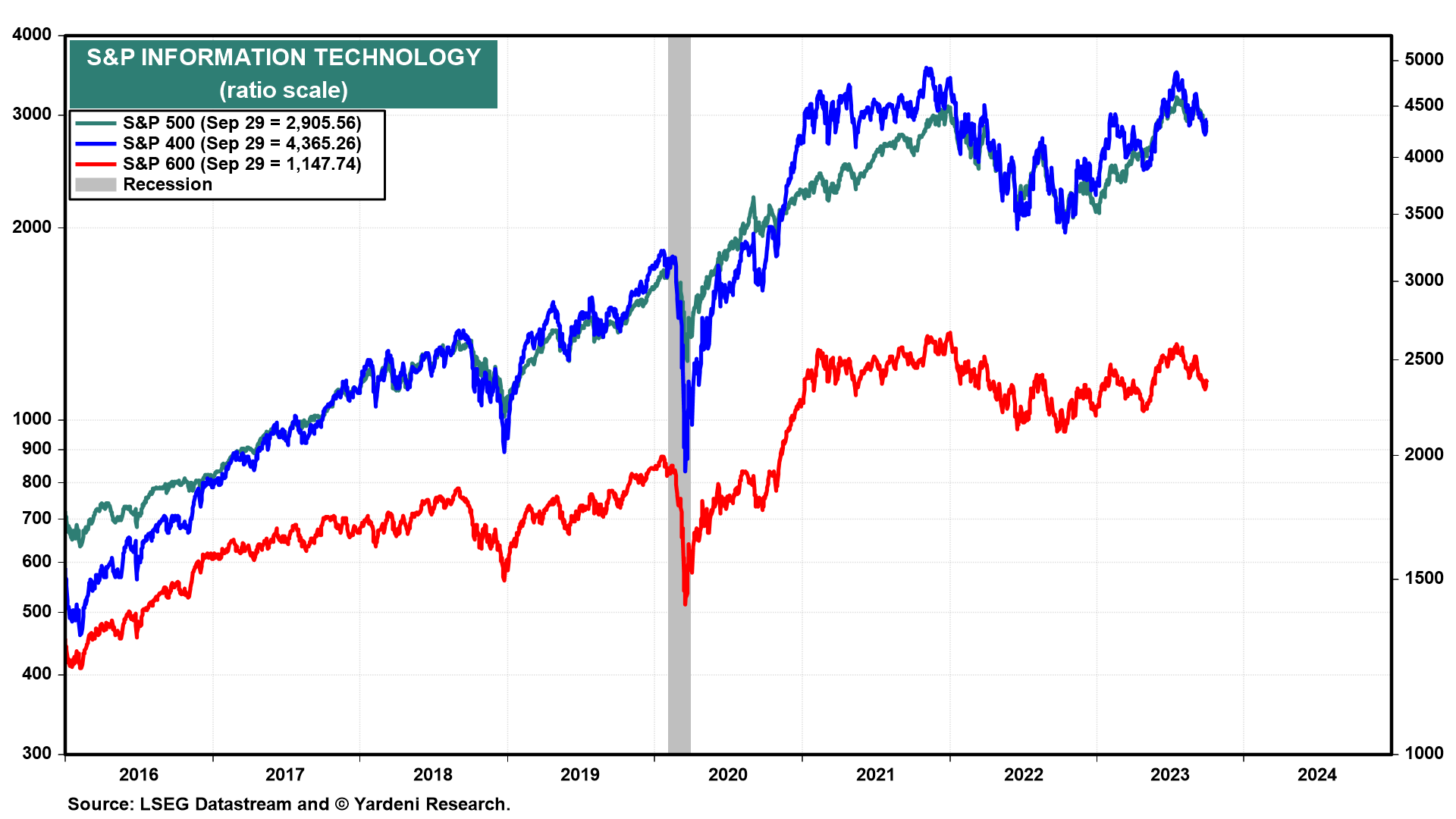

"Now comes the tougher part for me. I seriously doubt that the Nasdaq's drop will lead to meaningful upside beyond a fun short-term rally, as the majority of tech stocks show topping patterns (chart). That doesn't mean the market can't still creep higher, as the Put/Call Ratio—having backed off a bit—remains on the high side.

"If the S&P 500 manages to close its gap, it could sneak up another 2.5% (to 4401). It's tough for me to get more optimistic than that with these toppy tech charts and some real lousy breadth stats (especially on Nasdaq). It could also be that the market is range bound such that one can buy on down days while lightening up on the advancing days.

"I'm looking forward to seeing how the sentiment indicators react to averting a government shutdown. In the past, such situations have influenced the stock market only very temporarily, and investors usually were best rewarded by bucking the trend of the market’s reaction." Thanks, Joe!